Two events at the end of 2020 encapsulate the challenge for airlines. First, several vaccines came to market in record time, raising hopes of turning the tables on the pandemic. Then a new, more contagious mutation started to appear around the world, leading to immediate lockdowns, border closures, and travel bans and fueling fears of a COVID double or triple dip. Airline executives could be excused for complaining of whiplash.

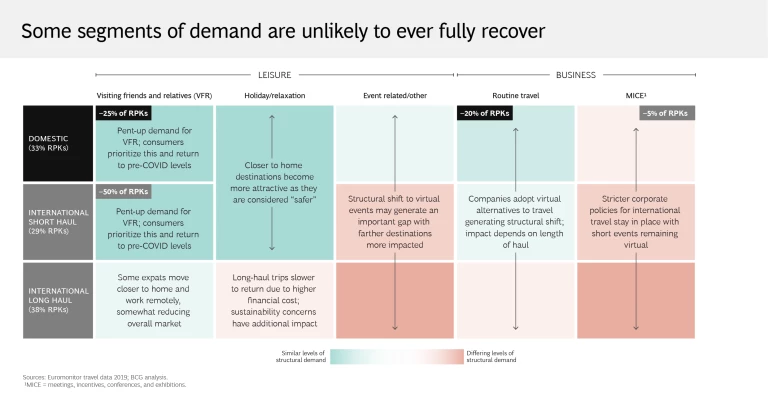

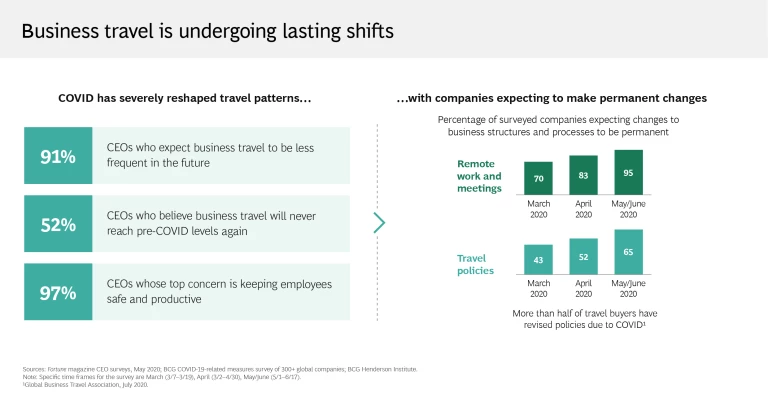

It’s an almost impossible environment in which to plan. But airlines, like all companies, must continue to look to the future and try to determine where they will be one, two, and three quarters out. A few things are becoming clear, at least for the near term. Even with the apparent success of the new vaccines, the outlook for business travel is mixed, with substantial variation by geography, sector, length of haul, and other factors. As our slideshow indicates, more than half of business travelers still do not expect to fly in the next six months.

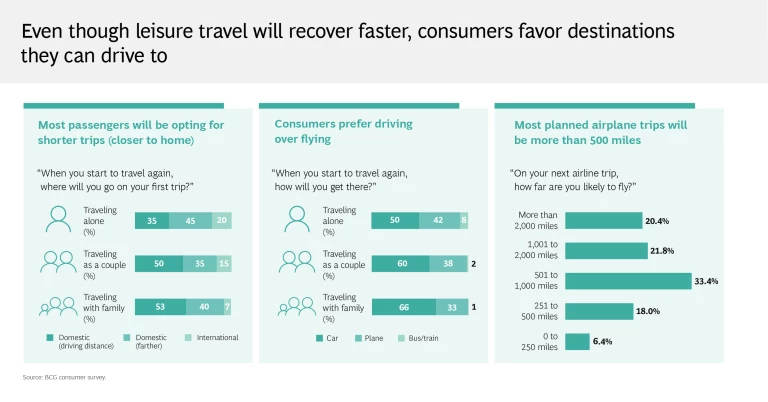

Consumers are also staying closer to home, making shorter journeys, and driving more. When they do decide to fly, they want flexible booking and cancellation policies, online direct purchasing, and touchless interactions.

At the airport and onboard, all flyers are looking for cleanliness and explicit health-focused procedures, including social distancing. And of course, they want it all for less: consumers understand they are in a buyer’s market, and they expect great deals from carriers.

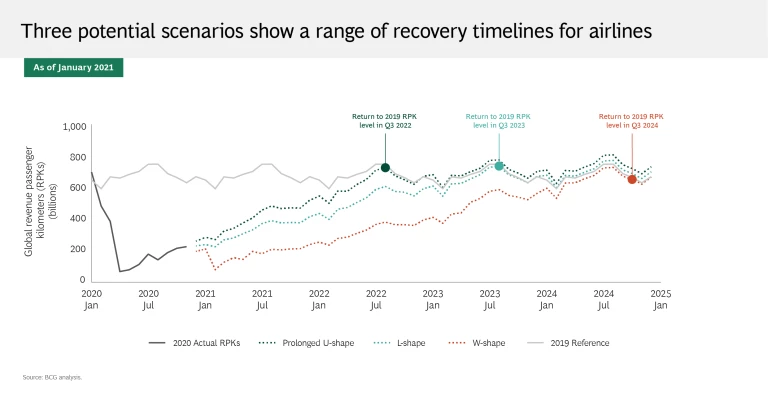

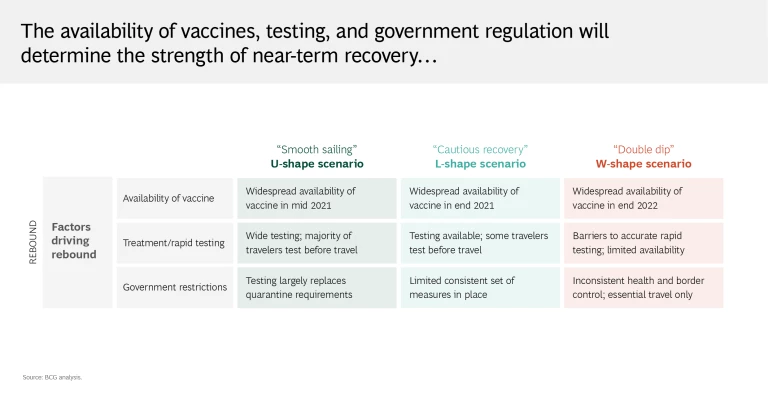

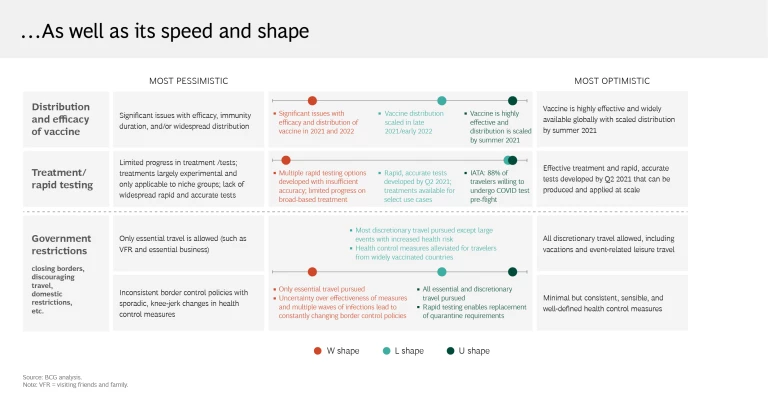

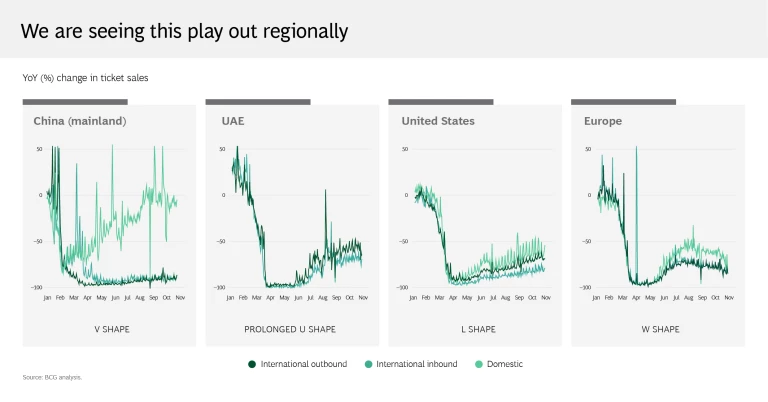

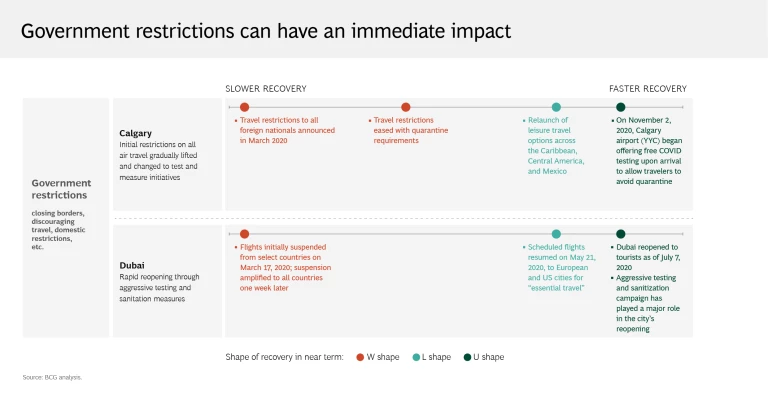

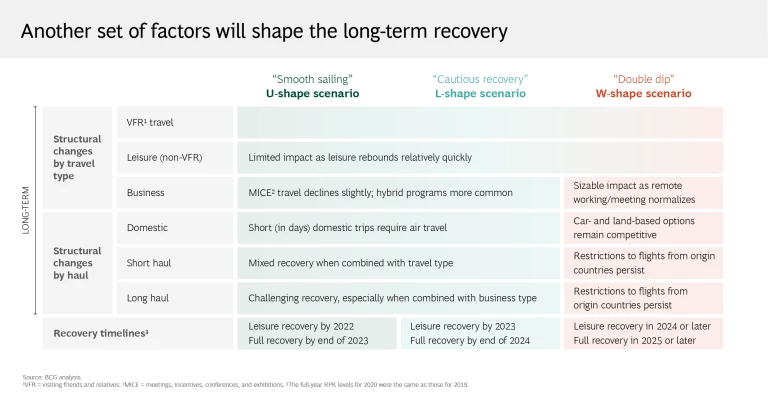

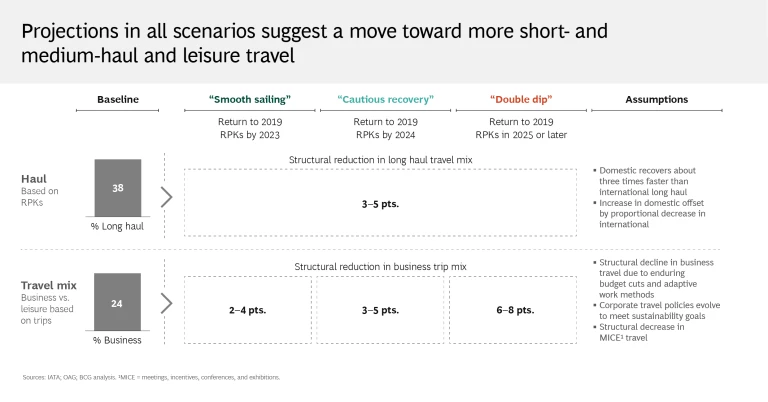

Based on the best modeling of our health care experts, our ongoing research among consumers and businesses about their travel plans, and our work with governments worldwide, we have analyzed several potential scenarios for the future and their short- and longer-term implications for airlines. This planning exercise builds on our first one in March 2020 , which included five scenarios (the two least likely of which failed to materialize). The three remaining scenarios are presented in the slideshow below. We will examine the implications in the text that follows.

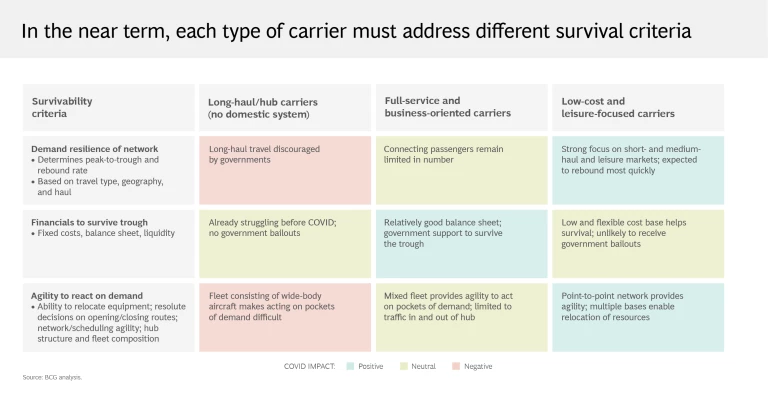

Near-Term Implications for Carriers

We hardly need to point out the importance of balance sheet strength in times of crisis. This means more than conserving cash, however; no one can tread water forever. Even as uncertainty reigns, it is important to revisit historical models for cost and revenue production and question whether past assumptions and constraints still apply. Equally, companies can benefit from a thorough review of their competitive advantages and core competencies, which can lead to placing strategic bets in a measured way. Airlines have rightly been operating in crisis mode, and the need for that has not changed. But as an end to the pandemic appears on the horizon, it’s also time to shift focus and resources and think about post-crisis positioning.

Agility amid uncertainty is also critical. Some airlines, such as low-cost carriers, are structurally advantaged with lower and more flexible cost bases and a stronger focus on leisure traffic. But all airlines can act with agility to make immediate short-term changes to better position themselves for the new reality, such as by reshaping their networks to focus more on leisure destinations. All options should be on the table. Actions that appeared unrealistic months ago may now be worth considering again, depending on circumstances, as the marketplace will continue to evolve. Opportunistic organic and inorganic moves may fortify competitive position.

Longer-Term Considerations

In the longer term, structural market changes are likely to require that airlines consider significant adjustments to all three aspects of the business model: network and fleet, commercial, and operations. Here are some key questions that airline management teams should ask themselves in each area.

Network and Fleet

Two main factors are at play here. First, short flights are doing poorly now because people are choosing to drive. Long-haul flights are also doing poorly because of border restrictions and people being uneasy traveling far from home. How long will these trends continue as COVID vaccines roll out? Second, the long-term impact of the crisis will be more pronounced on business travel: amid economic uncertainty and tight budgets, companies cut back on business travel, and this crisis has proven that remote working is somewhat viable. Both factors have an impact on airlines’ networks, fleet plans, and fleet configurations. Here are some key questions:

- Can the airline operate profitably with current cabin layouts, or should layouts be changed on new aircraft deliveries?

- Should retrofits be considered for low-density or premium cabin-heavy aircraft?

- Is the current fleet mix and order book compatible with a shift toward more medium-haul flights and more leisure traffic

- What should be the strategy for key business markets where frequency and relevance used to be critical to competition?

- Which markets are most susceptible to entry from low-cost carriers, and what competitive action should be taken to protect strategic markets?

- How can the company protect critical assets (such as high-value slots) during periods of underutilization? What strategic moves can take advantage of competitors disposing of critical assets?

Commercial

In addition to shifts in the passenger mix, we’ve seen consumers move toward booking direct through airlines rather than through travel agencies. This is partially because of the change in the business-leisure travel mix and partially because consumers are more comfortable booking directly with suppliers in the current environment. How much this shift will stick is still unclear. Complicating matters, the COVID crisis renders historical data irrelevant given the changes in travel habits. Key questions include:

- How does the airline adapt distribution and channel strategy to attract and better serve more leisure travelers?

- What changes should it make to its loyalty program to maximize relevance with leisure travelers (especially since there are fewer and less frequent business travelers)?

- How does the airline adjust pricing (directly and through moves such as upgrades or unbundled premium cabin fares) to tackle an oversupply of premium cabin space or attract new pockets of premium-cabin demand (albeit at lower yield), at least in the near term?

- How does it address a lack of reliable historical data for pricing and revenue management systems?

- How can alliances, joint ventures, and codeshare agreements maximize synergies and value realization?

- How can the company adapt the product, from hygiene factors to meal service, to shifts in consumer preferences and a changing customer mix?

Operations

Customers are also booking their flights much closer to departure than they used to. Some have moved out of cities to rural locations served by smaller airports. Airlines have parked aircraft or even entire types of plane. These changes raise the following issues:

- How should airlines adapt their planning cycles when booking data becomes accurate only days before departure?

- Where does the company base aircraft and crews, given potential changes in the network?

- How do lower-frequency flights in key markets affect operations?

- How does the airline rectify potential imbalances in supply and capacity? How does it adapt maintenance and catering facilities to shifting patterns of flying and airport usage?

- How should fleet costs and investments be adjusted in a balance sheet restructured for a new future?

- How can we improve our ability to manage disruption in volatile circumstances?

- How many aircraft and types of plane should we recommission and when?

Looking ahead, the overarching question is this: As airlines emerge from the pandemic, will the new dynamics support a healthy high-margin industry similar to what airlines experienced pre-COVID, or will the environment more closely resemble the industry economics of the early 2000s?

Either way, in the near term, airlines need to move quickly and with agility to deal with the immediate demands that COVID-19 has imposed. Looking further down the road—and assuming the arrival of vaccines signal a return to rising traffic in the next few years—there are any number of big issues to tackle. Even amid the uncertainty, there’s no better time than now to get started.