On a scale of 1 to 10, the difficulty of decarbonizing the aviation industry by 2050 rates a 12. The importance of decarbonization, for the industry and for the rest of us, rates a 12 as well.

Even as the airline industry works to recover from the worst business downturn in its history, its leaders are clear-eyed about the necessity and the hurdles of decarbonization. While the industry is far from the worst when it comes to carbon emissions, without action, its contribution to global emissions could grow from 2% to 3% to as much as 20% by 2050. As one executive put it, “The goalpost hasn’t changed.” If anything, the COVID-19 crisis has brought the potential consequences of climate change into sharper focus in the public eye. And as climate concerns rise, customers, employees, shareholders, and governments are watching. Recent moves by activist shareholders and EU policymakers underscore the urgency. Those carriers that don’t act on their own could have change imposed by outside forces.

Here’s our overview of what it will take for airlines to reach net-zero emissions by 2050. It’s a complex picture. The key moving parts are how far current technologies can go, the prospects for emerging technologies , the outlook for removal technologies, and what airlines can do, individually and collectively with their partners, to speed things up.

The Current Components of Decarbonization

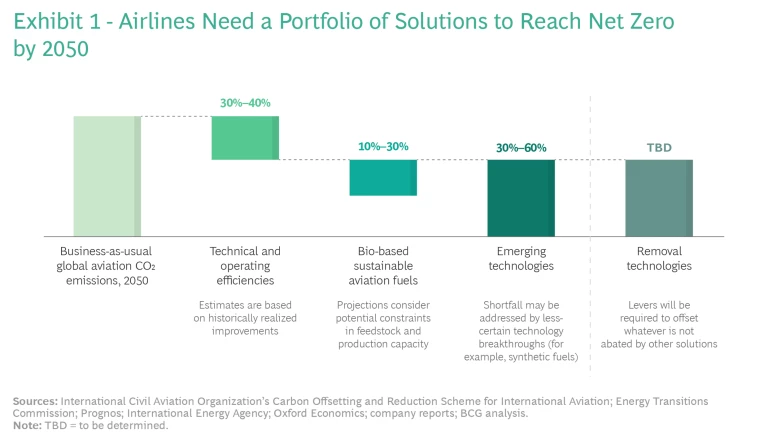

Like other industries, the airline sector needs to apply a portfolio of solutions to reach net zero. (See Exhibit 1.) But unlike other industries, there are so few alternatives to air travel that it’s hard to avoid emissions without doing away with the basic product. Reducing aircraft emissions in any significant way therefore requires decarbonization.

Our analysis indicates that continuing to improve technical and operating efficiencies and making greater use of biofuels can eliminate 40% to 70% of projected 2050 CO2 emissions, although these are ambitious targets that will take concerted efforts to meet. Even the best case for technical and operational efficiency improvements—including bullish estimates for bio-based sustainable aviation fuel (SAF) adoption—leave a shortfall of 30% to 60% in 2050 between projected industry emissions and net zero, much of which will need to be addressed by new technologies.

Efficiencies. Over the past decade, the industry has achieved an annual reduction in average fuel consumption per revenue passenger kilometer of 2.3% through a combination of technological innovations and improvements in operating practices. Airlines will need to continue to reduce fuel consumption at almost this rate: an annual improvement of at least 1.7% would result in a 40% reduction in emissions by 2050. This will require advances in aircraft and engine technologies, retrofits and upgrades of existing fleets, air traffic management improvements (such as Europe’s single-sky initiative), more efficient continuous climb and descent procedures, and better surface-congestion management. The reduction also mandates much more deliberate consideration of carbon impacts in airlines’ network and operations planning, with minimizing emissions being given similar weight as achieving revenue and cost metrics.

The pandemic has actually provided an assist. Lower traffic levels have led many airlines to make business decisions with environmental benefits, including retiring aircraft early, retrofitting aircraft to improve efficiency, implementing better operational practices (such as single-engine taxiing and IT and system upgrades), and rationalizing routes. Such moves are no-regret opportunities for every company in the aviation value chain.

Bio-based sustainable aviation fuel is one of the few proven sector-specific solutions available to airlines.

Bio-based SAF. A key component of decarbonization is using bio-based SAF, and it is one of the few proven sector-specific solutions available to airlines. The technology has been certified safe for use at the right blend ratios and does not require changes to aircraft technology. Indeed, more than 200,000 flights have already been flown using a blend of jet and bio-based fuels. In an optimistic scenario, we estimate that biofuels could close 10% to 30% of the global gap by 2050, but there’s a long road to reach that goal. Bio-based SAF represents only 0.01% of aviation fuel consumption today. In the short term, the main challenge is demand: because bio-based SAF is two to six times more expensive than traditional jet fuel, there is no incentive for airlines to use it, and very few production facilities have been built. In the long term, the challenge is supply. Even though bio-based fuel can be produced using multiple feedstocks and production pathways, supply is limited by the availability of a scalable, sustainable feedstock. Moreover, scalable and effective bio-based SAF requires a low-carbon supply chain, which poses a major challenge as feedstocks are widely scattered.

The Need for Emerging Technologies

In short, improvements in aviation efficiencies and the growing availability of biofuels will not be enough to get the world of aviation to net zero. The 30% to 60% shortfall between projected emission levels and net zero can be closed only by accelerating the development and adoption of emerging technologies. Here’s a brief assessment of the emerging technologies that are in the works. These will be explored in more depth in a subsequent article.

Synthetic Fuels. These fuels are composed of oils made from renewable electricity, water, and captured CO2. Unlike bio-based SAF, synthetic fuels do not require arable land or biological feedstock, and they can be up to 100% carbon neutral. Current production is minimal, and estimated prices are two to five times as a much as A1 jet fuel. We are seeing an increase in startup activity and planned facilities as well as investment from traditional oil and gas players. As technological innovations emerge in synthetic fuel and production scales up, we expect the unit costs to drop substantially to as little as 1.5 times the cost of A1 jet fuel by 2050. The likelihood of rising carbon taxes on jet fuel could further help make synthetic fuels more cost competitive.

Electric Aviation. Electric aviation generates a lot of excitement, but it also has big technological hurdles. While a few major companies (such as American Airlines, DHL Express, and United Airlines) have announced plans to buy battery-powered planes from different startups, significant advances in battery technology are necessary before electric aviation can be a solution for medium- to long-haul flights, and many question whether batteries will ever power long-range air travel. We expect that electric aircraft will be restricted over the next several decades to intracity travel and domestic short-haul trips.

Hydrogen Fuel Cells. Hydrogen fuel cells are a high-potential alternative because they produce low amounts of greenhouse gases and can power planes despite the distance, including those used for medium- and long-haul flights. But they are technologically challenging. Significant advances are required at all stages of the value chain, starting with hydrogen production and compression, to achieve viability. In addition, hydrogen fuel cells require cooling mechanisms, the weight of which poses challenges over longer distances. Developing these technologies also is a long-term proposition since they will require robust testing to ensure that safety standards are met before they can be certified.

Developing hydrogen fuel cells is a long-term proposition since robust testing is required to ensure that safety standards are met.

Hydrogen Combustion. Hydrogen combustion shows similar promise to fuel cells, but it needs more hydrogen to power a plane. The technology is also nascent, and the same challenges that impede hydrogen fuel cells—hydrogen production and storage—hamper development. Aircraft engines will have to be redesigned and airframe structures rethought to store the required hydrogen volume—changes that will likely take decades.

The Role of Offsets

Barring revolutionary technological advances, the majority of aircraft will be powered by carbon-emitting technologies for the foreseeable future. So carbon offset commitments—such as the Carbon Offsetting and Reduction Scheme for International Aviation program that was developed by the International Civil Aviation Organization—will play an important role in reaching net zero. At a high level, offsets comprise removal technologies and programs to avoid or reduce emissions. Meeting net-zero commitments likely requires an offset portfolio that employs only removal technologies.

Removal technologies involve capturing and storing carbon from the atmosphere through natural measures (such as tree planting and soil sequestration) or engineered levers (such as direct air capture and bioenergy with carbon capture).

Nature-based removal technologies are at a crossroads. Natural measures operate widely at scale with low costs. Their effectiveness is limited, however, by built-in constraints (you can plant only so many trees). In addition, the impact of some measures is difficult to measure, report, and verify, and there are concerns around permanence (caused by such factors as the risk of wildfires and changes in farming practices).

Engineered removal technologies show great promise. They are permanent, measurable, and verifiable, and they are emerging as the next frontier of decarbonization. They are also in the early stage and not yet at scale. Costs are a big issue, as is physical location. A supportive policy environment, proximity to geological storage, and access to cheap low-carbon or carbon-free power are all prerequisites. In addition, development cycles are long. Some in-progress projects are estimated to take five years from the time that initial engineering and design studies are begun to the point when the facilities go on stream. The few demonstration-scale projects currently underway are expected to capture 500,000 to 1 million metric tons each, highlighting the need to significantly ramp up capacity to reach at-scale deployment.

Carbon removal technologies remains an important part of many airlines’ sustainability strategies, and they are one of the few solutions available today. But by themselves, these levers are not efficient, and they have the risk of being seen as Band-Aids by customers and regulators. And of course, carbon removal is ultimately not a long-term solution to in-sector decarbonization for aviation or any other industry.

How the Industry Can Accelerate Progress

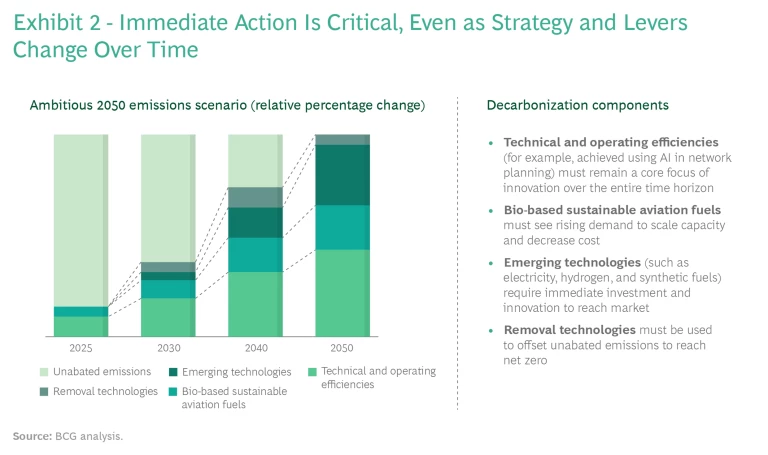

Airlines have three strategic considerations. The first is that they themselves do not have the expertise or capital to individually develop the solutions that are required; they must work with others. Second, while each company will make its own determinations and place its own bets, the prospects for rapid progress are much greater if carriers also collaborate. Third, to meet the 2050 net-zero goal, airlines must act immediately and sustain the focus over a period of several decades, which means continuously pushing the throttle forward through business cycles, management changes, mergers, and whatever upheavals the future holds, some of which inevitably will be substantial. The near-term attention should be on technical and operating efficiency improvements and signaling strong and growing demand for bio-based SAF. For example, there may be opportunities for airlines to engage with their customers, particularly in the B2B segment, by creating an attractive bio-based SAF offering that would allow airlines to go beyond legal mandates while enabling companies to reduce their indirect emissions. The hard work also must begin on bringing emerging technologies to market and on developing high-quality removal technologies. (See Exhibit 2.)

Airlines have a track record of putting competitive issues aside and collaborating on big issues of common interest, such as safety. The industry can take a similar approach to decarbonization while recognizing the need for a level playing field to avoid competitive distortion for those companies making the greatest effort. There are multiple benefits.

Aligning on priorities helps focus efforts and impact. By working together, airlines can align on the priority technologies and intervention methods through robust and informed debate and allocate scarce resources accordingly.

Pooling resources allows for more and larger bets. Pooling resources among multiple companies limits an individual company’s exposure to risk and enables committing meaningful capital to the opportunities that airlines see as most promising.

Bringing other players to the table helps align the entire industry on the path forward. Other participants in the aviation value chain, such as aircraft and engine manufacturers and fuel producers, look to airlines for market signals when allocating their R&D capital. Collaboration across the value chain can help build critical mass and ensure that all participants work toward agreed upon technology priorities.

Taking a unified message to policymakers can accelerate regulatory change. Given the critical role that policy incentives will play in driving progress in technologies—both existing (biofuels) and emerging (synthetic fuels)—airlines need to present a unified message to policymakers around the world.

The aviation industry plays a pivotal role in modern life, connecting companies, economies, families, and countries. The industry must lead its own efforts to decarbonize, but we all have a vested interest in its success.

The authors are grateful to the following for their contributions to this article: Nicky Collins, Vicki Escarra, Mara Kronauer, Colleen McDonald, Steffen Rau, and Jan Rejeski.