BCG’s latest survey on the impact of COVID-19 shows which changes in how doctors engage with the pharma industry will last beyond the pandemic.

Within the span of a few months, pharma companies have seen major shifts in physicians’ behaviors and preferences. The pace of these changes has varied significantly across therapeutic areas and markets. Our research at different time points during the pandemic shows that many of these changes have solidified into longer-term changes to MDs’ preferences and behaviors.

Here are the headlines from BCG’s latest survey of MDs on the impact of COVID-19, our third since the start of the pandemic. It shows which changes in how doctors engage with the pharma industry and patients are hardening as vaccination rates climb and a new reality takes shape.

Virtual Engagement Is Here to Stay

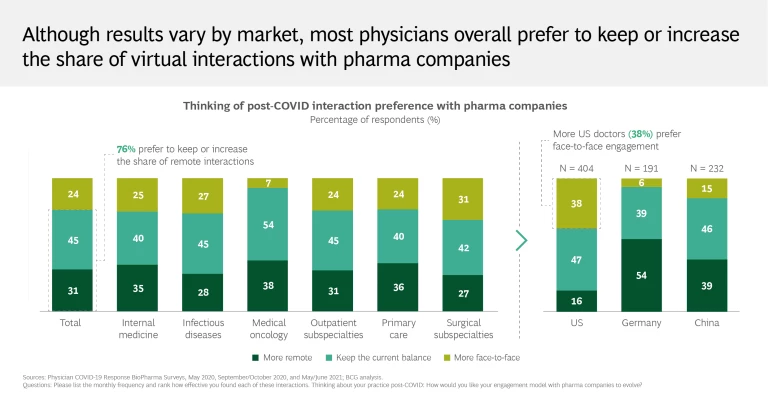

Post-COVID, three-quarters of MDs prefer to maintain or further increase the amount of the virtual (versus face-to-face) engagements with pharma reps that they became accustomed to during the pandemic. They see virtual engagement with pharma companies as efficient and effective. Although physicians’ preference for face-to-face meetings has rebounded from its low point last May, it remains well below pre-COVID levels.

There are some significant differences among the three countries we surveyed this time (China, Germany, and the US). US doctors in particular show a preference for face-to-face engagement. More than 90% of MDs in Germany and 85% in China want to maintain or increase virtual interactions, compared with 63% of doctors in the US.

In each market, pharma companies need to find the right balance between virtual and face-to-face engagement, while recognizing that more virtual interaction is here to stay.

New Communication Channels Have Caught On

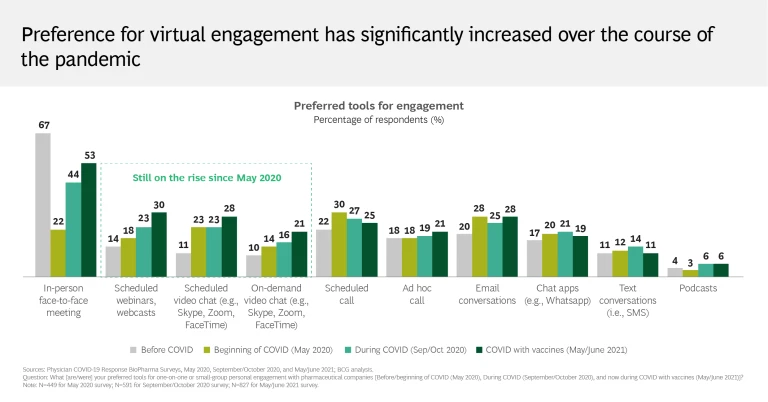

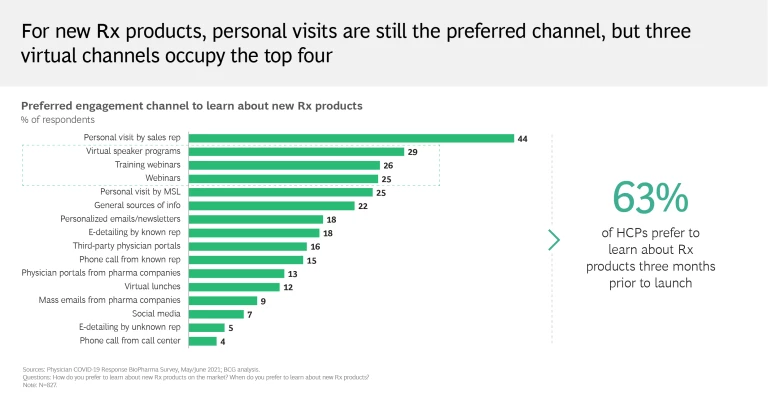

Doctors are looking for new models of cooperation with the pharma industry. Two of the four most effective communication channels for MDs are now virtual (training webinars and virtual speaker programs), and despite the expectations of some for virtual fatigue, the perceived effectiveness of these channels has continued to increase since May 2020. Preferences for scheduled webinars and webcasts, scheduled video chats, and on-demand video chats have more than doubled since the pandemic started and are still on the rise.

Face-to-face visits and telephone interactions by sales reps are still essential, but virtual channels give physicians access to the information they need in an easy and convenient manner. The same holds true for information on new products: physicians highly value webinars, virtual training, and speaker programs. While MDs still count on personal visits by sales reps and medical liaison personnel, particularly during a product launch, they are looking for pharma companies to adapt to changing times.

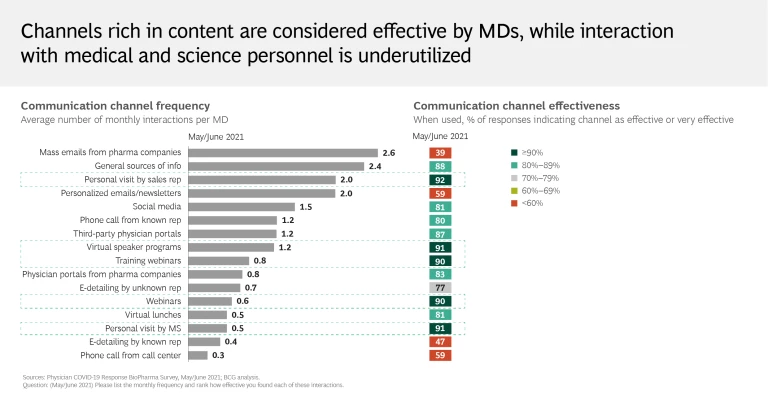

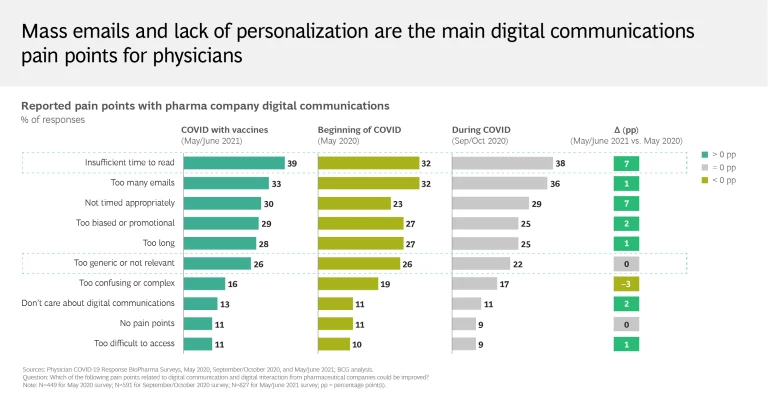

Personalization of Communication Is a Top Factor in MDs’ Satisfaction with Pharma. MDs want more personalized engagement and tailored content. Many cite insufficient time to read and generic or irrelevant content as barriers to digital communication. They increasingly expect pharma companies to demonstrate an understanding of their particular needs and interests. In fact, our analysis found a strong statistical correlation between how doctors perceive pharma companies’ understanding of physicians’ needs and interests and MDs’ satisfaction with a company’s digital communications and the quality of interaction generally.

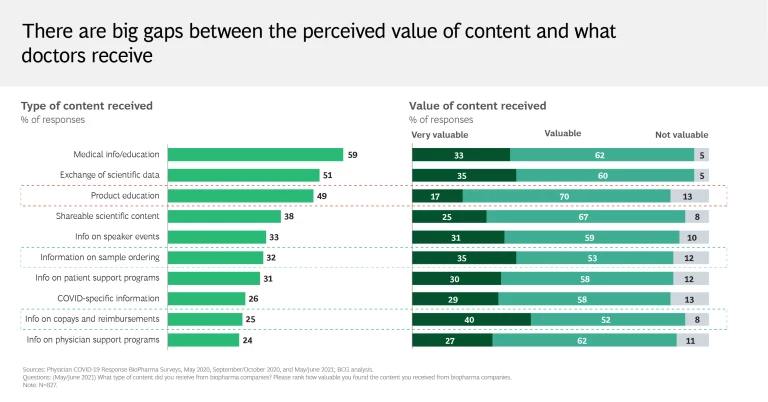

Physicians continue to have high levels of interest in medical information and scientific data, and more are interested in learning how biopharma companies can support patient care with digital tools and engagement. Post-COVID, 40% of MDs would like to receive more medical and scientific information. Approximately half or more say they don’t receive regular content on medical developments and education, scientific data, or product education.

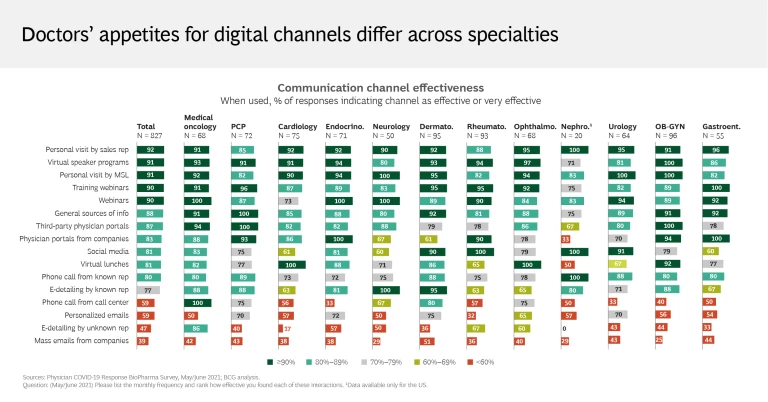

There is no one-size-fits-all solution for communications; our data shows that individual characteristics, such as therapeutic area and years in practice, influence how each doctor wants to engage, but these are only starting points. Several pharma companies are now finding the value in leveraging data and analytics to personalize engagements.

Pharma companies need to build up their knowledge of physicians’ preferences and pain points, by market, and find the right channel mix for interaction. In addition to virtual channels, most MDs (91%) cite visits by medical and science liaison (MSL) personnel as very effective, and they believe this channel is underused by the pharma industry. Indeed, virtual speaking programs, webinars, and visits by MSLs are all cited as very effective channels by 90% or more of doctors, yet they rank well down the list in frequency of use.

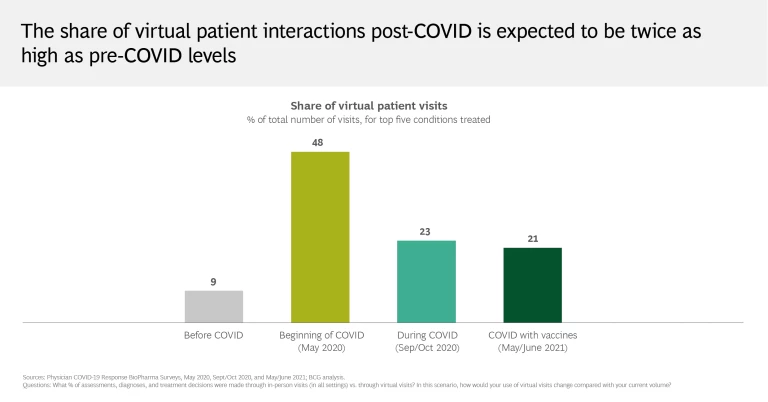

Virtual Patient Visits Are Now a Fixture

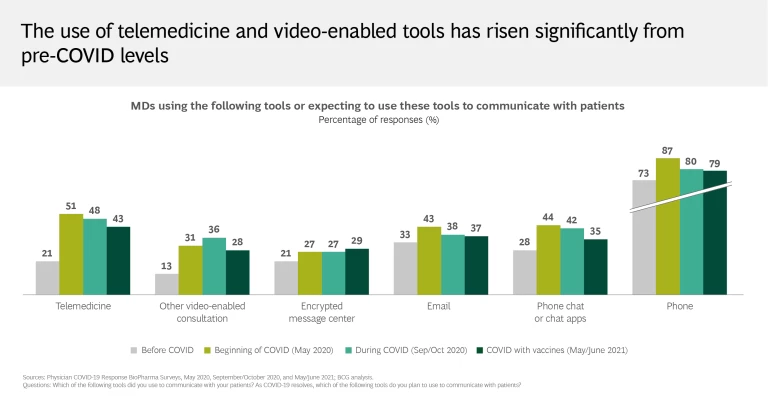

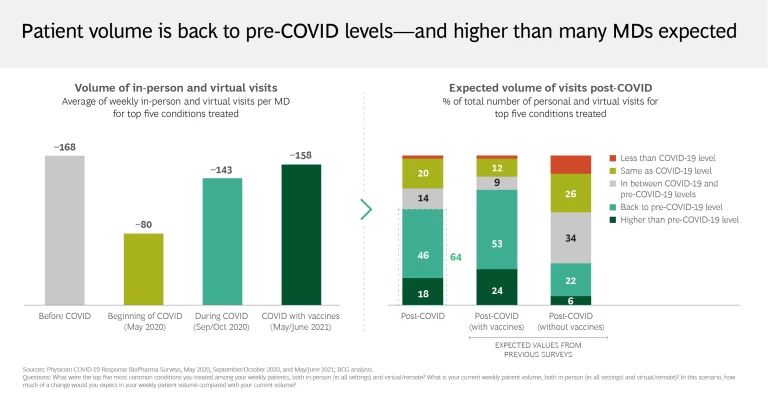

The virtual doctor appointment will transcend the pandemic. Physicians expect twice as many virtual MD-patient interactions post-COVID compared with pre-COVID. They anticipate significant increases in the use of telemedicine, video-enabled tools, and phone chat or online chat apps. Doctors continue to experience a lower volume of in-person patient visits, citing patient cancellations, office or clinic policies that limit patient volume, and fewer referrals as the main reasons. Pharma companies need to address the increases in undiagnosed populations and the decline in medication adherence that could result.

The June 2021 Results

The slideshow below contains the key results from the latest survey, which was conducted in May/June 2021 and is our third since the onset of COVID-19. The first survey (May 2020) assessed the changes doctors were making in immediate response to the upheavals caused by the pandemic. The second (September/October 2020) looked at the uneven shifts taking place in countries that were coming out of crisis and those that were still mostly locked down. The current survey involved some 800 physicians in the three countries.

Implications for the Pharma Operating Model

Many pharma companies have started to reshape their engagement model. The dynamic of the pandemic has accelerated this process, and now pharma companies have a clearer perspective on what will work and what will not:

- Data-driven, personalized engagement can create significant value and measurably increase satisfaction.

- Professionalizing remote engagement through well-managed, dedicated remote medical and commercial teams delivers strong value that physicians appreciate.

- Providing personalized, modular, timely, and effective virtual content remains a challenge throughout the industry, but when pharma companies master this, we see clear improvement in engagement scores and company success.

- Supporting physicians’ efforts to digitize their engagements with patients and addressing the implications for diagnosis and prescription in a more virtual care environment represent opportunities for pharma companies to tighten their MD relationships.

Although most pharma companies are now reviewing their engagement models, and many are launching initiatives that signal fundamental changes in their go-to-market model, they still struggle to make the jump from individual pilots to scale across the organization. The right level of focus, rigor in scaling, and true change management and effective rollout will be decisive factors in the future. We will explore the implications of this in more detail in a future article.