We have entered the age of digital PMI. Today’s business leaders are beginning to realize the possibilities and realities of digital platforms, artificial intelligence, and data analytics. As these new tools reshape the way companies structure themselves, digital transformation is becoming the key driving force behind many mergers and acquisitions.

Historically, after a deal, newly joined companies focused on seeking synergies from their combined workforce, supplier base, and customers. Expansion and innovation were often second to productivity and cost reduction. Today, deal logic is increasingly oriented toward growth, especially the rapid growth associated with tech upstarts. The more robust that companies’ data platforms, analytics capabilities, and digital skills become through acquisition, the better-equipped these organizations will be to understand their customers and expand with them.

This trend has particularly affected the practice of post-merger integration : the ways in which two or more merged enterprises are brought together. Advanced technology is now both the rationale and the means for designing a single post-merger enterprise. This trend has started in a few industries, such as retail and hospitality, consumer packaged goods, financial services, and automotive sales; but before long, in every sector, PMI will be increasingly linked to digital transformation.

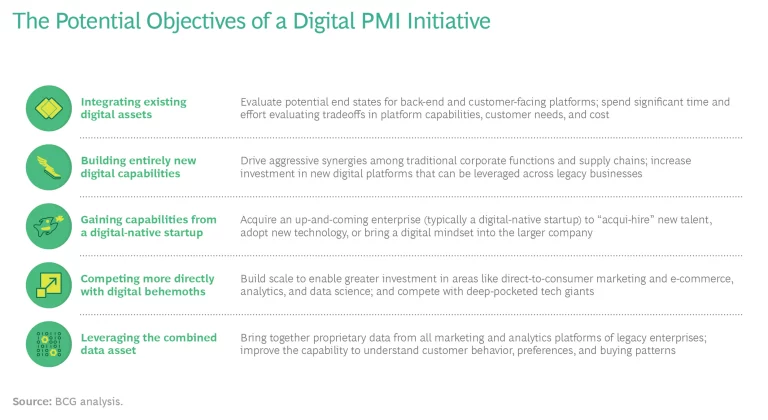

In our research on successful digital PMI initiatives, we have found that the acquisitions vary by their nature, depending on the deal logic. (See the exhibit.) Some large companies are acquiring smaller digital-native enterprises for their technological prowess: their skilled employees, AI algorithms, back-end systems, and customer interfaces. Others, particularly in consumer-facing industries, are following the example of Amazon with Whole Foods Market. By acquiring complementary brands, they gain access to large pools of data about customer preferences, buying habits, and cross-purchasing tendencies. Yet for all this variation in the objectives, there are six principles that apply consistently in nearly every successful digital PMI.

Conduct Digital Due Diligence First

At the start of a merger or acquisition process, many companies expect to install a state-of-the-art technology platform that will seamlessly integrate all the software and data. But after the deal is closed, they discover the constraints of the legacy IT systems. Their architecture may be incompatible, the user interfaces may be custom-made and thus difficult to integrate, or the data may not easily migrate. It might seem that cloud computing has overcome this problem. But in practice, integrating legacy systems is still so difficult and expensive that, in the worst cases, it can undermine the value of the deal.

The answer is to prepare for surprises at the outset of the deal. Set up a technical due diligence process, assessing compatibility and interoperability among legacy systems. This should be conducted alongside strategic and financial diligence and treated as equally important. IT experts should conduct this exercise on behalf of the merging companies (and not the vendors).

This technical due diligence may naturally lead into more detailed planning for integration: the choice of front-end and back-end platforms, the lining up of necessary resources and vendors, and the assignment of teams to be accountable. Although actual implementation can’t begin until the date of legal execution, these preparations can. And even if the deal falls through, not much has been lost—just a few months of planning.

One merger that accomplished effective due diligence was the joining of two business services firms that provided background checks to employers. As part of their mutual due diligence, the companies conducted an extensive technical review. It turned out that one of them had a powerful, automated back-office platform, which could gather data quickly at low cost. The other company relied on manual systems for its research, but its user interface and user experience were strongly favored by customers. Because these two systems could be made compatible, the groundwork could be laid for a very successful digital integration, even before the deal closed.

Know Your Scale Strategy

Most companies already have an implicit scale strategy in place: a set of ingrained assumptions about how to pursue digital innovation and other technology practices across a broader footprint. But by explicitly reconsidering their scale strategy, they can often make it much more effective—maximizing investment, deploying the same technologies and people throughout all parts of the new enterprise, and harnessing the potential of combined data.

A scale strategy should identify where scale is helpful and where it isn’t, and then push for as much standardization as possible.

A scale strategy should identify where scale is helpful and where it isn’t, and then push for as much standardization as possible. It should establish commonality among different parts of the organization, reduce the complexities associated with internal boundaries, and minimize opt-outs and exceptions.

Some stakeholders may insist on maintaining separate platforms even after the integration. They may have compelling reasons—for example, involving trade secrets or legal restrictions. But ROI, technological, and compliance considerations all generally support integration, if it can be done well. The burden of proof should be on the separatists; establish a high bar for opting out of the shared platform and incentives for opting in.

One major media company discovered the benefits of a carefully considered scale strategy during the aftermath of a trans-Atlantic merger. The company saw several potential benefits: leveraging its existing library of content in more regions, improving the business case for investing along its entire value chain, and gaining much better ROI on machine learning and analytics. The scale strategy became a step-by-step learning curve, and the company is now reaping the benefits from its broader geographic footprint.

Lay Out a Roadmap That Everyone Can Follow

As a newly merged digital enterprise comes together, many potential benefits accrue: streamlined organization structures, a more agile and proficient culture, and a faster, more effective change process. To realize these benefits, it’s not enough to have an implicit way forward. Companies must have a carefully laid out transformation roadmap, including the decision points to come, proposed technical architecture, and expected milestones at every stage.

The map is not just a planning document. It is also a common frame of reference so that people at all levels understand the changes to come and the benefits of the deal. Staff commitment and creativity will be crucial. And during the months after the merger, the company can assess each part of the initiative against this common framework.

The roadmap may also be integrated with plans for job changes, training opportunities, and new ventures—especially as they relate to the technology. It should identify specific use cases: situations in which challenges are met with new solutions that can then be adopted more broadly. It is also a forcing function for cross-disciplinary decision making, bringing IT, digital, and market-oriented professionals together to discuss issues like customer interfaces. Finally, it should address the level of upfront investment required and involve a clear sequence for different parts of the merged enterprise to adopt the common platform.

At one well-known financial services firm, a leadership council of business unit leaders retained its value long past the integration-planning period. The council still uses a shared roadmap to oversee the continuing evolution of the combined company’s digital platform. Specifically, the group provides input on how roadmap decisions impact the legacy businesses and makes recommendations to the executive steering committee on decisions related to the roadmap and on managing change inside the organization.

Rip the Band-aid Off Legacy Systems

Companies are always tempted to ease the pain of technological change with slow, methodical, and incremental upgrades. But this doesn’t work with legacy systems after a merger—they all have different histories and often use separate foundational platforms. It’s faster, less expensive, and much easier to “rip the Band-Aid off” quickly: convert all the existing digital systems to a single platform in one swoop. This rapid turnaround can be a unifying experience for the enterprise culture.

Instead of setting up waterfall-style transformations, in which each part of an initiative completes its process before the next part begins, bring a disparate group together to work intensively on digital conversion all at once. By setting up this type of cross-functional team to manage the transition collaboratively, one retailer accelerated the post-merger integration of its e-commerce platform from an initial estimate of 15 months or more to an actual achieved deadline of 8 months.

Determining the right approach for integrating enterprise resource planning (ERP) systems is a particularly difficult decision for many merged companies because of the complexity, time, and investment required. One European energy utility pursued an overall ERP transformation by developing a best-of-both-worlds approach. It took advantage of the buyer’s legacy ERP with its high degree of centralization and of the acquired firm’s legacy system with its modernized technical platform. It thereby reduced the time needed to integrate and modernize and avoided regret.

Remember that the goal is not just to reconcile your technology but to focus on your business growth and the technological support it needs.

Remember that the goal is not just to reconcile your technology but to focus on your business growth and the technological support it needs. Although the business problems haven’t changed, the tools to address them have evolved, and you can incorporate them in radically new ways—if you focus on future outcomes.

Ruthlessly Prioritize Business Objectives

When you focus on value, you value your focus. Instead of adopting a state-of-the-art platform for the sake of technological superiority, look for the business case for every aspect of IT, working with use cases—from the companies involved in the merger or others—that show the link to results.

Make sure every decision explicitly takes into account the benefits offered to customers and the associated gains in revenue and profitability. This is particularly important in areas involving large technological investment, even if it’s transitional. There will inevitably be some vested interests, vendor relationships, and old priorities on the table.

It can take thoughtful end-to-end planning to keep digital transformations focused on value. For one consumer-facing restaurant company, a series of acquisitions meant that the company suddenly had an enormous sea of data about customer behavior and operations. The integration team developed a long list of use cases to capture the value, along with a vision and long-term roadmap. But the team also ruthlessly limited itself to a handful of initial priorities. These were opportunities with a concentration of potential value, where the company could begin to build a foundational platform and organizational capabilities. One of the first projects was a model for forecasting customer traffic on the basis of weather and local events. This enabled the company to staff restaurants in an optimized way that could rapidly be scaled from one brand to another. More broadly, this early win built management’s confidence that they could scale value in digital and analytics.

Get the Right Talent and Culture in Place

Digital talent is in short supply today. As companies build a new digital platform, most also need to build and refine the supporting teams. A merger or acquisition provides an opportunity for attracting people to work on the digital platform, drawing them in from legacy businesses on the inside or recruiting them from outside the company. Although building the new team will be a high priority, you don’t need everyone in place at the outset; you can get started with your scale strategy while bringing people onboard.

Given the competition for digital talent, a top post-merger priority should be a retention strategy for skilled employees. Don’t think about redundancies or replacing people to find new skill sets; focus on retaining and maximizing the contribution of people already inside the company. In developing this talent pool for your newly merged company, emphasize “vying for opportunity” rather than “vying for jobs.” In other words, instead of thinking about narrowly defined roles that must be filled, establish a broader base of needs that must be addressed—and not necessarily by a particular role.

Companies can often manage talent needs through explicit structures. One merged European firm found itself with two incoming divisions at different stages of digital maturity. The company set up a secondment program in which the leading division lent its talent to the second, lagging division, building shared digital capabilities and fostering long-term careers.

The Aftermath of Integration

A well-designed, well-executed digital post-merger integration can serve as the combined organization’s starting point for a more technologically advanced way of life. For most companies taking this journey, the undertaking will not be their last digital transformation; there will be successive waves of increasingly sophisticated technological change or other dramatic shifts to come. By focusing on the six principles in this article, you can help establish the IT and digital functions—and, by extension, the rest of the organization—as an innovative enterprise with a strong value focus, now and in the long term. With a well-designed digital PMI approach, you can lead your part of the future.