Inflation is growing faster today than it has since the Great Recession. Whether it is driven by temporary shocks or longer-term forces is unclear at this point. Regardless, consumer packaged goods (CPG) companies are feeling a hit to the bottom line.

With costs rising across a variety of inputs, ranging from commodities to labor to transportation, the question is not if CPG manufacturers will increase their prices, but when and how. We expect CPG players to offset costs while resetting category price dynamics in a surgical manner so that they can recover margin in the short term even as they establish a foundation for long-term growth.

We’ve spoken with leaders at more than ten of the top North American CPG companies across multiple categories to understand their approach in this challenging inflationary environment.

Rising Pressure

Revenue management leaders at CPG companies are reporting significant increases in the cost of goods sold, and May brought reports of a 5% year-over-year increase in the Consumer Price Index, the largest 12-month increase since 2008.

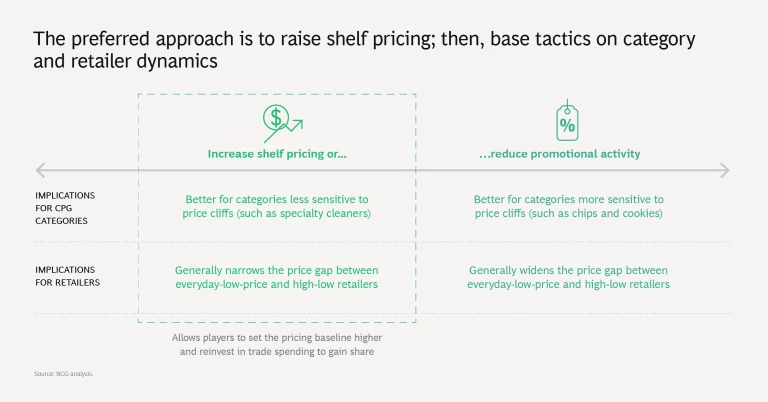

While many economists believe that the inflationary shock is likely temporary, the opportunity to reset prices is too important to miss. In fact, prices had already started to rise across categories from April 2020 through March 2021. But much of the price increase in like-for-like goods during this period came from a reduction in promotions as manufacturers pulled back to address pandemic-onset supply shortages. This lever is nearly exhausted for some categories, so CPG leaders are looking at a host of net revenue management (NRM) tactics to effectively improve price realization in 2021.

Four Moves for Raising Prices Effectively

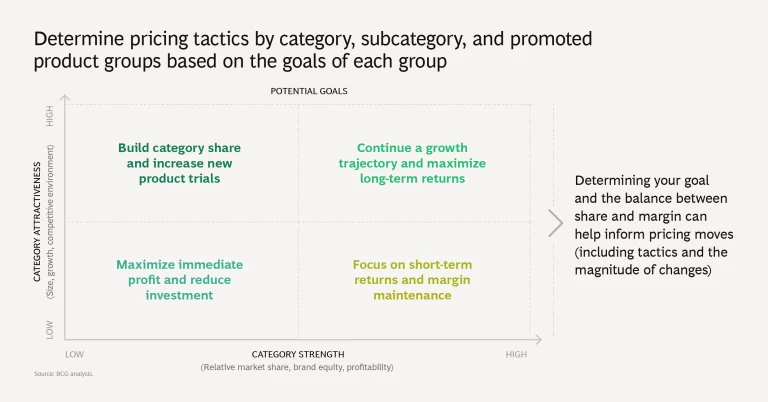

A different mix of NRM moves will be appropriate for each category, so CPG leaders should ask themselves: “How elastic is the demand for my brand and products? How does this vary across packs and SKUs in a competitive context? What is the degree of exposure to commodities in my cost base?”

Answering these questions will help companies adopt a winning combination of moves:

- Deaverage. Not every category or pack requires the same magnitude of price increase. For important growth drivers, minimize increases to hold or gain share. For slower-growing profit generators, price above inflation and maximize contribution, even at the risk of share loss.

- Prioritize shelf price increases. Shelf price increases are expected to have more traction today than at any time in recent years. Market conditions support raising shelf prices, opening the ability for CPG players to selectively reinvest in trade spending (increasing promotional activity or offering coupons, for example) to drive share and reset marketplace dynamics across retailers.

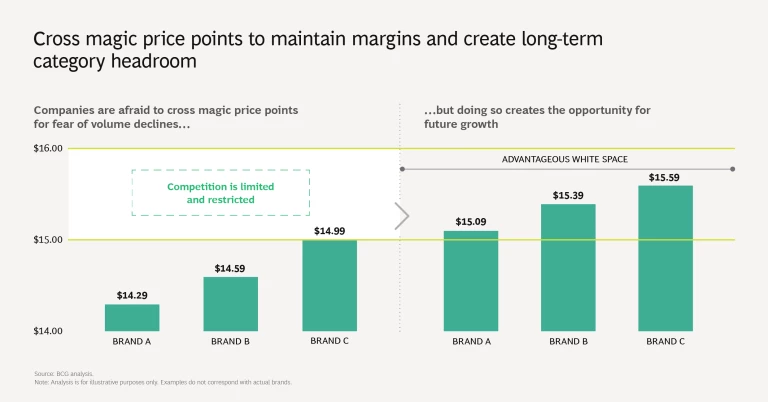

- Reset architecture. Setting new list prices strategically above so-called magic price points will nudge competitors and retailers to move categories into higher price bands. It will also improve price realization in the short term while opening up room to enable longer-term growth.

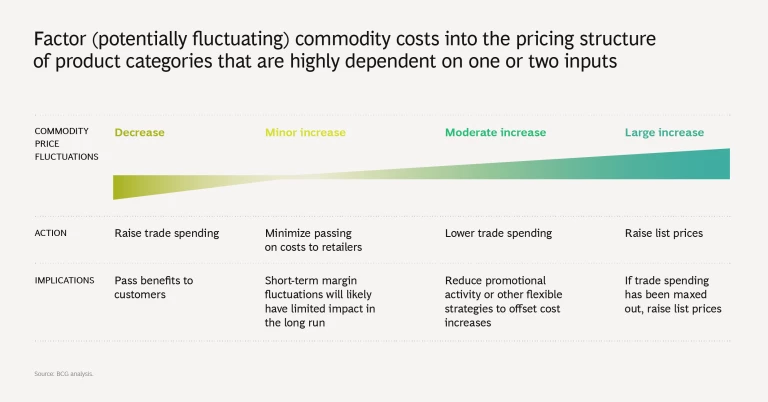

- Control for commodities. Players in categories with heavy commodities exposure could even build mechanisms for passing along input costs in their pricing arrangements with retailers. This move isn’t right for every category, but it could be valuable for those with significant exposure to the open market prices of one or two key inputs.

Four Enablers for Execution

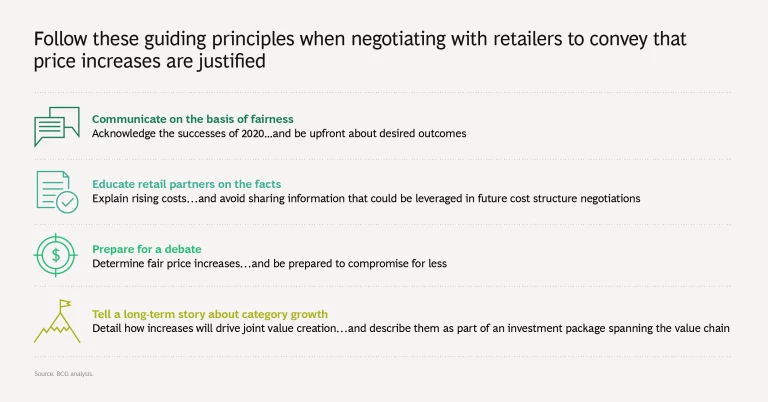

Given the CPG industry ’s success in 2020, retailers may be asking why suppliers can’t just absorb rising input costs, at least for the time being, or until cost trends become clearer. We recommend focusing on execution and retail interactions to ensure that price moves are attractive and successful.

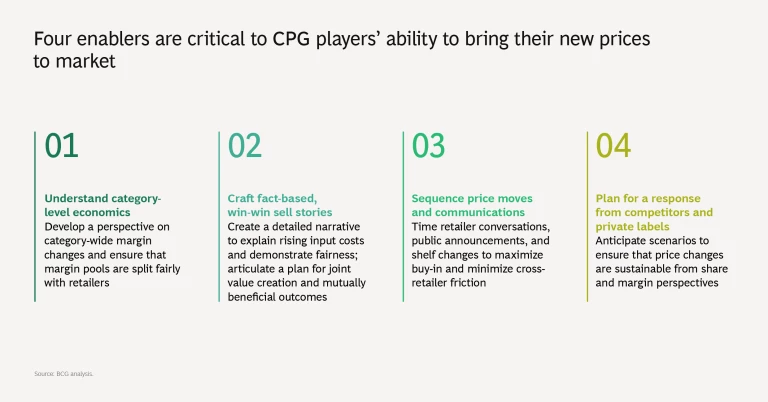

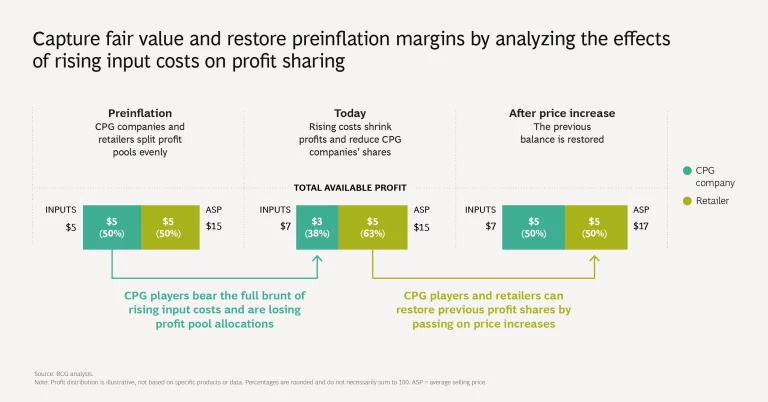

- Understand category-level economics. Input costs are currently affecting CPG players disproportionately, shrinking the total profit pool and shifting its allocation toward retailers. Suppliers need to prove that they aren’t trying to grab more than their fair share of the profit; they are merely restoring preinflation proportions.

- Craft fact-based, win-win sell stories. Invest time in preparing a fact-based narrative, with the goal of educating on the shifts in top cost drivers and why adjusting pricing is the only option. Even better, pair a short-term, cost-based view with a longer-term story of how price increases will create room for category growth over time (supplemented by investments across the value chain in innovation and productivity).

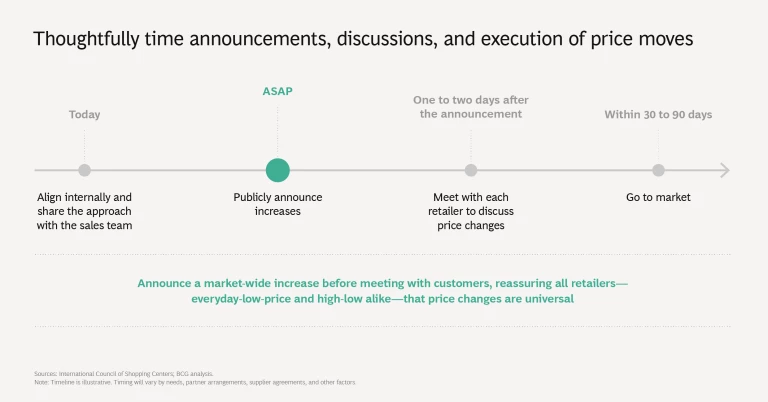

- Sequence price moves and communications. Rather than getting bogged down in difficult conversations, the easiest approach is to start by announcing a market-wide increase. Category leaders have the most credibility to move first; secondary players may want to wait it out if they can absorb a margin hit, or else prepare for blowback and potential concessions. Signal to all retailers—everyday-low-price and high-low alike—by announcing that price increases will occur across the market.

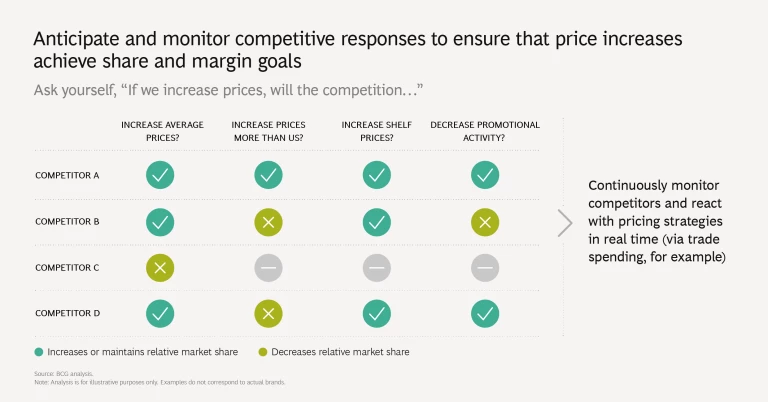

- Plan for a competitive and private-label response. Anticipate share changes, considering margin tradeoffs and potential mitigations, such as heightened promotional intensity. Formulate a projection of costs and a picture of supply to determine if it is viable to steal a few points of share from the competition.

CPG companies can get to work immediately by looking carefully at their portfolios and determining strategic goals, target prices, and tactics. From there, it’s a matter of crafting an execution approach that generates buy-in with retailers. Too much is at stake to overlook this pricing opportunity: rising input costs means diminished profit—and losing out to savvy competitors.