Which technologies are capturing private investment, where is more investment most needed, who must provide it, and how best can they make the necessary investment decisions? Find out where the smart money is headed.

Evidence of the impact of global warming—including disruptive weather patterns, rising sea levels, and melting polar ice caps—is already upon us. Now the issue is whether or not we can slow the process quickly enough to mitigate its worst effects.

The goal of the Paris Agreement is to limit the earth’s warming to less than 1.5°C by 2050, which will require reaching net zero —the point at which the global greenhouse gas (GHG) emissions released into the atmosphere are balanced by those removed. But doing so using the technologies we currently have at our disposal—including electric vehicles (EVs), energy storage, solar energy, wind energy, nuclear energy, and biofuels—won’t be enough. We must also develop and implement a range of less mature low-carbon technologies that have the potential to significantly lower our global carbon footprint further. These include hydrogen power; carbon capture, utilization, and storage (CCUS); and climate analytics.

As much as $21 trillion in new investment in both mature and newer low-carbon technologies will be needed over the next ten years.

To get the job done, according to the IEA, as much as $21 trillion in new investment in both mature and newer low-carbon technologies will be needed over the next ten years. And of that $21 trillion, fully 10%—a minimum of $2.1 trillion—will likely have to come from private investors, including venture capitalists (VCs),

private equity (PE) firms

, corporate venture arms (CVAs), and financial institutions.

Unfortunately, we are nowhere close to reaching that level of investment. To get there, according to our analysis, annual private investment must reach $470 billion by 2030.

Which technologies are capturing private investment, who is investing, and where is the investment coming from? Where is more investment most needed, who must provide it, and how best can they make the necessary investment decisions? In this article, we at BCG’s Center for Growth and Innovation Analytics analyze the sources and trends of private investment into the innovative emerging technologies that must play an outsize role in reducing carbon emissions, and we take a look at where private investment is especially lagging. We also examine the investment trends we expect to see over the next decade.

The Low-Carbon Technology Landscape

First, the bad news. As noted, global private investment in low-carbon technologies is nowhere near where it needs to be if we are to limit global warming to less than 1.5°C by 2050. (See “Methodology” for a discussion of how we analyze and categorize the different kinds of private investment.)

Methodology

- Private Placements. These are private sales of newly issued equity or debt, most often minority stakes, to select investors. They include the VC or PE funding of early-, growth-, and late-stage funding rounds and private investment in public equity (PIPE) funding.

- Nondebt or Equity-Backed Funding. This includes, for example, the crowdfunding of new products, nonequity assistance, and grants.

Private investment is most often directed toward innovative companies developing and scaling up new technologies, where returns are risky and have relatively long time horizons.

Investment data used in our analysis was sourced from NetBase Quid, a platform that applies natural-language processing to data from S&P Capital IQ and Crunchbase to analyze and quantify the low-carbon private investment ecosystem. The scope of the analysis covers companies that have received private investment since 2016. Data for 2021 was collected through August 2021 and then projected for the remainder of the year. Dollar amounts shown are for disclosed values; only about two-thirds of deal values are disclosed in this data set, and data on specific investors was not disclosed for 25% of private investment events. Therefore, it is likely that total private investment amounts are underestimated.

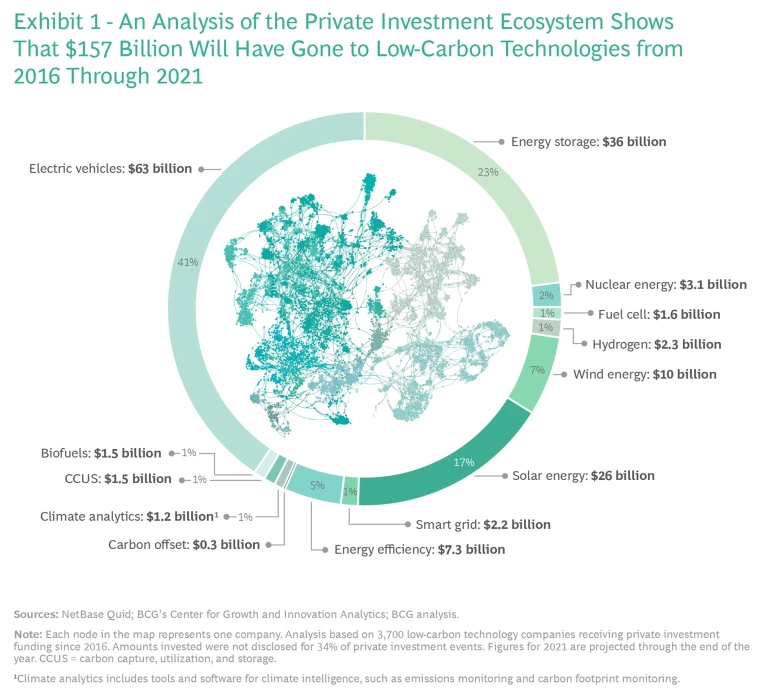

According to our analysis, from 2016 through the end of 2021, close to $160 billion in disclosed capital will have come from private investors. While private investment has increased every year during this period, we will need fully eight times the amount invested in 2021 to get the job done by 2030. Moreover, by far the largest portion of private investment—more than 90%—will have gone to six relatively mature technologies: EVs, energy storage, solar energy, wind energy, nuclear energy, and biofuels. EVs alone have captured more than 40% of the total.

As important as these mature technologies are in the fight against climate change , however, they cannot by themselves enable us to meet GHG mitigation goals. According to the IEA, more than a third of the reductions in GHGs must come from less mature technologies that are still in the newly emerging stages, including hydrogen, CCUS, carbon offset, and climate analytics technologies. (See “Hot Tech for a Cooler Planet.”) Yet just 3% of private investment has gone into these newer technologies over the past five years.

Hot Tech for a Cooler Planet

Potential Game-Changers

Early-adoption technologies are just beginning to reach the market, and innovation is ongoing. Newly emerging technologies, by contrast, are still in their infancy, and while some nascent developments have come to market, many are still primarily experimental in nature. These technologies are the ones that will be critical for reaching emissions abatement goals, and they have the greatest need for investment.

Hydrogen. Hydrogen’s potential for reducing the greenhouse gas (GHG) emissions that are the primary cause of global warming is huge, whether used as fuel for transport, in the form of fuel cells and other technologies, or to power a variety of industrial processes. Considerable efforts are being made to develop electrolyzer technologies that can produce hydrogen economically; produce it with renewable energy and integrate its production with carbon capture, utilization, and storage (CCUS) to produce green hydrogen; and store and transport it safely. Figuring out how to use this explosive gas in direct combustion and other uses in industries such as steel manufacturing also remains a challenge.

CCUS. The range of technologies intended to capture and sequester GHGs in their various forms will play a critical role in reaching net zero. Recently, there has been a surge in private investment activity, with the amount of investments made in 2021 already more than double that of 2020. Corporate investors in the private capital ecosystem are notably active in CCUS, with oil and gas players leading the way. Chevron is investing in a variety of technologies, including industrial CO2 capture and the use of CO2 in making concrete. BP has also invested in industrial CO2 capture and technologies for using CO2 as a feedstock for making chemicals—a technology that is receiving significant investment. Another technology receiving significant investment is direct air capture.

Climate Analytics. Unsurprisingly, VCs and PE firms remain the key investors in the digital technologies designed to measure and monitor GHG emissions, carbon footprints, and other types of analytics related to climate change. Private investment in the sector is growing rapidly, more than tripling in 2021 compared with 2020.

While the presence of industry players in climate analytics is limited, activity is stirring. For instance, Schlumberger recently invested in GHGSat, an emissions monitoring company, while the Oil and Gas Climate Initiative, a consortium of top oil and gas companies, has invested in both GHGSat and Kairos Aerospace, a methane emissions detection company.

Bimodal Technologies

Several mature technologies continue to undergo considerable innovation. These bimodal technologies, as we call them, have a high potential to disrupt more traditional technologies. Energy storage in the form of lithium-ion batteries, for example, continues to attract a great deal of capital for building manufacturing facilities, but much research is still being conducted into other battery chemistries, including advanced lithium, sodium-ion, and solid-state technologies. Some biofuels, such as methanol, are also well understood, but research is ongoing in others, such as advanced ethanol, emerging plant-based fuels, and algae-based fuels. And revived efforts to develop controllable fusion reactors could transform the nuclear power business, including the way electricity is generated.

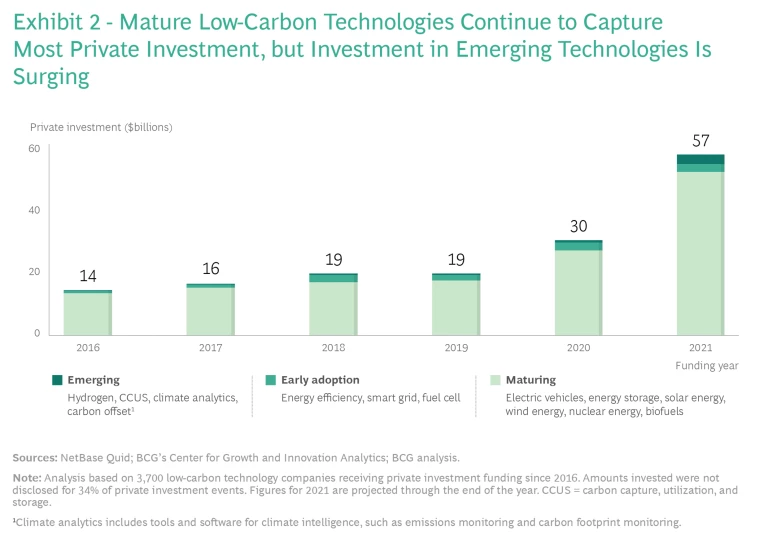

Now the good news. Private investment in low-carbon technologies has almost doubled since 2020, to a projected $57 billion. Moreover, the proportion of investment dollars devoted to early-adoption and emerging technologies has grown from just 1% in 2016 to a projected 6% of the total in 2021. (See Exhibit 2.)

This is key because, historically, VCs and PE firms have played a critical role in supporting innovation and emerging technologies. Over time, according to numerous studies, they have accounted for 12% of industrial innovation and delivered more than twice the innovation returns of corporate R&D investment.

The Investor View

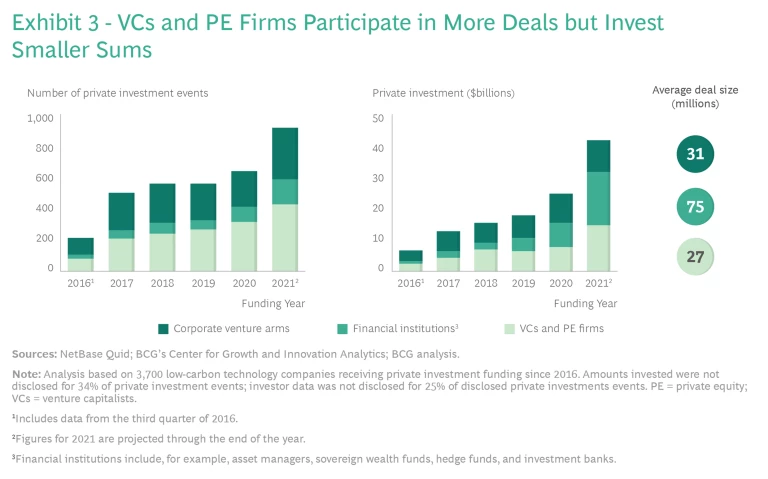

Just as the types of technologies attracting private investment are finally swinging toward newer, less mature ones, so the mix of investors is changing as well. From 2016 through 2021, CVAs and financial institutions dominated the space in terms of dollars invested, contributing two-thirds of the total. VCs and PE firms made considerably more deals over the period—no surprise, given the smaller dollar amount of the deals they made.

During the past year, however, the total financial commitment from VCs and PE firms has almost doubled, as have investments from financial institutions, while investments from CVAs remained essentially flat. (See Exhibit 3.) The jump in investment from VCs and PE firms is understandable, given their desire to participate in the ongoing development of promising new technologies. And many financial investors have increasingly turned to less mature companies that are developing new low-carbon technologies both as a way to boost investment returns and as part of their sustainability aspirations.

The lack of investment growth on the part of CVAs, however, is concerning. If we are to reach the level of private investment needed, corporations will have to invest more actively in young companies pursuing promising new technologies. Forward-thinking corporations should see this not just as a necessity to mitigate the effects of global warming but also as a business opportunity. By placing multiple strategic bets on young companies, corporations can help accelerate innovation while identifying and supporting new technologies as they mature. Such investments will also aid corporations in meeting their own strategic emissions reduction goals. And multiple investments will enable them to spread their risk across various potential winners.

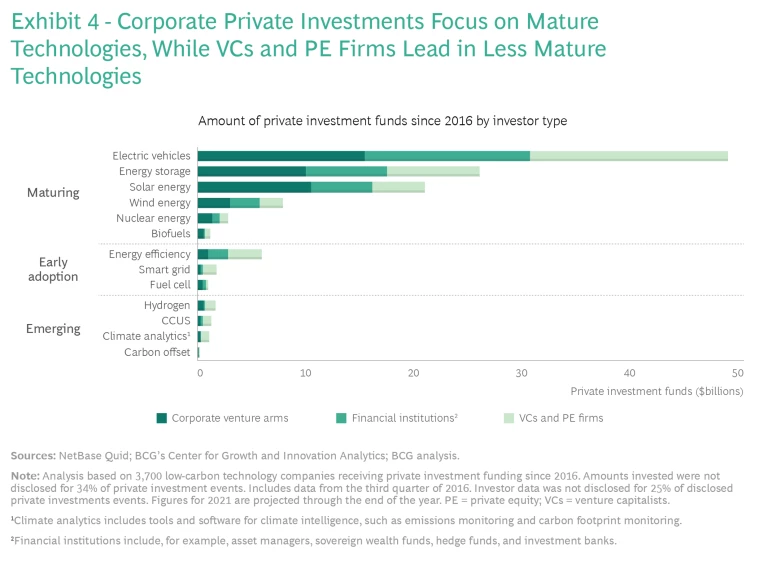

Yet CVAs—and financial investors, too—are focusing primarily on scaling up and consolidating their financial gains in more mature technologies. (See Exhibit 4.) Fully 90% of their investments have gone into just four technologies: EVs, energy storage, solar energy, and wind energy. It is the VCs and PE firms that are focusing a larger proportion of their investments in the less mature technologies that must be further developed to meet our climate goals. Of all the private investment going into emerging technologies, VCs and PE firms account for almost two-thirds of the total, while CVAs account for less than 30% and financial institutions less than 10%.

Industry-specific data, however, suggests that CVAs in several key sectors are beginning to diversify their private investments into newer technologies.

Electric and Electronics Companies. With investments totaling more than $9 billion since 2016, CVAs in this sector have invested the most in low-carbon technologies overall. However, they have focused their investments more heavily in the top four technologies than any other industry. For example, Panasonic recently invested in Gogoro, an electric-scooter company based in Taipei that plans to go public soon, while Schneider Electric last year led a $169 million investment in Wanbang Digital Energy, a Chinese electric charging company.

Automotive. More than 90% of investments by CVAs in this sector have gone to EVs and energy storage, but those organizations are beginning to show interest in newer technologies, notably hydrogen. Toyota recently invested in Universal Hydrogen, a maker of hydrogen transportation and hydrogen-electric drivetrains. (JetBlue and Airbus have invested in the young company as well, with the hope that its technology can be applied to the airline industry). Auto companies are also working with their suppliers to reduce the carbon footprints of their vehicles by increasing the circularity of materials they use, including green steel, recycled aluminum, and low-carbon plastics. However, whether they should be investing in other, equally valuable technologies is an open question, especially given how much their products contribute to GHG emissions.

Technology. To date, the CVAs of technology companies have invested even more heavily in EVs than the automotive CVAs have. But they are beginning to invest more actively in other areas as well, including energy efficiency and carbon offset technologies, CCUS, and even nuclear energy, where new private investment is largely driven by increasing interest in fusion technology. US-based TAE Technologies has already raised upwards of $1 billion from Google and others to fund its fusion demonstration efforts.

Oil and Gas. Recently, CVAs in this sector have significantly upped their low-carbon investments: fully 76% of the deals they participated in have been made since 2019. The great majority of their investments have been in mature renewables, such as solar energy and wind energy, and in energy storage—no surprise, given their need to diversify as a way of lowering their carbon footprints. But they are beginning to place more bets on newer technologies; their investments in hydrogen and CCUS, for example, have almost doubled since 2019. Last year, for example, Total invested in hydrogen-powered heavy-truck maker Hyzon Motors; more recently, Baker Hughes made a strategic investment in Electrochaea, an innovator in CCUS technology.

In general, we expect to see a number of promising trends play out over the next several years. Certain technologies, for instance, are experiencing an increase in cross-industry investing, an indication of their growing importance. CVAs in a range of industries—including oil and gas, airlines, shipping, and automotive—are investing in new hydrogen technologies across the value chain. CCUS and carbon offset technologies, too, are attracting investments from companies in diverse industries, including oil and gas, chemicals, and technology.

Liquid Wind, a Swedish company founded in 2015 that has developed technology to combine CO2 and green hydrogen to produce e-methanol, is a prime example. Since 2019, the company has received private investments from a diverse range of CVAs, including those associated with Siemens Energy, chemicals company Haldor Topsoe, industrial machinery maker Alfa Laval, and German utility Uniper.

We also expect to see a resurgence in investment activity in several more mature technologies that are still experiencing considerable innovation, which we call bimodal technologies. Investment in fuel cell technology, for example, which in the past centered primarily on stationary power applications, is focusing more and more on the electrification of transport and on further innovation, specifically in hydrogen fuel cell technology. More investment is occurring in several technologies in the biofuel sector as well, including fuels based on methanol, ammonia, and jet kerosene, to be used in the aviation and shipping industries, among others.

We are also likely to see a spike in investments by manufacturers , which as a group have not yet made significant investments into the low-carbon technologies they will need to decarbonize their own operations. Similarly, more companies are looking to create environmentally sensitive businesses that can provide new low-carbon technologies to others. Many are turning to the VC and PE innovation ecosystem for partners and technology to help them accelerate their capabilities and build products and services to drive their own business strategies.

The Regional Perspective

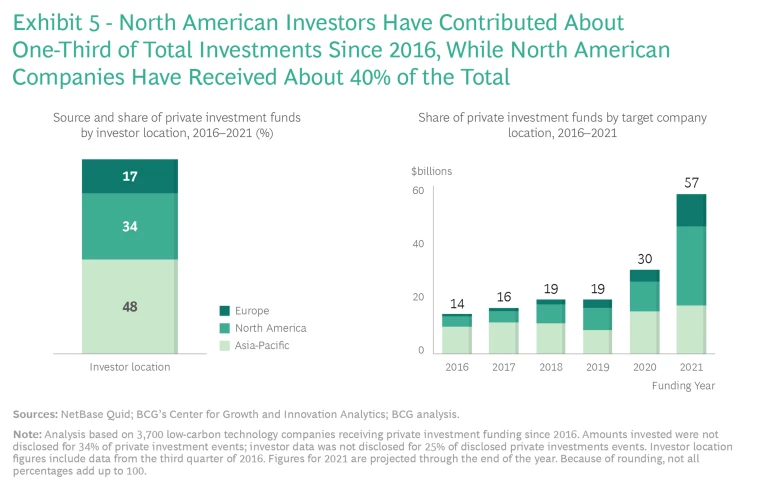

Private investment in low-carbon technologies has not been spread evenly around the world. Since 2016, investors from the Asia-Pacific region contributed almost half the total, with investors in North America contributing about a third and European investors adding less than a fifth. North American and European companies have rapidly increased their share of investments received, however. In just the past year alone, they attracted 2.7 times the amount they received in 2020, with North American companies capturing fully half of the total. Meanwhile, investment in Asia-Pacific companies remained essentially flat. (See Exhibit 5.)

A closer look at the mix of investor types and technologies being invested in, however, suggests that there is much work to be done, especially to support newer, less mature technologies.

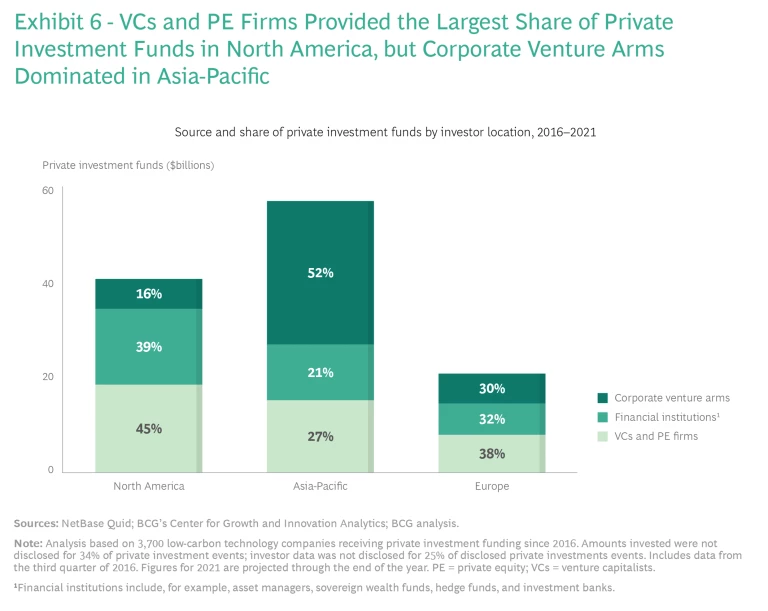

The Investor Mix. From 2016 through 2021, North American VCs and PE firms will have made almost half of the private investments in the region, a considerably larger level of activity on their part than in Asia-Pacific and Europe. (See Exhibit 6.)

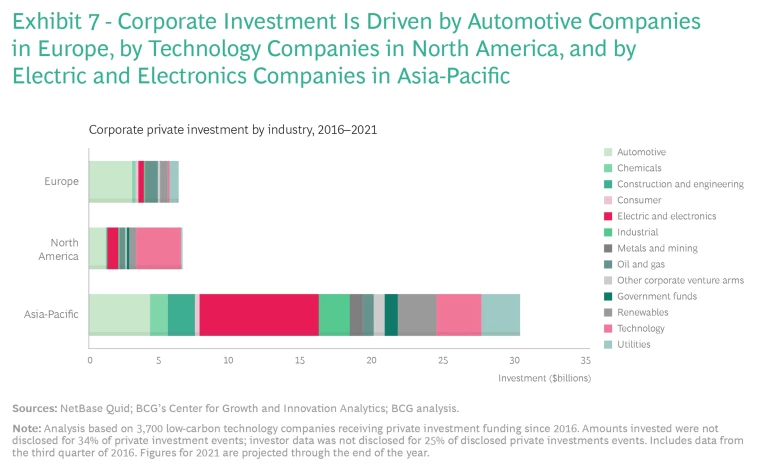

Technology companies dominate among corporate players, making up half the total, and the vast majority of their investments in low-carbon technologies are in EVs. (See Exhibit 7.) Automotive players make up a much smaller share of the total in North America compared with their European and Asian counterparts; they also focus on EVs and energy storage. Investments by the CVAs of oil and gas and electric and electronics companies account for much less in North America as a share of the total when compared with the other regions.

In contrast, CVAs dominate the private investment landscape in the Asia-Pacific region, making up more than half the total. Electric and electronics companies lead all investors, followed by the automotive industry. Asia-Pacific VCs and PE firms also focus primarily on EVs, followed by energy storage, but they focus significantly less on solar and wind energy than do the CVAs there.

The mix of investors in Europe is far more even than in other regions. VCs and PE firms lead the way, accounting for almost 40% of the total, focusing primarily on EVs, energy storage, and solar energy, with significantly less focus on wind energy and less mature technologies. The automotive sector is by far the largest investor among CVAs, with oil and gas companies and utilities distant seconds.

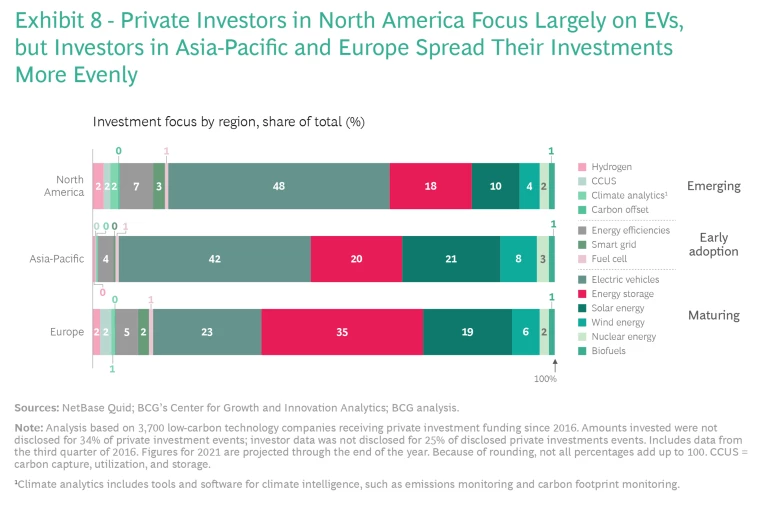

The Technology Mix. Investors in all three regions continue to focus their efforts on mature technologies, but this may change over the next several years. Almost half of North American private investment, for example, is going into EVs; considerably less is going into solar energy and energy storage as a share of the total. (See Exhibit 8). In Asia-Pacific, almost a third of investment is still going into solar and wind energy. In Europe, by contrast, a third of investment is going into energy storage, making it the top technology being invested in; EVs are second, followed by solar and then wind.

Meanwhile, investors in North America are committing a greater share of their investments to energy efficiency technologies, which account for close to 10% of the total. They are also investing more than investors in either of the other two regions in emerging technologies, notably hydrogen and climate analytics.

Future Needs. The implications of the regional perspective are clear. Most important, more private investment is needed across the board. No region is investing nearly enough to meet our climate goals, and the mix of investments continues to be heavily weighted away from critical, newly emerging technologies.

Moreover, corporate private investors must put more skin in the game and increase their bets on innovative new technologies. North American CVAs, in particular, continue to underinvest in the low-carbon ecosystem—and in emerging technologies in particular—relative to CVAs in other regions. This suggests that while they are beginning to understand the importance of such investments in our increasingly green economy, and are likely to make significant internal investments, they need to commit more private investment to the newer, untested technologies that are so desperately needed.

In contrast, the dominance of CVAs in the Asia-Pacific region may be due in part to the nature of the economy there, with less emphasis on venture and private equity financing. At the same time, it is encouraging that the range of sectors there is more diverse, suggesting a greater understanding of each individual sector’s role in the coming green economy. It may also be that the governments in the region are making strides to mandate the development of these technologies.

And in Europe, where so much investment is going into EVs and energy storage, the auto industry dominates, unsurprisingly. Where are the technology companies and others that also have huge strategic and regulatory stakes in developing new low-carbon technologies?

Strategies for Private Investors

While the sheer amount of money going into low-carbon technologies is nowhere near what’s needed, it is growing. If there is a single piece of advice we could give to private investors, it would be, “Invest more.” But simply throwing money at the problem is not the way to develop the technologies needed to slow global warming. VCs, PE firms, CVAs, and financial investors alike must approach the problem strategically if they are to get the most bang for their buck technologically while maximizing their own financial returns in the process. And more investment is especially needed in the bimodal and emerging low-carbon technologies that will be so central to winning the fight against climate change.

To that end, private investors should take into account the following measures as they develop their low-carbon technology investment strategies. These moves will help investors navigate the uncertainty and potential gap in returns associated with investing in low-carbon technology, particularly emerging technologies.

Think in terms of an ecosystem. As valuable as individual investments can be, investors should keep in mind that the full range of low-carbon technologies will ultimately complement one another in the fight against global warming. Many corporate investors in the private investment landscape lack visibility into the entire low-carbon ecosystem, as well as the means to engage effectively. By focusing narrowly on a limited set of solutions, they may miss out on valuable opportunities.

Investors should therefore use multiple lenses to gain deep, data-driven insights into the individual technologies they plan to invest in and the interrelations among them within the broader ecosystem. And they should consider engaging with the private investment ecosystem in multiple ways, building a portfolio of investments into different, complementary technologies using a variety of investment vehicles, from early-stage investments to acquisitions.

Take a portfolio approach. Private investors should consider any investment they make as part of an overall portfolio of investments. This means taking into account how the technology they’re investing in fits into a strategy determined by the range of potential relevant investments, as well as how the expected potential returns spread the risk across the portfolio. And because these technologies will likely become technically and economically feasible at different times, investments should cover a variety of companies in different stages of technological readiness.

We recently worked with a US client in the shipping and trucking industry to develop a portfolio of low-carbon businesses. We examined, among other things, where to place specific bets, with whom to partner, where to invest in early R&D, and how to engage. The company’s portfolio included a near-term focus on building out existing intellectual property in diesel-electric hybrid technology for short-haul shipping, the medium-term production and supply of hydrogen in partnership with equipment suppliers, and long-term bets in the distribution of ammonia for long-haul shipping.

Partner wisely. Find ways to collaborate with investors outside your sector, and even with competitors, to accelerate the maturity of the technologies in which you invest, and to help scale them up once they mature. This could include pooling resources or deliberately and thoughtfully building or participating in innovation networks to address specific technical hurdles and challenges. Consider participating in one of the growing number of special-purpose and nonprofit VC funds—such as Prime Coalition—which support early-stage, high-risk R&D in low-carbon technologies, and monitor their investments with an eye to investing further.

In 2020 for example, shipping giant Maersk led a partnership of key players to create the Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping. In the shipping industry, these players included ABS, Cargill, Mitsubishi Heavy Industries, NYK Line, and Siemens Energy; in oil and gas, they included Total and BP. The partnership has committed up to $1.2 billion to fund research on decarbonizing the shipping industry, with the goal of reaching net zero by 2050. Research will focus on energy solutions for the maritime industry, including new fuel technology, such as ammonia and hydrogen. The center recently announced a joint project with Alfa Laval, DTU Energy, Haldor Topsoe, and Svitzer to accelerate research on solid oxide fuel cell technology, with the potential to develop a highly efficient and scalable solution that would help decarbonize the marine industry.

Helping to reach net-zero climate goals while profiting financially will require investing in often-untried, risky technologies.

Take risks. Helping to reach net-zero climate goals while profiting financially will require investing in often-untried, risky technologies. Match investments or holdings in older, more mature technologies with investments in less mature or emerging technologies that could add further scale or efficiency. Some investments will require taking a longer-term view, so set aside funds to make multiple bets in riskier early-stage startups and place multiple bets. And be prepared for some of these to fail.

Consider the risks involved in developing direct air capture, a highly experimental technology intended to convert airborne CO2 into useable synthetic fuels. It took Carbon Engineering, a Canadian company founded in 2009, six years to begin capturing CO2 from the atmosphere and two more to begin producing synthetic fuel from the CO2. Only in 2016 did the company begin receiving substantial private investments from several oil and gas companies, including the venture arms of Occidental Petroleum and Chevron, and a number of VC and PE firms. Carbon Engineering has raised a total of $102 million and is now building its first commercial plants, in the US and the UK.

The Good Fight

Private investors are putting more money into developing and bringing to market the low-carbon technologies necessary to meet the goals of the Paris Agreement. But even more investment is needed, especially in the innovative new technologies with the most potential for replacing current sources of energy, reducing GHG emissions, sequestering CO2, and providing insights and guidance into our efforts to limit global warming.

The smart money is already heading in this direction. And no wonder, given that these new technologies will likely serve as the basis for a rapidly growing green economy on a global scale and a healthier planet.