How would you react if you found out that your main competitor had discovered a new commercial model that is two to three times more effective, enables better outcomes for patients, and delivers greater overall value in health care? Let this sink in.

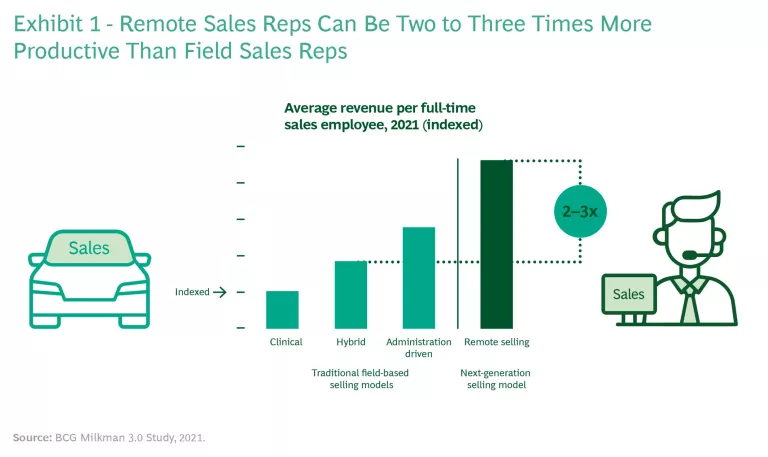

In the medical technology industry, a next-generation commercial model—one that capitalizes on digital and omnichannel interactions—can lead to a twofold or threefold increase in the productivity of sales representatives, as measured in revenue. These are the results that early pioneers of next-generation commercial models have achieved in medtech. But to get there, they had to completely rethink their old commercial models. They had to design a target future customer journey (rather than optimizing existing processes); put marketing in the pole position to generate, nurture, and qualify leads; build a bionic sales force with performance-enhancing technologies; and expand their focus beyond selling to actually making customers successful. These leaders also took an agile, use-case-centered design approach along the customer journey to experiment and learn one step at a time, build the required digital enablers on the way, and ensure strong change management.

The beauty of this new model is that it goes beyond improving commercial effectiveness. It also enables a closer partnership between medtech companies and health care providers to deliver better patient outcomes at lower costs, thus contributing to a more sustainable health care system. Digital marketing, self-service portals, and virtual-engagement models provide physicians and hospitals access to a richer reservoir of knowledge and expertise that is needed in the delivery of care. And taking the customer journey all the way to customer success management makes it easier to do business while at the same time moving beyond selling products to providing solutions that unlock better value in health care.

The beauty of this new model is that it goes beyond improving commercial effectiveness.

We have completed our third “milkman” study, again with broad participation from across the sector. We surveyed more than 8,500 employees in commercial functions at medtech companies and conducted over 200 interviews with senior leaders across the US, Europe, Japan, and the BRIC countries. We also extended our financial and organizational benchmarking database to 150 medtech businesses worldwide—including nine of the ten largest companies in the industry. The benchmarked businesses collectively represent more than $85 billion in annual revenue. (For details on earlier publications in this series, see “The Evidence Continues to Build.”)

The Evidence Continues to Build

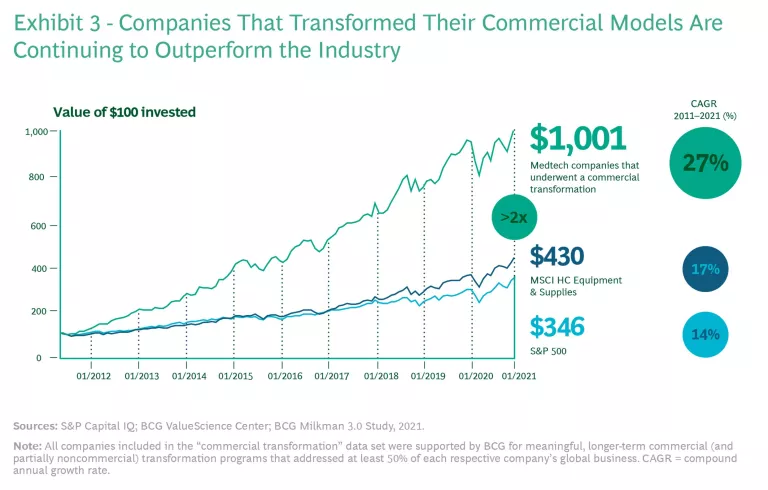

In our comprehensive follow-up study (Moving Beyond the “Milkman” Model in Medtech) in 2017, we found that the industry had made limited progress despite mounting pressures on gross margins. But those companies that had acted on the transformational moves we recommended were winning in the market and generating annual shareholder returns that were 10 percentage points higher than the average of a representative medtech index. We recommended that in addition to fixing their commercial models, it was imperative for medtech companies to invest in more-innovative business models focused on value-based health care, digitization, and low-cost products and services.

The evidence from all three studies suggests that the old commercial model is outdated. Medtech companies need a new approach.

As with previous surveys, the new results illustrate the value that firms can unlock by redesigning their commercial models. Overall, the industry has still made little progress, but those organizations that have taken the steps we recommended are vastly outperforming their peers. And in the past year, the coronavirus pandemic has opened eyes at many medtech companies. Because commercial teams were forced to find new ways to interact remotely with their customers, they saw the potential in building a next-generation, omnichannel commercial model.

That was a kind of forced experiment for the industry, but medtech companies cannot—and should not—try to revert to their old ways after the pandemic has passed. Instead, they should follow in the steps of leading players. In this report, we lay out our view on how companies can design the next-generation commercial model and realize its potential.

A Wake-Up Call to Fix the Old Commercial Model

Until the advent of COVID-19, the medtech industry had only made slow progress in fixing its traditional, high-cost commercial model since our previous studies in 2013 and 2017. On average, medtech companies are still spending two to three times more on selling, general, and administrative (SG&A) expenses (as a percent of the costs of goods sold) than the typical technology or industrial company. Our analyses had originally identified three selling-model archetypes: selling primarily to clinicians, primarily to administrative decision makers, or a hybrid approach targeting both groups. For all three models, the productivity of sales reps has remained roughly the same over the past decade.

The pandemic is changing this. Before COVID-19, a few pioneers had started to experiment with a next-generation commercial model. But the challenge to connect remotely with customers during the crisis has unleashed dramatic change in commercial model design—with highly promising results. As illustrated in Exhibit 1, the commercial productivity of remote sales reps can be double or even triple that of traditional field reps when embedded in a well-oiled, omnichannel model.

This has led to revolutionary insights for a few early movers that are already shifting massively to this new way of working. (See “A Company Unlocks $5 Billion with a New Commercial Model.”)

A Company Unlocks $5 Billion with a New Commercial Model

The company started the journey in Europe because the diversity of national markets would provide a fertile ground for business model innovation. It subsequently rolled out the solution globally, starting with its home market in the US.

The company took several measures to realize its ambitions, which might also serve as inspiration for others.

It generated deep insights to design the future customer journey. The company started by conducting in-depth ethnographic research, shadowing stakeholders in hospitals across seven countries in Europe and identifying more than 100 actionable pain points along the end-to-end customer journey. This research took place three years before the pandemic began, and, even then, hospital stakeholders were surprisingly open to digitally enabled, virtual-engagement models in the form of self-service portals and remote selling. In fact, many customers wondered why supplier-customer interactions in the B2B hospital environment were so far behind the seamless customer journeys they experienced in their personal lives as consumers.

Day-to-day customer service was a point of friction. Customers experienced late or incomplete orders and high numbers of invoice disputes with long resolution times. One nurse actually maintained a hand-written checklist of whom to contact at the medtech company for specific issues—and how—given that each business unit had its own particular way of handling customer service. Leveraging these insights, the company designed a new end-to-end customer journey across all touchpoints, from awareness to customer success management, differentiated by customer segment.

It aligned on a harmonized approach to customer segmentation. Next, the company devised a simple customer segmentation model that grouped its customer base into five categories based on size (extra large through extra small) and two types of behaviors (transactional or clinical). In addition, the company defined clear criteria to prioritize strategic accounts and value-based health care leaders. It also included central buyer overlays, such as hospital groups and general purchasing organizations, in addition to regional and national decision makers. It then profiled and segmented its complete European customer base for all businesses.

It crafted a differentiated value proposition. The company defined a concrete value proposition for each customer segment in terms of coverage model (from strategic account management via traditional field forces all the way to remote selling and e-commerce), beyond-the-product solutions, value-added services, and basic customer service levels such as consignment stock and back-order prioritization.

It standardized commercial roles. The company examined its organization structure and found that it had 70 different field roles in its commercial model across businesses and countries, with substantial duplications and similarly titled roles bearing different expectations. To reduce this complexity, the company defined a standard set of roles and a clear logic for commercial model design by type of business (based on the archetypical selling models referred to above) and customer segment. It complemented this with stringent productivity guidelines for sales force sizing—and with clear collaboration models to be used in strategic account management, or between field and remote reps, for instance. The company then enabled commercial excellence teams to help each of its businesses review and strengthen their respective go-to-market models by deploying standardized role profiles in a modular fashion.

It built a next-generation, omnichannel commercial model. To build an omnichannel model, the firm ran a series of tests on smaller accounts, which were not well-served by field sales reps. The company created seven remote-selling hubs to cover 15 countries in Europe and built a demand center that used digital marketing to identify, nurture, and qualify sales leads. It took care in selecting the right talent, who, despite being based in remote-selling hubs, reported to frontline sales managers (as fully integrated members of local sales teams). The early results surpassed even the company’s most optimistic expectations: these long-tail accounts started to grow twice as fast as core customer segments, clearly in response to the improved service level.

The company furthered its efforts by rolling out a blended model in which field and remote sales reps worked together. Again, the results were extremely positive: the blended channel grew at three times the rate of businesses covered exclusively by field sales reps.

Today, the company is fast approaching 300 remote reps in Europe, whose average productivity is up to three times higher than that of their field peers. The company has also substantially improved its digital marketing effectiveness—increasing search engine visibility by 30 times, for example.

It streamlined customer processes. Capitalizing on the ethnographic research described above, the company began implementing the target customer journey to reduce customer service issues, starting with six end-to-end processes, such as order-to-delivery and invoice-to-cash. It again took an agile approach, translating the desired customer journey and segmented-customer-value propositions into concrete internal processes. It also devised new digital tools and analytics to automate manual steps and methods related to centralizing, outsourcing, and offshoring transactions. In parallel, the company strengthened its governance of customer and product data, as well as its digital platforms and integrated business-planning approach, to address root causes of customer problems. The process redesign led to a massive improvement in customer service, which translated into an estimated 2% increase in revenue and a 20% decrease in operating costs over three years.

It built digital analytics capabilities. Last, the company discovered the power of data analytics. It built a dedicated data layer in its tech architecture and created a data analytics team to focus on concrete business use cases, such as demand sensing during the COVID-19 crisis, next-best-action nudges for sales reps and frontline sales managers, 360-degree strategic account management, and AI-powered integrated business planning.

Overall, this series of agile sprints substantially increased the company’s sales growth and reduced the costs of its commercial model. As a result, the company has already generated $5 billion in shareholder value in the EMEA region alone. More important, it has become a stronger partner to health care providers in generating better outcomes for patients at lower costs—and thus helping make the health care system more sustainable.

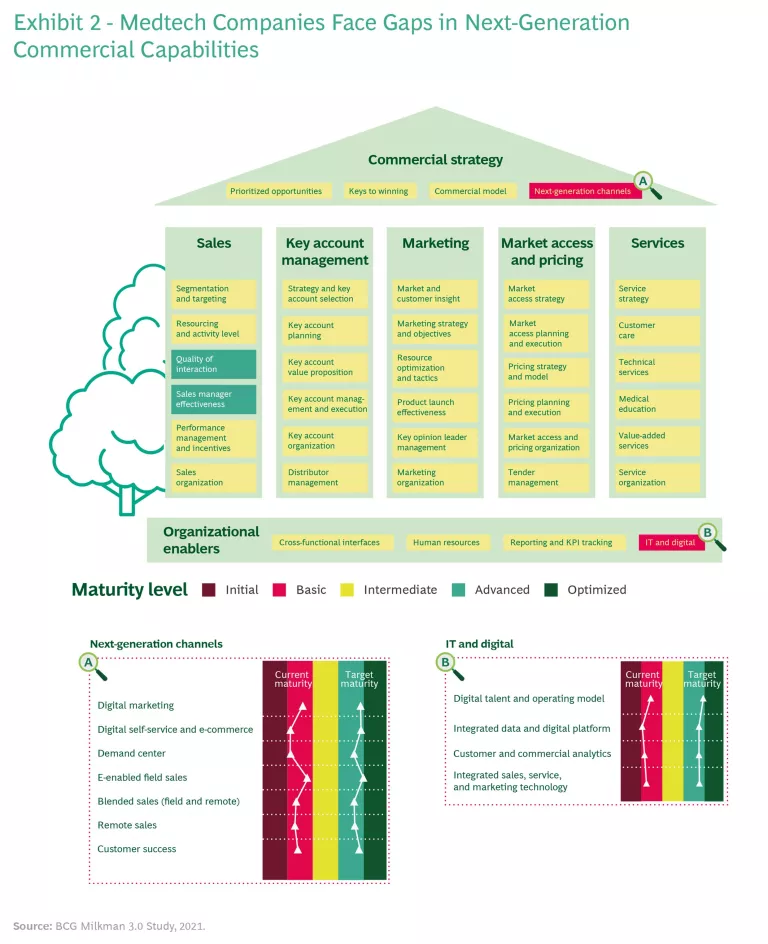

As with previous surveys, we asked respondents to rate their companies’ commercial capabilities in five key functional disciplines: sales; key account and distributor management; marketing; market access and pricing; and services. Respondents ranked their capabilities as intermediate across most areas (as was largely the case in previous studies). In two critical areas—leveraging next-generation channels as well as IT and digital enablers—respondents gave their companies only a basic rating. (See Exhibit 2.)

To explore these ratings in critical areas further, we asked detailed questions about the medtech industry’s readiness to reimagine its go-to-market model in the wake of COVID-19. The results leave no doubt about the opportunity: there is a massive gap between companies’ current capabilities and aspirations. Most do not yet have the capabilities in place to develop and implement a next-generation, omnichannel commercial model—but they have become fully aware of its potential.

Those companies that are innovating their commercial models and improving their capabilities are winning in the market, while those that have not yet acted face an increasingly urgent need for change.

In our last milkman study, we analyzed how companies can generate shareholder value by transforming their commercial models. We have continued to track that impact. Again, we started measuring total shareholder return from six months after the kickoff of such programs for a period of five years. Exhibit 3 highlights the industry’s continued bifurcation. Those companies that are innovating their commercial models and improving their capabilities are winning in the market, while those that have not yet acted face an increasingly urgent need for change.

Building the Next-Generation Model

The transformative actions we recommended in our first milkman publication eight years ago are still highly valid. A successful commercial model transformation needs to be rooted in an actionable growth strategy—one that prioritizes the right market segments, determines how to win in those targeted segments, and helps company leaders tailor the commercial model accordingly. And the foundational requirements remain the same. Companies must build best-in-class commercial capabilities by reinventing clinical selling; partnering better with key accounts; building real marketing muscle that drives home the value of products; investing in market access and pricing capabilities; and making service a differentiator and source of revenue.

But now, we’re building on our original recommendations with six next-generation design pivots that will turn your commercial model on its head.

Start by designing the desired future customer journey. The first pivot is to become more customer-centric by designing the ideal future customer journey, even before thinking about how to set up internally. Companies can use an end-to-end, digitally enabled omnichannel approach to help customers discover and successfully use their products and solutions. The approach tailors differentiated value propositions by customer segments based on their needs and potential. (See “Bringing a Next-Generation, Omnichannel Commercial Model to Life.”)

Bringing a Next-Generation, Omnichannel Commercial Model to Life

Digital Marketing

First, companies need to leverage digital marketing when engaging with customers.

Capitalize on visibility as the new currency. More often than not, medtech customers inform themselves online before reaching out to sales reps, so companies need to excel at performance marketing (including search engine optimization and activation) and master digital channels to meet these customers. Google’s search volume for the top 500 health keywords are increasing by an average of 15% per year, and B2B keywords such as “CT scanner” and “ultrasound system” are increasing even faster, by as much as 40% annually.

Test your marketing campaigns. The speed, reach, and transparency enabled by digital tools allow companies to test, analyze, and improve digital marketing continuously. Feedback about alternative campaign configurations (gained through A/B testing, for example) provides insights on what is most effective and allows marketers to refine and personalize campaigns—in areas such as imagery, layout, messages, subaudiences, and channels—on an ongoing basis at a very low cost.

Develop the next generation of marketers. To realize this opportunity, medtech companies need to upskill their marketing teams and introduce such new roles as digital asset managers, digital channel specialists, and marketing automation specialists.

Digital Self-Service

Digital tools empower customers to do significant research on their own before they interact with a sales rep (if they interact with a rep at all).

Take good care of your website; it is your shop window. Providing a smooth and appealing digital experience are basics that are too often overlooked in medtech. In a recent study, we found bounce rates can range from 30% to 70% and loading times can vary from 1 to 15 seconds between the best-in-class and lowest-performing websites.

Understand that content is king. Provide customers with content that is high quality and personalized to maximize their return on engagement. We have seen a significant variation in customer engagement, with the average time spent on medtech websites ranging from one to nine minutes and the average number of pages visited ranging from two to nine. Companies must therefore establish the right capabilities to create, curate, store, personalize, and publish content at scale and at speed.

Take advantage of e-commerce. While e-commerce is often thought of as more relevant in B2C environments, we have seen tremendous potential in medtech, especially when there is a fragmented base of decision makers (such as researchers in academia buying reagents for experiments). Personalization in data, orders, pricing, and promotions is critical, as is presenting engaging content in an intuitive, accessible format. Building e-commerce capabilities allows medtech companies to reduce their costs-to-serve by up to 80% while helping customers find, order, and track products more easily. Some medtech companies are now generating more than 50% of their business via e-commerce, making digital the top channel.

Demand Center

Medtech companies also must build a demand center that can capture, nurture, and qualify incoming leads.

Use data-driven insights to reach out. In addition to being shop windows, websites help medtech companies advance customers along the buying journey by allowing for the generation of leads through tracking and collecting contact details (for example, to access premium content). Retargeting high-value customers across the web or contacting them through the commercial organization via e-mail, chat, or phone will further increase customer engagement and help assess the attractiveness of the lead. Modern technologies allow formerly unprecedented possibilities to capture data from online journeys (such as pages visited, videos viewed, and e-books downloaded) and generate relevant customer insights that enable commercial organizations to maximize sales success.

Nurture the lead. Marketing-automation platforms allow medtech companies to move prospective customers down the sales funnel by engaging with them in a personalized yet efficient manner. They provide the right content through the right channels depending on a customer’s profile and stage along the buying journey. Clear lead scoring and prioritization based on expected attractiveness maximizes sales conversions.

Stick to the five-minute rule. There is a rule of thumb in the consumer world: leads are only hot for five minutes. Based on their experiences as consumers, medtech customers are increasingly expecting a similar responsiveness along the customer journey. Companies need to be able to react to a request in an ultrashort timeframe that would have seemed unreasonable just a few years ago. Receiving an invitation to chat and a phone call within minutes of having browsed on a website is becoming the norm.

Get your hands around the handover. Providing a seamless customer experience depends on having well-defined lead qualification criteria, handover points, and service-level agreements between marketing and sales. We frequently observe frictions in this handover, as leads are either not qualified well enough by marketing or not taken up effectively by sales. Advanced companies already use AI-enabled technologies to guide the sales organization on when to engage customers and even plan the date and content of sales calls based on deep customer insights (including customers’ meeting preferences and downloaded content materials).

Remote Sales

Our analysis has identified the tremendous potential of remote sales.

Embrace the new kid on the block. Remote sales reps have become a staple in many B2B industries, including high technology and industrial goods, but they are still underdeployed in medtech. The pandemic and the increasing willingness of customers to engage in a remote and virtual way—combined with such technological possibilities as virtual and augmented reality—have unlocked the enormous potential of remote selling in the industry.

Run five times faster. Medtech companies that have embraced remote selling are now generating a two to three times higher commercial productivity per rep, arising from a substantially higher number of customer contacts (typically 75 to 100 calls per week versus 15 to 20 in-person customer visits) and a stronger use of data and analytics compared with the traditional field sales model. At the same time, remote sales approaches benefit from lower costs, as no travelling is required, and remote-selling teams can be based in lower-cost locations.

Blended Sales

The bringing together of remote and field sales is an unbeatable combination.

Win as a team. A blended selling approach, through which remote and field teams partner with clear roles and aligned incentives, is highly effective. Bringing their different capabilities together serves customers optimally and allows for the smart deployment of resources based on customer segments and stages along the buying journey. We have seen successful examples in which the fragmented tail of customers is served exclusively by remote sales teams, while a blended selling approach is deployed for higher-potential customers.

Data-Driven Field Sales

Empowering sales reps with technology can unlock huge opportunities.

Learn from digital-native companies. Customer insights generated through strong data and analytics, along with digital tools, are obvious drivers of success for remote sales teams and should also be leveraged to enable field reps. Digital and AI-enabled solutions (such as automated call planning, next-best-action nudges, and defection detection of lapsing customers) that help field reps better understand their customers, make smarter decisions, and simplify their tasks are evolving rapidly—and are already key sources of competitive advantage for leading medtech firms.

Customer Success Management

After the initial sale, the real journey starts.

Understand the economics of customer loyalty. Reducing customer churn and expanding existing customer relationships can be as effective as—and cheaper than—acquiring new customers. Companies that do these things well create a deep understanding of customer behaviors and goals, put in place a proactive measurement and response system for customer signals, and establish a clear operating model that incentivizes a mindset for customer success within all customer-facing functions.

Partner with your customers to drive value in health care. Medtech companies are uniquely well-positioned to help providers deliver better outcomes for patients at lower costs. Most outcome variations are attributable to practice variations, stemming from health care professionals working in different ways because they have divergent experiences, judgment, and capabilities. According to our experience, some 70% of health care costs are related to care provision (5% to 10% are for medical products and 15% to 20% for pharma products), and nearly a third of these costs are caused by inefficiencies. Thanks to its innovations, therapeutic and business expertise, and deep relationships with providers, the medtech industry can help improve both elements of the value equation.

Redesign processes to become an easier company to do business with. It is often the day-to-day customer operations that create the most severe pain points for customers and distract sales teams from selling. We have found companies that fixed their end-to-end offer-to-cash processes generate substantial incremental growth just by being more reliable and easier to work with.

Redesigning the customer journey in this way requires deep insights. We have found ethnographic research—conducted by shadowing customers in their daily work—to be particularly valuable in this phase. Many medtech companies will find that their customers are already informing themselves online about products and solutions before discussing options with field forces. Company websites and peer-to-peer exchanges on social media are key sources for this information.

Companies are also often surprised by the extent of pain points and frustrations along the customer journey. As a result, commercial leaders may question whether the traditional go-to-market model—in which products and services are pushed through the sales force—is the optimal approach for finding and delighting customers.

Put marketing in the pole position. Just as an engine needs fuel, an omnichannel commercial model needs customer leads to succeed. Cold calling only works in limited cases. The underlying idea here is to identify new business prospects more efficiently. By capturing customer demand at the right point in time—through personalized, data-driven, and digital marketing methods—companies can source, nurture, and qualify concrete leads for a seamless handover to the sales force. Marketing automation and self-service portals can make this new approach scalable. We have found digital marketing use cases highly impactful, with 30-fold increases to a company’s search engine visibility and up to 90% of the opportunity pipeline value fueled through performance marketing.

Build a bionic sales force. Bionic sales reps, who effectively augment their human capabilities with machines, are fast becoming a new reality in medtech. The important unlock comes from the success of remote sales teams composed of sales reps without cars. Because remote sales teams don’t meet customers in person, they instead depend on the flow of leads from marketing, along with technologies such as data analytics, next-best-action nudges, self-dialers, virtual-demonstration kits, automated call reporting, AI-supported coaching tools, and other similar solutions. When set up well, remote-selling use cases vastly accelerate growth. The same can be said about blended selling teams, on which remote and field reps work in tandem. The combination of relevance (through marketing’s qualified lead engine) and increased productivity (stemming from no travel or waiting time) unleashes an unbeatable power. And, counterintuitively, more-advanced products and solutions tend to be easier to sell remotely. Commoditized products, in contrast, provide less of a differentiation angle to talk about.

We have found remote-selling use cases to be highly impactful, as they increase sales rep productivity by two to three times. Moreover, this approach unleashes innovation that benefits field forces. For example, it can turn a CRM system from a perceived administrative burden to a powerful support tool—the equivalent of a jet cockpit with all the right flight instruments, navigation support, and even an autopilot.

Make customers successful. Customer loyalty has a huge impact on longer-term profitability. Reducing customer churn tends to be much cheaper than acquiring new customers. Yet a large disconnect still exists in many medtech companies between marketing, sales, and customer success management. In terms of improved outcomes for patients and lower costs of delivering these outcomes, medtech companies can play a huge role in helping hospitals and health systems deliver better value in health care. The recent forays in Europe into value-based procurement are opening the doors widely for such partnerships.

But it is often the day-to-day customer processes—which tend to be siloed in customer service teams, supply chain organizations, and accounts receivable functions—that are creating the most severe pain points for customers (and often distract sales reps from selling to solve burning issues such as back orders and invoice disputes). We have seen programs that are geared toward making it easier for customers to work with a medtech company—by redesigning and automating customer operations processes end-to-end from offer to cash—improve sales and unlock efficiencies.

Apply an agile, use-case-oriented design approach. We recommend taking an agile design approach. Prioritize specific use cases with high business value as lighthouse projects—such as a digital-marketing-based lead engine and a remote-selling capability—and deliver them in successive sprints along the future customer journey. Instead of aiming for the perfect solution, which will require significant time and capital to develop and risks missing the mark, the idea is to develop minimally viable solutions within weeks. Experiment and learn, celebrate early successes (or fail fast), and continuously refine based on customer feedback—all while developing internal capabilities.

This sounds easy in concept but represents a massive shift for many companies. However, once companies have experienced this kind of agile approach, they do not want to return to old ways of working. In our experience, it is advantageous to start with sales-oriented use cases, such as building a remote-selling capability for a specific customer segment. This allows a company to test and learn as well as generate measurable top-line impact right from the beginning. In that way, companies can build a foundation to test the impact of additional use cases like digital marketing or sales analytics, and thus build momentum for a broader transformation.

Build required digital enablers along the way. The sixth pivot is to define the required digital enablers—in terms of the new skills, sales and marketing technologies, and data and digital platforms—in parallel to implementing the first lighthouse use cases. While an upfront assessment of available digital tools and capabilities naturally makes sense at the start of a next-generation commercial model program, it is much more practical to educate the digital enablers through use cases rather than delaying the onset of such an initiative by trying to fix the foundations beforehand. For that reason, we recommend relying on pragmatic off-the-shelf tools initially.

When it comes to required skills, a crucial aspect is not to outsource next-generation commercial capabilities, which are core drivers of future success. Rather, we recommend upskilling the organization and building internal experience while acquiring digital talent (such as marketing-automation specialists, data engineers, and data scientists) to accelerate progress. A build-operate-transfer partnership with external experts can be an effective approach to ensure a fast and successful start, with the clear objective of sharing the required know-how and enabling the organization accordingly.

Getting all six pivots right requires careful change management, which is essential as the silos between sales, marketing, and other functions need to fall; capabilities need to be centralized to achieve synergies and scale across businesses and countries; and new ways of working are established. Start off by designating a high-performing team, identifying and embracing new behaviors, and constantly iterating on the approach and design with senior leaders (whose visible support of the effort is crucial). As a second step, establish an inclusive approach—and cocreate change with your commercial organization—to ensure full buy-in in the transformation. You can never win by forcing the sales force to change. But if you capture their hearts and minds, there is no stopping them.

Over the past ten years, the medtech industry has made only slow progress in rethinking its increasingly outdated commercial model. But those companies that have acted on the foundational moves we recommended in our initial milkman study are winning in the market, delivering vastly superior value for their shareholders.

But those companies that have acted on the foundational moves we recommended in our initial milkman study are winning in the market, delivering vastly superior value for their shareholders.

The COVID-19 crisis has changed the game. The challenge to connect with customers remotely has shed new light on the potential of a next-generation, omnichannel commercial model. Our research has shown the high aspirations—and low starting point—medtech companies have in building the related capabilities. There is a substantial gap that needs to be filled. Early pioneers have seen highly promising results and are already shifting massively to this new way of working.

The transition to a next-generation model isn’t easy. By following the six pragmatic design pivots discussed above, companies can position themselves to capitalize on the new era of marketing and sales in medtech. The time to act is now. And those that get it right stand to be rewarded for their underlying business model innovation. They will be creating better value in health care.

The authors are grateful to their current and former BCG colleagues Erik Adams, Stéphane Cairole, Victor Corzo, Torben Danger, Christophe Durand, Anders Fæste, Tammer Farid, Colm Foley, Stuart Gander, Erik Gilbertson, Benjamin Grosch, Dan Grossman, Henri Hagenmüller, Charles Hendren, Sultan Hochweiss, Jason Jager, Hrvoje Jenkač, Frank Jia, Nicolas Kachaner, Meg Kedrowski, Torsten Kurth, Bob Lavoie, Sam Karita, Wyatt MacKenzie, Brad Martens, Shogo Nishida, Johan Öberg, Barry Rosenberg, Daniel Schroer, Christoph Schweizer, Carla Spörle, Vaidyanathan Srikant, Johannes Thoms, Sahil Sanghvi, Mills Schenck, Simon Völler, and Gerd Wübbels for sharing their medtech expertise during the development of this report, conducting senior-management interviews, and helping us engage with their clients.

The authors are especially grateful to their current and former BCG colleagues Anna Heikkurinen, Clara Beck, Laure-Anne Deltort, Gian Gallati, Laura Hansmann, Angela Kaiser, Fabrice Kalmbacher, Patrick Kessel, Lorenz Kunze, Nikola Lampe, Naomi Meertens, Malavika Raju, Cristina Rolandi, Mikaela Sörman, Linda Spahiu, Beate Steen, Maxime Ueberschlag, Ville Vilkuna, and Karin Zhu for their contributions to the research and analyses contained within this report.