At a time of rapidly evolving scientific breakthroughs and, coincidentally, of the expiration of many blockbuster drug patents, the key to innovation and revenue growth is pharmaceutical business development. While some innovation and new revenue can come from internal pipelines and assets, business development teams are under intense pressure at most companies to supplement internal efforts with external licensing agreements and M&A. Unfortunately, those teams are frequently unable to deliver the transactions needed for innovation and growth.

Often a major reason for this shortfall is that executive team members are not fully aligned on the role of business development in achieving the company’s strategic priorities. They may agree in theory that business development should pursue partnerships, ecosystems, and collaborations, but that consensus falls apart when it comes to making decisions about specific deals.

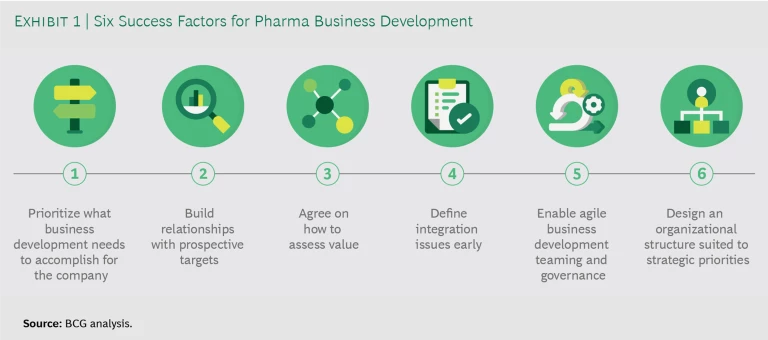

We have identified six success factors that enable more rapid and effective decision making, which, in turn, will lead to substantially enhanced business development performance.

Subscribe to our Biopharma E-Alert.

Biopharma M&A and Licensing Remain Strong

Biopharma M&A deal value more than doubled between 2017 and 2019, from $138 billion to $336 billion, and valuations reached all-time highs. Most of those deals involved midsized biotech companies, for which the average premium paid was close to 70%, with an average EV/sales multiple of nearly 8x. All in all, close to 60% of new therapeutic drugs in the last five years have been externally sourced.

The COVID-19 pandemic slowed biopharma M&A activity in 2020, especially in the first half of the year. But since the core drivers of deals remain intact—scientific breakthroughs, expiring patents, and an increasing focus on key therapeutic areas or on modalities such as cell and gene therapy—deal activity will continue to rebound. A recent example is AstraZeneca’s acquisition in late December of Alexion for $39 billion.

Moreover, biopharma companies can finance transactions cheaply with today’s very low interest rates. They also have significant financial resources to pursue business development. BCG’s ValueScience team estimates that the top 20 biopharma companies have more than $700 billion in cash, short-term investments, and additional debt capacity. But as a result, many companies are pursuing the same assets, driving up valuations and the risk of overpaying.

Six Success Factors for Pharma Business Development While we focus here on M&A, the six success factors we have identified will enable business development teams to create value through both M&A and licensing. (See Exhibit 1.)

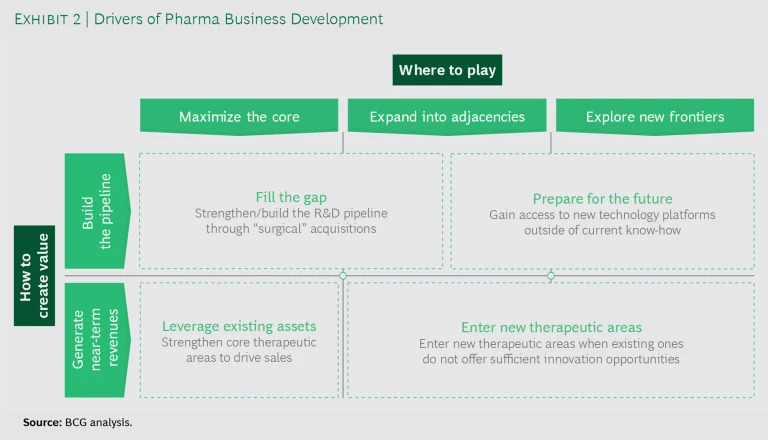

1. Prioritize what business development needs to accomplish for the company. Executive team members often have differing views about how to prioritize business units, technology areas, and technology platforms and what types of deals to pursue (early- versus late-stage R&D deals, for example, or transformative versus tuck-in acquisitions). To ensure alignment, it’s critical that team members agree on how and where they want to create value. Will they use business development to generate near-term revenues or to build the pipeline for future innovation? Will they seek to maximize the core, expand into adjacent markets, or explore new frontiers? (See Exhibit 2.)

As part of this prioritization process, the executive team needs to regularly review and agree on how much revenue growth the current internal portfolio or pipeline will deliver. Only then can it determine the revenue gaps that business development needs to address in which specific therapeutic areas or modalities—and with what urgency. It’s astonishing how often management teams are misaligned on this simple setting of objectives, which often results in business development teams wasting time assessing opportunities that are fundamentally unattractive to the executive team and will never get approved. To avoid such situations, the team should ask itself two key questions about every transaction early on: What revenue gap will the transaction fill? And who on the executive committee will champion the transaction from start to finish? By forcing these decisions early, the team can avoid a lot of wasted time.

2. Build relationships with prospective targets. Executive teams should commit to building relationships with potential partners or acquisition targets for two or three years. Proactive sourcing, screening, and relationship building are far better for deal execution than simply showing up at the target’s headquarters with a banker and an offer. An established relationship will give a prospective buyer an edge over other bidders, perhaps even preempting the bidding process altogether. Such relationships can also accelerate due diligence.

Active engagement with potential targets over several years also gives companies a better grasp of the range of potential deals available. It might, for example, make a pharmaceutical company more likely to take small equity stakes in a number of promising biotechs, perhaps supporting Phase 1 trials with its own clinical and regulatory expertise.

3. Agree on how to assess value. Depending on one’s assumptions when valuing a target, the same transaction may seem spectacularly attractive or exceptionally unattractive. So teams need to agree about how they will value all aspects of each deal and then apply that valuation with discipline. Too often, companies end up redoing their analysis and engaging in repetitive decision making because they haven’t agreed on valuation approaches or metrics from the start.

One common valuation pitfall is to focus only on core asset value, that is, the value of the cash flow generated by current and future products in the market. Valuation models need a wider lens, encompassing multiple dimensions of value, including the following:

- Synergies. What is the value of cost, revenue, and capability synergies across the value chain—for example, in R&D, manufacturing, and sales?

- Platform Value. What is the value of the future products a technology platform might make possible?

- Strategic Value. What is the value of preempting a competitor from acquiring an asset, gaining access to a large proprietary data set, or being recognized as a leader in an emerging field?

Because these advantages are less tangible than core assets, large swings in valuation are possible depending on the underlying assumptions. We have found that companies with a clearly defined and endorsed valuation approach are able to use a common “language” in their deliberations, leading to better, faster decision making. These advantages are amplified when the company is highly transparent about the underlying assumptions and entertains a range of scenarios and associated probabilities.

Teams need to agree about how they will value all aspects of each deal and then apply that valuation with discipline.

4. Define integration issues early. Executive and business development teams are frequently so focused on due diligence and valuation that they don’t consider the integration process until after a term sheet has been signed. Integration issues should be considered at the outset, when assessing the deal’s attractiveness and viability, and in parallel with due diligence. Teams should ask such questions as: Will the acquired company be a distinct entity or be integrated into the acquiring company? What governance will be applied to the acquired assets? How will cost synergies factor into the valuation?

Knowing the answers to these questions early on is critical to realizing the full potential of the transaction. Our research shows that successful integration can drive 8% to 10% more value compared with the average transaction. Planning for that success right from the start is essential.

5. Enable agile business development teaming and governance. Even when a company has a clear vision for the transaction, it still needs an agile process and governance to execute the deal quickly and effectively. But because the business development process is highly cross-functional (and often involves many junior-level people), it can be unclear who has the authority to make decisions and who will provide the necessary analytical resources. In addition, preexisting governance committees (such as executive committees) often meet too infrequently to keep up with the fast pace of business development decision making.

To address these challenges, we recommend three best practices:

- Designate resources. Within each function, several senior staff members with business development experience and authority should be on call. This will help build continuity and organizational learning.

- Establish clear processes and responsibilities. All members of a business development project team should be aligned on processes, deliverables, and timelines. That should include who is responsible for what and who has what decision rights. For example, who in R&D will calculate the probability of success of a specific asset under review?

- Create nimble governance. A few members of key governance committees should meet more frequently than the entire group (perhaps even on a weekly basis, depending on deal volume) and have the authority to mobilize the entire committee within 24 or 48 hours if there’s an urgent issue to be addressed.

Integration issues should be considered at the outset, when assessing the deal’s attractiveness and viability, and in parallel with due diligence.

6. Design an organizational structure suited to strategic priorities. Because companies have different revenue gaps and objectives and use business development in different ways, there is no single “right” organizational structure. One company might focus on early-stage and another on late-stage acquisitions. One company might be looking for deals to strengthen the core business, another to build up new therapeutic areas. A company’s business development organization must be suited to its strategic purpose, whatever that may be. There are three main approaches (with various permutations) to consider:

- Centralize business development in one group. A central function maximizes scale, alignment of activities, and resource prioritization. This setup works well for companies looking to make relatively few late-stage or transformative acquisitions.

- Separate R&D and commercial transactions. Assessing an early-stage R&D acquisition requires a different mix of expertise than assessing a late-stage, commercial acquisition. When a company intends to pursue both types of transactions, it’s best to keep at least some of these due diligence activities separate. But such companies can still centralize certain functions—valuation modeling, for example—in order to maximize scale.

- Separate by business lines or therapeutic areas. It can be sensible to separate business development activities by business lines or therapeutic areas at different levels of maturity. This arrangement works well if a company has a mature business area looking for transformative deals and a smaller business unit looking for technology platform acquisitions. Here again, certain aspects of the business development process, such as valuation modeling, can be centralized for scale and efficiency.

Current market conditions present unique opportunities to tap into external innovation and drive revenue growth, but the inherently complex and cross-functional nature of business development makes it difficult for many pharmaceutical companies to execute effectively. As a result, these companies are not winning the transactions necessary for future success. We believe that the six success factors described above can significantly improve business development capabilities and are worth serious consideration by management teams.