The Jeep. The Porsche. The Mustang. Throughout the past century, iconic dream cars like these fueled imaginations, tapping emotions and aspirations: independence, status, an ineffable “cool.” Advertising bolstered brand images, touting attributes like design, acceleration, and oversize exhaust systems. Today, automakers have the opportunity to tap into the emotions and aspirations of a new generation of car buyers: digital-age consumers who prioritize attributes that emphasize personalization, connectivity, and immediacy.

Enter the software-defined dream car.

More than 90% of innovation now comes via software, a leader of a premium OEM told us. In recognition of the shift, auto OEMs, auto suppliers, and startup and established tech companies are investing in pursuit of the software-defined dream car: a customer-centric vehicle that can be personalized and updated just like a smartphone. To catch and commercialize this next-generation vehicle, they must transform not just the cars they make but also the ways in which they make cars—how they create value, optimize technology, and operate.

The pivot from a hardware to a software orientation is a dramatic redirection, but one that will pay off. Look at Tesla, whose software-centric innovations—to extend battery range through over-the-air (OTA) updates, introduce autonomous-driving features, and more—have fueled valuations and fanned devotion to the brand and its maker. Tesla customers love their Tesla vehicles and community. And look at our projections: we anticipate that the move will save billions of dollars across OEMs’ value chain and up to $7,500 per vehicle while opening the door to new sales and service monetization opportunities.

The pivot from a hardware to a software orientation is a dramatic redirection, but one that will pay off—saving billions of dollars and opening the door to new monetization opportunities.

Software-driven transformation is happening across industries. Now it is truly reshaping the automotive industry—which has already been working in this area: connected services have been available for decades, cars already contain up to 100 electronic control units supported by millions of lines of code, and advanced AI algorithms are being developed for autonomous driving .

Still, automakers are not currently equipped to build software-defined dream cars. Though it might be a cliché to speak about the “dinosaur companies” that did not survive disruption in other industries, it is certainly a mistake to disregard key indicators of potential large-scale upheavals, such as the ability of new players to enter the field with superior technology and novel points of differentiation, as is the case in automotive right now.

Despite the disruption imposed by the pandemic, automotive players should continue their transition to software. We anticipate that auto sales will recover . And we believe the pandemic is creating a consumer base inclined toward car ownership for safety reasons and accustomed to software-based functionality—two trends that will converge, with car buyers favoring vehicles that incorporate the same software-based options they have come to rely on at home, at work, and at leisure. To prepare to tap that demand, automakers should take apart the engine of the traditional auto industry and rebuild it with software at the center. How? Through the four dimensions of transformation we describe next.

Accelerate the Move to Software on Four Dimensions

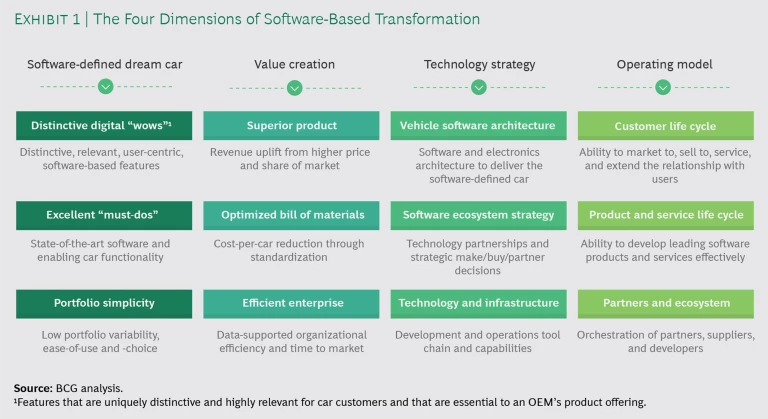

To overcome the challenges of a switch to software, companies need to accelerate four foundational software-driven efforts that will position them to compete in the new, and ultimately more lucrative, terrain (see Exhibit 1):

- Reimagining the dream car, with software at the center

- Rethinking value creation opportunities for a software-centric industry

- Redefining technology strategy to seize control points

- Revamping the operating model to fit the software-first approach

Reimagine the Dream Car, with Software at the Center

Over the past decade, successful tech companies have blazed a new trail to win over and lock in users. They build on deep insights and predictions to continuously give consumers the experiences they crave: being on the cutting edge of innovation and feeling a sense of belonging to a group of similar users. They also provide consumer-centric attributes like simplicity and outstanding convenience. The products they sell are not one-time purchases but initial purchases that launch a connection, a community, and a continuum of related applications and upgrades. All of this creates a highly relevant experience and a fiercely loyal customer base.

Automakers must do the same to compete for users’ attention and wallets. That means reinventing their product. Think of it this way: the iPhone is still a phone, but it also sparks a full and varied experience. The software-based car must likewise retain its primary role of moving people, goods, and tools but incorporate other attributes, which means changes in what is required of automakers:

- They must deliver relevant new and upgraded applications to users frequently via OTA updates.

- They need to seamlessly incorporate their users’ digital life—delivering intelligent suggestions to users regarding their needs and preferences by managing home lighting from the car, for instance, or suggesting forms of entertainment.

- They must build vehicles that include software that will ultimately support autonomous driving and active safety.

- They will have to use advanced analytics to interpret near-real-time user and vehicle data, connect extensively to technology players outside the automotive ecosystem, and learn how to create outstanding user experiences.

These are all “must-dos,” the changes they need to make in order to stay relevant to customers in the fast-moving competitive environment. Just achieving the must-dos significantly raises the bar for OEMs; few now have these capabilities. (See “How OEMs Can Stay Relevant,” for a sampling of the things OEMs have to achieve, by category.)

How OEMs Can Stay Relevant

Predictive and Personalized Interaction. Design a product that learns about the behaviors and preferences of users and makes relevant recommendations. Internet tech company ByteDance serves as a good example. Its product Toutiao (meaning “headlines”) started as a news recommendation engine but evolved into a content platform with rich interactive features such as machine-learning-enabled personalization feeds. This user-experience-driven product innovation has made the young tech company one of the world’s most valuable unicorns.

Freshness and Updatability. Enable as many elements of the car as possible with software and connectivity to make remote updates possible: speakers, screens, all electric actuators, engine, interior lights, smart surfaces. Constantly update these features over the vehicle’s lifetime. For example, Tesla was able to make 124 different OTA updates to its Model 3 in an 18-month period.

Integration of Digital Ecosystems and Design. Build a well-integrated ecosystem of services through APIs and the cloud, extending far beyond the current projected modes. Users today live complex and pervasively connected digital lives and want that in their vehicles as well. They also crave a compelling and natural usability wherever they want to consume the services provided.

Simplicity. Manufacture vehicles that feature very limited combinations of hardware configurations. Let buyers customize their car after the sale with a robust set of software offerings that can be purchased and added via OTA updates as smartphone apps are. And further simplify the entire experience: searching, buying, activating, servicing, using the vehicle and software services. Think about Apple’s iPhone experience.

A Fast, Reliable, Modular Technology Foundation. Ensure the highest reliability and availability for the car and its features. A software-based car cannot “not work,” a lesson that tech companies have learned over the years. Auto customers want to buy a car whose software is reliable, quick to react, and swiftly updated over the lifetime of the vehicle. They also want to be able to change hardware features years after the initial purchase. Tesla, again the leader, launched a retrofit approach for its core chip sets to install the new full-self-driving (FSD) computer in older vehicles. The chip set, designed in-house, aims to significantly improve image-processing speed and performance.

Data Protection and Cybersecurity. Pay attention to cybersecurity. With the software dream car increasingly powered by fast connectivity, intelligent machines, and open systems, customers have rising concerns and higher expectations regarding cybersecurity and data protection. And regulators are increasingly defining and enforcing norms, policies, and procedures to address these concerns.

Active Safety. Proactively satisfy consumer and regulatory groups. Through software, automakers have developed a variety of sensitive functionalities that greatly enhance the safety of automobiles. In-vehicle monitoring systems allow immediate and even predictive software-directed actions. Examples include brake assistance, pedestrian detection, blind spot monitoring, and accident detection and response. These innovations quickly become standards, incorporated into safety ratings that guide consumers’ purchasing choices and regulatory bodies’ requirements.

But they need to move further—which leads us to the “wows,” the powerful, unique attributes that will spark users’ excitement, advocacy, and loyalty. For instance, OEMs could provide outstanding integration of consumers’ digital life or offer exceptional intelligent assistance as a unique selling proposition. We may see impressive technology such as smart surfaces, holograms, and multisensory entertainment experiences or truly outstanding mobility experiences. Vehicle instruments may so closely mirror users’ intentions that they feel natural and intuitive.

With their new products, automakers must achieve “wows”—powerful, unique attributes that will spark users’ excitement, advocacy, and loyalty.

Despite the heavy lifting that the must-dos entail, it’s the wows that will win the day. Our research into tech companies shows the importance of capturing three to five distinguishing features that will build the brand and appeal strongly to consumers. Auto companies should look to success stories from other industries to see how unique, well-crafted wows create outstanding brands and win a devoted following. Peloton, for example, achieved success by offering what we might call the software-defined dream stationary bicycle. It did this by combining a digitally enabled product, entertainment, and a community.

With the right wow factors, automakers, too, will position themselves at the center of a coveted and enduring brand relationship .

But delivering the must-dos and the wows is not enough. Recall another hallmark of successful digital companies: simplicity, which opens the door to the outstanding convenience that consumers cherish. The automotive industry today, like many other mature industries, is hardly simple, with highly fragmented and complex portfolios that result from decades of incremental change and microsegmentation built atop a largely static product proposition.

A high-end car today comes in billions of potential configurations. Options span the powertrain, wheelbase, body, roof, electronics such as exterior and interior lighting, screen size, acoustics, seats, design elements, and colors. This variety carries high costs that arise from supplier fragmentation, cumbersome logistics and production, an elaborate aftersales parts industry, and more. It lowers the return on R&D on most sophisticated features, which will often reach fewer than 1% of cars. In terms of electronics, variety leads to complex branching of hardware and software platforms, compatibility management, testing, and expensive modular wiring to cater to all of the potential options. It also slows innovation. Above all, complex products present challenges for prospective buyers, who must grapple with the many minute choices to be made regarding a standard product. This is not convenient.

Compare the current automotive context with that of the iPhone. When introduced, the iPhone came with two memory options (4GB and 8GB). That’s it. Now, more than a decade later, it offers little further variation. Essentially, the limited choices involve screen size, computing power, and camera—but it still sells by the hundreds of millions. Customization happens, but it’s simple and convenient, accomplished through software (and accessories). The result: a clean, low-impact, direct sales approach that sidesteps congested stores and offers instead an enticing online experience. New software can be deployed globally on all iPhones within days. Customers get help through a highly effective aftersales service that resolves the few typical incidents easily and delivers a great experience for the customer.

This simplification does not negate the possibility of successful wows. For the iPhone, these include an outstanding gaming experience and superior augmented-reality features. These wows, standard in mainstream iPhones, achieve a higher average profit per device than can be had with a strategy of microsegmentation.

The auto industry is correct when it claims that configuration options and extras create essentially all of today’s new-car margin. Still, the success we see from Apple shows that a radical simplification of the portfolio will outweigh today’s price discrimination benefits and is a must on the route to the software-defined dream car.

Rethink Value Creation Opportunities for a Software-Centric Industry

OEMs are seeing median margins of 6% to 8%, while suppliers are doing slightly better, at 8% to 10%. These margins will not suffice to fund the investment required to build an automaker’s software muscle. Companies must thoroughly understand the economics of software so that they can answer the big question: How are we going to make money from the shift to software?

The big question: How are we going to make money from the shift to software?

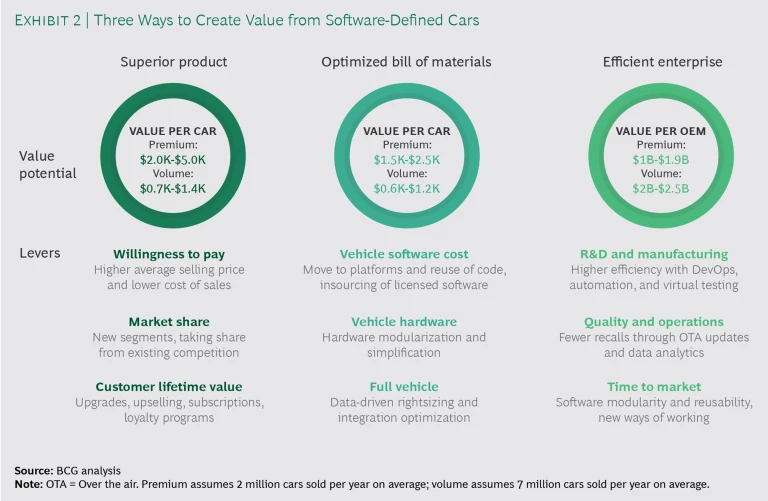

Our analysis indicates that the shift, if done well, will deliver a prize of considerable size: up to a $7,500 improvement in margin per car in the premium segment and up to $2,600 in the volume segment through an increase in realized prices and a reduced bill of materials. This comes on top of $2 billion to $2.5 billion in savings and margin potential across OEMs’ value chain.

The payoff will come from three main sources: a superior product, optimized cost per vehicle as shown by the bill of materials, and an efficient enterprise. (See Exhibit 2.) Companies will need to develop a clear business case and ensure a laser focus on putting in place whatever is needed to get a return on the large-scale investments in the software transformation.

A Superior Product. Gaining leadership in automotive software will position OEMs to more effectively sell at a premium, gain market share, and sustain value.

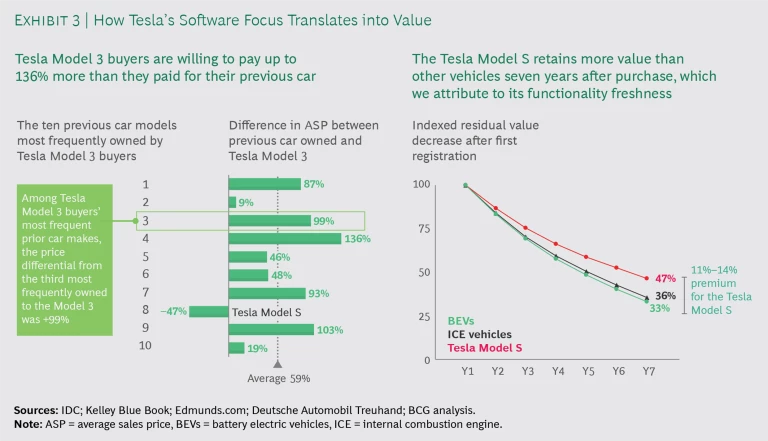

Tesla’s market performance shows that these software-powered moves pay off. (See Exhibit 3.) The company is growing in multiple segments and at the expense of both premium and volume players—even managing annual price increases on the Model S without major changes to the vehicle. Given that, it seems feasible that automakers that successfully bring software-defined dream cars to market will be able to increase prices to a level four times higher than historical growth rates (which are typically 0% to 1% per year). They then need to continue delivering material upgrades—as in the software world, monetization will not stop with the initial sale. This ability to refresh the vehicle OTA throughout its lifetime can pay off in another way, too: automakers may score a 15% higher resale value on used cars.

An Optimized Bill of Materials. A software-centric approach allows automakers to cut costs substantially. Our analysis suggests that OEMs can reduce hardware costs by $600 to $1,200 on an average car and up to $2,500 on a premium car. They need to be bold to capture these opportunities, though, because entrenched ways of thinking can hobble progress. The key levers they can pull:

- Rigorously reduce complexity. When cars are differentiated by the software functions they offer, hardware can be standardized, reducing complexity and therefore costs. Further radical simplification can be achieved through centralized computer architectures, including substantially simpler wiring and consolidated end-user hardware such as screens and buttons. Some OEMs are also considering deeper design cooperation directly with semiconductor players.

- Reuse code through a systematic platform approach. Software, too, can be standardized, allowing for optimized licensing costs and fostering modularity and ultimately reusability.

- “Despec” and rightsize hardware. Analyzing data collected from the vehicle by software will yield insight into which hardware is really being used and how—for instance, real-life expected battery discharge levels or maximum repeat brake pressure. Such insights should direct future spending.

An Efficient Enterprise. Efficiency yields rewards and should be achieved in the following ways:

- Drive for deep customer insights and more-efficient customer interactions. These will enable upselling or cross-selling and lend efficiency to the enterprise overall. Remember, Apple customers interact with Apple primarily through their iPhone, not a dealer or call center.

- Push R&D productivity and cross-OEM platforms. By adopting a platform approach, automakers continuously develop a single codebase that they can deploy across makes. Quality needs to be boosted through closed-loop, data-driven development. In addition, software leaders have started to license their IP to other OEMs, opening up new revenue streams and building the scale that makes true software companies so profitable.

- Apply OTA updates to quality. New efficiencies can be found when incidents can be addressed in real time through predictive capabilities and OTA software upgrades instead of recalls that require owners to bring their car to a service center.

- Use data to make better decisions. Fully unleashing data improves decision-making efficiency across the value chain. Real-time and historic vehicle data can be used to generate customer insights that enhance the development, manufacturing, and operations processes.

Redefine Your Technology Strategy to Seize Control Points

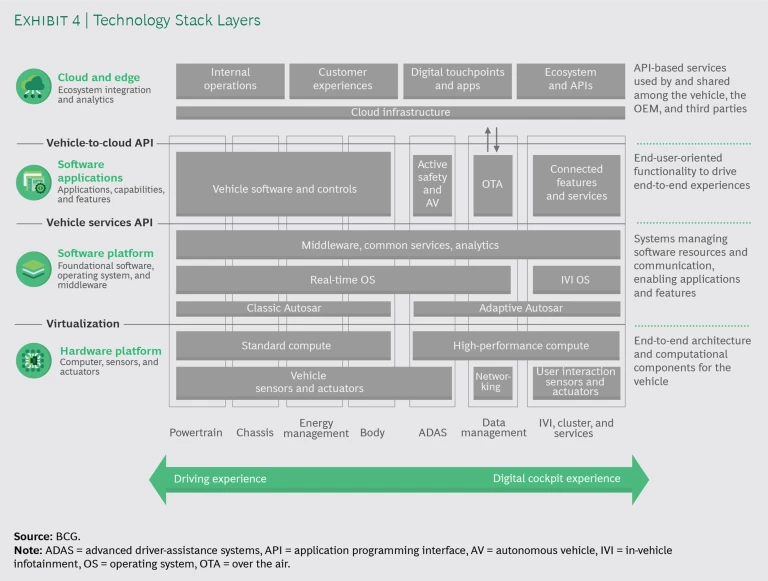

The relationship between OEMs and suppliers has been longstanding and solid. But tech players are shaking up the game, and market positions and dynamics are changing. Traditional suppliers are fighting for relevance in the age of the software-defined car. With the industry in a state of flux, all participants must determine their “play” in each part of the technology stack, which is illustrated in Exhibit 4. They will need to figure out which economic models will work for them, when to make versus buy versus partner, and what they want to control. These are key choices, because software supplier alliances will be much more fundamental and long lasting than arrangements with traditional component manufacturers.

On the basis of our research, we predict that key control point battlefields will substantially shift the setup of software and electronic designs in cars. We believe OEMs should fight to:

- Achieve control of the user experience by increasing hardware integration. This is what tech players have done as they develop both hardware and software (and in some cases underlying semiconductors) for smartphones and laptops. OEMs must heed the requirements for the efficient and safe delivery of features such as Level 2 and 3 advanced driver-assistance systems (ADAS)—which show orders of magnitude higher complexity than what exists today. This strongly suggests that automakers should push hard for deeper integration of functionality, with a central server or zonal model as the likely landing point.

- Control architecture and standards by deepening their operating system skills. The OS represents a key control point. While automakers on the one hand attempt to control and develop in-house more of the in-car software stack, they are also forced to partner with large consumer electronics and tech players and work within their software ecosystems—often at the expense of control over data, experience design, and functionality.

- Gain access to a unique set of data. Software and sensors generate and use enormous amounts of data. The players that manage to create the most relevant insights into the driver, the environment, and the vehicle will capture outsize benefits in efficiencies and from new business models that involve insurance, aftersales, or mobility services. Automakers, suppliers, and ecosystem software players will fight over this control point.

The path to electric mobility offers automakers a unique chance to more radically adapt their software and electronics designs for users who expect a state-of-the-art, high-tech experience from this new generation of mobility. They will be less tolerant of mediocre digital functionality or outdated safety options. Also, electric vehicles allow very different packaging, wiring, heat, and energy management approaches, opening the door to higher-performance zonal and central computing architecture. Some OEMs will depart more boldly from their legacy than others, creating the opportunity to shape the battlegrounds outlined above.

To move the old win-win supplier partnerships in new directions, automakers and software-capable suppliers must come to new arrangements.

To move the old win-win supplier partnerships in new directions, automakers and software-capable suppliers must come to new arrangements. An auto industry that is used to multiyear commitments, stringent liability clauses, and inflexible buyer-supplier deals needs to face a self-confident tech industry that thinks in 18-month technology cycles, experiences hyperfast growth, and is not willing to commit to extreme warranty risks. Software development ecosystems offer the possibility of shared development costs—but could also mean ceding control to third-party players.

With smaller providers, OEMs can define detailed requirements, negotiating a development roadmap for a specific software product. With larger tech partners such as Google, OEMs need to rely on the provider’s roadmap and focus on contingency planning to prevent risks. In addition, OEMs need to change their mindset: rather than receiving a perfect product the first time, they must adapt to using products that are continuously improved through frequent exchanges with software suppliers.

Revamp the Operating Model to Fit the Software-First Approach

On the surface, the challenges of the software-defined car seem primarily to involve engineering, owing to complex and interdependent vehicle portfolios, safety considerations, unit cost realities, regulatory requirements, and industry specialization. In reality, though, the software transformation will extend beyond engineering to disrupt the industry overall—as has happened to many other industries. Software is all about delivering continuous innovation directly to users; this will be true for the software included in cars as well. This changes the vehicle and the way it’s made. And it changes everything else: relationships across the supply chain and with the consumer, required capabilities, ways of working, and more. In sum, it’s not enough to manage the technology change. A new business model is required, supported by a new operating model.

Shedding tradition and welcoming change will lead automotive companies to the unique wows that will position them as makers of software-defined dream cars. This requires a new operating model, built on five pillars.

A 360-Degree View of Users and the Vehicle in Real Time. Data from a vehicle’s hundreds of sensors is foundational to understanding needs and usage patterns. It is the key to improving so much: buying, selling, servicing, safety, product development, the relevance of predictive recommendations to drivers, even production. Car makers must turn data-driven insights about users and vehicles into features that win in the marketplace.

Data from a vehicle’s hundreds of sensors is foundational to understanding needs and usage patterns.

The Customer Life Cycle. The 360-degree view and the software-supported experience (characterized by excitement, personalization, and intensity) combine to give automakers opportunities to forge lasting relationships with customers. It’s critical to excel at customer service and issue resolution. The target: achieving end-to-end availability comparable to that provided by telecommunications service providers. This requires that car makers implement 24-7 customer support with skilled and generalist roles for all postsales services, KPIs based on customer satisfaction (such as improved net promotor scores), self-service features, and smart automation to orchestrate incident support and reduce cost, and more.

The Product and Service Life Cycle. This life cycle includes innovation, implementation, activation, and operation of both software-defined vehicles and digital services, with the ultimate goal being to continuously provide and update top-quality, emotionally appealing software-based products and services at an optimized, ultracompetitive cost.

The transition to software includes a move to working on platforms. The organization design must change to accommodate that. Here are some examples of the required changes:

- Software and Hardware Uncoupling. To properly accommodate fundamental differences in hardware and software life cycles, OEMs should uncouple these two functions—giving each its individual roadmap, product portfolio, capabilities, and governance—while ensuring alignment and collaboration between the two.

- Design Authority. Offering rich and cohesive user experiences across the customer life cycle and the product and service portfolio becomes a strategic differentiator for car manufacturers. So, OEMs should set up a nimble central design authority with hardware and software capabilities to quickly incorporate user and market feedback and deliver innovative prototypes.

- Agile and DevOps. Advanced OEMs have established cross-functional agile teams. However, many OEMs still lack ways of working that foster reusability, software compatibility across models, and a long-term software vision. OEMs should define software teams to work along separate software platform cycles, owning products and services throughout the life cycle.

The Enablers. The enablers are functional groups that support the product and service life cycle by providing the necessary skills, infrastructure, and ways of working. The human resources department needs to improve its ability to attract and develop top-notch digital talent. Finance needs to move from a rigorous hardware-centric model that overemphasizes vehicle-level returns to a holistic, platform- and software-centric model that puts the right emphasis on the continuous delivery of functionality to all models and users. IT needs to turbocharge its ability to effectively connect vehicle data to enterprise processes in marketing, sales, production, and logistics. Procurement may have to replace many of its methodologies in order to embrace new tech partnership approaches, as discussed previously.

Partner and Ecosystem Management. Auto manufacturing has always involved deep supply chains and complex interdependencies. With software at the heart of car making, this is more true than ever. Technology partners become an integral part of the ongoing experience for users—streaming entertainment content, connecting to smart homes and payment services, providing safety-relevant information about roads and urban infrastructure, and more. This makes vendors and third-party developers a fundamental operating-model building block for OEMs that want to succeed in the new software-driven world. Automakers need to build high-performance developer platforms and interfaces, expand their commercial cooperation models, and seek novel partnerships that will yield breakthrough products and services.

A New Path to Leadership in a Transformed Industry

Recognizing that software is radically transforming the automotive industry, we have developed the Framework to Accelerate Software Transformation, or FAST. FAST breaks down the transformation into actionable dimensions, clarifying the challenges, opportunities, imperatives, and economic implications of the shift in order to help companies scale the capabilities they will need.

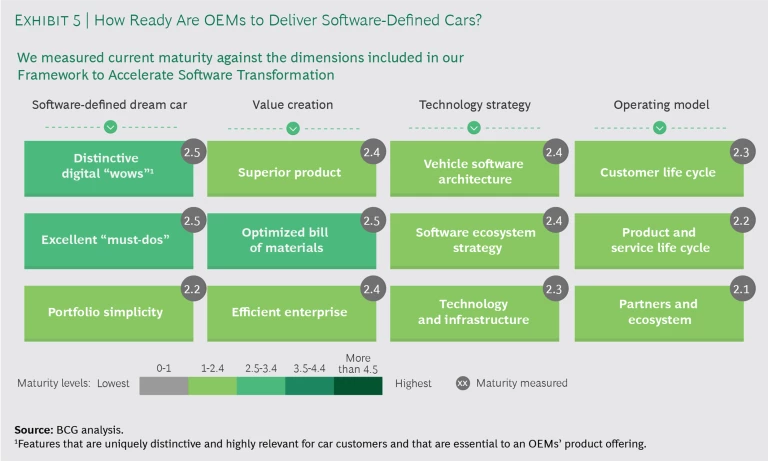

As part of our FAST approach, we surveyed more than 100 industry executives and engineers at auto companies around the world to determine each company’s starting point for the software transformation. Our survey followed the four dimensions of change we’ve outlined in this report. This benchmarking of OEMs’ progress when it comes to bringing software-defined dream cars to market reveals that most have not attained the needed maturity—yet. (See Exhibit 5.) The maturity assessments are a starting point for plans that will position them to compete in the promising new software environment.

To move on from that starting point, each OEM needs a clear vision of the company it aspires to become and the differentiating factors it will bring to the marketplace. This vision should focus not just on the cars they will build; rather, it should be a panoramic view of the company as a whole: how it will sell, how it will hire, how it will shape the customer experience, and so on. As OEMs formulate the vision, they must also think about how they will fund it. They need to imagine the long-term value creation that will turn the aspiration into reality.

Each OEM needs a clear vision of the company it aspires to become and the differentiating features it will bring to the marketplace.

This requires undertaking a thorough transformation, one that spans all four dimensions we describe here and is pursued wholeheartedly: pilot projects and incremental efforts won’t suffice. To make a change of this magnitude, OEMs must go big. This kind of transformation requires change management of the highest order. OEMs have a long and successful history, built on a clearly defined and directed functional model. The shift to software requires them to tear down their venerable houses and rebuild very different structures.

We believe OEMs can summon the spirit of innovation that fueled a century of hardware- and engineering-based success to reinvent themselves for the age of software—starting now. With competitors from other industries making inroads to this new business, OEMs should make ambitious plans and move quickly to set them in motion.