Real-world evidence is changing the health care industry. Stakeholders have successfully leveraged insights from real-world evidence to generate impact across the entire value chain—from optimizing the distribution of care to improving the protocol designs for clinical trials.

Stakeholders have successfully leveraged insights from real-word evidence to generate impact across the value chain.

An application garnering increased interest is the use of real-world evidence to serve as synthetic control arms (SCAs), dramatically changing the historical approach to clinical development testing. SCAs have the potential to reduce the number of patients required in traditional control arms, especially active-comparator or standard-of-care arms, thereby decreasing the study cost, accelerating the speed to result, and boosting the overall attractiveness of clinical trial participation for prospective patients.

Indeed, all signs indicate that the use of SCAs is poised to take off. The relevant data is becoming more readily available, and the advanced analytics needed to gain insights are rapidly improving. Moreover, regulators have become increasingly open to accepting the results of SCAs as the basis for decisions and are supporting efforts to test their use. Adding to these catalysts, the COVID-19 pandemic is expected to accelerate efforts to expand the use of real-world evidence in the pharma industry.

Although the enablers are falling into place, the initial moves have just scratched the surface of the potential opportunities. Unlocking the full value will require a broader set of actions and decisions at the industry and organization levels.

Initially, companies should focus on using SCAs to augment, rather than replace, randomized clinical trials. To drive execution, companies must decide which assets to prioritize for SCAs and implement a data access strategy and refined operating model. They can then influence the adoption of real-world data by study teams and define a roadmap for expanding the use of SCAs.

What Are Synthetic Control Arms?

Most traditional randomized clinical trials require the use of a control group, which can be either placebo or standard of care, depending on the disease area and study design. This control group serves as the statistical foundation for determining the overall efficacy levels of the experimental treatment under study. Thus, when many patients choose to enroll in a clinical trial for a new experimental treatment, there is a meaningful chance they might not receive the new treatment. These control groups also create significant costs for the overall study budgets, particularly in oncology and rare-disease indications with high-cost standard-of-care treatments.

SCAs seek to replace some or all of these patient control cohorts with the use of real-world data to model the comparator results. As a first step, companies select relevant studies, considering the available data sets and the type of trials they are conducting. (See Exhibit 1.) For each relevant study, they filter the available data by applying inclusion and exclusion criteria as well as trial-specific design criteria, such as indication, line of therapy, trial phase, age, or risk profile. Next, they conduct propensity score matching to compare the control data with that of the treatment group. The matching allows them to determine the baseline characteristics of the control group, conduct a comparative analysis of efficacy (response rates and survival curves), and ascertain the adverse-event frequency.

In certain disease areas, the use of SCAs could present the safest and fastest way for pharma companies to gain experience using real-world data—particularly given the continued rise in available data sources. These sources include electronic health records (EHRs), payer claims and billing, product and disease registries, patient-reported information, personal devices and health apps, and pharma companies’ own historical control data.

Not all diseases lend themselves to SCA approaches equally, however. Ideally, the disease under study should have a well-defined standard of care and clearly described disease measures that are aligned between treatment practice and accepted trial endpoints. Many oncology indications fit the bill because they have commonly accepted treatment guidelines that aim to achieve specific survival benefits.

SCAs are also valuable when randomized clinical trials are not feasible, such as in the case of rare diseases, small patient populations, or clear treatment preferences (that is, a lack of clinical equipoise), or when the drug under investigation is available outside of the clinical trial. Although these opportunities are significant, they comprise only a subset of drug investigations. As a result, traditional clinical trials will not be completely replaced and will remain the gold standard in many instances.

The Enablers Are Falling into Place

Pharma companies and regulators have acknowledged the opportunities to use SCAs for more than a decade. Today, however, a number of factors are coming together to realize that promise.

A number of factors are coming together to realize the promise of synthetic control arms.

First and foremost, the overall availability of large-scale real-world evidence has increased as more data providers offer access to patient-level information. At the same time, powerful computing tools and technologies—such as unstructured data storage in so-called “data lakes,” artificial intelligence, and machine learning—have become available to mine and analyze such data in an iterative and self-improving way. The cost of these tools and technologies is declining as well.

Industry support is another critical enabler. Pharma companies have set up partnerships to jointly pursue the opportunities. For example, an alliance called Project Data Sphere provides external control data to trial sponsors. The organization has received data sets from several leading pharma companies. As another example, the Alliance for Clinical Trials in Oncology Foundation is collaborating with leading players on a data study that aims to augment clinical oncology research with high-quality real-world data from patient records. The partners include the Dana-Farber Cancer Institute/Brigham and Women’s Hospital, the American Society of Clinical Oncology, and the Mitre Corporation. Additionally, top technology companies are teaming up with pharma players to leverage their strength in data management and insight generation.

So far, legislators and regulators in the US have been the front-runners in paving the way for SCAs and other novel applications of real-world evidence. For instance, the 21st Century Cures Act, enacted in the US in 2016, supports using real-world data from observational and postmarketing studies in order to get drugs to market more efficiently and affordably. The US Food and Drug Administration (FDA) has published draft guidance for the pharma industry on how to use real-world evidence in regulatory submissions to the agency. In another sign of the FDA’s interest in expanding the use of real-world evidence, the agency appointed Dr. Amy Abernethy, Flatiron Health’s former chief medical officer, as the principal deputy commissioner. Dr. Abernethy is recognized as an expert in using contemporaneous SCAs in hybrid trial designs.

The FDA’s Oncology Center for Excellence, through its “Project: Switch,” is investigating whether SCAs can be created retrospectively to match the live control arms used in successfully completed clinical trials. If feasible, this would enhance researchers’ ability to make inferences regarding the effect of a new drug. The center is also looking at whether an SCA could be used to compare real-world data with active control arms in ongoing randomized controlled trials involving rare tumor types for which the standard of care has stagnated and the prognosis is especially poor.

Additionally, an FDA demonstration project involving Aetion, a technology company, and Brigham and Women’s Hospital seeks to replicate or predict the results of more than 30 completed or ongoing randomized clinical trials.

The FDA is not alone in supporting the use of real-world evidence. On the other side of the Atlantic, the European Medicines Agency’s network strategy for 2016 through 2020 highlighted the expanded use of real-world evidence as a key next step in supporting regulatory decisions for safe and effective use of medicines and increasing overall innovation.

The Value Is Real

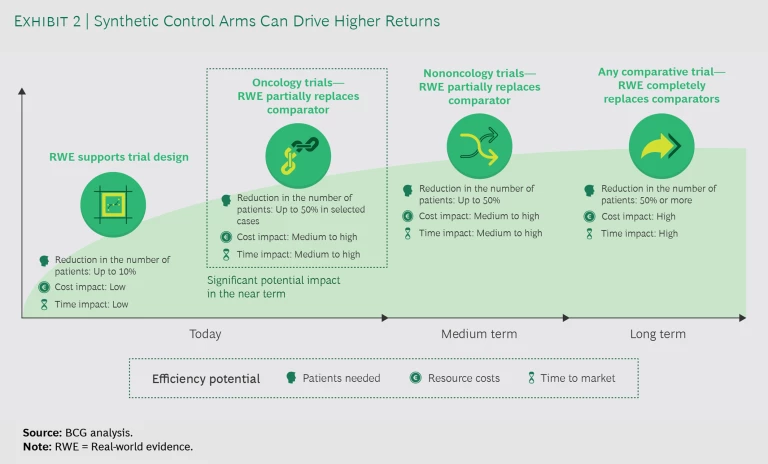

For pharma companies, the return on investment (ROI) in terms of cost and time from using real-world evidence instead of actual patients in clinical trials is significant. Today, companies use real-world evidence to support trial design and partially replace comparators with SCAs in oncology trials. (See Exhibit 2.) Expanding applications to nononcology studies or fully replacing trial arms with SCAs remains unlikely until the medium to long term. Even so, the current opportunities to improve efficiency are significant: considering that the cost per patient in an oncology trial frequently exceeds $150,000, the savings would be substantial.

For example, during the past five years, commercially sponsored phase 3 trials had an average enrollment of approximately 600 patients, half of whom were slated to be enrolled into a comparator arm. Our initial estimate, dependent on the context, indicates that a 20% to 50% reduction in the cohorts is possible. This has the potential to generate approximately $10 million to $20 million in savings per trial. A 50% reduction would also mean that approximately 300 patients who would traditionally be enrolled into comparator arms would be randomized into innovative treatment groups. This would allow them to more quickly complete patient signup, although the overall impact on the timeline depends on study-specific enrollment rates.

Adopting SCAs also makes trials more productive and builds resilience. This has become a necessity in the face of uncertainties, such as those arising from the COVID-19 crisis. The pandemic has increased cost pressure and complicated efforts to run successful clinical trials. For example, it is difficult to enroll a sufficiently large number of patients within a reasonable window of time. To address the challenges, pharma companies need new ways to build resilience and realize efficiencies in clinical trials beyond well-established levers such as moving clinical operations to lower-cost countries and deploying risk-based monitoring.

Other stakeholders involved in clinical trials also benefit from the use of SCAs. Fewer patients are exposed to a potentially less efficacious active-comparator or standard-of-care regimen. For regulatory agencies, SCAs are a means to promote innovation, reduce the cost of drug development, and decrease the number of patients in trials. Market access stakeholders also benefit, as they can request additional analyses that are based on the same real-world data set accepted by regulators or a similar one.

Oncology Trials Are Demonstrating the Opportunities

Pharma companies are initially using SCAs in oncology trials, for a number of reasons. The benefits with respect to reducing the high costs per patient and decreasing the number of patients in placebo groups or on potentially less efficacious therapies are especially valuable in oncology studies. These trials also entail more frequent breakthroughs that show a step change in efficacy rather than marginal improvements. Additionally, a strong alignment exists between regulatory endpoints and everyday clinical treatment goals such as tumor shrinkage, change in tumor burden, and survival benefit.

Several examples illustrate the opportunities for SCAs in oncology.

Accelerating Approval. Roche used an SCA to speed the marketing approval of Alecensa (alectinib), a lung cancer drug, in the EU. Although the drug had received accelerated FDA approval in the US in 2015, the EMA initially granted only conditional approval for marketing in the EU in 2017. The agency required Roche to provide additional evidence of effectiveness relative to the standard care. Rather than wait for Phase 3 trial results, Roche used data from Flatiron Health to create an SCA of 67 patients. The evidence from the SCA provided the basis for the EMA to approve the drug for use in 20 European countries.

Assessing Efficacy. Pfizer and Merck KGaA employed an SCA to evaluate the efficacy of Bavencio (avelumab), a PD-L1 inhibitor, for treating Merkel cell carcinoma. An SCA was needed because the short patient survival time precluded the recruitment of a prospective control group. The SCA used EHR data from community and academic hospitals. In 2017, the FDA and EMA approved the drug for this indication.

Expanding Labels. In 2014, the FDA broadened the approved use of Amgen’s leukemia drug Blincyto (blinatumomab) on the basis of evidence from a single-intervention group trial. The study compared the response rate in the trial with historical real-world data from 694 comparable patients, extracted from records in the US and EU.

Speeding Up Research. In 2020, Medidata received FDA approval to create a hybrid external control group that combines SCA patients with randomized patients. The approval came in the context of a Phase 3 trial relating to Medicenna’s MDNA55 treatment for recurrent glioblastoma, an aggressive form of brain cancer. Among other benefits, the use of an SCA to augment a randomized control group will help accelerate research that might otherwise not have been completed owing to high patient dropout rates.

The Barriers to Overcome

Although some companies are pushing ahead with the use of SCAs, many still have the mindset that trials should be conducted with patients. In order for more companies to try out SCAs, stakeholders need to address several barriers.

First and foremost, companies need access to the right type of data. If data is not available—which is likely in most cases—SCAs are not an option. A major reason underlying the unavailability of data is that many pharma companies are reluctant to share their data with other organizations and do so only selectively.

Even when real-world data is available, other barriers increase the risks and effort entailed in using it. The obstacles include limited standardization of data sources or statistical approaches and the need for a closer dialogue with regulators prior to and during trials. Pharma companies also require people with experience in setting up and conducting SCAs, but talent remains scarce and expensive. Additionally, companies need to help market access stakeholders become comfortable with the idea that some patient data comes from real-world evidence.

The Road Forward to Success

To lay the foundation for effectively using SCAs, companies must take several steps.

Prioritize pipeline assets. The applicability of SCAs varies among assets. Companies should rigorously review their portfolio to identify which pipeline resources are most suitable from the perspectives of data requirements, risks, and opportunities. To prioritize assets, they should define a holistic set of criteria, including the clinical endpoint, patient population, disease area, risk profile, and criticality of the project.

Refine the operating model. Companies need an operating model that breaks down organizational silos by optimizing processes and implementing standard operating procedures. They also must have appropriate governance to select and manage the right development projects. A refined operating model allows subject matter experts from several functions—clinical, data analytics, and regulatory—to agree on various topics early and at multiple touch points. It also promotes rapid, agile execution.

Develop strategies for accessing data and analytics capabilities. Access to the right set of data is essential for using SCAs effectively. Companies need to define their data access strategy early—options include building an in-house data repository, partnering with other pharma companies and groups, and buying data as needed. Companies should also designate real-world evidence “scouts” within their organization to help identify patient data sets and serve as interfaces between development teams and data providers. In addition, companies need to build their data analysis capabilities. This includes not only developing internal know-how but also partnering with big data companies to benefit from their complementary skill sets.

Influence adoption among trial teams. Trial teams that use SCAs will incur additional costs and risks that may lengthen their timeline. To increase adoption in the face of these challenges, companies should consider refining their governance model. This includes formalizing and implementing a mandatory SCA feasibility check by teams as part of the normal governance process of creating clinical developments plans. In addition, companies can consider providing trial teams that use SCAs with more time to complete studies or access to a centralized budget.

Define a roadmap toward utilization. Developing a roadmap begins with identifying which relevant data sets are currently available in the organization and which SCA initiatives are already underway. For companies that have not yet started to use SCAs, it is especially important to initiate pilots in order to gain experience, build the right network of external partners, and initiate internal lighthouse projects that serve as examples for the organization. To track progress, companies should establish a set of KPIs that measure whether development teams are ramping up their SCA efforts. Relevant KPIs include the number of SCAs used or the number of clinical development plans the team has considered for SCA use by exploring the availability of suitable methodologies and data. KPIs should also be created to gauge whether opportunities have been captured—such as the number of patients replaced with SCAs.

The prerequisites for using SCAs in clinical trials are quickly coming together, while promising initiatives and examples have demonstrated the value. Now is the time for the R&D departments of pharma companies to identify their specific opportunities and gain experience in this critical area. Although the effort is significant, so too is the reward: accelerating the delivery of safe and efficacious drugs to the patients who need them.