Digital transformation helped telcos provide the connections—technical and human—that meant stability in an uncertain time. But are they ready to seize digital’s full potential?

When the world moved from onsite to online, telecom operators helped it adapt . They provided the connectivity that fueled new models for commerce and education. And they fostered collaboration—and community—during a time of extreme isolation. In the process, telcos opened the door to new opportunities and revenue streams in the digital ecosystem. The question is, How well poised are they to seize the potential?

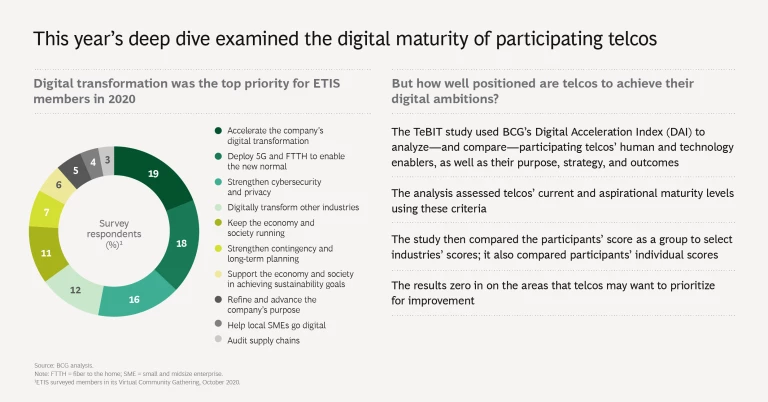

This year’s telco IT benchmarking (TeBIT) study, jointly developed by ETIS—The Community for Telecom Professionals—and Boston Consulting Group, leaves little doubt that they are getting into position. Now, telcos need to fortify it. (See “About the TeBIT Benchmark.”)

About the TeBIT Benchmark

Collaboration is a key component of TeBIT; the goal—as it is with ETIS working groups and community gatherings—is to identify, and even shape, the best practices that can help telcos better serve customers in a rapidly changing world. In return for allowing themselves to be compared with other telcos, participants can access a full set of benchmark results, along with further trend analysis.

Steady in an Uncertain World

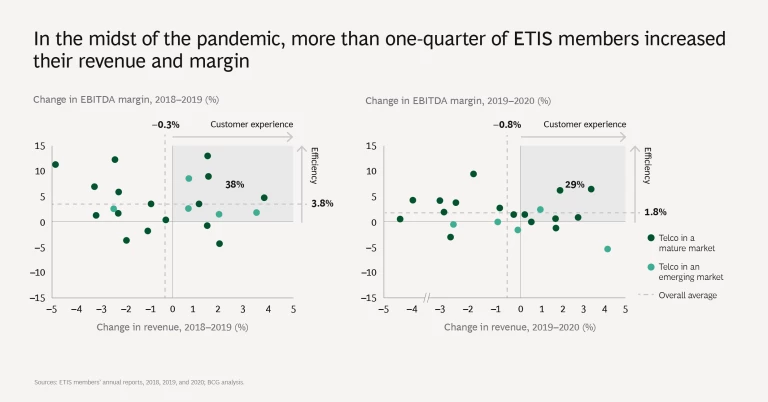

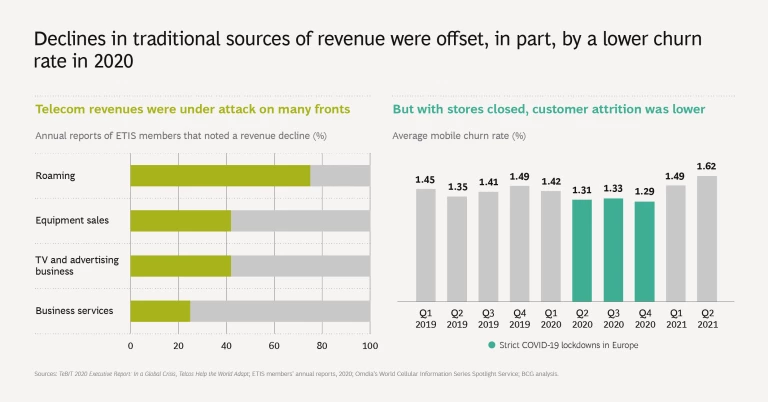

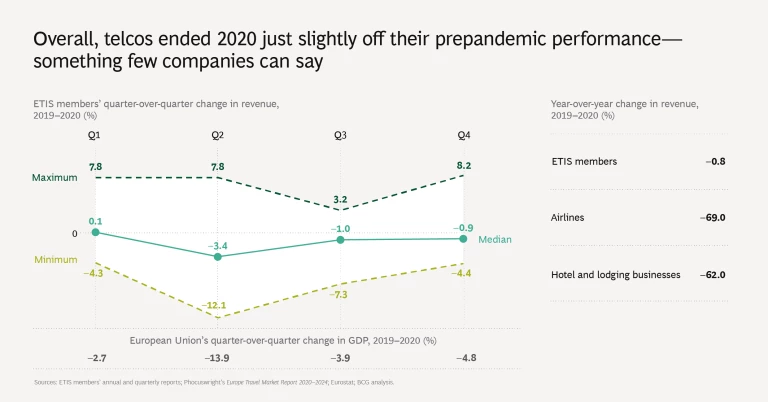

During the pandemic, many telcos accelerated their digital transformations . This let them not only adapt their customer journeys and offerings to the dramatic changes in needs and behaviors but also boost their efficiency. Those improvements proved critical to telcos’ resilience. While lockdowns decimated roaming revenues and depressed equipment sales and business services, telcos managed to end 2020 on stable ground. On average, ETIS members’ revenues dropped just 0.8%, and more than one-quarter of the group—29%—increased revenues and margins. That’s down from the 38% that raised both metrics in 2019, but it is still impressive in a year when the European Union’s GDP fell 6.1%.

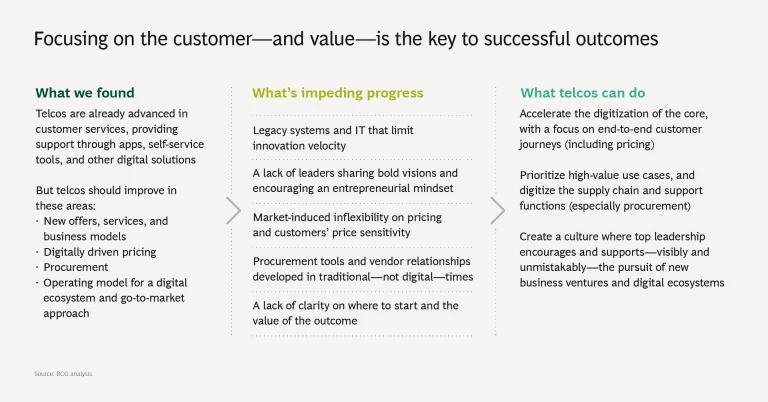

Yet the study also suggests that while telcos are thinking big, they’re not always thinking big picture. TeBIT participants continue to prioritize and invest in digital transformations, but they are doing so with more of a technical vision, rather than a strategic one. They’re taking a lot of near-term steps and leveraging a lot of powerful technologies: apps, customer self-service tools, and analytics are now commonplace. But what’s often missing is an end-to-end, holistic view of digital—a vision that makes all their advancements work together in ways that best promote opportunities and achieve goals within and beyond telcos’ core business.

Growing into Digital Maturity

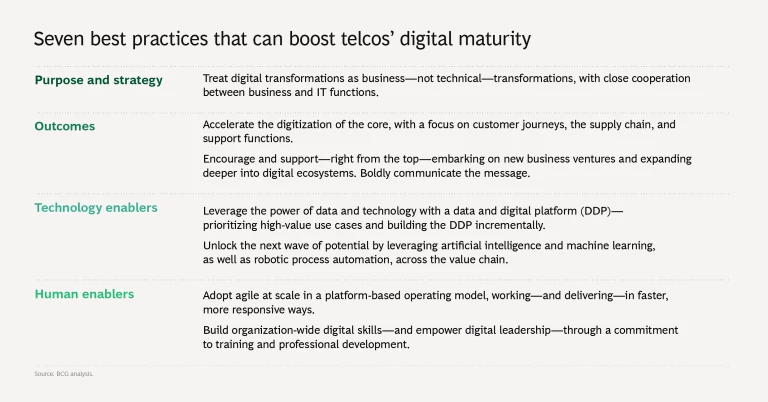

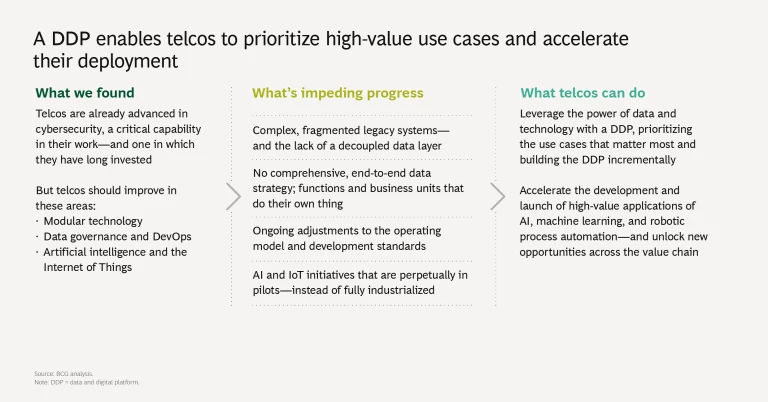

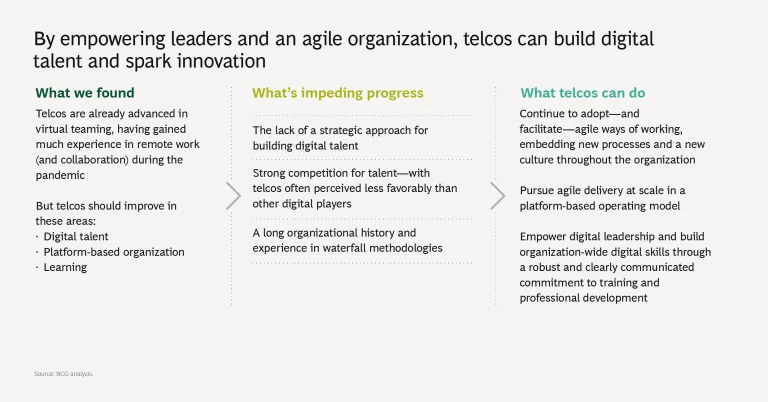

This year’s TeBIT analysis took a closer look at telcos’ transformations; specifically, we assessed their digital maturity —a measure of an organization’s ability to create value through digital. Today’s digital leaders do more than invest in scattered initiatives. They’re bionic companies : businesses that combine human and technical capabilities in ways that spark—and speed—innovation, responsiveness, and continual improvement. According to BCG’s Digital Acceleration Index (DAI) study, digitally mature companies outperform their peers across nine KPIs, including revenue growth, enterprise value, and return on investment in digital projects.

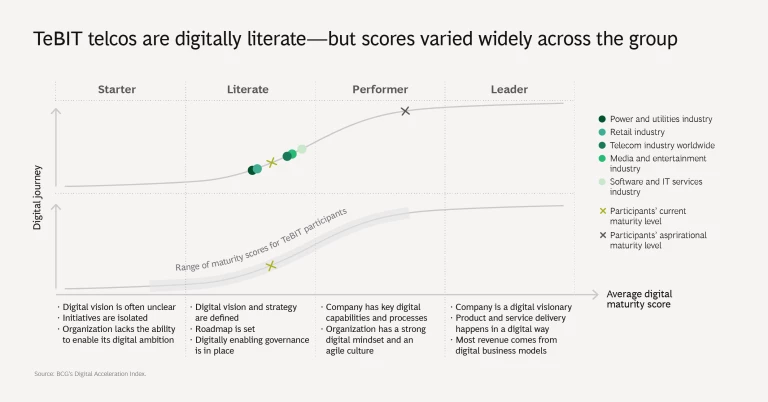

The DAI—which looks at human and technical enablers of digital maturity, as well as an organization’s purpose, strategy, and outcomes—categorizes companies into four tiers: starters, literates, performers, and leaders. While starters typically pursue isolated initiatives and lack a digitally enabling organization, leaders are digital visionaries that possess a strong digital culture (and the processes to support it) and generate most of their revenue from digital business models. Overall, TeBIT participants fall roughly in a middle ground as digitally literate, though we found much variance within the group. Some telcos are at the performer level, while others are still at the starter tier.

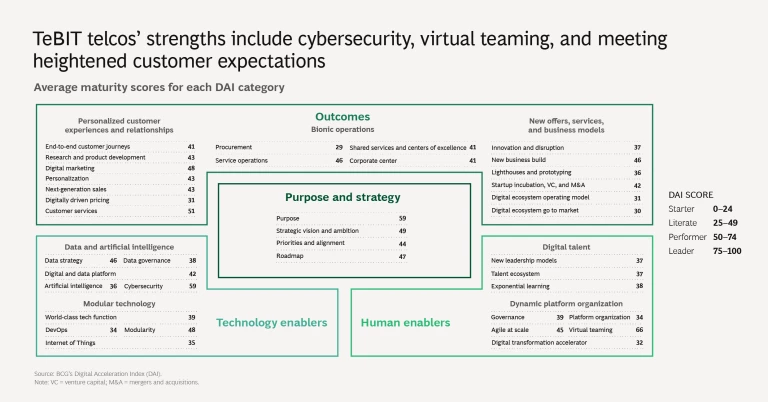

We also saw where TeBIT participants appear to be performing well—and where they might want to improve. Areas of strength include cybersecurity, virtual teaming, and meeting heightened expectations from customers. (In a digital world, customers demand faster and better service, notifications, and journeys—and telcos seem equipped to deliver.)

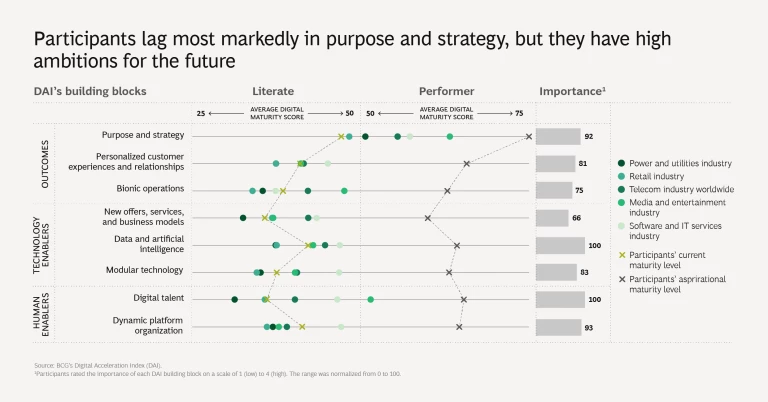

Weaker areas include digitally driven pricing, a capability that enables companies to quickly optimize pricing—and margins—on the basis of demand and advanced analytics. Telcos’ capabilities are also weaker in the categories of modular technology (which helps boosts flexibility and reduce time to market), digital talent , and leveraging digital to create or support new offers, services, and business models. That last category is particularly noteworthy because so much falls under its scope, including using automated platforms, tweaking phone plans, and monetizing data.

Of note, too, is what telcos themselves seem to view as their biggest area of concern: purpose and strategy. In this category—which includes strategic vision, priorities and alignment, and the digital roadmap—we saw the largest gaps between where telcos are, in terms of digital maturity, and where they aspire to be. It’s also an area in which TeBIT participants, as a group, lag behind several industries, including media and entertainment , power and utilities , retail , and software and IT services.

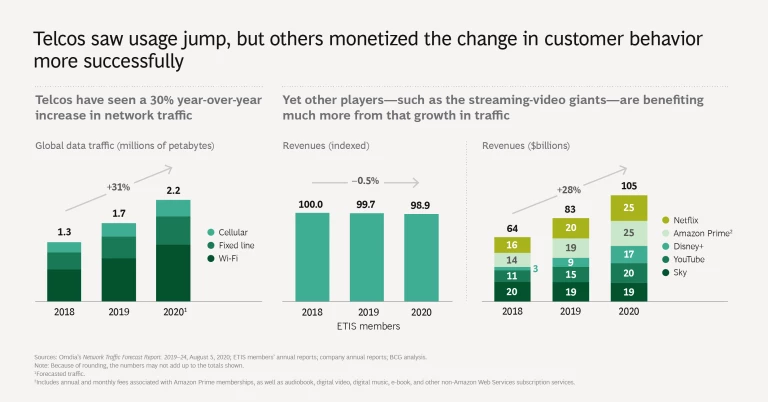

Telcos need to close the gaps between their current maturity levels and their aspirational levels in order to use their digital advances as a springboard for seizing new opportunities and new revenue streams. During the 2020 lockdowns, telcos provided crucial connectivity and, globally, saw a 30% year-over-year rise in data traffic. Yet other players—such as the streaming-video giants who built their businesses on top of telecom infrastructure—have been far more successful in monetizing the growth in traffic.

Focusing on Customers—and Value

So how do telcos become digitally mature? Operators need to strengthen their digital capabilities and apply them in a coordinated way to achieve a strategic, rather than a technical, vision. Digital transformation is a business transformation. CEOs and other top executives should prioritize—and evangelize—digital’s integration with the business purpose, strategy, and goals.

Just as important, adopt a customer-centric approach. What does the customer actually need in terms of offerings and experiences? What enhances or hinders their experience with telecom services and channels? By taking this perspective, operators can more readily—and more successfully—identify the products and journeys that resonate with customers.

Finally, prioritize for value. Zero in on the digital initiatives that matter most and move them to the top of the to-do list. By prioritizing use cases, telcos can create value quickly, which is crucial in a transformation. It demonstrates—quite visibly—the power of digital, creating buy-in for the next initiatives. And it helps fund the longer-term journey. In this way, telcos can build capabilities to fast-track the most important enablers, while gradually developing the others. And they can put emerging technologies (such as artificial intelligence and machine learning) to use—quickly—and seize the next wave of opportunities and value.

Telecom companies are accelerating their digital journeys, but running the transformations as—and only as—IT projects is never going to bring the outsized rewards that digital leaders already see. The holistic, end-to-end approach is essential. By aligning their digital initiatives, capability building, and business strategy, telcos can serve their current customers better—and a lot of new ones too.