For some years now, telecom experts—including us—have been hammering home a point: telcos need to embrace new ways of working, new business areas, and new technologies if they are to adapt to, and thrive in, a changing world. Maybe 2020 hit the nail a bit harder than anyone needed. But the world has changed, dramatically, and the question is, are telcos ready? Are they prepared not only to adapt to a new reality but to help lead the way?

These questions are at the heart of this year’s telco IT benchmarking study (TeBIT)—a survey of European operators’ IT spending and performance that was completed in December 2020. While TeBIT takes a deep dive into a different topic each year, at its core the benchmark is about adaptation: how telecom operators are reacting to new trends, new market challenges, new customer preferences and behaviors. COVID-19 has all of that, supersized, and has put telcos’ adaptation skills to a tremendous, unprecedented test.

As a group, telcos have risen to the occasion. They’ve ensured robust connectivity when customers needed it most, provided enhanced services to critical institutions like hospitals, and helped governments use movement data to inform, and improve, their mitigation efforts. They’ve played a new role and are perceived in a new light: as crucial players in keeping economies, and society, resilient.

Telcos have played a new role during the pandemic and are perceived in a new light: as crucial players in keeping economies, and society, resilient.

But we also saw that some operators adapted more successfully than others. Operators that stayed close to their customers—proactively reaching out with information and enhancing digital channels when retail stores closed—experienced a smaller revenue decline than their less digital, less customer-centric peers. Some telecom companies were able to respond quickly and effectively to rapid shifts in how customers, and their own employees, work. And as digitization accelerated, some telcos were well positioned to support new kinds of solutions and capture new kinds of customers.

Why were these telcos able to adapt so well? Enablers were key. Telecom operators have increasingly, if not always wholeheartedly, embraced digital transformation, agile methodologies, and data and analytics. In a highly digital world, where requirements—and expectations—are evolving, these enablers are no longer optional. Mindset is important, too, however. Telcos have to define their place and purpose in a postpandemic world. They have an opportunity, sure, to strengthen and differentiate their core businesses. But with their expertise, infrastructure, and data, telecom companies also have opportunities to expand beyond the core, into areas like health care; to become vital players in all layers of the ecosystem.

Moves like this will take telcos in less familiar and perhaps less comfortable directions. But sometimes you need to embrace change in order to adapt to it.

The Calm and Then the Storm

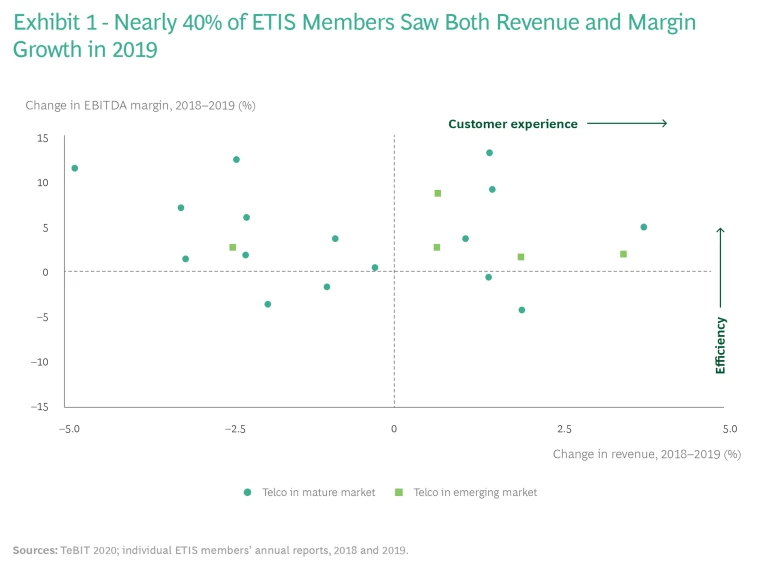

Going into 2020, telcos appeared to be holding steady in the face of familiar challenges, such as competition from over-the-top players, price pressure, and the increasing commoditization of their traditional fixed and mobile offerings. On average, ETIS members saw just a 0.3% drop in revenues for 2019 while TeBIT participants notched a hair of a gain with a 0.2% increase. And improvements in customer experience and efficiency, driven largely by digitization, appeared to be paying off: even in a challenging market, 38% of ETIS members were able to increase revenues and EBITDA margin. (See Exhibit 1.)

The majority of TeBIT participants—83%—boosted their IT spending in 2019, the increases driven by IT capex investments, particularly in digital transformation (including system renewals and automation) as well as infrastructure consolidation and renewal.

Then COVID-19 arrived. First-wave lockdowns led to a median revenue change of –3.4% for ETIS members in the second quarter of 2020. Yet the third quarter, when many countries dialed back their mitigation policies, saw considerable recovery. The median was just a –0.6% drop compared with the same period in 2019.

A few points about these findings. First, while the pandemic impacted revenues, telcos do not appear to have been hit as hard as some other industries. GDP for the European Union declined by 13.9% in the second quarter and 3.9% in the third quarter—sharper drops than operators, on average, experienced.

Second, the correlation between national mitigation policies and telco revenue development was a bit more nuanced, perhaps, than expected. As a point of measure, we used the Oxford COVID-19 Government Response Tracker, which, for a given country, assesses the stringency of policy responses and aggregates them into an overall score. We found that maximum stringency did not necessarily translate to maximum revenue impact. Rather, the stronger indicator was the number of days a country maintained a stringency score greater than 70.

We also saw that certain types of revenue were hit harder than others. With travel substantially reduced, revenues from roaming dropped sharply. Data from TeBIT participants and members of ETIS’s Network and IT Transformation Working Group reveals decreases of up to 75%. That added still more pressure on traditional offerings—and more pressure on telcos to reinvent themselves.

Staying Close to the Customer

When retail stores shuttered, digital channels became essential to business continuity. Most TeBIT participants saw a surge in online device sales in March and April—the height of the lockdown. Yet once stores reopened, sales via digital channels returned quickly to their prelockdown levels.

This suggests that, at least when it comes to purchasing devices, many customers still have a preference for in-person interaction. A BCG survey of telco consumers, completed in June 2020, lends support here: a not-insignificant proportion of respondents, 26%, said they preferred to make their postlockdown mobile purchases in a physical store.

But there are signs that digital is—perhaps gradually rather than dramatically—gaining ground. When the BCG survey asked respondents to note their preferred pre- and postlockdown channels, digital saw a slight uptick on the “after” side of the comparison: 2.5% more respondents now consider it their channel of choice.

Customers also seem to have valued the “proximity” that digital can create. TeBIT participants that were able to stay close to their customers during the crisis—through online, mobile apps, call centers, and so on—experienced less revenue decline.

The takeaway: if telcos develop these channels in ways that emphasize and enhance closeness to customers, they can accelerate and sustain a shift to digital. Innovation is often born in crisis, and already we are seeing some promising ideas. One TeBIT participant, for example, is using its mobile app to offer customers free data and minutes, among other things, to make life a little easier during the pandemic. (See “Getting Closer to the Customer.”) The offers do double duty. They meet emerging needs but also serve as a gateway of sorts: spurring customers’ interest in using the app and discovering other features, like bill payment, and even new add-on services.

GETTING CLOSER TO THE CUSTOMER

“The lesson here—for all telcos—is that extra commitment to supporting employees, customers, and society, and using the crisis as a catalyst for transformation, will pay off in the long run.”

A crisis can test a relationship. But it can also strengthen one. When Europe went into lockdown, connectivity became more critical than ever, and user demands and challenges increased. Telcos needed to understand the shifts and, with retail stores closed and workforces homebound, find new ways to address them. And do it all quickly and effectively. For details on one telco’s approach—and how it sparked the use, and success, of its digital channel—BCG and ETIS spoke with Branimir Spajić, the director of customer experience management at Hrvatski Telekom.

When we analyzed the TeBIT data, we saw that telcos that stayed close to the customer—through messaging, support, and easy accessibility—fared better during the crisis. How has Hrvatski Telekom maintained customer proximity?

For us, this crisis started with a devastating earthquake here in Zagreb, so our priority was to quickly respond and protect our employees, our customers, and our business continuity. At the same time, we had to make sure that everyone stayed safe and connected. We managed to start with work from home early in the crisis, and we ensured full service for our customers. In terms of customer proximity, companies that recognize this crisis as an opportunity to get to know customers better, and get closer to them, strengthen the relationship by addressing needs with extreme empathy. We use a program, which we call In Good Hands, to get closer to our customers and support them in these challenging times. Through our digital channel, customers can activate a set of benefits, from additional gigabytes for free, to other telco perks and entertainment content such as exclusive music content. With this program, we continuously engage and communicate with our customers, surprising them with meaningful rewards and providing them with relevant information and customer journeys.

You mentioned that In Good Hands works through a digital channel. Do you mean through an app?

We have a unified mobile app called OneApp. Customers access In Good Hands through this app and can see a list of benefits available for them at any moment. To make their home life more enjoyable, we’ve added a lot of features to the app during the pandemic, for customer service and support and so on. The app has been valued as an important channel for communication and interaction, as it enables customers, for instance, to pay their bills digitally or chat with agents. This is a long journey, and along it we’re learning how best to bridge the digital divide and meet customer needs.

How did the reopening of physical stores impact the digital channels? Did the utilization level off, drop, or continue to rise?

We’ve kept the positive momentum. We are really proud of what we did, and more importantly, how we did it. Month over month, we are seeing increased penetration of our mobile app—our stores opening didn’t change that. Sales through the digital channel are also improving. I think a big lever for success is how we educate our customers; changing their mindset on digital and showing how easily they can perform tasks. You can’t simply push a digital feature in front of customers and make it mandatory. You have to create a supportive environment for customers to learn and understand how that feature works and how it brings value for them.

To change the mindset on digital, did you need to adjust your digital agenda—perhaps introduce more online support?

We reprioritized our agenda to focus on features that would be particularly useful during the crisis. Basically, we scanned all of our analog processes and reassessed the company’s digital priorities in order to create digital workarounds that support new business requirements in a simple and effective way. To accelerate your digital agenda, you have to be bold in embracing a fast-paced test-and-learn environment. And you have to ensure digital trust by measuring the customer experience continuously and making improvements based on what you learn.

As we speak, Europe is in a second wave of the pandemic. How have the lessons of the first wave shaped your strategy and product development?

Certainly, we keep adjusting our business models based on the situation with the second wave of the pandemic. Our goal is to find the best way to serve our customers by responding to a higher demand effectively. We continue to digitalize customer journeys. We continue with our successful story known as Smart Work—our flexible work-from-home model. Also our focus will remain on network performance and stability, in order to provide connectivity and infrastructure for customers, employees, and society. In regard to product development, we continue to design customer-centered solutions with a focus on the customer journey and an agile way of thinking and doing things.

Do you see opportunities to help specific verticals—for instance, health care—with digital transformation?

We are exploring new opportunities constantly and are closely looking at what is going on in the market. The COVID period has highlighted areas where there is potential for telcos to develop new revenue streams and new collaborations. One interesting area is digital education. A second area—one that I saw at an ETIS presentation and is personally interesting to me—is telemedicine. I think there is great potential here, especially with the capabilities of 5G. Accordingly, a few months ago Hrvatski Telekom launched the first commercial 5G network in Croatia.

Let’s talk a bit about the internal perspective. What were the key changes and challenges you faced in the transition to remote work?

I would first note that the pandemic really underscored the potential of agile. We started introducing it toward the end of 2019, and at the moment we have more than 400 people working in agile. In setting up agile, we introduced digital tools for collaboration. So we already had that set when the crisis hit.

Shortly after the pandemic struck Croatia, we introduced our Smart Work model, which was a key first step in ensuring business continuity. It gave our employees full flexibility on where they worked and integrated tools that helped us communicate effectively and measure our performance, especially in support functions. To manage the crisis, we have to be transparent with our employees and customers and communicate with clarity and humility so they can see, from an early phase, that we’re in this together. We also implemented a new operating model for employees who worked in our stores. After closing the stores, we adjusted all processes so that these employees could work from home and we educated them on a new set of tools.

Looking into the future, how do you envision the “new normal” customer experience?

I think the new normal for customer experience started when COVID started. Companies that can identify customers’ needs in an early phase of the new normal, and adapt their business and operating models, will be in a much better position—and ready for what the next normal will bring. It’s all about experiences that are built around customer needs and expectations, instead of telcos looking into their own yard only and at what their competitors are doing and how they are doing it.

The needs of our customers are much different now than they were just a year ago, and they will be much different in 2021. Telcos have to reconsider the ways they address needs and expectations. You have to get to know your customers, gain insights into their behaviors and requirements, and be more responsive to their expectations. This is the reason why it is so important to enhance digital experiences. And why it is so important to create a data-driven, test-and-learn culture to drive successful customer experiences in the new normal.

Are you seeing higher customer satisfaction?

Yes, but we are also seeing higher employee satisfaction. We know that engaged and satisfied employees are fundamental for creating satisfied customers. We are proud that our employees recognize the effort and actions that we take to protect them and how we demonstrate success through difficult times as a team. The lesson here—for all telcos—is that extraordinary commitment and dedication to support employees, customers, and society during unprecedented times, and using the crisis as a catalyst for business and digital transformation, will pay off in the long run.

Keeping Pace with Shifting Usage Patterns

Connectivity is the lifeblood of a world in lockdown. With much of Europe shuttered in the early months of the pandemic, telco networks became a critical enabler—fueling the remote working, distance learning, and e-commerce that would keep economies, and society, running. While network usage increased, it also changed in important ways, creating both challenges and opportunities for telcos.

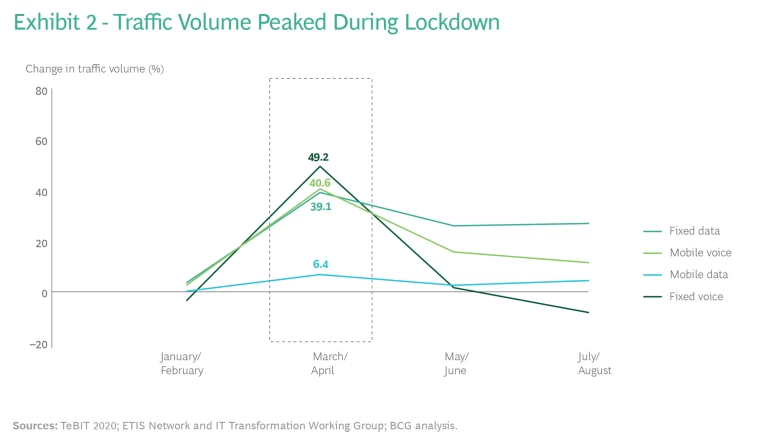

Data compiled from TeBIT participants and ETIS working groups reveals the shape and shifts of usage patterns. During the first-wave lockdown, in March and April 2020, all forms of traffic peaked, with fixed data, fixed voice, and mobile voice up sharply from prepandemic volumes. (See Exhibit 2.) Mobile data, however, rose more modestly. This makes sense: with in-person activities restricted, telco customers increased their use of videoconferencing, video streaming, and voice calls. And with much of their usage occurring over fixed broadband networks at home, customers placed comparatively less demand on mobile data networks.

Once restrictions eased, fixed voice usage declined sharply, but fixed data remained well above pre-COVID-19 levels. And mobile data usage remained relatively stable, maintaining a slight uptick from prepandemic days. These usage patterns also follow, as many people continued to work and learn remotely, either fully or in hybrid models. (At the time of this report’s preparation, Europe was in the midst of a second wave of coronavirus—prompting new lockdowns and restrictions—and first-wave traffic patterns were reemerging.)

As the world adapted to virtual interactions, telcos kept pace. When Europe locked down in March, telcos immediately started sharing their experiences in ETIS working groups, and it quickly became apparent that no operators were facing serious issues with their network. One factor working in telcos’ favor: the network loads, while high, were not unprecedented. Even during lockdown, daytime traffic increases did not reach the evening peaks seen in more normal times, when streaming, calling, and web usage typically spike.

Telcos did, however, take steps to reduce outage risks. They put planned but noncritical network and site work on hold. They also developed prioritization and throttling strategies, though they did not ultimately need to apply them (over-the-top players like Netflix and YouTube temporarily lowered video quality in several countries). And to ensure that critical functions were not interrupted, operators provided additional capacity to health care facilities and other essential institutions.

Indeed, the link between critical functions and connectivity demonstrates just how vital telcos have become to resilience and economic stability. Telco infrastructure keeps countless processes—in health care, logistics, education, and many other areas—running. And many new behaviors and preferences depend on robust and dependable networks.

For telcos, there are some clear messages here. Operators need to ensure the reliability of their infrastructure. This means increasing the use of network automation and optimizing for low-latency performance. Telcos should also invest in new technologies and network capabilities: 5G and fiber to the home are key enablers for accelerating digital transformation and making the new reality a thriving reality.

But perhaps the biggest takeaway for telcos is that they have new opportunities. Across industries, the pandemic has jump-started digital transformations. Telecom operators have a chance to expand deeper and wider in the digital ecosystem, playing a role that goes far beyond network connectivity—and touches on application development and enablement, analytics, security, and end-to-end solutions. At the ETIS Virtual Gathering in October, participants ranked health care, government, and transportation as the three most promising verticals for digitization. Some telcos have already started down this path. (See “Adept at Adaptation.”)

ADEPT AT ADAPTATION

“We didn’t want to sit in a bunker and think about the kind of support customers might need. We had to go and ask. Then we’d set our priorities around that.”

Telcos needed to react quickly in the face of the pandemic. How was Elisa able to adapt so rapidly?

I think there were two key factors. First, videoconferencing and remote working were already familiar to us. We sell videoconferencing as a managed service, so several years ago we decided that we should be the model. In all levels of the company—from the very top, the board and the management team—we had meetings where people could attend from anywhere. Of course, there were parts of the organization, like customer service, where remote working wasn’t so widely adopted, but we had the infrastructure in place, and we had supervisors who were already trained on what it is like to manage remote work. This made it relatively easy to transition to a fully remote model. The other factor is that our network operations are highly automated. Initially, we weren’t sure if the automation could adapt to a radical change in usage patterns. But it did, quite smoothly.

In our discussions with telcos, one question that comes up is how to measure productivity. There can be a lack of trust that people are really working when they’re home. But there are also concerns about overburdening people with measurements. What is Elisa’s approach?

What’s crucial is transparency. We believe strongly in measuring results, but at the same time, we make it very clear to everyone—from the leaders down—what is expected of them, what targets they should be meeting. Then managers can focus their actions on those who need support. For us, it’s gone smoothly because we have experience in remote working and already had these mechanisms in place.

What were Elisa’s priorities at the start of the pandemic? Have they changed over time?

The first order of business was to make sure our people were safe and able to work safely. But it was also important to increase our communications with customers. We didn’t want to sit in a bunker and think about the kind of support customers might need. We had to go and ask. Then we’d set our priorities around that, whether it’s more VPN connections or robust connections for everyone now working and learning at the same time at home. In effect, we cocreated with our customers. This was especially important because very early on, we decided that we were sticking with our targets. Roaming was going away and that is a profit-making business. So we needed to come up with new sources of revenue. The idea was, we could help our customers adapt, keep society functioning, and turn that into business opportunities.

Can you give some examples?

Here’s one from my own area of responsibility, telecom software. Traditionally, we’d go onsite, making sure that everything works in the customer’s environment. When that became impossible, we completely reconfigured the way we delivered software, creating ready-made packages customers can install and test themselves. In our consumer business, we wondered what we could do for the many elderly people in Finland who were now isolated, alone and far from relatives. So we configured a tablet to simplify the process for making a video call. There are just a few buttons on the screen, and the tablet itself guides you along, so you can find contacts quickly and start communicating. There are tens of examples like that. Here’s a problem, here’s how we can help. Thinking like that leads to new offerings.

How do you evaluate, pursue, and fund such ideas—especially opportunities outside the core business?

We’ve fostered—over many years—a culture of experimentation, and this has really helped in the current situation. In our traditional development process, we use something we call Elisa X, which is a combination of design thinking and lean startup. It’s based around the idea that first you need to understand what the customer really wants. Then you build a prototype and start testing your hypotheses. But a very close relative of this is something we adapted from the Toyota production system: the use of kaizen, or continuous improvement. We have trained some 400 kaizen coaches. So in the midst of the pandemic, when we need to be fast and agile, we are able to experiment and quickly see what works and where we should continue investing. Instead of trying to figure out everything in planning, we figure it out with real customers in real situations.

Did you also conduct or support activities for the public domain—for example, the assessment of movement patterns, or app development for health care?

We did. Although we are not the incumbent in Finland, we have a strong relationship with the public sector. When the crisis struck, we helped agencies and ministries expand their videoconferencing capabilities. One thing we are very proud of is our work with the Helsinki University Hospital (HUS). They faced a huge challenge in managing their resources—personnel, equipment, spaces—as they expanded their capacity. We had developed a set of applications to help our manufacturing clients run their factories. So we offered to adapt that to a hospital environment. We connected to their data sources and created dashboards and other visualizations that let the hospital better understand and coordinate everything under its roof. The solution became so important, so integrated into daily management, that the hospital system became our customer. And an offering designed for factories became an offering for hospitals, too.

At ETIS’s Virtual Gathering in October, there was a lot of interest in how Elisa has successfully monetized new opportunities outside the core. Many telcos worry about betting on the wrong things. You mentioned the health sector, but what other verticals hold promise?

I think it’s important to note that we have not always been successful, but we have learned a lot. Most importantly, we’ve learned that the chances for success are greatest when you build on what you know, and do, well. It’s tempting to say, “I have a large customer base and a lot of assets, I can do this new thing.” But most of those ventures fail. Our experience—and how we approach expansion—is that it has to be based on processes and capabilities we have already mastered.

That’s how we ended up providing automation software to other telcos. We developed technology for automating our own network, and we saw that we could use that know-how to provide value to other operators. The smart factory, another area in which we are investing, is a very close relative. Both of these businesses are based on our long-term investment, and experience, in data analytics. So I can’t tell you where a telco should go because every telco needs to look inward, identify what it is very good at, and build from that.

Any additional recommendations for telcos as they tackle the new reality?

I would stress the importance of experimentation and of building the capabilities and practices that foster it. This is where the truth is, not in a planning department or a meeting room, but in experimenting with real people, real customers. Good communications are also essential. That was a big lesson for us as we adapted to working from home. We started biweekly sessions where our CEO addresses everybody directly. And we’ve seen a huge change within the organization, how people feel about working at Elisa, as every second week you can hear how we are doing, what our plans are, what is new—directly from the CEO. There is an opportunity now to communicate more directly, more immediately, more effectively. And telcos need to figure out the mechanisms that work for them.

Minimizing Internal Disruption

While telcos managed the additional network traffic well, a larger issue, it turned out, was the supply chain. A drop-off in production in China, a major source of equipment, was particularly concerning. In some cases, operators had to scramble to find alternative supplies within Europe. For at least one ETIS member, supply chain management became a key component of its crisis program. (See “Telcos Take Center Stage.”)

TELCOS TAKE CENTER STAGE

“Agility is a big thing for all of us, for every telco. And maybe that’s the most important thing we’ve learned this year: you need to know how to respond quickly in order to survive.”

At the ETIS Virtual Gathering, we heard about the major trends and lessons of the pandemic as they relate to telcos. For example, operators are accelerating their digital transformations. For KPN, were there any additional lessons?

I would add two observations. First, in this industry, people tend to be very good at firefighting—they like working with adrenaline. We saw this at the beginning of the crisis: people eager to be involved, a lot of energy within the organization. And productivity actually went up. But you can’t live on adrenaline forever. So I think there is a question about what it means to be 100% working from home. An engineer is no longer sitting next to three other engineers, talking about changes and getting insights that may improve results. You’re missing the spontaneity.

Telcos should also consider how they handle organizational change and the uncertainty that can spring up around it. If you’re in the office and you hear about organizational change, you can go see someone, talk about it by the coffee machine. That’s pretty much gone. So the uncertainty is magnified now, it gets bigger to people. How do you mitigate it? We are doing a lot of things to support employees who, just like you and me, are sitting at their screens all day.

What should telco executives think about in terms of contingency and long-term planning? Any lessons from the pandemic there?

An area that jumps to mind is the supply chain. That was high on our agenda and it remains so. Another thing we realized is that our business continuity plans were technology focused—not so much looking at what happens if a whole team gets sick. So there was a new dimension that we had to add to our plans.

Longer term, one thing that’s interesting to me is our position with respect to the over-the-top players. When this started, we thought, what if everyone is working from home, and the kids can’t go to school and can only watch Netflix? We concluded that the network should be able to handle it, but say it didn’t. You can’t shut down services because then you are making a distinction between types of traffic, and in the Netherlands we are committed to net neutrality. So you need government support. As it turned out, the European Union asked streaming services to reduce their bit rate and traffic went down 25%. Then the bit rates were restored. This isn’t a discussion telcos normally have with over-the-top players, and I think the crisis has underscored that the model isn’t quite right.

You mentioned the supply chain. Could you give examples where you had interruptions?

Two things happened in relation to the supply chain—more or less at the same time. First, of course, was COVID. International transport was reduced significantly, and production in China also dropped. So as part of our crisis program, we started an initiative to manage the supply chain. You have to have good insight into your stock levels, because you don’t just have one stock somewhere but in a lot of places. When you have that insight, you can have specific discussions with suppliers. Then there was the US government’s measures regarding Huawei. There were restrictions on the delivery of material based on US intellectual property. This was happening in parallel with COVID, and it made things even more complex.

The crisis has also underscored the role that telcos play in society. How has KPN viewed that role—and has it taken steps to play an even larger one?

The crisis has accelerated digitization, so on one hand, we have been able to support that—in health care and other areas—with the things we already do, like providing a stable network. But you’re right, it has become increasingly clear that telcos have, and should take, a key role in helping out. We placed temporary mobile capacity at hospitals, created programs to provide free connectivity to families that couldn’t send their children to school but didn’t have the money for connectivity—lots of things that have had an impact. We’re very proud that we’re among the top five telecom companies, worldwide, according to the Dow Jones Sustainability Index, and COVID has not changed our commitment to becoming a carbon-neutral company by 2030 and fully circular by 2025.

So I think there is an intrinsic motivation for playing a key role in society. But there is also a business motivation. Telcos are under pressure and digitization is an opportunity, a way to get relief from that pressure. If we don’t do it, we’re going to miss revenue, we’re going to miss opportunities for growth.

What can telcos do to position themselves to seize those opportunities?

It is a little strange to talk about the digitization of society and then not do the same in your own organization. They are linked. Digitization means that customers will expect a sort of instant delivery. If they want a new connection, is it okay for them to wait for two months or a week or even a day? So definitely digitization should happen internally. Telcos need the ability to deliver their portfolio quickly but also the ability to adapt that portfolio quickly.

Fiber to the home and 5G will be key enablers in moving economies and societies forward. At the same time, 5G in particular has been facing public scrutiny. How can telcos reconcile this paradox?

The Netherlands was, I believe, the second European country to see arson attacks, so certainly KPN and other Dutch telcos have been thinking about this. And something that has become clear is that we shouldn’t be the ones explaining that there is no issue with 5G, because we are the ones selling it. So we have worked closely with the government to get the word out on what 5G really is—what it can bring you, what it can bring society. We are committing ourselves to the standard the government defines. Fiber will help a lot as well. Actually, we’re spending most of our money on fiber because in a country like the Netherlands, where our population is condensed, it’s an easy investment model. Once you have your fiber network, you’re able to make your revenues for the next 30 years.

As digitization and remote work become more prevalent—and more important—we’re likely to see more concerns around data privacy, data protection, security, and so on. What is KPN’s view on this?

As an enabler of digitization, we have to live up to the highest standards of security. But we are also part of an ecosystem. So it is also up to a Microsoft or an Amazon to ensure that the data itself is secure. It is up to a Nokia or a Huawei to ensure that their equipment meets those high standards. The chain is only as strong as the weakest link. So the ecosystem as a whole needs to be operating at the highest level of security.

To what extent have cooperation and knowledge sharing increased during the pandemic?

Within ETIS, we started a few new working groups, focusing on the supply chain, on resistance to 5G, on COVID in general. I think these examples show that close cooperation is important, that telcos learning from each other is important. And it is particularly important for the smaller telcos that lack the scale of the big players. But to come back to the idea of the ecosystem, cooperation—like security—is a key aspect there. Telcos need to have discussions with over-the-top players and others in the ecosystem. If they have discussions on their own, it won’t work. We need to be able to adapt. ETIS showed agility in its approach, starting new groups and moving to virtual participation. But agility is a big thing for all of us, for every telco. And maybe that’s the most important thing we’ve learned this year: you need to know how to respond quickly in order to survive.

At the same time, telcos needed to manage an offsite workforce. Many telcos lacked sufficient laptops and licenses for using collaboration tools and other solutions remotely. And in some instances, teams found it challenging to maintain previous levels of productivity and performance. For instance, kicking off a project in traditional waterfall ways of working was much harder during lockdown.

Operators were quick to unblock some of the key bottlenecks. By modifying budgets, for instance, telcos were able to buy more licenses or give themselves increased flexibility in purchasing laptops. Work styles, however, are not so quickly transformed. Today’s waterfall does not become tomorrow’s agile. But the crisis may act as a catalyst to speed the process. TeBIT participants reported better results from their agile teams.

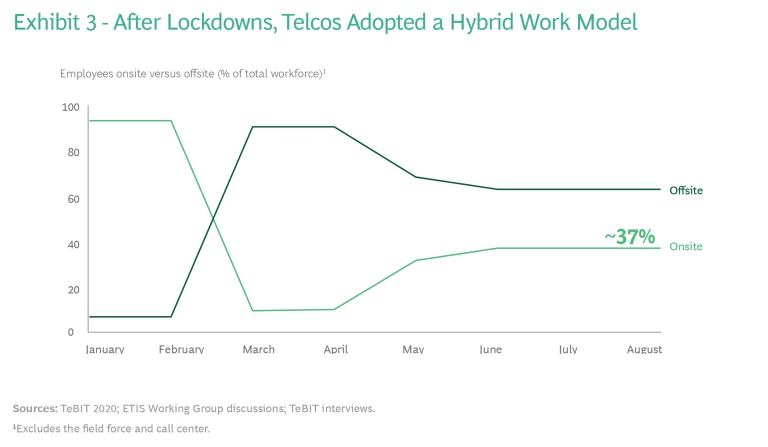

It’s especially important to perfect remote working, as it’s likely here to stay, in one form or another. After the initial lockdown, many telcos shifted to a hybrid model, and much of their workforce is still working remotely. Looking at data from operators participating in TeBIT or in ETIS working groups, we found that telcos had, on average, just 37% of their workforce onsite in August. (See Exhibit 3.)

Cash management—another focal point for telcos’ initial response—was complicated by tradition: in some regions, such as Eastern Europe, many customers still paid their bills in retail stores. Telcos needed to move these payments to digital channels, but to do so successfully, they had to make the online experience smoother and more intuitive. Operators also had to make it easier for customers to sign off on contracts and interact with sales agents and customer support in a virtual way.

The most successful strategies required changes to the digitization roadmap: prioritizing simpler interfaces and customer journeys (making credit card payments easier, for example) as well as tools like chatbots and digital signatures.

A Path and a Purpose

For telcos, the pandemic has been a crisis but also a call to action. Telcos have reinvented themselves, working and serving their customers in new ways. Now they have a chance to expand their impact even further.

Already, telcos are assisting with application development and enablement, and with data and analytics, in areas like health care. But they’re just scratching the surface of possibilities. Small and midsize businesses in particular will need help if they’re to become more digital, fast.

So how can telcos speed their journey to becoming more diversified and more influential players? The first step is to apply what they’ve learned from the pandemic. Double down on digitization and customer proximity. Fast-track upskilling to create a digital-ready, digital-centric workforce. Pursue agile at scale, expanding more flexible and more collaborative ways of working throughout the organization.

One more element is key: purpose. Businesses, individuals, and vital institutions no longer see telcos as simply connectivity providers, but as critical enablers for the adaptation and resilience that the new reality requires. So it’s not just about applying the lessons of the pandemic. It’s also about telcos embracing and building on their new role and new momentum. By doing so, they can drive real change. They can move economies, society, and themselves forward—if they so choose.