This is the first in a series of articles on the future of the finance function.

Finance functions face constant pressure to evolve in response to the ever-changing business environment. Although this evolution has no endpoint, forward-looking CFOs need to understand what a successful, value-adding finance function will look like in ten years.

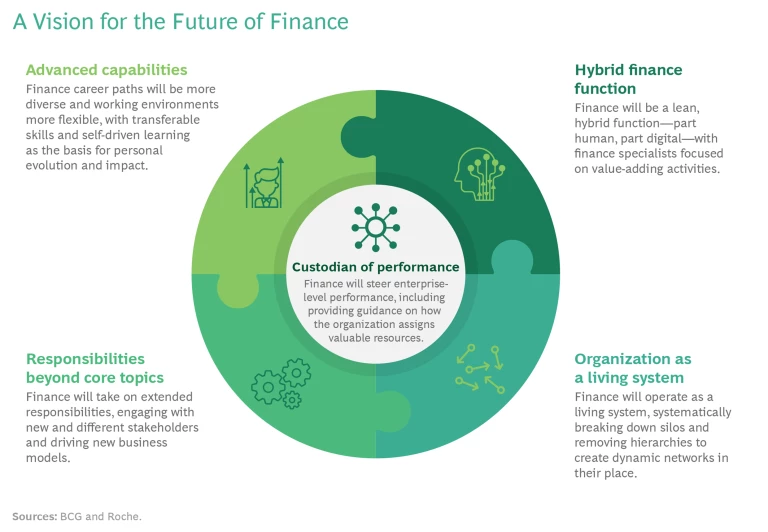

Drawing upon our experience and our exchanges with leading CFOs, we have developed a near-term vision for the future of finance . (See the exhibit.) As its overarching role, finance will become the custodian of performance. The function is uniquely positioned to steer enterprise-level performance, including providing guidance on how the organization allocates valuable resources. To fulfill this role, the finance function should change how it works and operates in four main ways.

We believe that this vision not only serves as an inspiration, but also helps finance functions in setting clear targets for their near-term evolution.

The Overarching Role: Custodian of Performance

As business models become more complex, a company needs a “custodian of performance” to steer performance holistically and objectively in the best interest of the entire organization. This role extends beyond what academics and practitioners typically describe as performance management —such as forecasting, planning, budgeting, tracking KPIs, and reporting. We view these elements as only basic enablers for custodians to fulfill their role.

To steer performance based on the corporate purpose, CFOs need to broaden their perspective beyond traditional financials, considering such issues as sustainability and societal impact.

The custodian steers performance to achieve the company’s purpose. Roche, for example, has articulated its corporate purpose as “doing now what patients need next.” Ideally, each decision entails making the optimal trade-off of resources—among business units, between business units and functions, and among functions—to fulfill this purpose. The custodian seeks to solve this multidimensional problem of resource allocation holistically. Although focusing on the corporate purpose increases the complexity of decision making, the payoff in terms of business impact is significant.

To steer performance based on the corporate purpose, CFOs need to broaden their perspective beyond traditional financials. For example, sustainability and societal impact have become increasingly important considerations. CFOs can integrate these topics—often referred to as environmental, social, and governance (ESG) factors—into performance steering. This extends well beyond the disclosure requirements and investor expectations that CFOs have typically considered in connection with ESG.

The Four Enablers

Four enablers support the finance function as the custodian of performance.

Hybrid Finance Function

It is clear that digitization is fundamentally disrupting finance. In their initial applications of digital, companies seek to reduce manual work by standardizing, optimizing, and almost fully automating their main finance processes from end to end. At the same time, they improve the availability and accessibility of data. Most companies have already embarked on this stage of the journey.

After mastering the first stage, finance organizations should move toward “hybrid finance”—a symbiosis of finance specialists and the digital ecosystem that includes artificial intelligence, machine learning, and advanced analytics. By integrating finance employees and digital capabilities, the finance function can use the digital ecosystem not only to promote efficiency, but also to perform value-adding tasks. In our view, every CFO’s agenda should include evolving from efficiency-focused digitization to hybrid finance.

Examples of how hybrid finance delivers value include:

- Providing initial hypotheses on the appropriate actions to take based on data-driven insights and pinpointing important questions to ask.

- Performing independent tasks (such as hedging) that do not entail repetitive work or clear rules.

- Conducting complex simulations relating to, for example, the interrelationships among cash, taxes, and the balance sheet.

Hybrid finance also creates new roles in the finance function, as finance employees need to administer the digital ecosystem and perform “sanity checks” to ensure the quality of, for example, forecasts and simulations.

Organization as a Living System

The finance function needs a fundamentally new operating model to support the custodian of performance. The end-to-end optimization and digitization of processes give rise to a networked organization that forms a living system. In this organization, the remaining manual tasks are fully transferred to global business services as well as to shared resources, such as automation experts, project managers, or business process owners. The boundaries between functions and business units further diminish. Work becomes functionally agnostic, less focused on specific deliverables, and performed more dynamically and iteratively.

The end-to-end optimization and digitization of processes give rise to a networked organization that forms a living system.

An effective and inclusive organization consists of three elements:

- Bundles of cross-functional support that pool data, tools, and systems to fully own end-to-end processes and their outcomes.

- Expert functions (such as tax, treasury, and HR) that support the cross-functional bundles—for example, in discussing the options or legal restrictions that need be considered.

- Business partners that support the business leaders and other leaders (from the corporate level to local affiliates) by not only providing an appropriate answer, but also asking the right questions.

Responsibilities Beyond Core Topics

The networked organization makes it possible for the finance function to extend its responsibilities into adjacent topics previously managed by other support functions. This enhances the finance function’s ability to steer performance holistically and promote optimal outcomes.

Among the expanded responsibilities, we see four topics as especially important:

- Building a bridge to regulators and government authorities to actively optimize regulations and tariffs.

- Serving as an incubator of finance applications or supporting new business models with financial expertise.

- Taking an active role in co-creating a company’s technology agenda, ensuring that business needs are addressed.

- Working with new types of stakeholders (such as kick-starter funding platforms) to develop new approaches to raising capital.

Cryptocurrencies exemplify the opportunities relating to technology and innovative funding approaches. (See “Finance Functions Should Lead Cryptocurrency Adoption.”)

Finance Functions Should Lead Cryptocurrency Adoption

Finance functions should take the lead in managing their companies’ adoption of cryptocurrencies in new business models as well as in transactions along the value chain. Cryptocurrencies allow transactions and payments to occur simultaneously, eliminating the delays that are common today. In addition to speed and efficiency, companies can gain new financing options.

Advanced Capabilities

Careers and ways of collaboration should evolve and become more diverse to support the finance function’s role as the custodian of performance as well as the other enablers. Every finance employee will need a differentiating expertise—such as in a business domain, finance topic, or know-how relating to the intersection of business and finance or IT and finance. Finance employees will increasingly serve as the connection between technical analysis developers and results-oriented businesspeople, facilitating their interactions and translating their terminology.

As a result, finance know-how will remain essential, and the ability to continuously improve technical and digital skills will gain importance, even as transactional tasks diminish or become automated. Analytics, mathematics, and technical skills will become commonplace, so that finance specialists can also serve as data scientists or developers of the digital ecosystem. For successful workers, self-driven learning will form the basis for personal evolution and impact.

In this environment, career paths will become less predetermined and predictable. This means that every finance position can be a springboard to a more dynamic career. Local finance roles in country organizations will move closer to the business units, creating the need for a broader set of skills. Additionally, expectations for leadership skills will change, as enterprise-level thinking becomes the basis for setting priorities and determining optimal outcomes.

The ways that employees collaborate should fundamentally change as well. Hierarchical departments and organizational silos should be replaced by purpose-driven finance teams. A strong mindset shift is required to lay the foundation for teams that are flexible and self-empowered while still being accountable. New remote setups open the way toward defining a unique, fit-for-purpose environment that balances remote work with proximity to the business units and enables people to perform certain roles from anywhere in the world.

Finance functions must be able to continuously evolve in response to the dynamic business environment. In the near term, successful finance functions will become custodians of performance, applying the corporate purpose to holistically steer performance across the organization. To fulfill this role, it is essential to integrate human work and the digital ecosystem, as well as to develop a networked organization that allows the finance function to take on new responsibilities. Advanced capabilities and new ways of working are fundamental enablers of the transformation. Companies that embark on the journey to this vision will reap the rewards of stronger steering through whatever turbulence lies ahead.

About Roche

The Roche Group, headquartered in Basel, Switzerland, is active in over 100 countries and in 2020 employed more than 100,000 people worldwide. In 2020, Roche had a market cap of CHF ~300 billion, invested CHF 12.2 billion in R&D and posted sales of CHF 58.3 billion.

About the Center for CFO Excellence

They focus on improving capital allocation to ensure a productive return on investments and to outperform competitors. Aiming to orchestrate company-wide transformations, BCG helps drive the corporate value agenda, identifying the best strategy for renewing the organization’s finance systems and increasing transparency and insight. If you would like to learn more about CFOx, please contact one of the BCG authors or visit cfox.bcg.com.