It’s no secret that first-party data—proprietary information that a company collects directly from the customer, with consent—is critical for improving relationships with customers and driving better business results. And such data will become even more essential for digital marketing success as increasing numbers of companies stop using third-party cookies to track website visitors. Moreover, BCG research has found that data-driven marketing can double revenue and increase cost savings by 1.6 times.

Yet while some brands have been able to gain a competitive edge from their investments in first-party data, many have not. According to our research, only about 30% of companies are creating a single customer view across channels, and just 1% to 2% are using data to deliver a full cross-channel experience for their customers.

To find out why top brands are getting more value from such data, BCG and Google interviewed marketing executives at 23 companies and seven advertising agencies across North America in 2020. Key findings show that top brands take the following three actions:

- Develop a comprehensive data strategy to prioritize investment and garner buy-in

- Test, learn, and measure to determine the best activation methods

- Build robust in-house tech capabilities while relying on strategic partners for other kinds of expertise

Develop a Comprehensive Data Strategy

Best-in-class brands develop a clear strategy for first-party data.

First-party data comes from multiple sources, such as loyalty programs and web interactions, and can include such information as demographics and customer purchase history. Many brands simply amass as much of that data as possible in the belief that collection itself translates to value. But in fact, collecting unneeded data burdens customers; increases the costs of technology, personnel, and management; and raises the risk of data breaches and other privacy invasions.

Best-in-class brands develop a clear strategy for first-party data. They create organization-wide strategic goals to guide the collection of and investment in such data. They also identify what data is essential (as opposed to merely nice to have), calculate associated costs and risks, and develop an implementation roadmap.

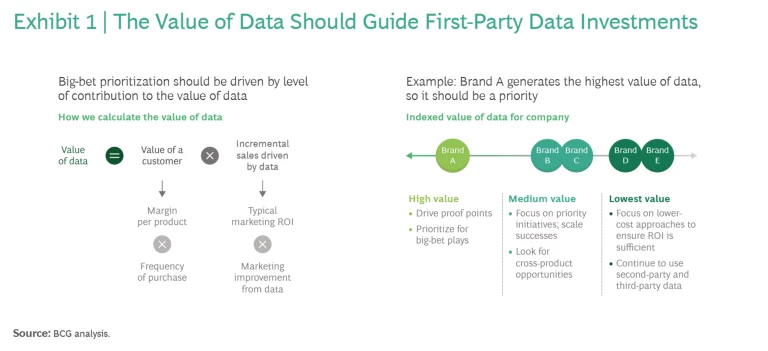

To validate their strategy, brands should assess the precise value of their first-party data. (See Exhibit 1.) Only then can they chart a clear path forward and obtain buy-in from executives.

Test, Learn, and Measure

Successful brands start by articulating a specific business case for their data and defining what needs to be personalized. For example, a brand that wants to increase upstream sales may decide that personalizing product recommendations is the best way to do this.

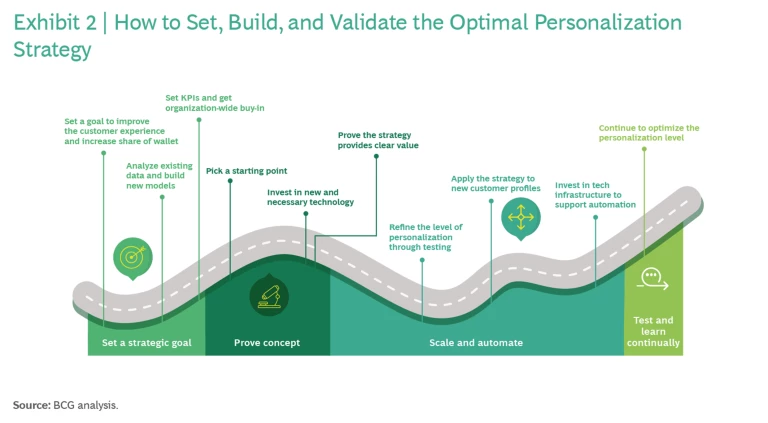

Many brands may opt for one-to-one personalization, but the investment and time needed for implementation and scaling are significant. We recommend instead that brands first use a test-and-learn approach to determine which level will work best, proving value quickly with narrow use cases. This could mean, for example, focusing on only one customer segment and investing only in the data and technology required to test that particular use case. (See Exhibit 2.)

Once value is proven, brands can deploy additional technology, such as artificial intelligence and machine learning , and expand personalization efforts to new customer segments and journeys. As brands go through the process of optimizing the level of personalization, they will improve their ability to predict customer outcomes and enhance customer lifetime value. Personalization thus can be used as a tool for improving outcomes.

For other brands, contextual targeting can be more effective than one-to-one personalization in the short term. That’s because contextual targeting can be implemented at nearly every level of first-party data collection, usually with less investment or risk.

At the start, these brands should analyze data to uncover triggers, such as weather conditions or specific events, that impact purchase decisions. The next step is to target customers in the context of these triggers by measuring the value created against the costs of data collection and management. Targeting should then be scaled for segments where there is sufficient return on investment (ROI).

Brands must deploy robust measurement tools to prove that their chosen method of gathering first-party data creates the most value.

For example, a consumer packaged goods company increased its collection of first-party data. Testing revealed, however, that one-to-one personalization was too costly to implement. So, the company instead used a small amount of data to learn about its customers’ habits. After learning that purchases were highly correlated with certain events, the company was better able to target customers at scale and realize a much greater ROI.

Regardless of whether brands use personalization or contextual targeting to gather first-party data, they must deploy robust measurement tools to prove that their chosen method creates the most value. To overcome the limitations of any individual measurement tool, top brands use various tools in parallel so they can measure KPIs for media reach and efficiency as well as for data collection, revenue lift, and other business outcomes.

Build Robust In-House Tech Capabilities

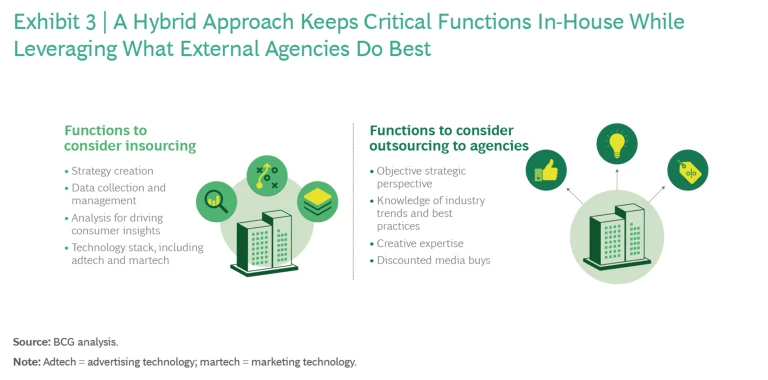

Brands need to think more strategically about their advertising agencies. Traditionally, marketers outsourced almost everything to them, but it’s more efficient and effective to consider which capabilities are best kept in-house and which ones an agency can provide. We recommend a hybrid approach. This means insourcing the technology stack and capabilities related to data analysis and activation while leveraging agencies’ ability to provide an unbiased strategic perspective, design creative content, and purchase advertising time slots upfront. (See Exhibit 3.) Such an approach helps increase executive buy-in, stewardship, and agility.

Agencies, meanwhile, are evolving their business models to meet their clients’ needs. They are willing to play any role their clients need—even helping them to develop in-house capabilities. Some agencies are offering services à la carte to mature brands that need support for a few specific aspects of their data strategies. Others are offering turnkey solutions and acquiring the proprietary data and technology capabilities that less mature brands may lack.

Top brands have figured out how to realize the greatest value from first-party data, thus improving the customer experience and boosting business results. As the importance of such data continues to increase, others will need to do the same in order to gain a competitive edge.

The authors would like to thank Mary Katerman and Nathan Micon for their contributions to this article.