During the COVID-19 crisis, resilience rose to the top of the strategic agenda , and many leaders also indicated a desire to extract lessons to increase preparedness for future crises. Our research indicates that resilience, although less emphasized in stable periods, creates significant value and does so well beyond times of crisis . Nearly two-thirds of long-run outperformers do better than peers in response to shocks.

Crises often precipitate or accentuate the need to transform because of the immediate pressure on performance. Crisis-driven transformations often aim to ameliorate performance pressure by increasing cost and asset efficiency. But what is their impact on resilience and long-term performance? And how can companies transform for not only efficiency but also resilience?

To better understand the impact of large-scale change programs on building resilience, we applied an evidence-based approach to study more than 1,200 corporate transformations over the past 25 years. The evidence indicates that roughly half of corporate transformations fail to improve resilience in response to future crises. The same dataset also offers valuable insights into how some companies successfully transform for resilience.

Measuring the Impact of a Resilient Transformation

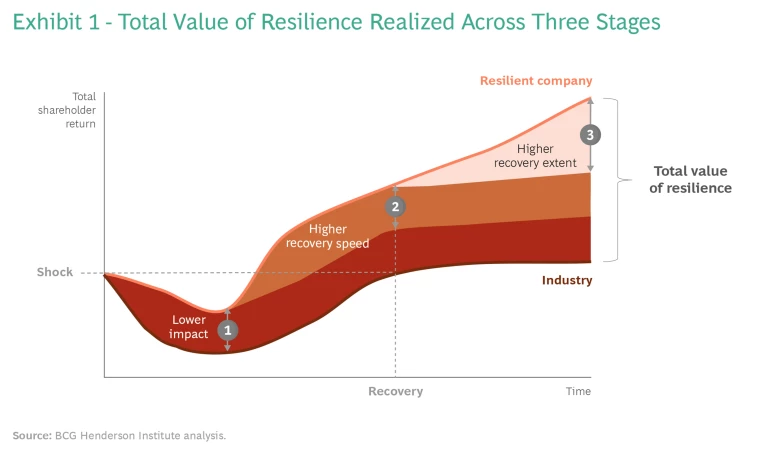

To study the success factors of a resilient transformation , we must first quantify the total value created by resilient companies in response to crises. Our past research has identified three stages during which resilience creates value relative to peers:

- First, the immediate impact can be lower than that on peers because they better absorb the shock.

- Second, they can have higher recovery speeds by rapidly adapting to new circumstances.

- Finally, they can have a greater recovery extent (in the 12-month period following a shock) by reimagining their business to flourish in new circumstances.

Cumulatively, the relative performance (TSR benchmarked to industry median) across all three stages is the total value of resilience displayed in response to a crisis. (See Exhibit 1.)

To measure the impact of change programs on resilience, we have studied the difference in total resilience in response to industry shocks during the five-year period following a corporate transformation. While roughly half of transformations fail to improve resilience, a significant spread in outcomes exists. The top quartile of resilient transformations improved performance relative to industry by 25 percentage points (pp) in response to future crises, while the bottom quartile saw a decline of 20 pp.

What can we learn from the outperformers?

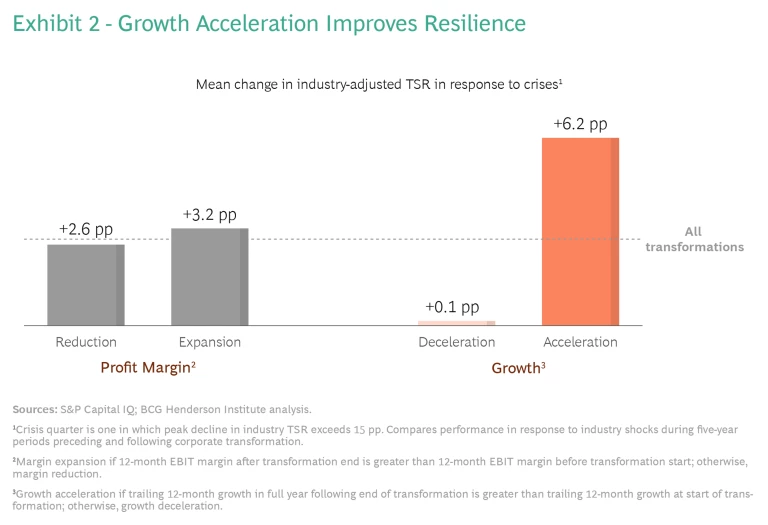

- Growth acceleration is the main driver of a resilient transformation. Whereas large-scale change programs, especially crisis-induced ones, typically target cost reduction, differential growth contributes most of the incremental value created by resilient transformations. Transformations that accelerate growth improve performance relative to industry during each stage of future crises (+6 pp total impact on average), while transformations that only reduce costs see future resilience decline.

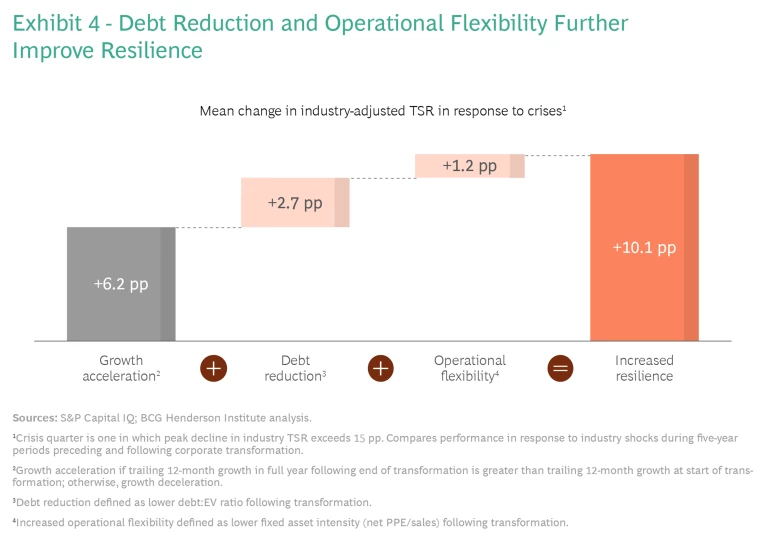

- Transformations that reduce debt and increase flexibility improve resilience. Transformations that reduce debt loads improve the ability to cushion the initial impact of a future shock. Furthermore, transformations that reduce fixed asset intensity boost adaptivity and recovery speed by shifting costs toward variable expenses. Growth transformations that do both increase the odds of improving resilience from half to nearly two-thirds and yield an average change in TSR performance relative to industry of +10 pp in response to future crises.

- Transformations are empirically less likely to build resilience when a crisis is no longer fresh. If history is any guide, resilience now risks losing its spot on the corporate agenda as the performance of economies and companies recover. Immediately following a crisis, transformations are 19% more likely to be growth-oriented and 20% less likely to increase debt than those at least 12 months removed. However, our research shows that allowing resilience to fall off the change agenda would be a mistake. In today’s dynamic business environment, resilience has benefits across the whole economic cycle.

Growth Drives Resilient Transformations

Our past research indicates that transformations often aim primarily at reducing costs . While this may improve performance in the short run, on average it does not lead to greater resilience in future crises. In contrast, transformations that accelerate growth, in aggregate, improve total resilience by 6 pp, while those that decelerate growth, on average, fail to improve resilience. (See Exhibit 2.)

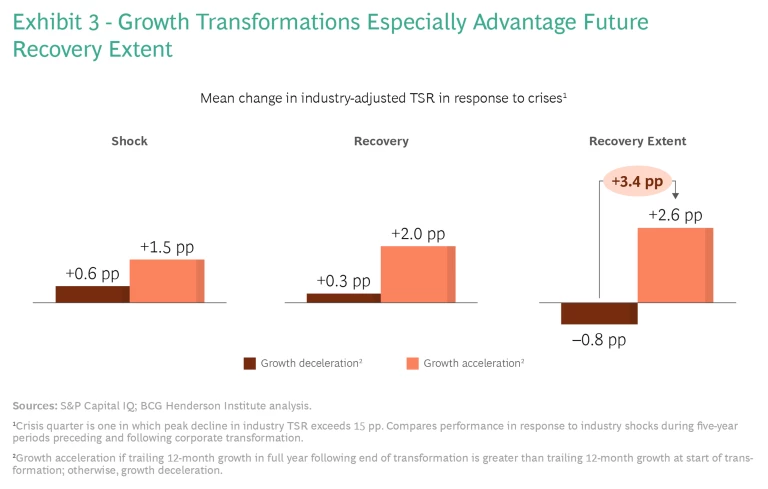

While growth transformations succeed in improving performance relative to industry during each of the three stages of future crises, nearly half of the improvement manifests in the extent of future recovery. In this third stage, after the recovery has taken hold, companies begin to reimagine their products and business models to thrive in the altered circumstances resulting from the shock. Growth-oriented transformations create significant advantage in this period by building the capability to spot and capitalize on new growth opportunities. (See Exhibit 3.)

For example, Nvidia’s 2015 corporate transformation restructured operations toward strategic growth areas in deep learning, automated driving, and gaming. Following the transformation, Nvidia doubled its growth rate over the next 12 months to 26%. With the semiconductor industry recovering to prepandemic highs in June, Nvidia once again shifted its strategic focus to identifying new growth drivers. In June 2020, the organization announced a partnership with the Daimler AG unit Mercedes-Benz to build software-defined computing architecture for automated driving and in April 2021 unveiled the company’s first data center GPU. Having previously performed in line with peers during postrecovery periods, Nvidia has thus far outperformed industry peers by 11 pp in the COVID-19 recovery.

Debt Reduction and Operational Flexibility Also Help

Transformations that reduce debt loads help companies cushion future shocks. Large-scale change efforts often require a significant financial commitment. In response, leaders may find it tempting—particularly in the low interest rate environment of the past decade—to fund change programs by increasing corporate debt. But doing so materially reduces resilience on average.

When a crisis hits, highly leveraged companies are more likely to struggle to sustain operations because servicing debt is a higher fixed cost. It also limits the ability of corporations to tap into corporate debt markets during a future crisis—either to sustain operations or to acquire distressed assets. Furthermore, amid the uncertainty of a crisis, investors often prefer the safety of corporations with lower debt levels, compounding the problem.

Our research finds that growth transformations that reduce debt burdens (lower debt-to-enterprise value) increase performance relative to industry during future market dips by 2.5 pp on average, while those that increase debt burdens see a decline of 0.3 pp during the initial shock.

Consider The New York Times and its corporate transformation effort throughout the 2010s. After its debt burden briefly surpassed 200% of enterprise value during the global financial crisis, the company began rebalancing its portfolio of businesses and restructuring operations. After selling off several noncore business segments and entering a sale-leaseback agreement on its headquarters to free up capital, the organization began dramatically reducing debt and investing heavily in its paid digital subscription model. By the end of 2019, the organization announced it was debt-free and had increased digital revenue to $800 million.

Without the higher burden of servicing debt, the organization was afforded a cushioning advantage as advertising revenue contracted sharply at the beginning of the COVID-19 crisis. Having struggled in past market shocks, The New York Times outperformed industry peers by 26 pp during the first stage of the crisis.

Transformations that increase operational flexibility boost adaptivity. To succeed in crises—particularly during the recovery period, which can be unpredictable in timing and magnitude—companies need to adapt rapidly to the changing environment and scale up new models. Companies with greater operational flexibility (which we capture using the proxy of lower fixed asset intensity) can more easily adapt to outperform during the recovery stage.

Companies with lower levels of asset ownership tend to have a higher proportion of variable costs, affording them the flexibility to tie costs closely to revenue in a downturn. They also tend to be less reliant on legacy assets, which creates an advantage in adapting to technological advances and seizing new market opportunities during the recovery. Our research shows that growth transformations that reduce fixed asset intensity increase performance relative to industry during future market recoveries by 3 pp on average, while those that increase levels of fixed asset ownership see no change in performance during the recovery stage.

From 2004 to 2006, consumer conglomerate Cendant Corporation undertook a strategic realignment to exit noncore business segments with high levels of fixed assets. Over the two-year transformation, the organization initiated public offerings and spun off segments in tax services, real estate services, and fleet leasing—reducing fixed asset intensity from 35% to 9% in the process.

Renaming the firm Avis Budget Group, the organization refocused its efforts on its core vehicle rental operations. With vehicles acquired under repurchase agreements (which allow for return of vehicles to manufacturer at set monthly depreciated value), the company now benefits from a highly variable cost structure. With the ability to de-fleet quickly during a downturn—and scale up during recovery—Avis was well-positioned when the global financial crisis hit. One year past the initial shock from that crisis, Avis was 62 pp above pre-shock levels while industry peers had yet to fully recover.

Companies that transform on all three fronts (accelerating growth, reducing debt loads, and increasing operational flexibility) improve performance relative to industry peers by 10 pp in response to future crises. (See Exhibit 4.)

Don’t Overlook Resilience in Good Times

The playbook for resilient transformations differs in a few ways from those that primarily aim to increase efficiency and optimize short-run financial performance. Transforming for resilience requires a new mindset that unfortunately tends to fade as stability and prosperity return.

Our research indicates that, when a crisis is fresh, leaders are more likely to adopt an approach to transformation that is consistent with building resilience. Immediately following a crisis, transformations are 19% more likely to be growth-oriented and 20% less likely to increase debt than those at least 12 months removed from a shock.

Put simply, as the crisis fades from memory leaders tend to neglect the importance of building resilience. Corporate change efforts tend to return to targeting cost reduction, stabilized corporate bond markets make debt financing more palatable, and the superior operational control afforded by asset ownership begins to look more attractive. Critically, however, the value of a resilient transformation remains the same—no matter the timing.

Future-oriented leaders recognize the long-term value of resilience and keep it on the change agenda in fair weather times. On the basis of our natural language processing analysis of SEC filings and annual reports, we find that transformations accompanied by a long-term strategic orientation are 10% more likely to accelerate growth, 30% more likely to reduce debt, and 24% more likely to reduce fixed asset ownership. For future-oriented leaders, keeping resilience on the transformation agenda pays off. Transformations that accelerate growth, reduce debt, and increase operational flexibility in more stable periods improve resilience by 7 pp over those that do not.

The Resilient Transformation Agenda

The COVID-19 crisis has brought the value of corporate resilience into focus, and many leaders now seek to rebuild their organizations to be more resilient. While every transformation is unique, our findings point toward a pattern of moves that can improve the odds for a resilient transformation.

1. Transform with an opportunity mindset. Defensive, cost-cutting measures might produce short-term gains, but they fail to advance resilience in the long run. To build resilience—especially in the recovery stage of a crisis—corporate transformations must increase the organizational capacity for innovation and reinvention.

Upstream of innovation lies imagination . Transformations that prioritize growth are those that increase the organizational ability to think counterfactually, break existing mental models, and conceive of new ideas fit for new environments. Transformations that push organizations to compete on imagination will be best positioned to thrive in altered circumstances after the next crisis.

2. Accelerate digital transformation. Digital transformations, executed correctly, can improve resilience by increasing operational flexibility and positioning the firm to capture new growth opportunities. Operational flexibility and adaptivity are both critical capabilities in improving a company’s future recovery speeds. Some asset-light companies take this approach even further by organizing in massive digital ecosystems, effectively reducing asset intensity, pooling resources, spreading risk, and accelerating the scaling of new models and offerings.

Companies that build a digital technology advantage and strategically deploy it can further benefit by extending the perceptive power of the organization to identify emergent opportunities. Digital transformations can also free up human cognition to focus on higher-level activities , such as imagination, to conceive of new ideas and identify fresh sources of growth. In doing so, they create significant advantage in the final stage of future crises as organizations reinvent themselves to succeed in new post-shock realities.

3. Keep resilience on the transformation agenda in good times as well. To capture the long-term competitive benefit of resilience in a very dynamic business environment, companies must transform with resilience in mind in stable times too.

Future crises are inevitable. Companies that recognize resilience as a long-term strategic imperative and make it a pillar of corporate change will be best positioned to outperform in future crises.

As corporations ready themselves for reopening and growth, resilience is now at risk of losing the limelight. Change programs that prioritize growth over cost cutting, debt reduction over debt financing, and operational flexibility over direct control will realize the full value of resilience and build advantage for the next crisis.