Through all the turbulence of the past year, a source of enormous hope for the health of the planet has emerged: the automotive industry is shifting toward electric vehicles (EVs) even faster than we envisioned only a year ago. With steady support from governments and leading automakers in the face of the COVID-19 crisis, the global market share of electrified cars, SUVs, and other light vehicles grew from 8% in 2019 to 12% in 2020, and has shown continued strength in early 2021.

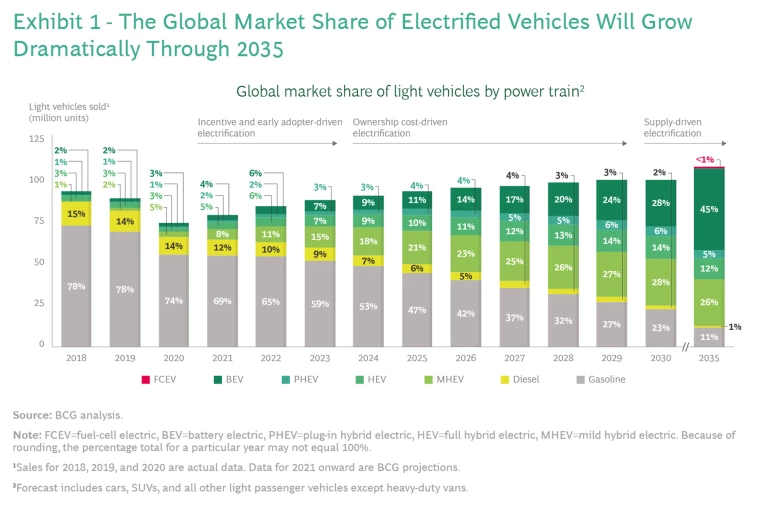

This shift will accelerate dramatically in the years to come. In fact, our updated forecast predicts that by 2026 electrified vehicles will account for more than half of light vehicles sold globally—four years sooner than we anticipated in our previous report . What’s more, we see zero-emission vehicles replacing internal combustion engines (ICEs) as the dominant powertrain for new light-vehicle sales globally just after 2035.

The transition from the ICE age to the EV age over the coming decade will represent rapid change in most countries. But from an environmental perspective, the EV age isn’t coming fast enough.

That’s because the global “car parc”—the total stock of vehicles in use—will change over far more slowly. As a result, our modelling predicts that the automotive sector in most major markets, including the EU with its European Green Deal, will likely fall well short of Paris Agreement targets for cutting worldwide emissions.

Steering the fight against climate change on course will require most markets to speed up the EV transition even further. For the EU to achieve its Green Deal targets, for example, it would need to reduce light-vehicle emissions by 90% by 2043—seven years sooner than currently forecasted—to compensate for its car parc emissions. This can be accomplished by further accelerating the adoption of zero-emission vehicles while strengthening the incentives to remove gas and diesel guzzlers from the roads. But it will also require transformational change and a fundamental shift in business models for most automakers.

The Forces Driving Faster EV Adoption

Electrified vehicles, including hybrids, have achieved a breakout over the past year. Sales of plug-in hybrid (PHEVs) and battery electric vehicles (BEVs) were especially strong: their share of the light vehicle market rose to 2.2% in 2020 in the US, 5% in China, and a remarkable 9.3% in the EU, where sales of plug-ins in the fourth quarter surged by 230% over the comparable period in 2019. In addition to robust incentives, sales growth has been propelled by the falling costs of lithium-ion batteries.

Batteries are the most expensive component of EVs, accounting for 20% to 30% of total cost. The average cost of a nickel-rich battery pack fell below $150 per kilowatt hour (kWh) in 2020 for leading players—$20 below what we had expected in late 2019. The plunging price can largely be attributed to innovation in cell chemistry and pack assembly, greater production scale, and improved manufacturing processes.

On the regulatory front, the EU set a net-zero automotive emissions target for 2050 as part of the European Green Deal. In the US, President Joe Biden has indicated a strong focus on more stringent tailpipe emissions and rejoined the Paris Agreement, while California intends to ban gas- and diesel-burning new car sales in 2035. More than 15 nations have announced they will phase out ICEs by 2035; our forecasts assume that most of these targets will be met.

These strong signals from governments have further encouraged General Motors, Volvo, Jaguar, and many other leading OEMs to push more forcefully into electrification, with a growing number pledging to phase out ICE powertrains altogether. Growing investment into supply chains, charging infrastructure, and upgraded electrical grids will also help make these goals achievable.

A Roadmap Toward Electrification

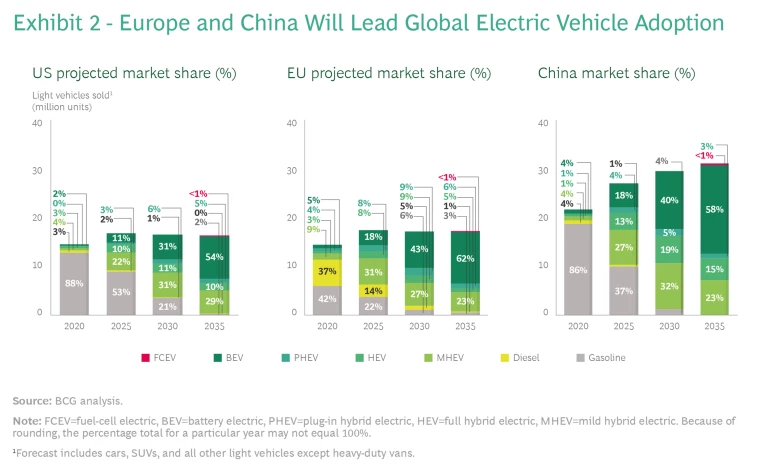

The powertrain transition is shifting into overdrive. We now expect that 47% of all light vehicles sold globally in 2025 will be fully electric or hybrids. This transition—especially to all-electric vehicles—will occur more quickly in the EU and China than other major markets, while electrification may occur relatively slowly in large developing nations such as Brazil and India. (See sidebar, “The Divergent Paths to Electrification.”)

The Divergent Paths to Electrification

Brazil is one such market. The nation’s regulatory roadmap does not push zero-emission vehicles; instead, it supports the adoption of biofuels. The lack of regulatory standards, financial incentives, and commitment to charging infrastructure in Brazil will make it hard for OEMs to drive adoption of EVs there. Currently, EVs are three times more expensive in Brazil than comparable vehicles with ICEs. We forecast that by 2030, only 2% to 10% of new cars sold in Brazil will be fully electric or hybrids—depending to a large degree on actions taken by the government and industry.

The situation is different in India, but we foresee a similar outcome. Although there is regulatory support—such as its Bharat Stage VI emission standards and subsidies for electrified cars, buses, and two- and three-wheelers—the transition is being delayed by long-standing subsidies for diesel fuels, growing investment in compressed natural gas infrastructure, and limited EV options from dominant OEMs. Insufficient charging infrastructure, especially in smaller cities and rural areas, will also slow adoption.

By our analysis, ICEs will account for 40% of new light vehicle sales in India in 2030, compressed natural gas powertrains for 15%, and diesel for 12%. Battery EVs will account for just 10% of the market and hybrids for the remainder. The transition from fossil fuels will be much faster, however, in the two- and three-wheel segments, where unit sales are five times greater than for cars. We project that by 2030, 15% to 25% of two-wheelers and 25% to 30% of three-wheelers sold in India will be battery EVs.

Japan, one of most advanced automotive markets, is on its own circuitous path to full EV adoption. Japan has been in the vanguard of electrification, with hybrids now accounting for 21% of its new car market—the highest penetration rate in the world. Japan also plans to ban pure ICE vehicles by 2035. But due to Japan’s transportation dynamics, such as the relatively low per-person miles driven annually, the regulatory environment, and the technology roadmap of OEMs, the market domination of hybrids will continue far longer than in many other advanced economies. By 2030, we expect that BEVs will account for just 15% of new light vehicle sales, while hybrids will account for over half and ICE vehicles for 32%.

The divergent powertrain trajectories will create complications for OEMs, which have spent decades trying to build truly global platforms and optimized supply chains. To remain competitive in major markets such as Brazil, India, and Japan, OEMs may have to undo the scale they have created with global platforms. Governments and industry will need to work together to drive further electrification where it makes sense by innovating for local markets—such as developing smaller battery sizes that will make EVs more affordable or systems for swapping batteries when it is not convenient to recharge them

Regardless of the market, rapidly declining battery costs, tougher government regulation, and the introduction of new EV models will continue to be the primary drivers of the shift. We see the end of the ICE age and dawn of the EV age playing out in the following three phases (see Exhibit 1):

- Phase 1: Incentive and Early Adopter-Driven Electrification. Regulation and government incentives will drive adoption of electrified vehicles through the next few years, at which point we project that electrified powertrains will exceed 25 million units sold annually across light vehicle segments. By 2023, OEMs are expected to have brought more than 300 battery electric and plug-in hybrid models to market, giving consumers vastly greater choice than they have today. Plug-in, full, and mild hybrids will command 25% of the global light-vehicle market in 2023; BEVs will claim a 7% share. With a number of OEM programs reaching high-volume production—and battery costs falling—more BEVs will be able to achieve parity in five-year total cost of ownership versus ICEs, even without government incentives.

- Phase 2: Ownership Cost-Driven Electrification. By 2030, consumers will begin converting to electrified vehicles en masse. The cost advantages of electrified-vehicle ownership will be clear, by then, across regions and segments. We project that battery pack costs will have dropped to $75 per kWh and that the global market share of BEVs will rise to 28%. The powertrain shift to zero-emission vehicles will be most notable in Europe and China; BEV penetration in those markets will reach 43% and 40%, respectively. Meanwhile, PHEV penetration might begin to decline as government incentives expire. We expect the market share of conventional ICEs to plunge below 20% by 2030. The first meaningful bans of fossil fuel-burning vehicles will begin taking effect during this period.

- Phase 3: Supply-Driven Electrification. By the end of this decade, we believe that supply, rather than total cost of ownership, will drive EV adoption. Several OEMs will start exiting the highest-volume ICE programs. The global BEV share will rise to 45% in 2035, and will reach 54% in the US, 58% in China, and 62% in the EU. (See Exhibit 2.) By this point, the eventual dominant players in e-mobility will have been largely determined. Every link along the automotive value chain will have been reshaped. We expect that market leadership will be divided among a more even mix of new EV-only players and incumbent OEMs, and be determined by how well the companies manage their portfolios across regions and scale up their production, distribution, and services.

Meeting the Climate Challenge

While these market trends are encouraging, they aren’t nearly enough to meet climate targets without significant change. The automotive industry has a particularly critical role to play in achieving the Paris Agreement goal of limiting global warming to 1.5 degrees Celsius above preindustrial levels. In all, transportation accounts for around 12% of global CO2 emissions. And unlike sectors such as marine transportation and aviation, light passenger vehicles have a clear technological path to net-zero emissions by 2050: electrification.

Currently, however, the light passenger vehicle sector is not on course to deliver on this goal. That’s because the worldwide car parc takes roughly two decades to turn over. If half of new cars sold around the world in 2035 are zero-emission vehicles, 70% of the vehicles on roads will still be burning gasoline or diesel. Even economies in the vanguard of the climate-change fight are therefore likely to fall short of decarbonization targets.

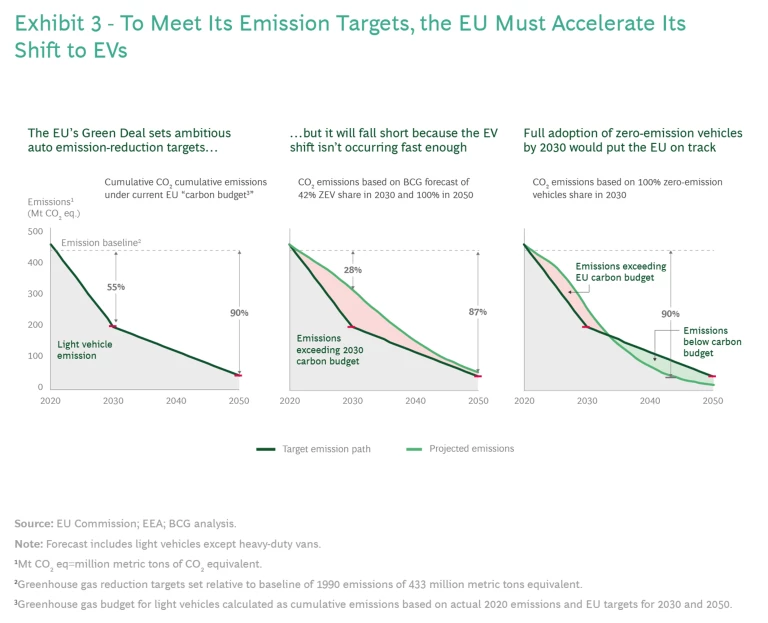

Consider the European Union. The Green Deal calls for a 55% reduction in emissions from the EU’s car parc by 2030 from a 1990 baseline of 433 million metric tons of CO2 equivalents—and more than a 90% reduction by 2050. Based on our estimate that zero-emission vehicles will account for 42% of new sales in 2030, gasoline- and diesel-powered vehicles will make up 65% of the EU’s car parc at that point. As a result, we estimate that the EU passenger vehicle sector will only be able to reduce greenhouse gas emissions by 28%.

We expect the EU car parc will meet the 2050 net-zero goal because by then almost all vehicles on European roads will be zero emission, with the few remaining ICE vehicles minimizing emissions through e-fuels. But over the two decades in between, the EU’s automotive sector will have been pumping far more carbon into the atmosphere than budgeted. This accumulated CO2 will make it difficult for the EU to fulfill its objectives in mitigating global warming without introducing additional measures during the current decade.

One way the EU automotive sector can achieve its emissions goals, by our analysis, is to halt new ICE sales even faster and sell only zero-emission light vehicles by 2030. (See Exhibit 3.) That target is probably impractical, given the well-founded concerns surrounding the availability of the raw materials for battery production and the charging infrastructure and energy grids capable of supporting zero-emission vehicles.

No other major market has set interim parc-emission targets for reaching its 2050 net-zero goals, though based on our projections the automotive sectors of Japan and China both appear to be on track. But for the world as a whole, emissions from light vehicles are unlikely to drop by 90% by 2060—let alone by 2050. We estimate that the US car parc will consist of a far higher share of gasoline-powered SUVs and pickups than in the EU, and for a longer period. As a result, we project the US automotive sector is currently on a path to cut its CO2 emissions by only 75% by 2050.

Meeting the emission-reduction targets needed to mitigate climate change, therefore, will not only require getting consumers to buy more electric cars—but also changing the composition of the car parc more quickly.

How Policymakers Can Speed the Transition

To transform the car parc, governments around the world will need to enhance the regulations and incentives to which they’ve already committed. The current timelines for bans on fossil fuel-powered vehicles will need to be moved up. Enforcement mechanisms—which now are lacking—must be put in place. Emission standards and consumer financial incentives will have to be strengthened to encourage faster adoption of zero-emission vehicles.

Governments must also work with utilities and the automotive industry to greatly expand battery-charging infrastructure. The shortage of convenient charging stations is among the most serious impediments to adoption of plug-in vehicles. Policymakers can help accelerate the buildout of charging points by streamlining the permitting process and through initiatives such as California’s Low Carbon Fuel Standard program, which provides a steady funding stream for charging infrastructure investments.

As they promote EV adoption, policymakers must also act to ensure that existing gas- and diesel-burning vehicles are removed from their roads more quickly—following the example of New Delhi, for instance, which has banned diesel vehicles that are more than ten years old. Governments could also consider incentives similar to US Senate majority leader Chuck Schumer’s proposed “cash for clunkers” program—an updated version of the US initiative launched in 2009—to persuade car owners to trade in their old, less fuel-efficient vehicles.

Another important way to help meet emission-reduction targets is for national and local governments to redouble efforts to expand alternative modes of travel, such as mass transit and biking.

Piecing Together the Puzzle

In addition to lower battery prices, regulations, and ambitious plans by automakers, several other elements must come together to speed the transition to EVs.

Our consumer research shows that inadequate charging infrastructure remains a key deterrent for customers who might otherwise pick EVs over ICE vehicles. We estimate that 100 million additional charge points will be required globally in the next decade to keep pace with projected EV growth. Most governments and OEMs are acutely aware of this, and are providing much-needed support. In some regions, electrical power grids will have to be upgraded to meet the increased demand from EVs. In the US, for example, we estimate that by 2030 an additional $1,100 in investment in grid upgrades will be needed for each BEV sold. Under our projections of BEV sales in the US through the rest of the decade, this would translate into around $25 billion in power grid investment. In other countries, investment requirements could be much higher.

The EV supply chain will also need to deliver. Production of battery cells and their key materials, such as lithium and nickel, will need to increase tenfold by 2030. Volkswagen recently announced that its demand for batteries in Europe alone will grow by 240 gigawatt-hours by 2030—more than what was required by all automakers globally in 2020. Though the raw material supply may meet battery demand in the long run, supply bottlenecks could arise in the short term, slowing the drop in battery prices. The role of dealers in the EV transition also cannot be underestimated; although they are investing in electrification, a 2019 study by Cox Automotive found that 56% of dealers did not feel they were well prepared for future EV demand. They will have to collaborate more closely with OEMs.

We believe each of these obstacles can be surmounted. Capital is increasingly available, the commitment among policymakers and industry leaders is strong, and the technology is evolving quickly enough to keep the EV transition from derailing in the long run.

A Tectonic Shift for the Industry

A faster transition to a net-zero carbon path won’t be easy for automakers. According to our forecast, one out of every two light vehicles sold will be powered by batteries in roughly a decade; that is only two vehicle-development cycles away for most OEMs.

This once-in-a-century shift entails far more than changing powertrains from ICEs to EVs. For automakers, it will require a fundamental rethinking of their business model. Today’s new-age EV companies not only offer strong products, but also operate under very different economics. Their simplified electrical and electronics architectures and software-driven approach significantly reduce costs while enabling them to command premium prices. Their sales and services models also take a different approach, relying on direct online sales instead of the traditional dealer network. In addition, many electric vehicle OEMs are ready to separate product from production by leveraging contract manufacturers. As battery prices drop further, their production models could more resemble that of an iPhone than a conventional pickup truck.

In addition to switching from ICEs to zero-emission powertrains, incumbent OEMs will need to transform their approach to electrical architecture, connectivity, and software—and develop new ways of engaging with and delighting customers. This far-reaching transformation will require a shift to an operating model and ways of working that are more akin to those of consumer technology companies than automakers. Incumbent OEMs will need to fund this journey by overhauling their cost structures.

The path ahead isn’t easy for challenger OEMs, either. They’ll be up against brands that have survived the test of time and hold special places in the hearts of customers. They’ll also be competing with automakers that have mastered the art of producing, at scale, high-quality products that last for decades—and of managing costs while they do it. New age OEMs will need to overcome the huge challenges of large-scale production, quality, distribution, and service. The history of the automotive industry is filled with new entrants that had great products but could not overcome these challenges.

The electrification of the global automotive market has made significant progress over the past decade, at a speed which has surpassed even the most bullish forecasts. Still, to achieve the overarching objective of mitigating climate change, policymakers and the automotive industry not only must accelerate the market penetration of EVs. They must also move faster to undo the damage being done by getting older gasoline- and diesel-powered vehicles off the roads more quickly. The stakes couldn’t be higher—not just for automakers, but for the planet itself.

The authors are grateful to Masao Ukon, Natarajan Sankar, Kazutoshi Tominaga, Xavier Mosquet, Ian Roddy, and Colin Bird-Martinez for their contributions to this report.