This article was produced in collaboration with Microsoft.

It’s a defining moment for telecommunications operators and the next-generation network architecture known as edge computing. After years of hype, edge is poised to come into its own, as telcos roll out commercial 5G and shift to cloud and virtualized architectures to modernize their networks. In the coming decade, the one-two punch of 5G’s faster speed and superior performance and the decentralized processing power of edge could produce a steady stream of business and consumer innovations.

“The opportunities that edge computing offers are attractive and vast, and telcos need to move quickly to pursue them or risk falling behind,” says Bob De Haven, Microsoft’s general manager of worldwide media and communications. “But first they have to decide which edge-enabled services to offer based on their existing business, resources, and capacity for risk.” Telcos can stick with providing connectivity but risk seeing significant value move away from operations, similar to their experience with consumer video and social media services. Or they can launch edge-based horizontal platforms and end-to-end vertical solutions, both of which are expected to create more lucrative returns.

Our survey of more than a dozen global carriers currently planning their edge strategies suggests that most telcos will likely work with a partner to launch edge-based services, since they lack the technical depth needed to do so on their own. One of the most attractive options is teaming up with a hyperscaler, such as Amazon Web Services (AWS), Microsoft, or Google, that has the size and existing infrastructure to make edge work. But these tech giants could also end up becoming rivals.

To make an informed decision and maximize their efforts, telcos must understand the options, what each one involves, and how to partner with a hyperscaler in a way that benefits everyone, including end customers.

Three Reasons to Act on Edge Now

Edge computing processes, analyzes, and stores application data and services at a network’s edge, which minimizes the distance to end users and IoT endpoints. This improves performance by reducing latency and the network bandwidth required to transmit data. It also results in significant cost savings, since the design of the general network does not need to satisfy the requirements of the most demanding applications. Because edge is decentralized, it is more secure than traditional network architectures and provides more control over data movement. It’s also more reliable, since parts of a network can continue to operate during outages elsewhere on the system. Finally, edge improves interactions with the public cloud, which allows it to use the cloud for artificial intelligence and other applications that require massive processing power.

Telcos have to decide which edge-enabled services to offer based on their existing business, resources, and capacity for risk.

Telcos have three reasons to act on edge computing now: the need to modernize their network architecture, the opportunity to create value as they roll out commercial 5G networks, and the chance to form strategic partnerships as new players enter the market and create new ecosystems.

Network Modernization and Transformation. Telcos and other connectivity providers are shifting from traditional networks to cloud and virtualized architectures in order to add capacity and keep up with the explosion of data flowing through their networks without adding exponentially to their costs. Over the next five years, we expect to see demand accelerate for software-as-a-service and cloud services, as well as for software solutions that replace traditional wide- and local-area networks. In response, operators’ cloud-based technologies will have to meet stringent security and service requirements when individual applications call for them.

Commercial 5G Rollouts. Telcos have an opportunity to create value as they roll out commercial 5G networks. To meet 5G capacity and performance standards, they are embedding edge into their core network architecture and their radio access network (RAN), the portion of the network that transmits signals from wireless devices to the cloud. Incorporating edge improves latency and processing power. It also reduces transportation and storage costs and helps address security and regulatory issues.

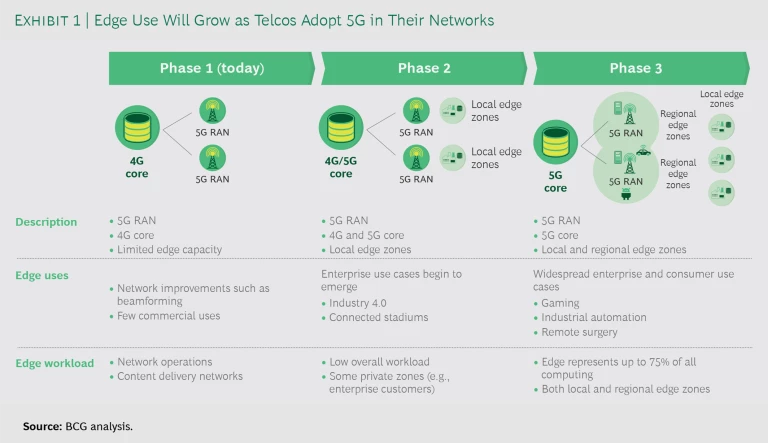

To free up physical space devoted to network and processing servers, telcos are upgrading to 5G RAN first, before moving to upgrade their core network architecture to 5G core as well. (See Exhibit 1.) That will enable edge computing and storage in regional edge zones, where processing happens within a last-mile wireless hub or operator point of presence. 5G will also support private or local edge zones, where processing takes place inside a building, home, car, or other environment.

New Players and Ecosystems. Companies in multiple technology sectors have begun investing in edge computing and storage, another reason why telcos must not wait to act. Chief among the new entrants are hyperscalers such as AWS, Microsoft, and Google, which have begun to move their massive core data centers to edge. Companies such as IBM’s Red Hat subsidiary, Oracle, Microsoft, and VMware offer a mix of infrastructure, platform, and private hosted cloud service solutions on a massive scale. Other newcomers include cloud computing and IT providers; hardware and electronics OEMs; data center and specialized infrastructure providers, such as Equinix; industry conglomerates and control companies, such as Siemens and Beckhoff; startups, such as MobiledgeX; and various niche players.

New competitors such as AWS, Microsoft, and Bosch are launching partnerships that are creating edge ecosystems and spurring investment in the Internet of Things and artificial intelligence. We believe that these ecosystems will lead first to the creation of B2B services before eventually giving rise to ecosystems of B2C consumer digital services. We also believe that B2B and B2C edge-enabled connectivity services will produce attractive revenues, but these will be less than the revenues that providers will enjoy if they “own” the edge.

Opportunities in Edge

Telcos have historically been conservative about or late to adopting new capabilities. This was painfully clear when successive waves of over-the-top services passed telcos by, including B2C apps such as Skype, YouTube, and WhatsApp, and B2B apps such as Zoom, Microsoft Teams, and software-defined wide-area networks. Now, network upgrades, 5G rollouts, and new players are prompting carriers to act on edge or else lose out on the advantage they would gain as first movers. The next step is to determine the best way forward.

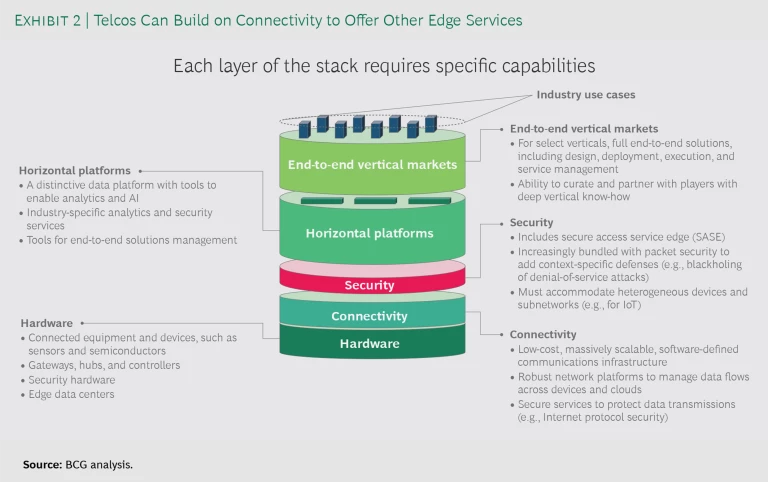

In principle, telcos are well positioned to capitalize on edge because of their existing infrastructure and physical proximity to customers. That and their strong position in network infrastructure and connectivity can serve as the basis for all other activity—think of it as the base of the stack. (See Exhibit 2.) Even before they expand into offering more complex services, telcos can use their existing connectivity business and expertise to offer secure access service edge (SASE), an edge-based network architecture that combines software-defined wide-area networking and security. SASE represents a significant potential commercial opportunity for telcos because it’s closely related to their core communication business and can help them move beyond connectivity.

Telcos that move beyond their traditional connectivity business will be able to take advantage of opportunities "up the stack" by building edge-enabled horizontal platforms or end-to-end vertical services.

All the global telco executives we interviewed said that they plan to transform their traditional networks to a low-cost, software-defined infrastructure. About half have a clear strategy and are in the early stages of implementing their plans. Of those, about two-thirds are pursuing some kind of horizontal play, and the remainder expect to launch or are implementing a strategy centered on end-to-end vertical uses.

Horizontal Platforms. Telcos can use edge computing to build horizontal platforms that consist of three layers: connectivity, hardware, and value-added services. We expect value-added services to account for approximately 64% of future growth in this area, with the leading contributors being IoT application software as well as IT installation and ongoing services. Hardware should account for 28% and connectivity for the remaining 8% of future growth.

The challenge for telcos that want to build platforms will be developing a strategic advantage that lets them use edge to participate in Industry 4.0 activities at a local level, while also gaining market share through white-label deals and resale agreements.

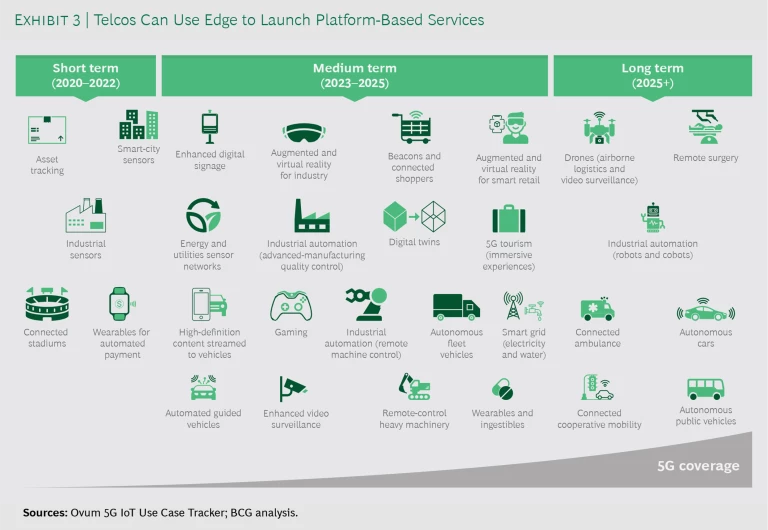

The IoT market exemplifies how the potential in edge-based horizontal platforms is likely to break down. Edge is expected to accelerate development of IoT networks, with approximately 65% of growth in that business coming from value-added services and the remainder from hardware, licenses, and the like. Over time, we believe that telcos could support the development of multiple horizontal B2B and B2C platforms. (See Exhibit 3.)

In the short term, through 2022, we believe that on-premise and near-premise edge-based platforms will support the development of such devices as smart-city and industrial sensors and wearables for automated payments. By 2023 to 2025, these platforms could lead to the widespread development of advanced-manufacturing quality control, remote-control heavy machinery, and autonomous fleet vehicles. By 2025 and beyond, platforms could serve as the basis for fully autonomous technology, including self-driving vehicles, remote surgery, and industrial robots. One early example of such a platform for industrial robots is an automated optical inspection system created by Taiwanese industrial manufacturer Inventec, which the company claims increases production line first-pass yields from 70% to more than 85%.

End-to-End Vertical Solutions. Horizontal platforms will also serve as the foundation for end-to-end vertical solutions in such markets as field service management, construction, logistics, smart cities, and service management.

Telcos are recognized leaders in network, communications, and security, and they have a track record of meeting data security requirements and regulations. The extra security and reliability that 5G and edge provide will let carriers offer private networks, private security, and a managed end-to-end service experience.

Our interviews suggest that the telcos most interested in providing end-to-end vertical solutions, such as the major US providers, typically already serve a large domestic market. Alternatively, they have government support in promoting a country’s digitalization, as is the case in the Middle East. Other telcos that want to enter vertical markets have a track record as systems integrators, or they have extensive B2B information and communications offerings in the local markets that they serve.

Even before they expand into offering more complex services, telcos can use their existing connectivity business and expertise to offer secure access service edge (SASE), an edge-based network architecture that combines software-defined wide-area networking and security.

Although early adopters have gained traction with initial proof-of-concept uses in areas such as remote-site connectivity, site security, and worker safety, it is not clear which industry-specific applications will become most relevant in the near term. As a result, some carriers are reluctant to pursue these solutions. Even telcos with existing local relationships that could serve as the foundation for vertical services often lack sufficient understanding of business and consumer needs. For that reason, business customers don’t see them as transformation partners. Telcos interested in offering end-to-end vertical-market services may lack other capabilities needed to enter this market, which would require them either to develop or acquire them or to find a partner to fill in the gaps.

Navigating Edge Partnerships

Whether they pursue horizontal platforms or end-to-end vertical services, telcos have to scale edge-based offerings quickly, as size is a key to success. Some telcos learned that lesson the hard way when their forays into the data center business and other past endeavors didn’t turn out as well as expected. Telcos should avoid spending too much time on technical proofs of concept, aiming instead to create rapidly scalable business models.

Bringing on a partner can help. Even though edge has attracted players from outside the industry that some long-time vendors fear could usurp their position, the majority of telco executives we surveyed believe that finding a partner is a must.

Telcos can take one of the following emerging paths to an edge partnership:

- Build up internal capabilities before taking a partner. In our survey, this option was mentioned mainly by carriers that had yet to settle on a strategy.

- Enter a few selected partnerships early in the process to solidify the commitment to working together. This option is most likely to be pursued by early movers.

- Team up with multiple best-of-breed partners early in the process to avoid relying on a single partner and provide multiple cloud provider options for end customers to choose from. Our interviews suggest that this is the path most carriers are likely to choose.

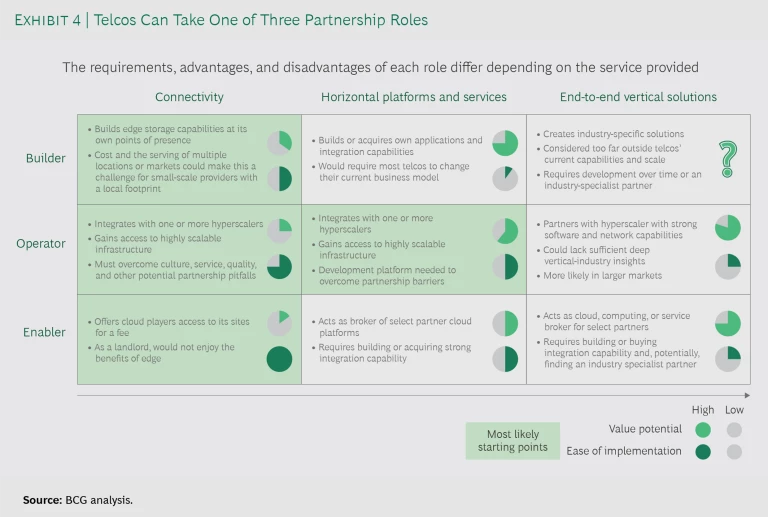

Telcos can assume one of three roles in an edge partnership. (See Exhibit 4.) They can act as a builder, constructing and running an edge-based service on their own or with limited participation from a partner. They can become an operator, running a service that a partner has created. They can become an enabler, acting as an integrator or creating a site, platform, or service that one or more partners use to provide their own services.

Each role has advantages and disadvantages depending on the edge strategy. In the short term, we expect telcos to create the most value by building, operating, and enabling edge-based connectivity and by operating horizontal platforms. In the longer term, we see some providers deriving the most value from operating end-to-end vertical solutions. However, those services will be much harder to launch because they are so different from what telcos offer today.

Most telcos see hyperscalers in the mix of potential partners because they can provide the cloud scalability and other technology needed to build horizontal platforms. Hyperscalers also bring an immense developer and partner ecosystem that can help in developing edge applications.

Before telcos move forward with one or more partners, they need to address the potential pitfalls. Many telcos have little or no experience monetizing partnerships or working with hyperscalers. They need to negotiate partnership agreements whose terms do not dilute their margins. And they need to introduce effective cross-domain orchestration and automated controls for services that integrate with the public cloud in order to maintain service levels appropriate to their edge applications.

Corporate culture can be a sticking point in partnerships. Historically, telcos and hyperscalers have had different cultures and ways of working—those of the former more traditional than those of the latter—which could make a partnership difficult to manage. Companies that end up operating in multiple edge ecosystems may have to negotiate their roles with each partner, including decisions about which company assumes the role of orchestrator.

Getting Started with an Edge Strategy

Our interviews indicate that telcos should do the following when evaluating edge-computing strategies and potential partners.

Set your own course. Edge is a new opportunity, one that is still in flux. Providing value-added services may not be for everyone. But since telcos’ core business is connectivity, and all edge strategies build on connectivity, telcos will be involved one way or another and need to pick their place in the edge ecosystem. The starting point will differ depending on a telco’s available assets and position in the B2B market. Telcos need to create their own plan rather than wait for another rip tide of over-the-top services. They need to be agile, hedge their bets and avoid the temptation to go in on a single venture, and follow the philosophy of “fail fast and learn,” making adjustments as they go. There’s no one right strategy. The most important thing is to get started.

Whether they pursue horizontal platforms or end-to-end vertical services, telcos have to scale edge-based offerings quickly, as size is a key to success.

Partner, but partner wisely. Carriers must decide which partner model makes the most sense for their circumstances and how to monetize it. When crafting agreements, they should consider a partnership’s scope and structure, since both can affect value and implementation. They also need to be careful about whom they team up with, since the line between friends and competitors in fast-developing edge ecosystems isn’t always clear.

Adopt new business models, ways of working, and skills. To embrace edge, providers must be prepared to develop their business model, taking it from what was traditionally a one-to-many business to the management of many-to-many B2B relationships. “Edge partnerships will require telcos to adopt new ways of working, including agile methods ,” says Microsoft’s De Haven. “They will also need to provide employees with new capabilities or bring on new talent with the required skills. Adopting agile ways of working will help providers innovate and problem solve.”

Build trust by becoming customers’ edge guides. Edge is so new that many B2B customers aren’t sure what to make of it. Telcos can leverage their existing relationships to become trusted guides to customers, helping them understand and embrace edge services. This will allow them to set themselves up as preferred providers of core edge-computing building blocks and as gateways to the Industry 4.0 specialist ecosystem. By establishing themselves as transformation partners and solution orchestrators, they can further solidify their edge business.

Make selective bets. Finally, telcos need to overcome their reluctance to invest in building out specific use cases ahead of the pack. Even in a challenging cost environment, they can make selective bets by starting new ventures in ways that don’t add substantial complexity to current operations.

Telcos have experience managing a server-like infrastructure of tens of thousands and, in some cases, hundreds of thousands of physical locations connected to their core network. In many ways, managing a large number of physical locations is similar to managing the edge’s distributed architecture. Telcos can use that “edge” to their advantage when implementing edge—but they need to act now. Edge ecosystems are forming, and forward-thinking providers are laying the groundwork to bring their implementation plans to fruition, including teaming up with business partners. Other providers need to formulate a strategy, the sooner the better.

The authors are grateful to their BCG colleagues Zia Yusuf, Val Elbert, Mali Zhang, Øyvind L. Bjørndal, and Jonas Sørlie for research and help in developing the insights presented in this article. They also thank Bob De Haven, Paul Everett, Rick Lievano, Shawn Hakl, Kimberly Lein-Mathisen, and Daniel Reime at Microsoft for their contributions.