How can deep tech help companies stay profitable while becoming sustainable? The answer lies in a combination of advanced technology and new business models.

CEOs and board members are quick to point out that they understand reaching net zero will require leveraging emerging technologies. They know they need to move—Fortune estimates that Fortune 500 companies account for about 27% of greenhouse gas emissions—and they are aware that mature technologies have the potential to reduce only 25% of current CO2 emissions (according to the International Energy Agency). They also understand that advanced technologies alone will not be enough. True sustainability will require game-changing technologies, such as advanced materials, bio-based processes, and new forms of industrial automation, plus new business models and associated changes in consumer behavior.

Sustainability is not just good for the climate. Fossil fuel energy prices are expected to remain high and volatile. Cutting energy consumption and emissions often go together, and we have seen new industrial processes that lead to reductions of up to 50% in both. Early adopters can get ahead of tightening energy requirements and potential environmental-impact taxes as governments ratchet up regulations in response to growing global pressure to act. They can also establish competitive advantage during the transition as new business models are enabled, opening opportunities to differentiate and create new markets.

Understanding the need—and the opportunity—is the easy part. The hard thing, these same leaders tell us, is determining how best to move the needle, especially in three big decision areas:

- Where to focus: which technologies to bet on and which areas of the business to transform

- How to accelerate R&D and sustainable-product development

- How to productively disrupt existing business models with more sustainable alternatives

It’s a tough trifecta. But the benefits in revenue, costs, and shareholder returns, combined with changing regulations that penalize unsustainable practices and the rising difficulty of financing emission-intensive businesses, will eventually force all companies to move. Slower firms are likely to find themselves playing technology catchup from a long way behind.

Based on our experience with sustainability leaders, here’s how to set your company on the right course.

Game-Changing Technologies

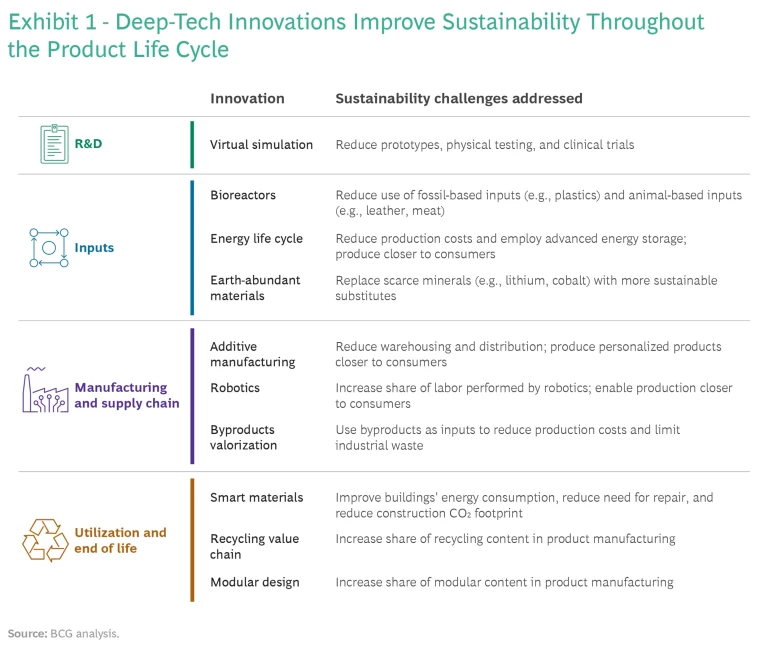

New technologies—some already in use and others still in development—promise to alter every stage of the product life cycle, from R&D to raw-material inputs to manufacturing and supply chain to utilization and end of life. (See Exhibit 1.) New companies in new industries, such as SpaceX with its reusable rockets, are applying advanced technologies systemically across the full value chain, including end of life. There are many examples in traditional industries as well.

R&D. In industries such as automotive and pharmaceuticals , companies spend billions of dollars annually to build and test prototypes and conduct clinical trials. Advances in computing and AI are reducing this requirement by making possible fast and accurate simulations of products in development, from cars to drugs. Quantum computers, still in early development, can simulate the chemistry of the battery, which is too computationally complex for classical computers. Daimler and IBM are leveraging this emerging technology to develop electric vehicles. Google's DeepMind AlphaFold is able to predict the likely 3D structure of proteins (which translates into biological activity) based only on their amino acid sequence, a key advance for drug discovery

Inputs. Petrochemicals are used to make a wide range of products, from plastics to cosmetics to fertilizers. Advances in biotechnology make it possible to switch to renewable feedstocks (such as sugar cane or organic waste) by using modified organisms to transform these inputs into the desired molecules and materials, or by directly extracting polymers of interest from plants. For example, DuPont’s Sorona, used in carpet and apparel manufacturing, and Dow’s Ecolibrium, the key input in the latest Crocs footwear line, are made with bio-sourced polymers. ExxonMobil, BP, and other energy companies are working on sustainable aviation fuel, made from biomass, waste, and other non-oil inputs.

New technologies—some already in use and others still in development—promise to alter every stage of the product life cycle, from R&D to raw-material inputs to manufacturing and supply chain to utilization and end of life.

Manufacturing and Supply Chain. Until recently, massive scale was considered the best way to bring costs down, but it came with high environmental and societal costs since it led to offshoring and extended global supply chains . New incentives for regionalization and resilience, renewable-energy sources, and advances in additive manufacturing, robotics, and AI all boost the efficiency of local manufacturing and make it increasingly economical to locate factories near the end consumer. For example, Essentium's 3D printer produces aviation-grade parts for aerospace maintenance where they are needed, eliminating overproduction and increasing airplane uptime.

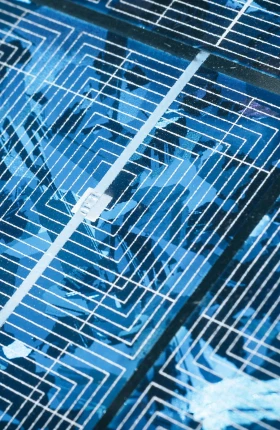

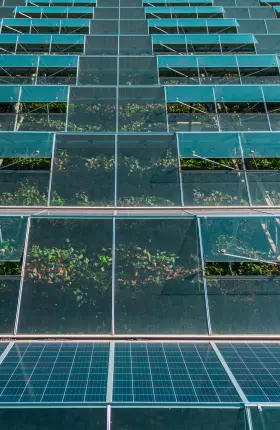

Utilization and End of Life. Heating and appliances for buildings account for almost a third of greenhouse gas emissions. Advanced materials can improve insulation, reduce the need for artificial lighting, and even generate electricity. For example, View, a Silicon Valley startup, makes smart windows that can yield annual savings of up to 18% in energy use from heating and air conditioning. Green Basilisk, a Dutch startup, is developing a self-healing concrete using bacteria that prevent the cracks that degrade traditional concrete. Other startups, such as Noveon and Urban Mining, look to address e-waste, as well as the limited supplies of rare-earth metals used in batteries and other forms of electrification, through improved recycling and reuse.

Permutations and Combinations. Innovations such as those described above can be combined for even greater impact. In construction, cement substitutes (production of cement accounts for 8% of greenhouse gas emissions), new manufacturing processes, and better building design—such as the collaboration between developer Lennar Homes and ICON, which uses 3D printing to produce concrete structures—can lead to less embodied carbon, greater energy efficiency, and more affordable housing. In the food industry, which is responsible for 26% of current greenhouse gas emissions, alternative proteins , made using new inputs and advanced processes, have met with a favorable reception from consumers. If these proteins continue to make inroads, and if technological advances lead to more and better products, the industry may undergo a disruptive technology upgrade, with value pools shifting upstream toward innovations that improve taste, texture, and nutrition.

The Green-Premium Dilemma

Technology is only one of the challenges that big companies face, and often not the toughest one. The cost of material or process substitutions, and therefore the price manufacturers need to pass on to consumers, can be a huge barrier to change. Bill Gates coined the term “green premium” to describe the price difference between green and more carbon-intensive products. From inception, deep-tech solutions typically cost 30% to 240% more per unit than traditional equivalents: 30% to 50% more for bioplastics, 75% more for new cements, 90% more for meat substitutes, and 240% more for sustainable fuels.

These levels of increase are hard to swallow, especially for companies in low-margin industries. Moreover, consumers are fickle. While more than 80% say they pay attention to the impact of their behavior on climate change, BCG consumer research shows that only about 1% to 7% (depending on category & geography) actually make purchases based on sustainability considerations.

Fortunately, many deep-tech solutions can benefit from scale curve economics, with unit costs decreasing substantially over time. For example, photovoltaic costs dropped by almost 90% in ten years. Precision fermentation costs fell from $1 million per kilogram in 2000 to $100 in 2020. Thanks in part to the kick-start provided by Tesla and its “gigafactories,” the average price of an electric-vehicle battery pack fell from $1,200 per kilowatt-hour in 2001 to $132 in 2021.

One way to overcome the green-premium dilemma involves starting a virtuous cycle with the 1% to 7% of eco-conscious consumers willing to pay for green products and then reducing prices with increasing scale to enable sales to more cost-conscious consumers. Adidas, for example, developed innovative additive-manufacturing processes and materials to make its Futurecraft sneakers 100% recyclable. The company brought the new shoes to market in 2017 at a premium price of about $350 per pair. The shoes are now available in the US for two-thirds that amount. Meanwhile, they have reinforced Adidas’s reputation as a leader in technology and sustainability.

Technology Plus Business Model Innovation

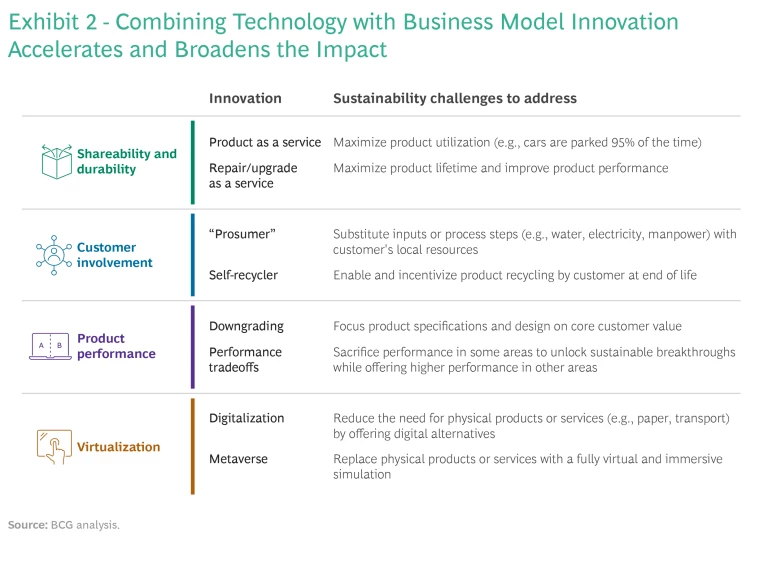

While the premium-entry approach has a proven track record, its initial reach and impact are constrained until the scale curve reduces prices to mass-market levels. Fortunately, production is only half of the equation. The climate change crisis has sparked growing innovation in the more sustainable use of everyday products. (See Exhibit 2.)

The best-known example may be future fleets of fully autonomous vehicles that will be shared on demand, enabling a more sustainable paradigm for transportation and mobility. Others include the following:

- Shareability and Durability. Miele is designing and pricing appliances that incorporate repair and upgrades as a service and are guaranteed to last at least 25% longer, on average, than competitors’ products. Outdoor outfitter Patagonia offers a marketplace for the company’s used gear that it claims adds about two years to the clothing’s lifetime. REI offers a similar trade-in service for many of its products.

- Customer Involvement. PepsiCo and SodaStream (which PepsiCo owns) are piloting soda sold as a syrup to which the consumer adds water and then carbonates using a SodaStream machine. The new model eliminates the need for plastic bottles, aluminum cans, and the transport of heavy palettes of finished product. We estimate that this approach could save about 80% of emissions over the product's life cycle compared with traditional soft drinks.

- Product Performance. Lightyear, a startup, has designed a solar-powered electric car that trades acceleration and speed, which many drivers do not need, for higher mileage. The car aims to reduce emissions by 65% over battery-powered EVs in California. So-called “ugly produce” companies are creating a market in the US for fruits and vegetables that would otherwise go to waste. A “frugal innovation” movement in developing economies helps consumers “get the job done” with lower-cost and more sustainable products, such as the MittiCool clay refrigerator in India and Spandan ECG, a portable heart-monitoring device that connects to a smartphone.

- Virtualization. Numerous fashion, apparel, and luxury goods companies, including Nike and Hermès, offer digital versions of their products for use in the metaverse. Virtual goods offer consumers some of the same benefits as physical ones (for example, fun, a desired identity, belonging in a group, or VIP status) without the direct environmental costs. Nike had sold $185 million worth of virtual apparel as of August 2022, according to Dune Analytics.

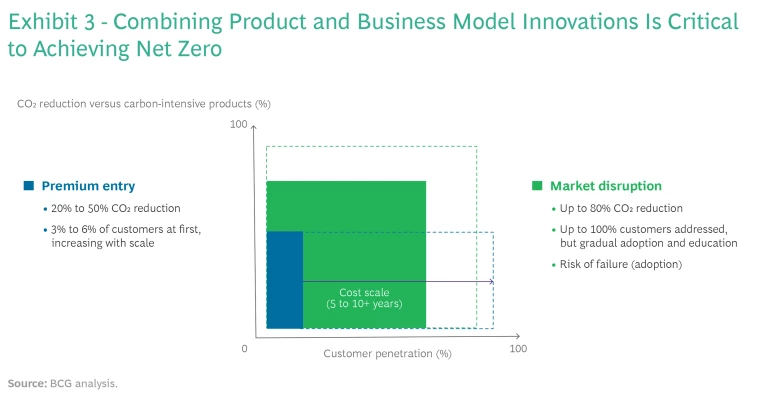

These business models are not only more sustainable, they also tend to be cost efficient. As a result, they can cancel out the green premium incurred by new technologies, opening paths for broader and faster adoption. We estimate that the combination of technology and business model innovation has the potential to reduce emissions by up to 80%. While not all products or services are candidates for radical business model innovation, combining premium-entry and market disruption strategies will in many sectors be essential to achieving substantial progress toward net zero. (See Exhibit 3 and the sidebar, "Combining Deep Tech and Business Model Innovations in the Auto Industry.")

Combining Deep Tech and Business Model Innovations in the Auto Industry

Combining Deep Tech and Business Model Innovations in the Auto Industry

- Reducing the high cost of prototyping and testing through virtual simulations using AI and quantum computing and powered by actual customer driving data

- Exploring performance tradeoffs that could be achieved by replacing lithium-based batteries with green hydrogen fuel cells, which are less convenient (they need to be replaced and cannot be recharged)

- Streamlining the production, storage, and transport of spare parts with decentralized, on-demand 3D printing factories

- Reducing vehicle weight and improving aerodynamics with design changes and the use of new materials, such as carbon fiber, innovative metal alloys, and ceramics

- Addressing low vehicle utilization and low passenger occupancy levels with advanced carpooling models enabled by AI and embedded sensors, and with vehicles designed for specific use cases

Forcing this kind of disruption has always been difficult for incumbents that have built massive businesses and market shares through models of incremental improvement. But climate change is a radical problem that mandates equally radical solutions—and a lot of them. We have already seen big gambles on new models by companies such as Ørsted in renewable-energy production, Maersk in green shipping, Unilever and Nestlé in alternative proteins, and Yara International (the former Norsk Hydro) in new modes of fertilizer production.

Four Steps to Get Started

Every company is different, but here are four steps that any business can use to integrate deep tech and business model innovations into their strategy and sustainability programs.

Establish the baseline. Progress requires metrics, but most companies can’t pinpoint their starting line. Our most recent survey of corporate carbon emissions found that only 9% of companies quantify their emissions comprehensively. The first step is a thorough emissions evaluation to identify the greenhouse gas reduction potential across the value chain.

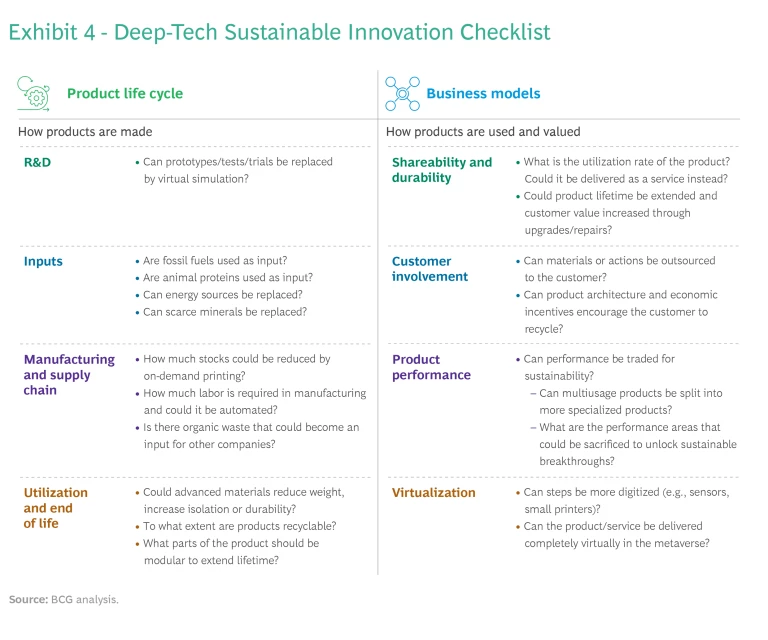

Assess the opportunities. Exhibit 4 contains a checklist for both product life cycle innovations and business model development. An objective assessment of the opportunities will help prioritize the effort according to value and feasibility by providing answers to such questions as:

- Which innovations will have the biggest impact?

- Which are (relatively) quick and easy to implement?

- Which require larger, longer-term investment, and which require external partners or possibly the creation of an ecosystem?

- Which require development outside the core business using incubators or corporate venture capital?

Remember that multiple innovations can be applied to one product or service and that the same innovation can be applied to several products or services.

Manage a portfolio. Companies will be operating in uncharted territory. Failure is inevitable. Management will need to make a portfolio of bets that it continually culls and adds to over time as progress is assessed, technologies advance, and relevant models in other sectors come to market.

Rethink the operating model. Once companies move beyond what can be achieved though technical and operating efficiencies, most will need new operating models and ways of working. Integrating advanced technologies and nurturing new business models require speed and the ability to work in agile and cross-functional teams that can test and learn—and test and fail and move on. This is different from the operating model that most incumbents use today and will likely require some form of transformation throughout the organization. Sustainability also is not a solo pursuit. Companies will need models for working with partners, such as suppliers, and in ecosystems with customers and others, especially when it comes to tackling scope 2 and 3 emissions.

It’s been said that no incumbent company has ever been responsible for industry disruption. This may be true, but times are changing fast. The demands of creating a more sustainable economy will reinvent how companies use new technologies and think about innovation. Leaders will be forcing radical, rather than incremental, change.

This is the second in a series of articles highlighting how deep tech—the problem-driven application of advanced technologies to address large-scale issues—can help deliver superior value and growth while enabling companies to achieve their sustainability goals.