The Australian Consumer Sentiment Snapshot series shares insights from a BCG consumer survey undertaken with our coding and sampling partner, Dynata. The survey aims to uncover how consumer perceptions, attitudes and spending behaviors are impacted by the evolving COVID-19 and inflationary environment. This snapshot presents insights from Round 6 of the survey, gathered from 2 November to 8 November 2022. We have drawn comparisons with research completed in previous rounds and other countries.

With uncertain economic conditions and the after-effects of the pandemic, consumer behavior and sentiment continue to evolve rapidly. We are seeing 7 trends emerge from the inflationary environment and receding COVID-19 impact:

- Consumers’ concerns are high after a brief period of post-COVID-19 relief

- Consumers are earning and saving less, yet spending more, primarily due to inflation but also because of pent-up demand

- Confidence in job security and the receding impact of COVID-19 are supporting consumers in this inflationary environment

- Six patterns of spending are emerging as consumers reset their category spending for the next 6 months—inflation driven, pent-up demand, no sacrifice, dip in volume, deal hunting, substituting

- Digital and online shopping continues to grow, but consumers also intend to shop at stores; channel preferences vary according to demographic and socioeconomic status

- Leisure travel is not only being driven by pent-up demand but also by continued intention to travel more. Cruise travel and international flights will gain momentum

- Climate and sustainability is one of the top 3 issues on consumers’ minds, but consumers need more support from companies to make sustainable purchases

1. Consumers’ concerns are high after a brief period of post-COVID-19 relief

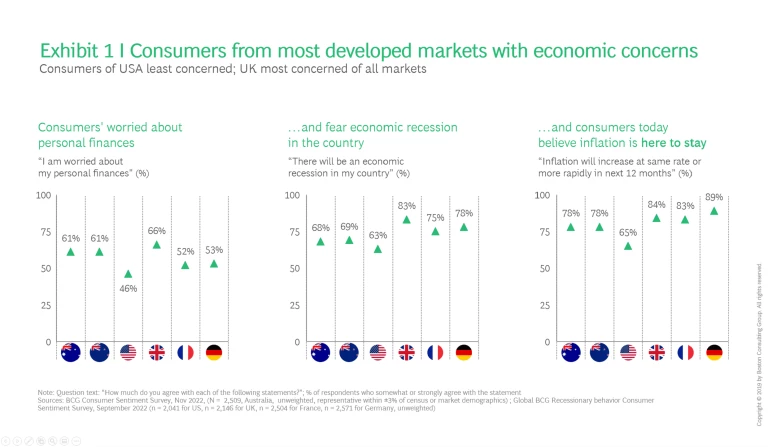

Two years after the onset of the pandemic, inflation has become one of the main concerns for the global economy. Prices are at a record high in the UK and Europe because of inflation and Russia-Ukraine conflicts. This has led to the highest level of concerns about macro and micro economic factors we have seen in all survey rounds. Most consumers across the countries surveyed, including Australia, think there will be an economic recession and that inflation is here to stay. See Exhibit 1.

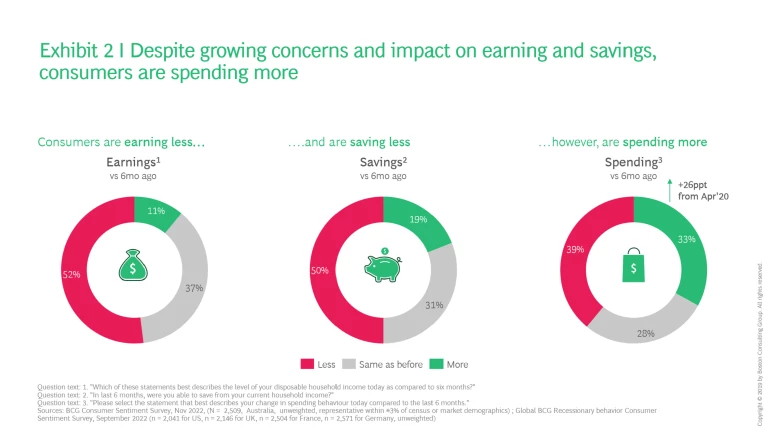

2. Consumers are earning and saving less, yet spending more, primarily due to inflation but also because of pent-up demand

Consumers believe it will take close to 34 months for inflation to stop rising in Australia. More than 50% of Australian consumers surveyed said they are earning or saving less compared to 6 months ago. Despite this, there has been a spike in overall spending with 33% of consumers saying that they are spending more than 6 months ago (up 26ppt from April 2020). See Exhibit 2. More than 63% of consumers attributed this growth in their spending to the increased prices of essentials, 37% to the increased prices of non-essentials and 34% attributed it to the impact of the Russia-Ukraine conflict. Notably 21% and 23% of consumers also cited higher interest rates and meeting pent-up demand respectively as drivers of increased spending.

The 39% of consumers who are spending less are doing so to protect their savings as economic uncertainty is expected to linger.

3. Confidence in job security and the receding impact of COVID-19 are supporting consumers in this inflationary environment

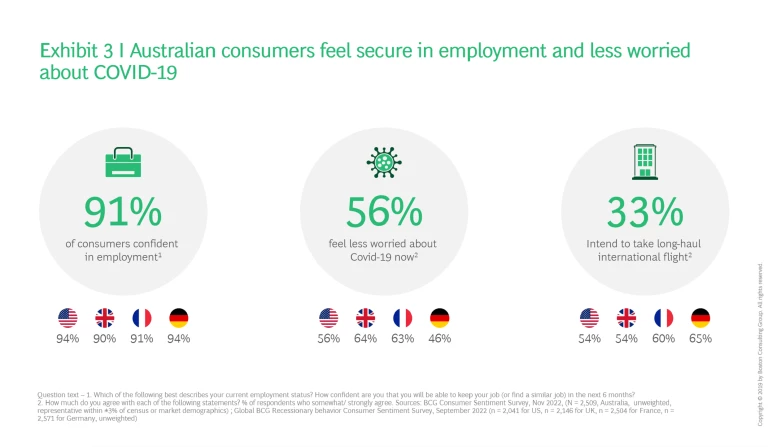

Despite inflationary pressures, this economic environment is unique. There are two shifts that come to consumers’ rescue. Firstly, Australia is without the high unemployment rates typical of past recessionary or inflationary periods. The unemployment rate decreased to 3.4% in October 2022, monthly hours worked increased to 1,864 million and 91% of consumers are confident about their employment. Secondly, consumers are more confident—benefitting from the receding impact of COVID-19. While 66% of consumers believe that COVID-19 will be present in their community for the rest of their life, 56% feel less worried about the impact now. This confidence is demonstrated by increased intention to travel overseas: 33% of consumers intend to take a long-haul flight for leisure travel soon. While this is lower than other countries surveyed, it is still positive compared to trends of previous survey rounds. See Exhibit 3.

4. Six patterns of spending are emerging as consumers reset their category spending for the next 6 months

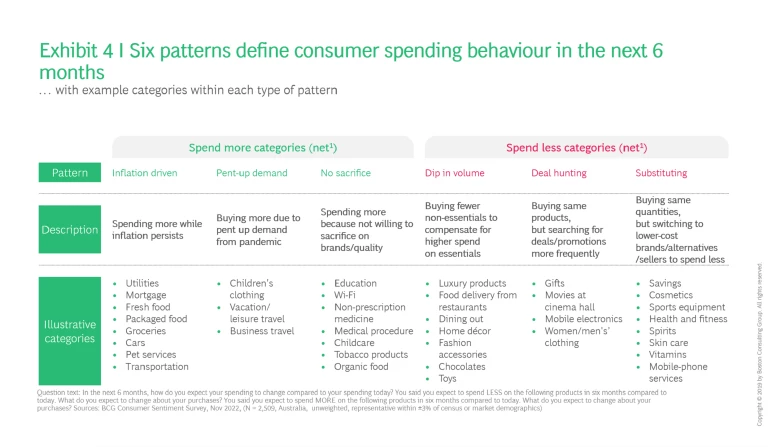

Although the rising price of essentials is the primary driver of increased spending—a reflection of inflation—some non-essential purchases and pent-up demand in categories restricted during COVID-19 are contributing.

Consumers showed unprecedented resilience during COVID-19 by adapting their spending to areas of most need. Now they are under pressure to change their spending again. Approximately 50% of consumers are checking prices on internet more often than ever before, choosing affordable or accessible brands to compensate for increased prices and hunting for deals and discounts.

However, behaviour is not the same for all categories. We have identified 6 patterns of consumer spending behavior that define where consumers plan to increase net spending versus where they plan to decrease it during the next six months: inflation-driven, pent-up demand, no sacrifice, dip in volume, deal-hunting, substituting. See Exhibit 4

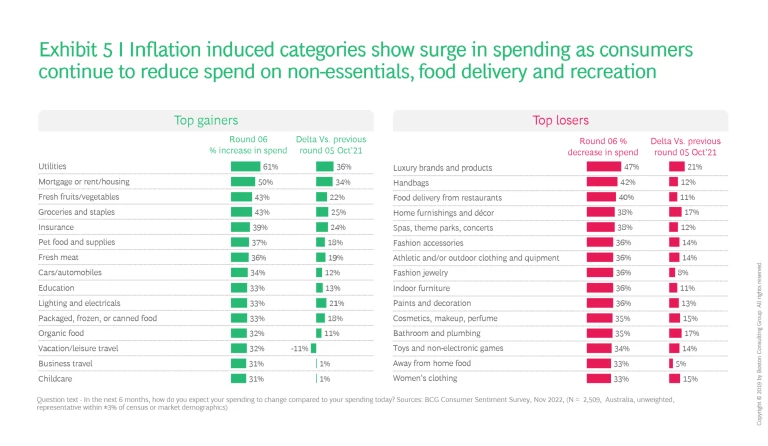

Consumers expect to spend more on inflation-driven essentials such as utilities, mortgage, food and groceries, cars and pet care. Consumers also continue to anticipate spending more in categories restricted by COVID-19 (e.g., travel)—a sign of pent-up demand. Categories where consumers typically do not reduce consumption during economic downturns—such as education and nonprescription medication—will also be likely to see a lift in revenues, given consistent purchasing despite inflated prices. Predictably, consumers expect to spend less on non-essentials, increase deal hunting, and substitute purchases with lower-cost brands and alternatives. The category that consumers most consistently point to as an area where they are likely to reduce their spending is clothing. See Exhibit 5.

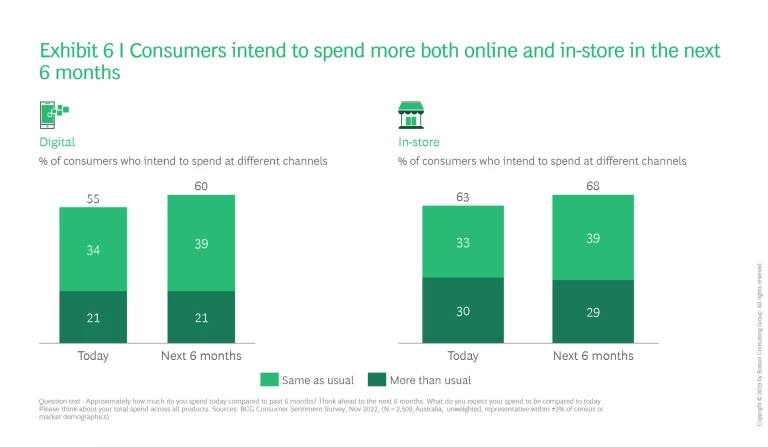

5. Digital and online shopping continues to grow, but consumers also intend to shop more at stores; channel preferences vary according to demographic and socioeconomic status

Digital channels show sustained growth among purchasers. At the same time, consumers are embracing the receding impact of COVID-19 and intend to shop more at stores. In the next 6 months, 60% of consumers intend to buy as usual or more from digital channels, whereas 68% intend to buy more from stores. See Exhibit 6.

While this is great news for in-store retailers, it will be important for retailers to monitor the consumers coming to their stores or buying from them online to tailor their offering to demographic trends. The digital consumer profile is skewed to women, consumers aged 26–45 years, couples with children, mid-income earners (around AU $100k) and full-time employed professionals. NSW and Tasmania show a marginally higher skew to digital buyers compared to other states. Segments who prefer to spend at stores are men, people aged 65+ years, couples and retirees.

As stores see the return of customers, our survey found an increasing consumer preference to purchase food and groceries from convenience stores: 34% of consumers said they are spending more at convenience stores than 6 months ago and 44% of millennials are shopping more from the convenience stores. These consumers are increasingly preferring fewer trips and smaller shopping baskets, with 38% of consumers primarily motivated by the ease of ‘getting in and getting out quickly’. While both supermarkets and online channels continue to serve consumers on their monthly/fortnightly grocery runs, convenience stores distinctly serve consumers’ need for purchases on the go or for a short trip. With close to 10% of consumers fulfilling their monthly grocery shopping missions at convenience stores, it will be interesting to monitor how consumers shift across channels as trends evolve.

6. Leisure travel is not only being driven by pent-up demand but also by continued intention to travel more. Cruise travel and international flights will gain momentum

Our survey found that 32% of consumers intend to spend more on leisure travel in the next 6 months as it emerges among the top 15 categories set to gain consumer spend (of 74 categories). See Exhibit 5.

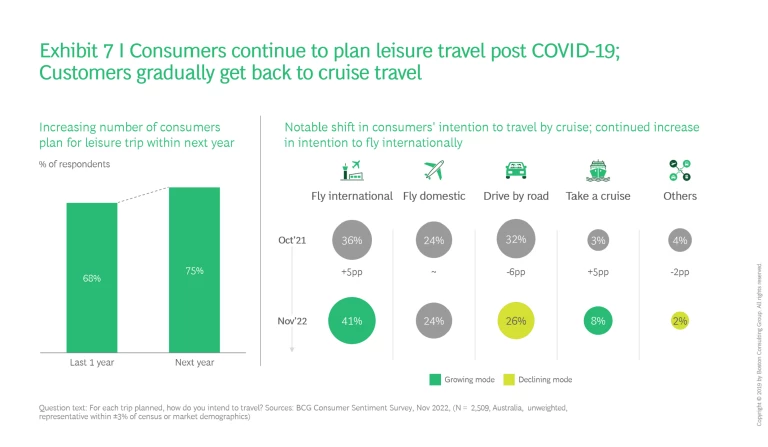

In the next year, we expect 7ppt growth in the number of unique travelers from 68% today. International long-haul travel and cruise are expected to see the highest rise compared to last year. See Exhibit 7.

As consumers worry less about the impact of COVID-19 and look to spend their savings on leisure travel, they want to do more international air travel and cruises compared to our previous survey round (October 2021) where consumers preferred road trips and domestic air travel. In great news for cruise operators, 46% of consumers at least reached the ‘research’ stage of purchasing a cruise trip—these were mostly millennials and families with kids. Consumers plan to take it slowly, starting with trips in Australia or the South Pacific. And while they’re hunting for deals and discounts, they are also redeeming their pre-COVID-19 credit to book holidays and craving the unmatched experience and end-to-end ‘treat’ of cruise travel.

7. Climate and sustainability is one of the top 3 issues on consumers’ minds but consumers need more support to make sustainable purchases

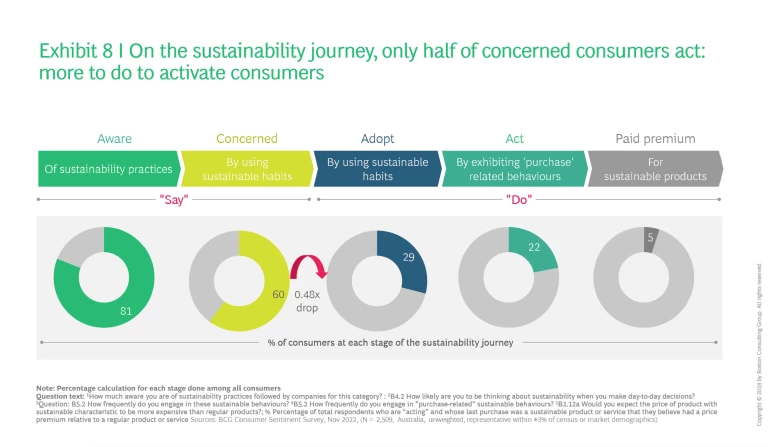

Despite impacts of inflation, sustainability remains in the top 3 agendas for consumers of Australia. This is great news for companies who have bold sustainability ambitions and net-zero pledges. However, while more than 80% of consumers are aware of sustainability in their day-to-day use of products, only 5% are willing to pay a premium for sustainable products and services.

Companies often interpret this as a signal that consumers are not ready to translate their awareness to action, but this is an incomplete picture of the consumer sustainability journey (outlined in Exhibit 8). It ignores 2 other important groups of consumers: those acting by buying sustainable products and services (albeit not at a premium) or adopting sustainable behaviors (e.g., minimising water and electricity use, restricting solo car travel or using refillable packaging).

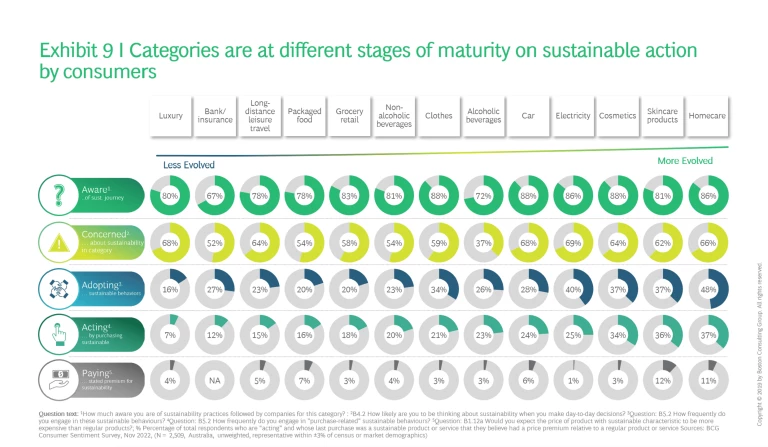

We examined sustainability journeys by category and found that categories are at different stage of the journey. Homecare, skin care and cosmetics are among top 3 most evolved sustainable categories where more than 33% of consumers are taking action by exhibiting purchase related sustainable behaviours. Recycling, re-using and re-packaging are widely accepted sustainable behaviours among these category consumers. More than 50% of home care consumers have started washing their clothes in cold water, 29% have reduced the variety of cleaning products they use and 29% have started using natural products. This has direct implication for companies on how they innovate, price and communicate new products. See Exhibit 9.

Various factors discourage consumers from making more sustainable choices in categories such as luxury and leisure travel. Consumers say lack of awareness and pricing issues discourage them from spending on sustainable leisure travel, whereas psychological barriers such as being too used to using the product hold consumers back from making sustainable choices in luxury products.

The key question for companies is: how do we encourage more of these ‘acting’ and adopting’ consumers to pay a premium for sustainable products? There are ways to reach and motivate these consumers by aligning sustainable offerings with their core needs. For many products, the premium for a sustainable solution is only 1-4% ; companies need to understand what deters consumers from fully embracing sustainable choices and what will motivate them to pay this premium. Then, companies need adapt products, services, and communication strategies in a way that resonate with these motivations.

Action for companies

The question remains how long employment and confidence in employment will hold up in the face of inflation and shrinking GDP—and when changes in those metrics will impact average and higher-income consumers. Given the prevailing uncertainty, companies need to prepare for declining consumer spending and closely monitor consumer sentiment and behavior. At the same time, supporting consumers to act on climate and sustainability provides opportunities for companies to encourage spending around a strong cause.

We see 4 key actions for companies:

1. Strategically plan in an inflationary environment. Strategic planning is more important than ever, but companies need to take an agile approach. Companies need strategies that provide a clear ambition, prioritise resource allocation, can react to material opportunities and provide clear and timely guidance to investors. While strategy often works well in stable environments, uncertainty can help companies build a more resilient strategy. To drive faster and more agile strategic planning, companies can ask:

- What world might we be operating in?

- What could winning look like?

- Which investments are most attractive and resilient?

- How aggressively can we move without limiting flexibility?

2. Win the customer in new reality. This inflationary environment is like no other. Price increases are resulting in spend increases but for the moment, consumers have employment security, savings and confidence as COVID-19 impacts recede. Winners need to understand market dynamics, their competitive landscape and the ‘shape of demand’ to succeed in these difficult times.

Let’s take the example of leisure travel. Customers are looking for new experiences and deals/discounts to make up for lost time during COVID-19. While there is still some uncertainty regarding COVID-19 impacts, they are ready to take the leap if they get assurance on refund and health protocols. Winners are those who remove the frictions, provide good deals and minimise perceived risks.

Subscribe to our Marketing and Sales E-Alert.

3. Take green to mainstream with consumers. There’s a big gap between consumer concern about sustainability and action for sustainability. With consumer-centric data, companies can:

Understand core consumer needs. Companies need a keen understanding of what consumers want and how sustainability fits into those desires. Which consumer needs drive sustainable choices? What do consumers believe about sustainability? What are the tradeoffs they feel they have to make?

In the beverages category, for example, only 7% of consumers cite sustainability in their top 3 considerations when making a purchase, but a larger share of consumers—as much as 43%—have ranked considerations that are highly related to sustainability in their top 3. These consumers seek beverages that are healthy, high quality, guilt-free, and socially responsible—and all these associations are positively correlated with sustainable products. By emphasising these attributes in product design and marketing initiatives, companies can attract consumers to sustainable products even when consumers are not deliberately seeking them.

Innovate to build a sustainable offering. Companies should start by generating a diverse set of ideas about the products and services their organisation might offer to remove real (rather than perceived) barriers to uptake.

For example, for many consumers who are concerned about climate and sustainability but are reluctant to act, cost is a primary issue or key tradeoff. It’s also a great example of a negative perception that may not be justified. Our research proves that consumers who do not actually buy sustainable products tend to think there is a much higher ‘green premium’ than there actually is. Consumers who are on the fence about making sustainable purchases for this reason need clearer price communication to combat this misperception.

- Drive sustainable choices. Companies need to get tactical to remove perceived barriers and change consumer choices; they need to engage with consumers, measure progress, and adjust the course depending on results. Making the attribute of sustainability an ‘and’ not an ‘or’ will be a win for the environment and the company’s bottom line.

4. Create a channel ecosystem that aligns with consumers’ expectations. COVID-19 accelerated consumer digital journeys and many of those behaviours have stuck. To realise the benefit of this, companies must continue to digitise their customer journeys, front to back.

Only 30% of companies navigate a digital transformation successfully. And navigating it in uncertainty is especially difficult as new behaviors and expectations evolve. By taking a bionic approach—blending digital and human capabilities—companies can kick their digital transformation into gear and keep the momentum going.