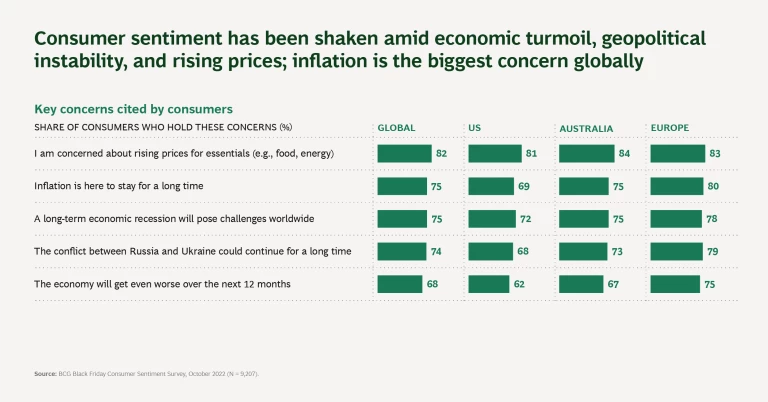

Black Friday is coming at a time of global uncertainty and waning consumer sentiment. More than 80% of individuals around the world are anxious about rising prices, with 75% worried about the prospect of a prolonged economic recession. Many are already feeling the impact of these global issues—as well as the war in Ukraine—on their ability to keep up with rising costs and afford everyday essentials.

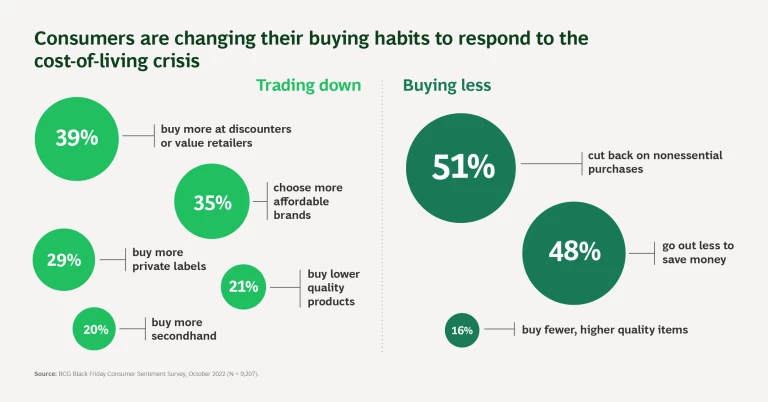

Consumption habits are changing as a result, with shoppers cutting back on nonessential purchases, going out less to save money, and turning to lower-quality items. Bargain hunting has become a more continuous activity, as consumers have become more accustomed to checking price tags and looking for discounts over the past few months.

Will brands and retailers resign themselves to writing off a rough 2022? Or will they look for the right opportunities to pull ahead of the competition?

To help brands and retailers navigate what all this means for their Black Friday sales—and maximize their returns on the week’s events—we’ve surveyed more than 9,000 consumers on three different continents. Our questions (focused also on Cyber Monday and the surrounding week of sales) spanned a number of topics, including the intention to participate, category and channel preferences, sustainability, and beyond.

Understanding the Consumer

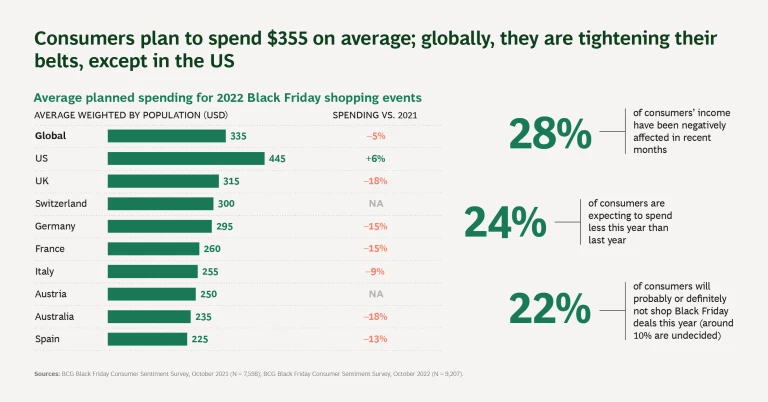

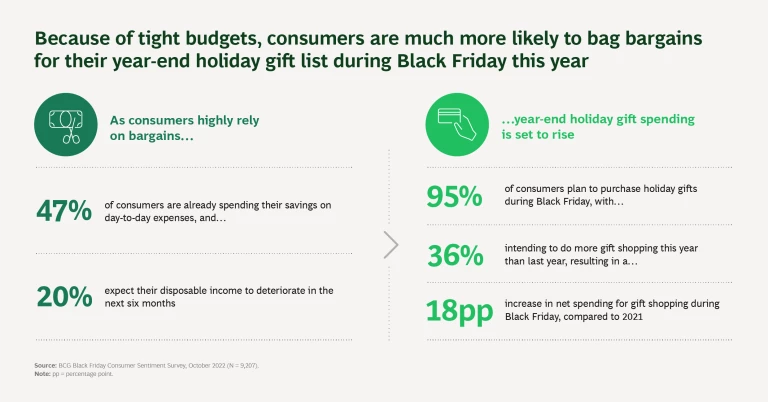

Given the current economic headwinds, a majority of consumers are planning on taking advantage of this year’s deals. Indeed, while Black Friday has traditionally marked the opening of the holiday season, consumers will be taking things to a new level in 2022. Among prospective buyers, some 95% plan on conducting their holiday-gift shopping during this year’s sales events.

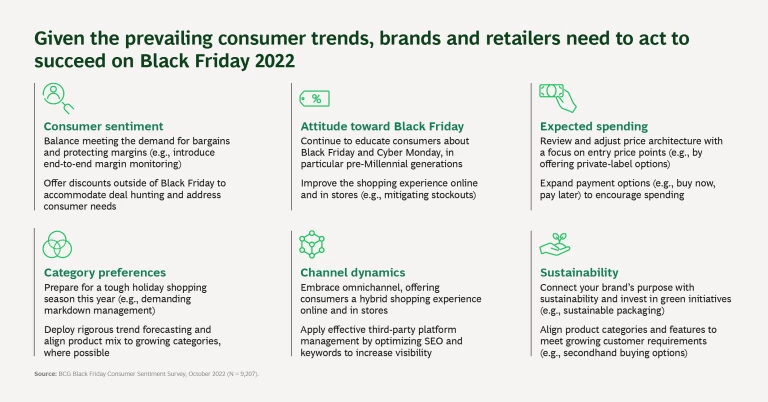

For brands and retailers, the mantra for 2022 is anything but “business as usual.” In this environment, the priority for companies is to better understand the nuances of consumer trends and adapt their strategies accordingly. They should focus on:

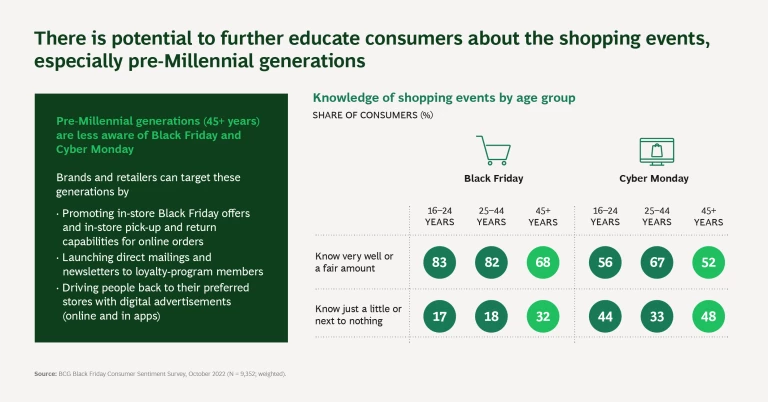

Awareness. Our research suggests that consumers are far less familiar with Cyber Monday than they are with Black Friday. This is particularly true among pre-Millennial generations (those individuals who are 45 years and older), almost half of whom told us that they know very little or nothing about the event. Brands and retailers should continue to educate consumers on Cyber Monday and Cyber Week by promoting in-store offers, for example, or launching direct mailings and newsletters.

Conversion. Despite most consumers’ familiarity with Black Friday (98%), a significantly smaller population (66%) actually plan on shopping, meaning that brands and retailers can still win new customers, especially in certain countries. This is true in Austria, Australia, and Switzerland, where only 53%, 57%, and 48% (respectively) of all consumers intend to shop this year. Companies should therefore target indecisive consumers with conversion-driving campaigns.

Satisfaction. There’s also an opportunity to improve satisfaction, with a mere 32% of last year’s Black Friday shoppers considering themselves “fully satisfied” with their experience in 2021. Almost half of all consumers who shopped online in 2021 encountered a stockout, while more than a third had to deal with long website-load times. By working on these issues and more, brands and retailers can beat the competition and foster repeat buying for the future.

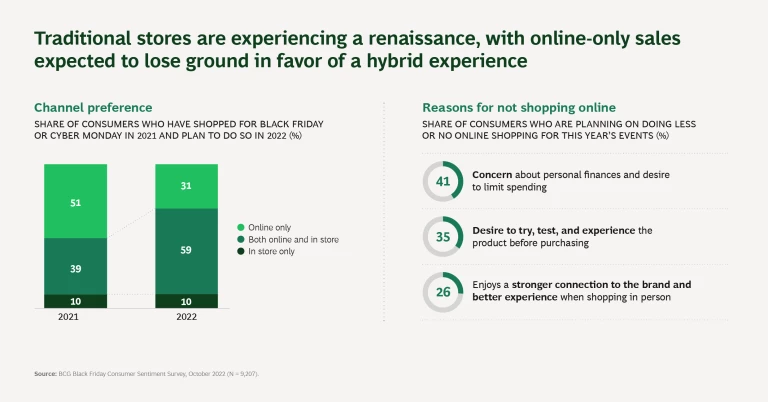

Companies should also take note of the ways that channel dynamics are shifting. While half of last year’s consumers conducted their Black Friday shopping exclusively online, less than one-third intend to do so in 2022. In-store consumption is headed for a renaissance, with nearly 70% of all prospective shoppers intending to carry out at least some of this year’s shopping in stores. Meanwhile, 60% intend to shop digitally and in person. The companies that respond to these trends with a seamless omnichannel experience will be better positioned to capture customers’ attention—and win a greater share of their wallets—than those that do not.

Emerging Trends

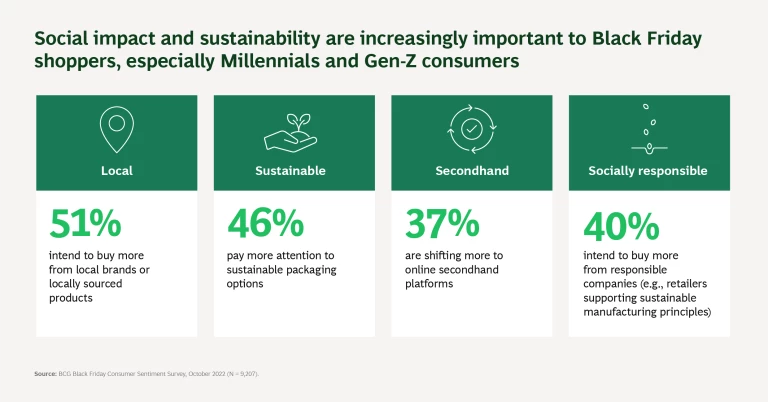

In addition to current patterns, our survey sheds light on some emerging trends that will be increasingly relevant in years ahead. There’s a growing desire—among Gen-Z and Millennial consumers, in particular—to shop sustainably and responsibly. Many of our respondents expressed the desire to buy locally (51% of consumers), secondhand (37%), and from purpose-driven companies (40%) in 2022. Given the growth in this trend, we believe that sustainability should be both a short- and long-term focus for companies, which should continue to invest in green initiatives and align their product portfolios accordingly.

The metaverse may someday—and perhaps sooner than many realize—present another powerful opportunity. For now, less than 40% of consumers claim to know much about the metaverse, with only 15% having ever used it before. But the opportunity for brands is there, with nearly one in every two consumers saying they could imagine someday conducting their Black Friday shopping in a virtual world, even in the near future.

For more information on this topic, including country-specific insights, please reach out to the author team below.