Data-driven transparency provides the basis for setting performance targets, designing and implementing collaborative vendor development programs, and activating the broader business ecosystem.

Energy companies need to accelerate efforts to improve the environmental, social, and governance (ESG) performance of their supply chains. Strong ESG performance has become table stakes for all energy companies and their suppliers. And the timeframe for hitting targets has shrunk as investors and other stakeholders demand faster improvements. Companies that fail to meet expectations will face escalating costs and risk losing their license to operate. Those that succeed will promote benefits for themselves and their supply chain partners, as well as for society and the planet.

To better understand the challenges and opportunities, BCG recently interviewed 25 chief procurement officers at leading energy players (including oil and gas companies, utilities , and integrated energy companies) around the world. Although all participants said they face increasing pressure to improve the ESG performance of their supply chains, most are just starting the journey. Many companies have struggled to measure supplier performance across the broad set of ESG categories and to extract insights from the information they collect. This lack of visibility has, in turn, made it hard to engage with suppliers to elevate performance.

Energy companies can overcome the obstacles by following a carefully planned ESG journey. Data-driven transparency provides the basis for setting performance targets, designing and implementing collaborative vendor development programs, and activating the broader business ecosystem . Enabling organizations with new capabilities and tools that promote transparency and monitoring is critical to success.

Supply Chains Should Rise on the ESG Agenda

Stakeholders are pushing energy companies to quickly improve their ESG performance. Governments are adding regulatory costs and burdens, while investors and financial institutions are considering sustainability criteria in funding decisions. At the same time, the public is demanding cleaner energy and more responsible corporate behavior across a broad range of issues. Energy companies have responded by announcing commitments that address a variety of ESG topics—including decarbonizing their business models, reducing water consumption, contributing economically to local communities, and engaging in ethical behavior.

At many energy companies, however, supply chains have been slow to rise on the ESG agenda. Oil and gas companies, for example, have typically focused their CO2 reduction efforts on their own operations—and justifiably so, considering that these scope 1 emissions account for approximately 60% of their total emissions. But supply chains account for nearly one-third of emissions today, and the contribution of these scope 3 upstream emissions to the total will increase as companies meet their net-zero commitments for operations. Adding to the urgency, companies will likely need to accelerate achievement of the emissions targets they have already set. We expect investors to demand that companies meet their 2030 targets by 2025 and their 2050 targets by 2030 or 2035.

Moreover, key stakeholders are now considering direct and supply chain emissions holistically when assessing companies’ emissions targets. For example, the new net-zero standard issued by the Science Based Targets initiative, an organization that certifies corporate emissions plans, requires companies to cut emissions across their entire value chain (all three scopes) by at least 90% before 2050.

Social and governance topics have been on energy companies’ agendas for decades. For example, these companies have been at the forefront of efforts to develop the economies of local communities where their operations are based. But to meet today’s more pressing ESG goals, companies need to step up their engagement beyond the typical community project and focus on developing local supply networks. Large energy companies, for example, can support their supply chain partners in implementing more advanced governance mechanisms, which is crucial to enabling local suppliers to expand internationally.

A Framework for Capturing the Opportunities

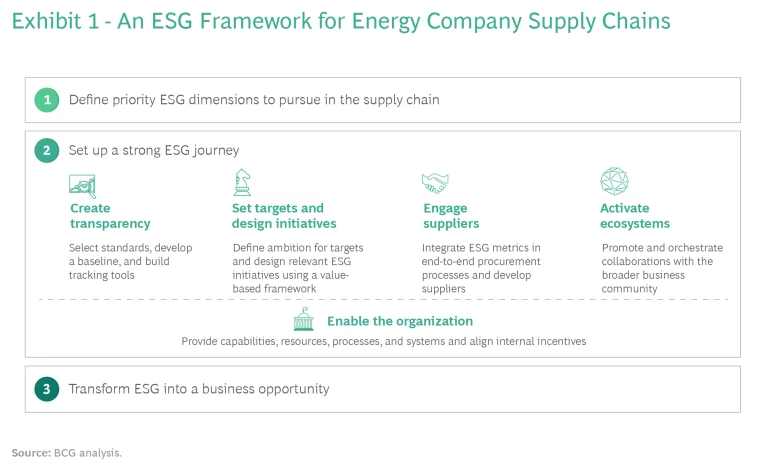

To capture ESG opportunities in supply chains, energy companies should take three main steps: define their priorities, set up a journey, and transform ESG initiatives into business opportunities. (See Exhibit 1.)

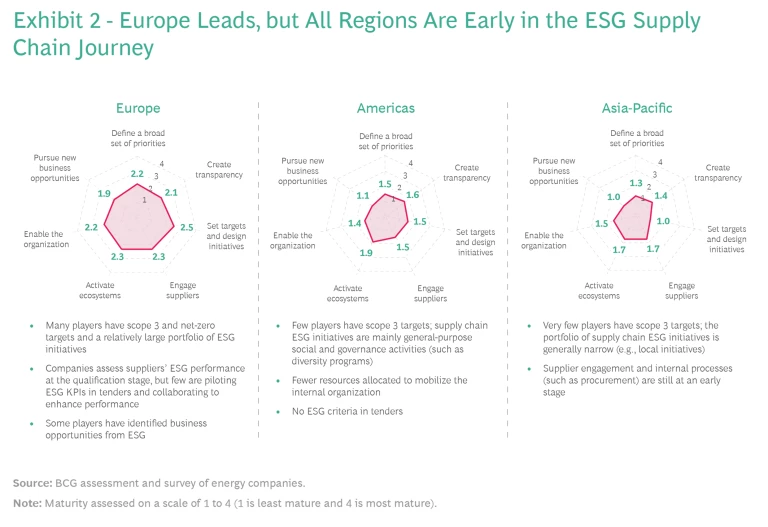

In our interviews, we noted regional differences with respect to the maturity of companies' efforts to improve the ESG performance of their supply chains. (See Exhibit 2.) On average, energy players in Europe are slightly more advanced on the journey, although still at an early stage. Very few companies in the Americas and in Asia-Pacific have a clear view of their supply chain’s sustainability performance, and neither do they embed ESG criteria into their supply chain decisions. But these companies do recognize that pressure is building to make progress.

1. Define Priorities

Supply chain managers should consider the ESG objectives that have been set at the company level—such as targets for scope 3 emissions reduction, requirements for diversity, or standards for ethical behavior—in the context of the supply chain network. They can then adapt those objectives as needed to the network’s characteristics and to the maturity of its participants.

2. Set Up a Strong ESG Journey

Setting up the journey is the most complex step, entailing five types of initiatives. The first is to create transparency into current performance. This provides the basis for setting targets and designing initiatives. Next come engaging with suppliers and activating business ecosystems, both of which are essential to achieving the company's ESG objectives. Finally, to make it all happen, the company must provide the right support to the supply chain organization.

Create transparency. Understanding how to measure the supply chain’s ESG performance has been a daunting task for energy companies worldwide. Many have relied on one-off surveys of suppliers, which often are not sufficiently comprehensive and generate few responses. Some suppliers provide poor-quality data, and energy companies struggle to validate the information they receive.

A more rigorous approach starts with selecting standards that will provide the basis for reporting and assessing supplier performance. The World Economic Forum’s "stakeholder capitalism metrics" are the result of one recent effort to create standards that are widely accepted by investors and other interested parties.

To apply these standards, managers can use commercially available digital platforms ; two oil and gas supermajors have already launched such platforms for their suppliers. These tools determine a performance baseline and then continuously measure, monitor, and report the improvements made by suppliers. To ensure information consistency and coherence, best-of-breed tools integrate with a company’s vendor management system as well as with the systems of third-party data and certification providers. Our interviews revealed a very strong correlation between a company’s early adoption of these tools and the overall ESG performance of its supply chain.

Set targets and design initiatives. Our interviews indicate that few energy companies have set clear targets for their ESG performance beyond basic health and safety objectives. Indeed, we observed a vicious cycle: companies that have not set meaningful targets approved by boards of directors and communicated externally also have insufficient funding and support for their ESG initiatives. In contrast, companies that have publicly announced a commitment to even modest ESG supply chain targets are much more likely to have achieved results. Without this type of commitment, it's hard to activate the internal support and organizational alignment required to implement initiatives successfully.

A good starting point is to set sustainable development goals connected to one or two key metrics (such as emissions reduction or water consumption). To define targets for its suppliers’ emissions, a large gas operator first chose a reference framework and measurement methodology and then set out a clear, target-driven plan to achieve its ambition. Similarly, a government regulator in Asia is embedding ESG targets into its ten-year strategic plan covering all oil and gas producers in the country and their supply chains.

Many companies have struggled to measure supplier performance across the broad set of ESG categories and to extract insights from the information they collect.

Targets provide the basis for designing a portfolio of ESG initiatives. Companies should assess potential initiatives by analyzing their spending through the lens of value. There is a misperception that improving the ESG performance of a company's suppliers will necessarily result in higher costs. But it's possible to unlock win-win solutions that will help a company and its suppliers achieve better ESG performance while reducing costs and increasing competitiveness. For example, a large European renewables operator and a global shipping operator are testing a buoy that serves not only as a mooring point but also as a charging station for vessels—enabling the substitution of green electricity for marine fuel.

Companies worldwide are studying the use of such joint “flagship” initiatives to promote circularity or an overall reduction of emissions while saving costs. To explore the possibilities, companies should select one or two procurement categories, given their suppliers and expected volumes. Establishing proof points and early successes in these categories will make it easier to scale up initiatives throughout the supply chain.

Engage suppliers. To successfully engage suppliers, companies need to embed ESG evaluations into their vendor management and procurement processes. Some leading companies, including a large integrated energy player, have developed scoring models with ESG elements for use in the bidding process. Applying data they extract from their digital platform, they use ESG scores as thresholds for suppliers making tenders or as criteria for evaluating bids.

Vendor development programs are essential for effective supplier engagement. A comprehensive program supports suppliers in balancing several objectives: CO2 footprint reduction, value delivery, risk management and resiliency, and local ecosystem development. BCG is working with several national oil companies to design nationwide vendor development programs that help suppliers meet ESG performance targets and local content requirements while keeping costs in check. These programs are on track to be launched in 2022.

Activate ecosystems. Initiatives that focus solely on tier one suppliers limit the possibilities for improving ESG performance. Instead, managers should seek to build or orchestrate ecosystems of supply chain partners and other companies. In addition to service and equipment providers, these can include financing partners to fund investments in equipment and assets, certification firms to validate outcomes, and a supply chain specialist to coordinate the ecosystem. Flagship initiatives often require one or more ecosystems in order to succeed. Indeed, the ability to design ecosystems that maximize economic benefit for all participants is crucial to achieving ESG objectives.

Data-driven transparency provides the basis for setting performance targets, designing and implementing collaborative vendor development programs, and activating the broader business ecosystem.

In Europe, for example, several energy companies have worked with financial institutions to create dedicated financing lines for suppliers participating in joint ESG improvement programs. European players have also promoted collaboration among supply chain partners. For instance, the power generation unit of a large utility is facilitating collaboration between a traditional spare-parts supplier and a provider of recycling solutions.

Enable the supply chain organization. To support initiatives along the journey, companies need to provide their supply chain organizations with the required capabilities, resources, processes, and systems. Several leading energy companies have set up dedicated ESG departments that report directly to the chief procurement officer or head of procurement and supply chain. These organizations typically serve as an ESG center of excellence that promotes standardization of practices and objectives, establishes a companywide ESG baseline, and provides capabilities and digital analytics to support end-to-end efforts. The center helps embed sustainability thinking into category management processes, supplier segmentation, and contract management, among other areas—just as maintenance centers of excellence and supply chain control towers promote excellence in their respective domains.

3. Transform ESG into a Business Opportunity

The most advanced energy companies will use supply chain ESG initiatives to create new business opportunities, whether through revenue generation, cost reduction, or synergies. Consumer companies have demonstrated the possibilities with their growing segment of sustainable products. These companies work with suppliers to, for example, offer products with a reduced carbon footprint or environmentally friendly packaging. Energy companies, despite the nonphysical nature of their services, can consider similar opportunities. For instance, they can collaborate with supply chain partners to develop circular solutions or carbon-neutral offerings that rely on carbon offsetting. They can also provide decarbonization services to their suppliers, selling them renewable or low-carbon energy products that reduce their own footprint.

Imperatives for Success

To succeed in the supply chain ESG journey, energy companies must meet the following imperatives:

- Develop an ambitious roadmap to deliver on corporate ESG objectives in the supply chain, supported by the right enablers.

- Prepare to accelerate decarbonization efforts for scope 3 upstream emissions. We believe companies will face societal pressure to achieve their 2030 targets by 2025.

- Create a comprehensive vendor development program that encourages collaboration and helps suppliers manage potentially conflicting priorities.

- Work with suppliers to identify and address social issues—for example, increasing diversity or balancing local content requirements against the impact of operations on local communities.

- Help suppliers strengthen governance. Suppliers must oversee ESG performance not only within their organization but also across their own supply chains. Small suppliers, in particular, lack governance mechanisms in important areas, such as risk oversight and ethical behavior.

Now is the time for energy companies to step up their engagement on ESG issues in their supply chains. Considering that investors and other stakeholders are pushing companies to meet emissions targets more quickly, the imperative to act is increasingly urgent. Data-driven transparency provides the foundation for designing and implementing an ESG journey that promotes collaboration across the supply chain and enables rapid improvements.

The authors would like to thank Pietro Cerboni and Paolo Trivellato for their contributions to this article.