Corporate leaders have a pivotal role in bridging the divide between institutional sustainability commitments and day-to-day investing practices.

For companies across the globe, pursuing sustainability often involves difficult tradeoffs between longer-term opportunities and near-term costs. Investor support is critical to striking the right balance. It gives management teams confidence that capital markets will reward them for investing in sustainability through higher share prices and total shareholder returns. It also gives them time to deliver on their sustainability strategies without disruption from activist attacks or takeover bids.

On the surface, investors’ support for sustainability appears strong. Leaders of top investment firms have voiced strong support for prioritizing long-term sustainability over short-term returns and profits. However, these top-of-the-house commitments by investment firm leaders are not fully reflected at the rockface of investment decisions—a phenomenon we call the “great disconnect.”

BCG’s research over the past several years provides evidence of such a disconnect. In surveys and interviews, portfolio managers and analysts have told us that they remain primarily focused on traditional investment considerations, especially potential returns from medium-term growth and profitability improvement. They point to a lack of clarity about financial returns as the most important impediment to giving sustainability greater consideration in day-to-day investment decisions. In turn, corporate executives are often uncertain about whether capital markets will reward them for making choices that promote sustainability. As a result, companies miss opportunities to deliver stronger long-term returns to shareholders by reducing material sustainability risks and/or tapping into new profit pools.

Bridging the great disconnect will require concerted efforts by investment firms, companies, and standards setters. The investment industry needs to translate leaders’ sustainability commitments more directly into day-to-day investment decision making. Companies need to give investors clear and compelling evidence of the expected benefits of their sustainability efforts—including their long-term financial returns. Standards for transparent and consistent sustainability reporting will enable investors and companies to close the gaps between ambition, investment, and value creation .

Sustainable Investing Starts—and Often Stays—at the Top

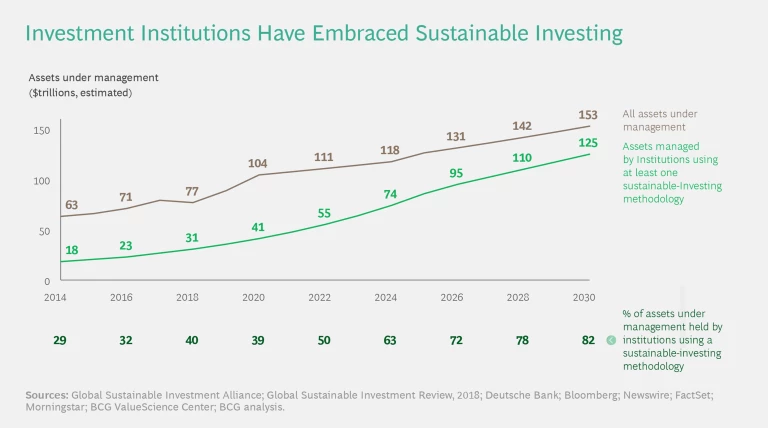

Over the past five years, sustainability issues have become important considerations across the investment industry. (See “Adoption of Sustainable-Investing Practices Accelerates.”) Advocates of sustainable investing , such as BlackRock CEO Larry Fink, regard it as a way for investment firms to promote their clients’ interests by limiting risks and capturing long-term growth and profit opportunities.

Adoption of Sustainable-Investing Practices Accelerates

The accelerating adoption of sustainable-investing practices reflects an important tipping point in the investing industry, as asset owners—such as pension funds and insurance companies—increasingly require commitments to sustainability. As a result, most investment firms also take an active stance on sustainability with the companies they invest in. Over the past several years, we have seen the number and size of ESG engagement and stewardship teams increase substantially across the investment industry.

Even more visibly, activist investors have made sustainability-related demands part of their repertoire—and even the core of campaigns. A prominent example is the success of Engine No.1, a small climate-focused hedge fund, in electing three members to the board of ExxonMobil.

Still, it appears that ESG commitments have not yet led to a broad-based surge in truly sustainable investments. Although most investment firms have adopted some form of sustainable-investing practices, these are often limited to “negative screening” strategies that prohibit investing in certain sectors or companies. More advanced sustainable-investing strategies focus on “ESG integration” (actively incorporating forward-looking ESG opportunities and risks into investment decisions) or “impact investing” (targeting investments that promote sustainability and measuring and reporting the impact).

Indeed, BCG’s analysis found that less than 5% of all mutual funds are currently classified as "sustainable" (based on Morningstar’s designation). This relatively low share follows Morningstar’s thorough assessment of whether funds bearing its sustainability label were truly investing in sustainability. For example, in February 2022, Morningstar removed its sustainable designation from 1,200 funds with total AuM of $1.4 trillion.

Morningstar’s cleanup efforts are indicative of the often unclear and misleading definition of sustainable investments, which is further highlighted by controversies surrounding exaggerated claims, or “greenwashing.” To improve the consistency and reliability of sustainability labeling, the US Securities and Exchange Commission has proposed rules to increase the level of disclosure from investment funds and advisors that market themselves as having an ESG focus.

However, the investing industry’s strong emphasis on sustainability has not trickled down to day-to-day investment decisions by mainstream investors (as opposed to those who are specifically focused on sustainability). Over the past several years, the findings of BCG's Investor Pulse Check series and Global Investor Survey, as well as investor interviews, have suggested that most portfolio managers and analysts do not make sustainability a prominent consideration. (See “About BCG’s Investor Surveys and Interviews.”)

About BCG’s Investor Surveys and Interviews

- Global Investor Survey. We have conducted this survey annually since 2009. The current article addresses findings from the 2019 and 2021 surveys, each of which comprised approximately 350 participants.

- Investor Pulse Check. Since March 2020, we have conducted frequent surveys to help corporate executives and boards of directors understand investor perspectives in today’s rapidly changing environment. The current article addresses findings from the first 21 surveys—the most recent of which was conducted in October 2022 and comprised more than 3,000 participants.

To gain deeper insights into specific sustainability-related topics, BCG has also conducted several surveys targeting sustainability-focused investors as well as asset managers more broadly. This article draws on insights from these surveys but does not present specific results.

Our analysis of all survey results is supported by interviews with more than 4,000 investors and sell-side analysts on behalf of our clients. During the past 12 to 24 months, sustainability has consistently been a topic in these interviews.

Investors participating in the Pulse Check surveys have consistently given sustainability and other environmental, social, and governance (ESG) considerations a ranking of 13 through 17 out of 18 key investment criteria. No individual ESG consideration is ranked by more than 5% of respondents as a top-three investment criterion. This confirms that mainstream investors remain squarely focused on financial metrics, especially revenue growth potential, valuation levels, and opportunities to grow profitability. Similarly, only 5% to 7% of investors rank climate (and other environmental risks) among their top three macro concerns. Investors assign much greater importance to traditional factors such as inflation, macroeconomic and geopolitical risks, supply chain disruptions, and asset prices.

Although there is ample evidence that investors want healthy companies to maintain their ESG commitments , our survey respondents are not giving materially greater consideration to ESG in their day-to-day decisions. In fact, an increasing number admit to not considering it at all. Among respondents in our 2021 global investor survey, 46% said that they actively consider ESG—only a 2 percentage point increase from 2019. In the same survey, 33% of respondents said they do not consider ESG—a 9 percentage point increase from 2019.

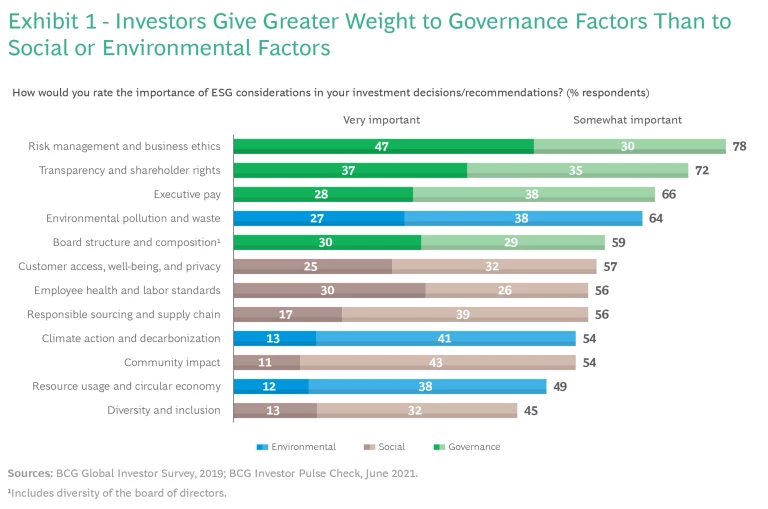

The growing share of respondents who do not actively consider ESG points to how sustainable investing has become an increasingly divisive topic—with a backlash evident in political debate and the media, as well as from anti-ESG activist investors. Not surprisingly, there is more consensus among investors on the importance of traditional governance criteria than on that of environmental or social agendas. (See Exhibit 1.)

Our interviews with more than 100 investors conducted over the past year paint a similar picture. Interviewees consider sustainability predominantly in terms of risk, and they avoid or sell stocks carrying material sustainability concerns. Beyond that, sustainability is not a key investment consideration.

All these observations suggest that the investing industry’s commitments to sustainability are disconnected from day-to-day investment decisions, which remain laser focused on financial and shareholder returns. This raises a critical question: Why have investors not "walked the walk" by incorporating sustainability more firmly and consistently into their decision making?

Interrelated Challenges Underlie the Great Disconnect

Our findings indicate that the challenges to sustainable investing addressed in our previous research still exist. The disconnect between institutional sustainability commitments and day-to-day investing practices, in particular, is the result of three interrelated challenges: a lack of incentives and quantification, unclear financial benefits, and inconsistent reporting and data.

Lack of Incentives and Quantification. Asset managers’ investing practices, and the underlying incentives, have traditionally focused on short- to medium-term investment returns. So far, only about half of all investing institutions include sustainability in their incentive systems, and an even smaller share measure their sustainability footprint.

In our interviews with managers and analysts who make day-to-day investment decisions, we observed a “check the box” mindset. These investors abide by corporate guidelines (requiring minimum ESG scores, for example, or excluding certain sectors, such as tobacco or oil and gas). But sustainability plays no further role in their investment theses, which are focused on expected financial performance, valuation upsides, and capital allocation.

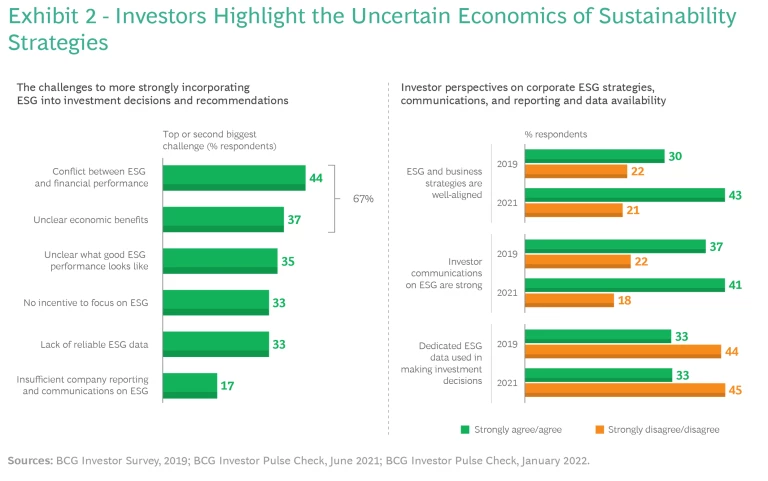

Unclear Financial Benefits. When asked about the most important challenge to making sustainability a more prominent investment consideration, 67% of portfolio managers and analysts highlighted concern about whether this conflicts with a company’s financial performance or provides clear economic benefits. (See Exhibit 2, left side.) This indicates that investors want companies to look at sustainability not in isolation but as part of their business strategy and capital allocation. In other words, they expect sustainability to translate into stronger financial performance and TSR, but not to be an end in itself.

Investors also want companies to help them make more explicit connections between sustainability and value creation—that is, how sustainability creates or strengthens competitive advantage or business resilience . Although companies have made strides in integrating their ESG and business strategies, less than 50% of investors believe that these strategies are well aligned. Additionally, only 40% say that companies are doing a good job at communicating their ESG objectives, strategies, and initiatives. (See Exhibit 2, right side.)

Inconsistent Reporting and Data. ESG professionals have long highlighted the lack of consistent sustainability reporting standards and readily available data. Indeed, only one-third of investors report that they use dedicated ESG data in their investment decisions and recommendations. (See Exhibit 2, right side.) That is, investors are unable to incorporate sustainability performance into their investment decisions because they cannot effectively measure and connect it to expectations for financial performance and value creation. As a result, companies are making strategic sustainability decisions and investments without any reassurance that key stakeholders will reward their efforts.

Three Imperatives to Bridge the Gap

Sustainability, especially decarbonization , will create winners and losers across and within many industries. So it’s a matter of when, not if, sustainability initiatives will translate into tangible financial results for shareholders. Investment firms, companies, and standards setters all have a role to play in removing the obstacles to making sustainable investing more mainstream and a more powerful engine for sustainable value creation.

1. Embedding Sustainability in Day-to-Day Decision Making

Asset owners are continuing to increase their demand for ESG-focused investment products. This will motivate investment firms to further shift their focus toward longer-term, sustainable value creation and to make the required organizational and cultural changes.

It’s a matter of when, not if, sustainability initiatives will translate into tangible financial results for shareholders.

To realize their ambitions, these firms must translate institutional sustainability commitments into day-to-day investment decisions and embed sustainability more fully into their toolkits and incentives. Success requires a more comprehensive approach that moves far beyond negative screening, which remains the most common method. Private equity firms —with their full control of and transparent reporting on portfolio companies—can serve as role models for public investors.

2. Integrating Sustainability and Value Creation

Companies need to better understand and articulate the business cases for simultaneously targeting sustainability and financial returns. They must take three essential actions:

- Apply a value creation lens to sustainability that considers its impact on longer-term growth, profitability, and valuation, as well as the capital spending required. Companies need a tailored capital allocation approach that ensures attractive returns on investments without stifling green initiatives. Similarly, portfolio decisions—including assessment of acquisition targets—should explicitly incorporate climate and sustainability considerations.

- Provide clear and compelling investor communications that highlight sustainability’s role in the company’s investment thesis—including expected financial returns and risk implications relevant to investors.

- Establish capabilities to track and manage the company’s sustainability footprint, including carbon accounting and pricing, and to integrate the related insights into strategic decision making and sustainability reporting.

In our experience, companies that understand and articulate the economic case for sustainability can garner strong investor support and translate these investments into value creation. For example, in October 2021, Dow Chemical announced a comprehensive sustainability strategy to achieve carbon neutrality by 2050. In addition to pursuing initiatives such as plastic circularity and bio-plastics, Dow committed to investing $1 billion annually to decarbonize its plants, including construction of the world’s first carbon-neutral ethylene cracker. Since the initial announcement, Dow has reinforced its messaging by highlighting the long-term EBITDA potential and the expected return on capital, while also sharing key milestones and medium-term financial targets. Over the eight months following the announcement, the company’s TSR clearly outperformed the average of its peers.

Companies need to thoughtfully assess the long-term strategic and financial benefits of their sustainability efforts relative to their costs and investment needs.

Despite such encouraging examples, the market will not immediately reward all investments in sustainability, especially if they initially are subscale, overshadowed by other developments, or last beyond typical holding periods. (See “Does Sustainability Affect Company Valuations?”) To be prepared, companies need to thoughtfully assess the long-term strategic and financial benefits of their sustainability efforts relative to their costs and investment needs. And they must understand the importance of sustainability overall and of specific components, such as carbon emissions, for investors in their sector.

Does Sustainability Affect Company Valuations?

This lack of consistent evidence likely reflects investors’ requirement that sustainability meet several criteria in order to be valued:

- Its impact must be incremental. More than 80% of differences in valuation multiples can be explained by differences in business models, financial profiles, and capital market conditions. For sustainability to truly have a valuation impact, it must meet the high bar of adding to the positive impact of these factors. That is, growing revenues and profits by investing in sustainability is not sufficient. Investors also need to value each incremental dollar of sustainable revenue or profit more highly.

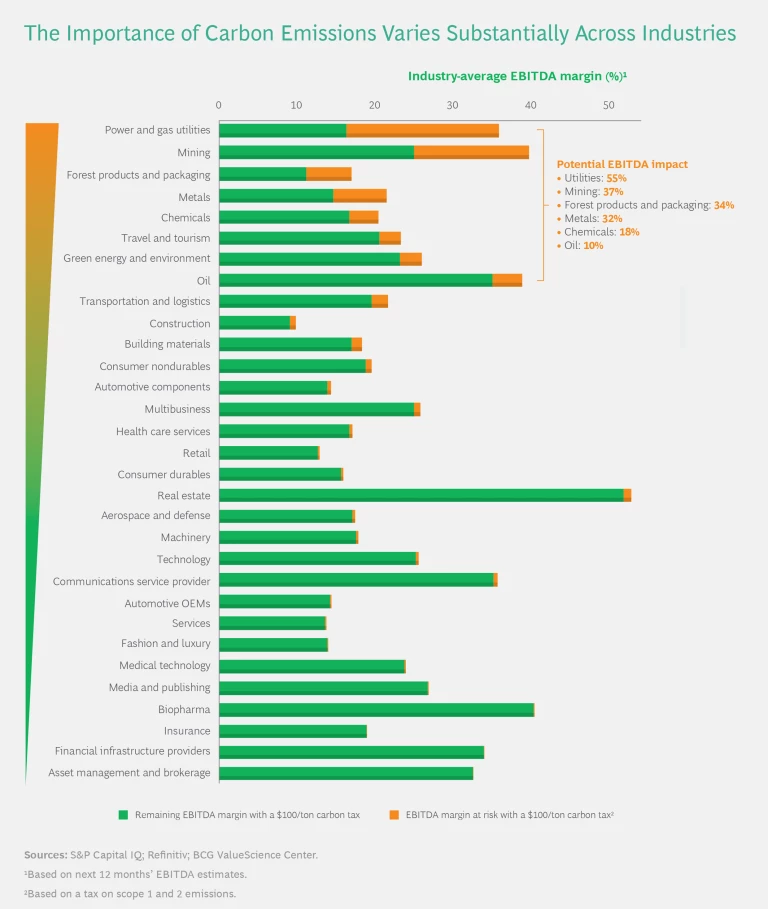

- Its impact must be material. The economic importance of sustainability and its specific components may vary substantially across different sectors. For example, a tax of $100 per ton on carbon emissions would reduce company profits by 10% or more in a handful of industries but in others would barely have any impact. (See the exhibit.) Not surprisingly, those industries in which carbon taxes would have a more meaningful impact on profitability are also the ones in which low emitters tend to have higher valuation multiples.

- Its impact must be causal. Even when companies that are sustainability leaders have premium valuations, the question often remains: Which is the hen and which is the egg? Although sustainability could promote higher valuations, the correlation could also be due to the fact that higher-valued companies with stronger business models have the resources and freedom to invest in sustainability. It will be important to closely monitor how such patterns evolve over time.

Encouragingly, there is reason to believe that the link between sustainability and valuations will become stronger and more consistent. In a BCG investor survey focused on carbon-emitting industries, only about half of respondents—ranging from around 40% in transportation to 67% in power production and utility—reported that climate leaders currently receive a valuation premium. However, more than three-quarters of respondents said they expect climate leadership to translate into premium valuations by 2030.

3. Improving the Clarity and Consistency of Sustainability Reporting

Finally, investors and companies will benefit from better and more consistent sustainability reporting. Standards setters—including the International Sustainability Standards Board—have committed to rapidly developing and rolling out standards. The European Union has taken a leading role by mandating certain disclosures starting in January 2023. As a result, we expect firmer guidelines, more advanced requirements, and expanded regional coverage in each year going forward.

While public equity markets are waiting for consistent sustainability standards to emerge, private equity investors have already taken on similar reporting challenges . Early insights from such pilots highlight the importance of a focused set of key metrics that enable investors and corporate leaders to prioritize their efforts. Of course, this may present new challenges, since any new reporting standards will almost certainly be extensive and complex.

Fostering a Virtuous Circle

Although all the various stakeholders will need to do their parts, the pivotal role in meeting the challenges of sustainable investing will be played by companies themselves. Corporate leaders have an opportunity to build a virtuous circle that starts and ends with fully integrating sustainability into corporate strategies and investment theses. Doing so involves several steps:

- Identifying and targeting sustainability-driven shifts in profit pools

- Assessing sustainability-related portfolio risks and opportunities, including the role of M&A in sustainability

- Understanding investor perspectives and the implications for valuation

- Taking a leading role in sustainability reporting and communications

- Assigning clear responsibilities for the sustainable value creation journey, including a leadership role for the CFO , whose organization is uniquely equipped to make the connection between sustainability and value creation

These steps will enable companies to determine and articulate how sustainability strategies can deliver longer-term advantages and financial returns. Clear upsides and messaging, in turn, will increase the likelihood that investors will reward companies with stronger valuations and stock performance. Finally, if corporate leaders know that capital markets will appropriately value sustainability performance, they will gain the confidence needed to reinforce their sustainability commitments and mobilize their organizations around sustainability ambitions.

The authors thank their colleagues Alexis Colombo, Michael Demyttenaere, Boryana Hintermair, Ryan McKenzie, Michael McLaughlin, Rachna Sachdev, and Hardik Sheth for contributions to this article.