The environmental, economic, and health benefits of meat grown from animal cells are clear. Cost and taste parity are on the horizon. What will it take to scale up cultivated meat in the UK?

Humans like to eat meat—a lot of it. Global meat consumption per annum exceeds 320 million metric tons

That’s why developing alternative forms of meat, whether derived from plants, microorganisms, or animal cells, will be critical in meeting the Paris Agreement goal to limit global warming to 1.5°C. Already, according to a recent BCG report , plant-based meat substitutes are beginning to reach parity with traditional meat in terms of cost, taste, and texture—and microorganism- and animal cell-based meats are expected to reach this milestone over the next decade or so.

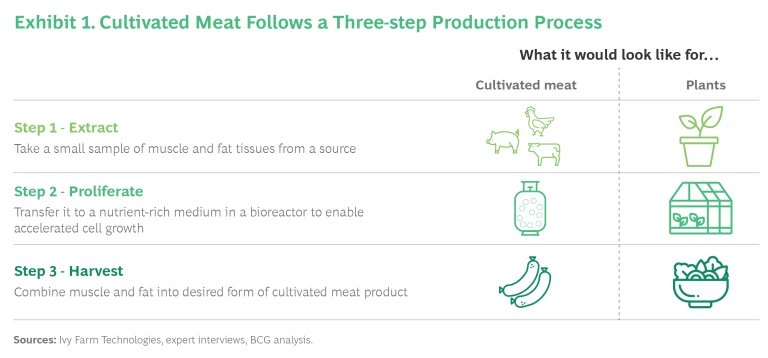

This report focuses on meats based on animal cells, or “cultivated meat.” The product is composed of the same cells as traditional meat; it’s just grown differently (see Exhibit 1). If cultivated meat can be made to taste, feel, and look the same as traditional meat, at close to the same price, it has the potential to become one of the preferred substitutes for the meat from cows, pigs, sheep, goats, and chickens that people have enjoyed for thousands of years.

In assessing the market potential and future value of cultivated meat, we have chosen to focus on its potential impact on the UK, where 55% of the pig and 30% of the beef, veal, sheep, and lamb supply are imported.

For cultivated meat to reach its full potential in the UK, however, it must become a widely available, preferred choice among consumers. This in turn will require collaboration on the part of all potential stakeholders—not just private sector players such as cultivated meat producers, food companies, restaurants, and retailers, but government policymakers and regulators too.

Cultivated meat by itself can’t solve all of the UK’s climate- and land use-related problems. In time, however, it can make a real contribution to the effort. The next sections look at the size of the opportunity in the UK and what it will take to get there.

Cultivating the Benefits

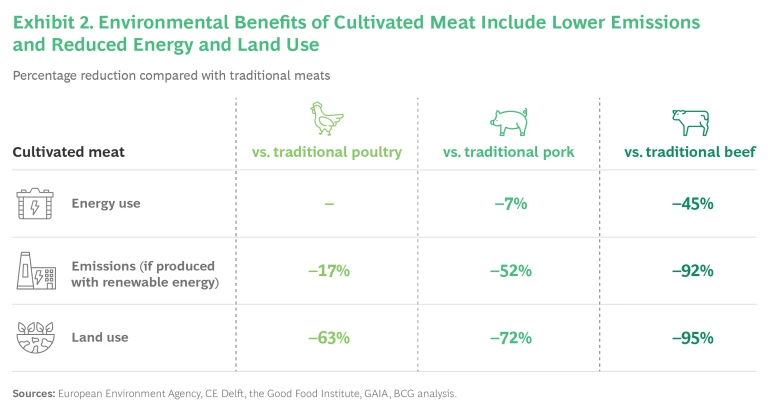

The environmental and health benefits of cultivated meat are undeniable. Compared with traditionally produced European beef, for example, cultivated meat uses 45% less energy according to estimates by the European Environment Agency. And when produced using renewable energy, it can emit up to 92% less GHG and use 95% less land and 78% less water compared to traditional beef (see Exhibit 2).

The benefits extend beyond those directly attributed to production. For example, less land use would reduce deforestation related to livestock farming and help increase overall nature-based carbon capture. And there’s no manure, so the risk of pollutants leaking into surface or groundwater is nonexistent.

Cultivated meat also has the potential to improve human health. By manufacturing the protein and fat that constitute meat separately, they can be recombined in custom ratios in the final product. Companies are already exploring technologies that allow them to optimize key amino acids and fats that can support a healthy diet. Cultivated meat also eliminates many of the health risks posed by traditional meat production. In many regions, the meat industry uses antibiotics in animal feed to prevent disease in livestock, a practice that has contributed to the rise of antibiotic-resistant diseases. But cultivated meat can be manufactured without any antibiotics at all.

While cultivated meat is not yet available in most of the world—so far only Singapore has approved it for consumption—the demand for more sustainable food options, including substitutes for eggs and dairy products, as well as meat, is rising fast.

When the entire value chain related to cultivated meat is included, the industry could drive significant value for the overall UK economy.

In a

recent BCG report

, we estimated that cultivated meat would capture a 6% share of the global alternative protein market by 2035. It is likely to capture an even higher share in the UK, where a third of consumers are already willing to try cultivated meat

Ensuring Success

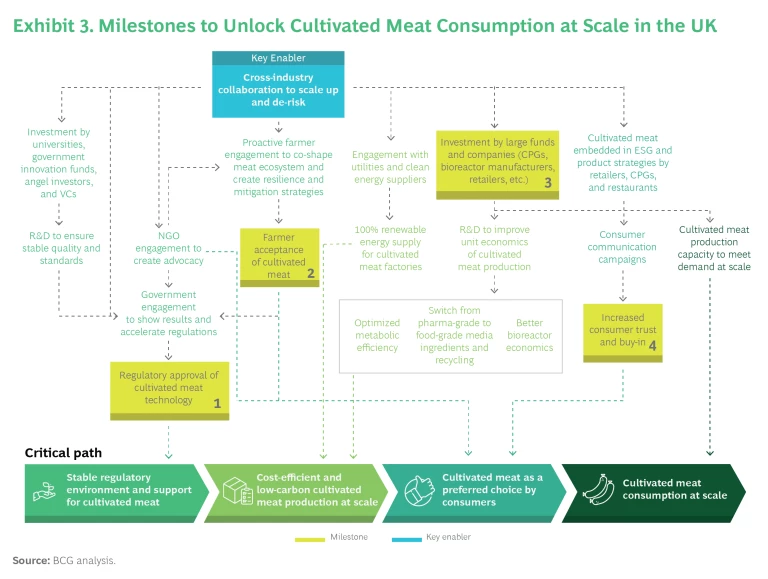

For a revolutionary innovation like cultivated meat to reach its full potential environmentally and economically, an approach that engages and moves the entire meat value chain will be required. The critical path to this goal has four main steps, each enabling the next: a stable regulatory environment; cost-efficient, low-carbon production at scale; consumer acceptance; and large-scale consumption (see Exhibit 3).

To reach each step along this path, certain milestones must be achieved:

1. Regulatory approval of cultivated meat technology. A strong and stable regulatory environment will be critical to ensuring consumer trust, quality standards, and private-sector investment. The first step is for the UK government to support the introduction of cultivated meat technology and the Food Standards Agency (FSA) to approve its safety. Singapore’s regulatory approval of cultivated meat depended on meat producer Eat Just working with the Singapore Food Agency to prove that the company could meet food safety requirements for novel foods and manufacture a high-quality product consistently and dependably.

The UK can take inspiration from examples like Singapore as well as its own previous successes in other innovation areas that were results of favorable regulation. The country’s progressive and forward-thinking regulatory environment for financial technology, for example, has triggered a strong ecosystem of startups, banks, and talent, making London one of the top three FinTech hubs globally.

Changes to the FSA’s Novel Foods Regulatory Framework will be essential in kick-starting the cultivated meat industry. The framework should reflect the pace of innovation in the sector. Advances in this field are happening quickly: by the time a company receives approval for their cultivated meat product, the technology might have moved to a new level—with new considerations and requirements. By establishing a suitable approach to regulation that takes into account the rapid pace of innovation, the burden on both industry and regulator can be reduced.

The UK’s most recent Government Food Strategy, published in June 2022,

2. Farmer acceptance. For cultivated meat to gain government support and consumer acceptance in the UK, the country’s farmers must also accept the industry. They will need to be convinced that their livelihoods won’t be affected, especially those running family farms and small to medium-size operations. Ensuring the survival of these farms will be essential in building public and governmental support for cultivated meat.

As a first step, it is critical that farmers understand that the first cultivated meat products will likely be minced meat—and that consumers will continue to demand high-quality cuts of meat such as steaks. Promoting cultivated meat as a way to reduce the country’s dependence on imported meat would also likely ease farmers’ concerns.

Producers of cultivated meat, major companies along the cultivated meat value chain, and NGOs should engage with farmers to convey these messages and shape the overall meat ecosystem. They also should work to mitigate any potential adverse effects that the transition to cultivated meat might cause.

3. Investment in R&D to improve unit economics. It will take time for cultivated meat to become economically viable—longer than for plant- and microorganism-based meats. We estimate that it will reach price parity with traditional meat sometime in the early 2030s. To get there, the manufacturing process must optimize the calorific value of the inputs required with the calorific value of the final cultivated meat product. In addition, the cost of the medium in which the cells are grown must decline and the economics of the bioreactors used must improve.

All of this will require major R&D efforts, which in turn will require significant investment by large funds and key players, including consumer products companies, bioreactor manufacturers, and retailers. To encourage investment, cultivated meat producers and leaders among these key players must be able to demonstrate—through projects showing progress in parity on texture, taste, and cost, and careful analysis of consumer demand—that the hoped-for returns for investors are real.

The UK government can also play a role. It could, for example, provide incentives to investors through programs like the Enterprise Investment Scheme, dedicate matching grants for R&D as part of initiatives like Innovate UK, and offer the industry further tax credits for R&D. It could also provide support through direct funding of research institutions to develop the technology. The UK government’s recent food strategy report commits to dedicating part of its £120 million food systems research fund to alternative proteins generally,

A concerted effort to make the UK a global hub for cultivated meat research would have the added benefit of attracting and retaining workers with relevant expertise in the UK, further accelerating the country’s R&D efforts.

4. Consumer acceptance. For cultivated meat to become one of the “default” menu options for consumers, it must not only reach parity in cost, taste, and texture with traditional meat. Consumers must also accept the idea of consuming meat grown in bioreactors. All of this requires significant effort from all stakeholders.

Collaboration among players in the cultivated meat value chain is a key enabler to scaling up the industry.

Consumer packaged goods companies, retailers, and restaurants can help with this by including the development and promotion of cultivated meat products in their environmental, social, and governance goals and product strategies, alongside plant-based proteins. This could involve designing engaging communications strategies across different platforms to increase product awareness and promote it as a viable option. Consumers must be able to understand what cultivated meat is, how it is made, and its health and environmental benefits; trust is essential to engender support.

Cross-industry collaboration. No single company will likely have the financial or operational capabilities to drive advances in cultivated meat technology to the point where it becomes competitive. Hence, active collaboration among players in the cultivated meat value chain—including producers, CPG companies, retailers, restaurants, and NGOs—will likely be necessary. Together these parties can work to ensure farmer acceptance and protection during the transition, encourage regulatory change, drive the required investment into the technology, and promote consumer buy-in at scale.

One way of igniting this collaborative effort in the UK would be to form a consortium, ideally before the end of this year, with the goal of achieving the following:

- Align on a strong cultivated meat strategy and timeline for the UK, and ensure commitment on the part of all stakeholders.

- Identify the key R&D and investment priorities needed to promote the safety, stability, and taste and price parity of cultivated meat—and engage with large investment funds and other potential investors, including consumer goods companies, bioreactor manufacturers, restaurants, and retailers to pursue further development.

- Develop and start executing on strategies to generate consumer awareness and buy-in, and engage with government to generate regulatory support.

The UK’s Alternative Proteins Association, which focuses on the broader set of these products, provides a strong signal of the interest in exploring alternatives to traditional sources of proteins in the UK. A consortium made up of influential players in the UK that concentrates even more specifically on cultivated meat can play a critical role in the speedy development of this essential addition to our future diets.

Conclusion

The adverse consequences of traditionally produced meat—on health, land use, climate, and the environment—are undisputed. Cultivated meat will likely reach key points of parity with traditional meat by the early 2030s, and thus offers a promising path to encourage people to eat more sustainable forms of protein.

A concerted effort on the part of all stakeholders in making cultivated meat a regular part of people’s diet would enable the UK to take a leadership role in this transition. The benefits of success—economic, environmental, and social—would extend across the entire cultivated meat value chain and throughout the nation’s economy. And the time to act is now.