The best approach to zero-based transformation comes from treating all spending as investment and making the CFO a key strategist for generating value.

Over the last ten years, the role of the chief financial officer has evolved dramatically. While in the past the CFO had a mandate to keep budgets and expenditures in line with profitability, today their role is to determine the value proposition of all financial activities. As the world faces an era of unprecedented change and upheaval, it is more important than ever for the CFO to act as value architect to assure that a business is resilient enough to thrive in times when the unexpected is becoming the norm.

One area in which the CFO can play a more strategic role through a zero-based transformation (ZBT). Beginning in the 1970s, businesses have used zero-based budgeting to reset their cost base and structure. While all zero-based budgeting is transformational, companies now need a longer-term, more sustainable way to reallocate costs so that they can dynamically redirect funds toward their most strategic priorities. This is a CFO-led zero-based transformation that treats all expenditures as investments in enterprise strategy and future needs, rather than setting allocations according to past performance and power centers. This budgeting approach builds resilience and agility only if it’s seen as a permanent change, however; a cultural transformation rather than a one-time initiative.

A CFO-led zero-based transformation treats all expenditures as investments in enterprise strategy and future needs.

Such a transformation requires a company-wide effort to determine what the future needs will be. It necessitates that one C-level executive is in charge of breaking down existing silos and creating a clear strategy for how the company will finance its future growth. No one is better placed to carry out this vision than the CFO. This is the executive who can determine and articulate the reasons for shifting budgets from one division to another, reshape the P&L for what comes next, and modify the incentives that have led to the ways the organization has spent and saved money in the past. The CFO of the future will be an arbiter of how the organization will generate value and keep its growth sustainable through whatever disruptions and economic conditions come next.

Transforming to Build Resilience

The traditional approach to uncertainties and rising costs would be for the CFO to launch an aggressive cost-cutting initiative in which nearly every business unit has to downsize and lower expectations. However, we’ve seen over and over again that this “slash and burn” approach can be damaging over the longer term. Companies will hold off on investment in future growth, sometimes cutting back on maintenance expenditures so that equipment or services become less efficient. Then when the outlook becomes brighter, there may be insufficient funding to rebuild.

Increasingly, the CFO’s job is to assure that this scenario doesn’t happen. Zero-based transformation is a far more long-term approach to assuring that innovation and growth can take place in any economic circumstance.

The CFO of the future will be an arbiter of how the organization will generate value through whatever disruptions come next.

As a value steward and risk manager, a CFO is accustomed to monitoring inflationary trends and understanding the company’s exposure. At a time of rising costs, the CFO has multiple levers for protecting against inflation. These include making portfolio adjustments, assessing the impact of the cost base, reducing capital expenditures, incorporating an inflation hedging strategy, adjusting pricing strategies, and saving on expenses. All these tactics and more should be addressed by a zero-based transformation.

However, while inflation is top of mind right now, CFOs should view this transformation as an opportunity to do much more. (See Exhibit 1.) It should not be a quick cost cutting initiative, but rather a transformative and sustainable way to manage costs so that the business is ready the next time it’s hit with an external shock. The reach of ZBT goes well beyond indirect expenses to a comprehensive review of the entire cost base and P&L structure.

A ZBT should address how the organization will invest in strategic priorities across the enterprise. These might include new capabilities, digital transformation, supply chain resiliency, net-zero ambitions, and environmental, social, and governance (ESG) initiatives.

Setting a balance between investment, growth, and margin improvement is a significant challenge for any organization, no matter how high performing it is now. For example, in the oil and gas sector there is the need to maintain current business profitability while freeing up funds to invest in the transition to new sources of energy. In the industrial goods sector, the COVID-19 pandemic has underscored the need to invest in the supply chain to increase resiliency and mitigate future mass disruptions. Each of these sectors faces increasing pressure from different actors, including consumers, governments, and activist investors, to embrace sustainability in their products, operations, and services.

In leading a transformation that will keep investment, growth, and margins balanced in a sustainable way, a CFO will need to determine how the transformation will fundamentally reset the company’s cost base. Post COVID, the CFO will need to identify the cost changes that are now structural, such as supply chain reconfiguration to mitigate future disruptions, versus costs that are temporary artifacts of the pandemic, such as enhanced cleaning and PPE requirements. Cost structure optimization will mean assuring that there are support functions in place to rigorously determine the value that each expenditure stands to deliver.

For example, if a company has recently made an acquisition, ZBT becomes the lever to fully integrate the acquisition, increasing both the likelihood of realizing deal synergies and the pace at which it happens. If an organization has recently divested a line of business, the transformation can be a means to strip out legacy costs that remain even after the business unit is gone. ZBT can also help manage shareholder activism when a company needs to demonstrate that a strategy for achieving higher profits is underway.

A zero-based transformation will allow the CFO to gain clarity on the fundamental profitability drivers of the company now—a process that should be reexamined and challenged every year. This is a matter of examining the logic of all costs in terms of the relation between price and quantity, including the drivers of demand cost and how the number of units is determined versus the supply cost and how the unit rate is determined.

The analysis of what drives profitability will bring visibility to hidden costs that are not readily understood by the organization. It uncovers the detail behind functional allocations, such as centralized costs such as HR, finance, and IT costs, that impact the budget of the business units. Costs like these are typically lack transparency and consequently drive the unintentional behavior of employees using more of the allocation because it appears to be “free.” The goal is to create a new level of transparency and understanding that will be clear to both the financial division and the business as a whole, thereby making it possible to bend the cost curve between price and quantity and transform P&L in a sustainable way.

Although the directives should come from the CFO and the financial team, a zero-based transformation will have a resounding impact across the entire organization. It will bring a new approach to the way all costs are determined and approved. The CFO will keep a constant eye on ways to build future resilience by allocating budgets to areas where there is the most expectation of innovation and growth. This typically requires establishing a Value Capture Office (VCO) that becomes a central reporting and tracking center reporting to the CFO, on a permanent basis.

There will also be a need for new capabilities, many of which are “softer” skills not traditionally core to finance. The finance division will need to shift away from facilitating tedious budgeting exercises, and toward conducting insights-driven conversations around tradeoffs and value generation. It will be more important than ever for finance professionals to be comfortable with analyzing new sources of data, utilizing dynamic planning tools, developing and understanding business scenarios and their implications, quantifying impact, and communicating their findings with the company’s leadership. In particular, the organization will need a CFO whose nontechnical talents include the ability to communicate the purpose and value of the transformation throughout the organization, collaborate cross-functionally to assure that the strategy works, and build enthusiasm around value generation.

Delivering the Message and Building Momentum

It is always a challenge to win the staff of an organization over to changes, perhaps especially when the program begins with the term “zero based.” Some will resist the idea of doing things differently. And everyone will recognize that if spending is going to be realigned, certain business units are going to be reduced or eliminated and jobs made redundant.

The CFO should work closely with the CEO, the chief HR officer, and the entire executive leadership team to ensure that the message of “why we’re embarking on a zero-based transformation journey” is clear to the entire organization from the very start. We have found that there are three key points to deliver in presenting a successful and sustainable CFO-led transformation:

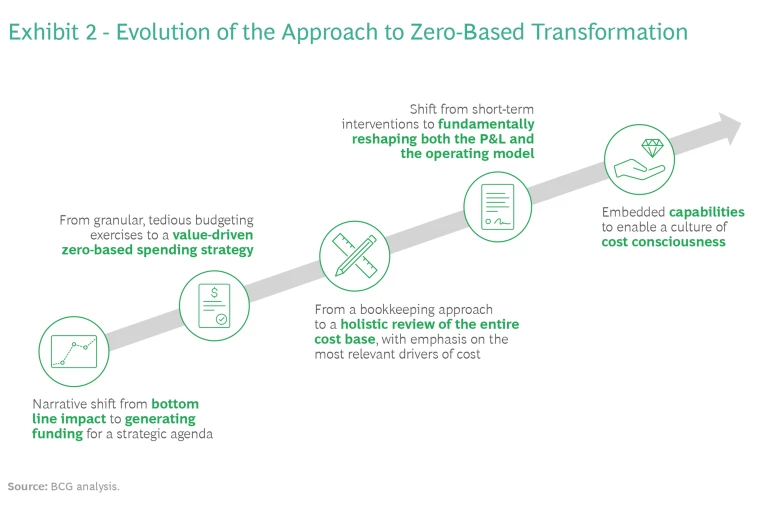

- It is not just another cost cutting program. Even in companies that have undergone previous rounds of cost reduction, this program will unlock new value through a more comprehensive review of P&L. Thinking about zero-based transformation itself has evolved significantly from narrowly focused budgeting exercises to a comprehensive business transformation and cultural change. (See Exhibit 2.) Under this new way of thinking, all costs are viewed as investment choices, rather than simply something that has to be minimized. The transformation will change the behaviors and mindset of the company by instilling an always-on cost conscious culture and capability.

- It is a business-led effort, not one determined by the finance division. Although typically it is championed and sponsored by the CFO, a ZBT involves the entire organization and demands universal ownership of decisions and outcomes. It is ultimately a fully coordinated effort among key business leaders, stakeholders, and experts throughout the organization.

- It is a purposeful transformation in which the organization is going to be re-wired. It will no longer be good enough for leaders to optimize their individual P&L; instead, they will participate in optimizing the company’s entire P&L, even if it’s at the expense of their own area of responsibility. The change will require an overhaul of incentives and metrics to drive the desired behavior and outcomes. The new system will need to ensure that individuals are not penalized for contributing to a net positive result for the overall company. The leadership teams will need to scrutinize not just what the organization spends but also what it does operationally. For example, the company’s leaders might examine a standard set of reports, looking at how they serve the intended audience, purpose, and outcomes in order to determine the reports’ utility.

Changing priorities that affect the workforce are generally seen as the downside of a strategic transformation. Inevitably, the transformation will be painful for employees whose roles do not have a place in the new value proposition. In some cases, the financial teams might find it necessary to relocate and re-staff entire business units. When retraining, talent redeployment, and remote work are viable and value-enhancing options, the CFO can and should work with other senior leaders to invest in those members of the existing workforce who have the potential to contribute to future growth.

While it won’t be possible to ease the pain for everyone, CFOs should be aware—and make the entire organization aware—that a zero-based transformation also presents a unique opportunity to create significant upside for certain groups of employees. The CFO is generally charged with becoming the sponsor and champion of a team of investment category owners (ICOs) who are appointed to lead the development of initiatives in each cost area. This is an expansion of the role formerly known as cost category owners and one that is critical to the success of the transformation. Investment category owners are catalysts for change management. ICOs challenge the status quo and work with business unit managers to uncover opportunities for mining value, holding budget owners accountable, and fostering the right mindset.

In many companies, the CFO and other senior managers handpick financial professionals from one to three levels below the C-suite to act as ICOs. It is a “plus one” role for these individuals, in addition to their regular day-to-day role, but it is a high-profile assignment and therefore a coveted one. ICOs have regular interactions directly with the management team, which means the individual has unparalleled exposure to the company’s senior leadership and visibility across multiple businesses and functions. Each ICO remains in their role for approximately two years.

With the responsibilities and exposure that come with the assignment, at many companies the ICO role has become a training and proving ground for future leaders and a key element of succession planning—within the finance function but also in other business areas. We have seen some highly successful transformations in which the CFO designs the ICO role to be a career accelerator for select employees. In these cases, the company provides extensive training, which is in itself an investment in identifying and developing top talent that might have otherwise been overlooked. At several global consumer products companies, we have seen the CFOs create ongoing ICO training programs that invite internal candidates to apply. The need for ICOs will be continuous, so it is important that companies continue to develop the talent pipeline for roles that are still quite new in many companies.

Making the zero-based transformation the CFO’s signature program is critical to getting the transformation formula right. The CEO defines the vision and is focused on the future of the company. Other members of the executive team are focused on their respective domains: the CHRO on talent and culture, the COO on supply chain and production, the CMO on brand strategy. But the CFO is the one senior leader who truly takes an across-the-board view of the organization and can link corporate strategy to investment priorities and investment priorities to funding sources. The CFO also has the ability to create funding sources through rigorous management of P&L.

Even when a CEO institutes cultural changes in the face of, say, an acquisition threat or other risks, the CFO’s leadership becomes critical to building—and sustaining—the momentum behind new spending and investment strategies. Organizations that design a CFO-led transformation with top-to-bottom alignment tend to outperform those that view the program as a project to complete rather than a truly transformational effort.

In one successful transformation, a global food group had experienced a decade plus of inorganic growth, largely through acquisitions. The company had greatly expanded its scale and geographic reach, but the acquisitions had added complexity and inefficiencies that led to slower growth, flat profits and an inconsistent cultural identity. In the year before the company embarked on a zero-based transformation, the CEO began a process of implanting a common performance management approach that stressed accountability of the individual for results and an ownership culture.

The transformation, however, became the mechanism to further break down silos and demonstrate the power of taking a cross-enterprise view. The CFO led the ZBT agenda in partnership with the CHRO to ensure that the messaging and purpose were explicitly linked with the cultural transformation. For the first time, the entire company had a single, globally consistent view of its cost base. It quickly became apparent there were duplicated costs and inefficient structures. The CEO and CFO championed a cost-efficient ownership mentality and reinvested a minimum of 50% of the value achieved back into the organization in the form of brand and asset investments.

Early in the program, the executive leadership team hand-selected a group of ICOs. Each ICO built their own global, cross-functional working teams to investigate opportunities and develop executable initiatives. They sought feedback from client teams with support from an outside consultant, thereby establishing trust and buy-in throughout the organization in a way that might not have happened had they simply brought in an outside consultant to give them recommendations. With alignment on the initiatives throughout the organization, silos melted away and the teams were able to identify significant value—13% of the total nonproduction cost base—to fuel the company’s strategic priorities.

In another case, a global mining company had attempted to cut its way to greater profitability for five years. With limited transparency in its cost structure, the company conducted a massively labor-intensive annual budgeting process that led to under-investment in its physical assets and workforce. Instead of giving a boost to EBIT, the continuous cutbacks actually ended up inflating the cost base, in part because the company had been deferring much needed maintenance on assets, so the assets became less reliable.

The CFO launched a zero-based transformation to create more cost transparency in order to identify value opportunities and break the cycle of top-down budget reductions. The financial teams began examining costs across multiple complex business lines through a cost category lens. As a result, they were able to develop internal benchmarking across operations as well as with external sources. The collaborative approach allowed the employees to feel a strong sense of ownership when it came to areas of growth opportunity. The finance teams developed new budget models that explicitly linked mine production plans to key cost drivers. Ultimately the company was able to identify more than $300 million in value that could be invested in ways that would increase production volume and boost EBIT.

Phasing in the Transformation

It typically takes 18 to 24 months to fully realize the changes and the value from a zero-based transformation. We have found that the companies that are most successful at staging this kind of transformation introduce it through four distinct phases, each of which builds on the previous one.

The transformation begins with a transparency and ambition setting phase. At this time the CFO and the finance team begin compiling and coordinating forensic level data analysis. The financial view of data is paired with operational data to create a complete picture of costs and cost drivers.

It typically takes 18 to 24 months to fully realize the changes and the value from a zero-based transformation.

Phase 2 is the value identification phase. This is a business-led effort supported by the finance and procurement divisions, aimed at generating specific initiatives and opportunities. It is in this phase that ICOs are appointed to drive the value identification process.

Phase 3 is the execution enablement phase. The CFO begins overseeing the construction of implementation plans throughout the company and sets up the Value Capture Office. Business unit performance is realigned to ensure that cross-functional tradeoffs are managed through shared key performance indicators. New governance routines are defined, metrics are realigned and new practices for working across silos are introduced.

Stay ahead with BCG insights on business resilience

Phase 4 is the implementation and sustaining phase. At this point the company begins the full implementation of new ways of budgeting and planning, tracking value and instilling the culture of cost consciousness. With the CFO guiding the effort, the whole organization begins operating with newly designated metrics, new ways of working and a system that continues to adapt to the internal and external scenarios that unfold.

When zero-based transformation is done right, a CFO gains greater agility to steer the company through disruptions and quickly adjust spending patterns to achieve the strongest impact. As a result, the budgeting process should become much less of a win/lose exercise and more of a flexible process in which funds are deployed to the areas that have demonstrated the greatest operational need and strategic value. Instead of looking back at how the organization’s financial activities have served it in the past, the CFO now must look forward and be the decision maker on future spending to generate value.