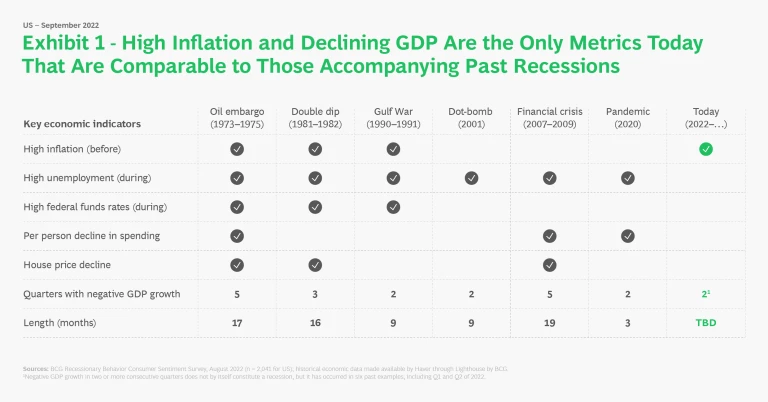

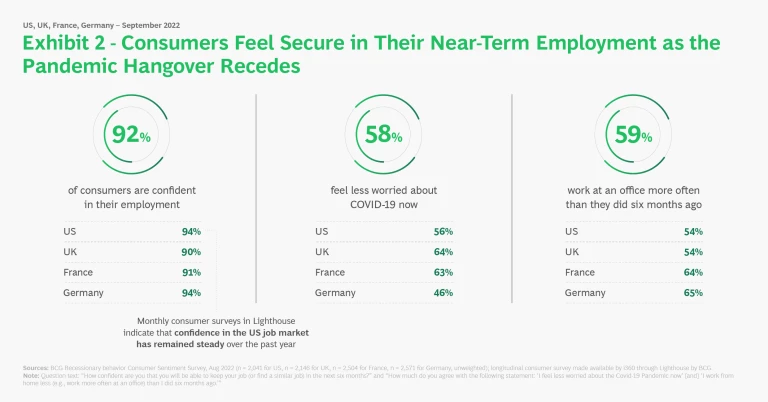

Like no other. It’s an economy similar to the high inflationary environments seen in the ’70s and ’80s, but without the disco ball, fuchsia leg warmers, and risqué Madonna song echoing in the background—and even more notably, without the high unemployment rates typical of past recessionary periods. (See Exhibit 1.) The post-COVID-19 revival appears to be providing buoyancy to some aspects of the environment, with high levels of actual employment and strong consumer confidence in employment both today and into the future. (See Exhibit 2.)

Borderline

(Madonna, 1987)

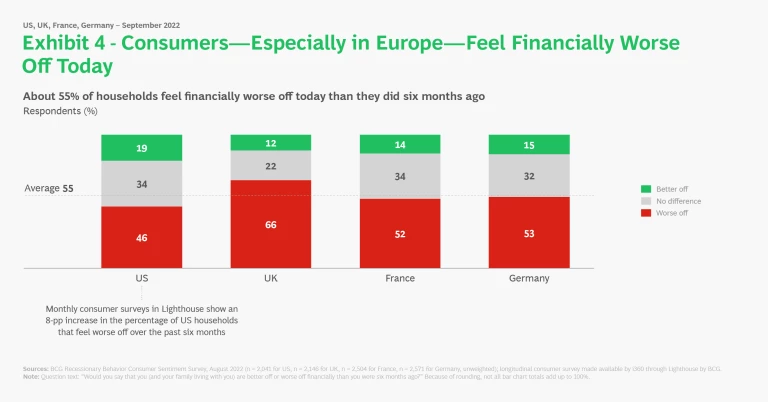

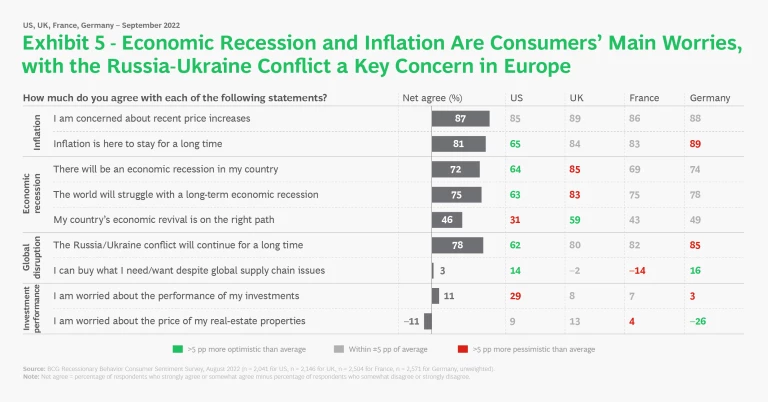

That said, most consumers across the four countries we researched believe that we are in a recession—and say that they are spending more and saving less. (See Exhibit 3.) Only 18% have seen their income increase in the past six months, and over half believe that they are financially worse off today than they were six months ago. (See Exhibit 4.) The recession and inflation are primary concerns across countries, in 87% and 81% of net households, respectively. Fear of a prolonged Russia-Ukraine war is also raising concern, but that concern is significantly higher in Europe, at 80% or more, than in the US, at 62% of net households. (See Exhibit 5.) And although fewer consumers say that they feel financially worse off in the US than do in other countries, as of early September, only 31% of net households in the US households agree that their country is on the right economic path, compared with 59% in the UK, 49% in Germany, and 43% in France.

It’s Tricky

(Run DMC, 1986)

Why doesn’t this recession fit the norm? Well, actually, it may. The seemingly unicorn nature of this economic cycle is likely to be ephemeral. For one thing, even though employment is currently strong and confidence in employment is high—atypical indicators in a recession—employment tends to be a lagging indicator that may spike multiple quarters after a recession

Under Pressure

(Queen & David Bowie, 1981)

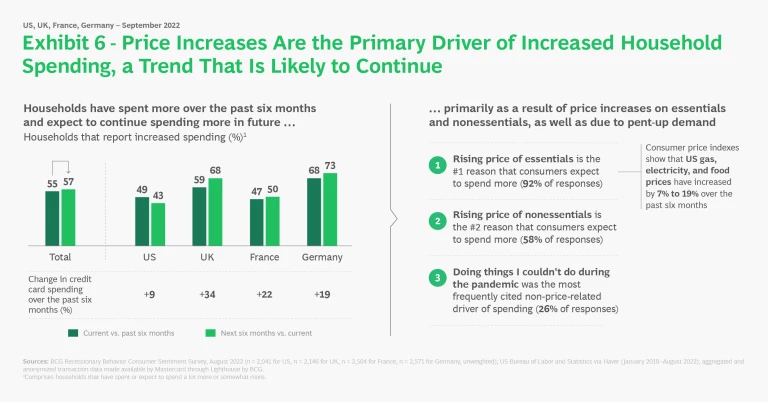

Not only are consumers spending more today than they were six months ago, but they are also saying that they believe that increased spending will continue in the future. (See Exhibit 6.) Although rising prices of essentials are the primary driver of increased spending—a reflection of inflation—we also see some nonessential purchases and pent-up demand in categories restricted during COVID-19 contributing to higher spending.

Self Control

(Laura Branigan, 1984)

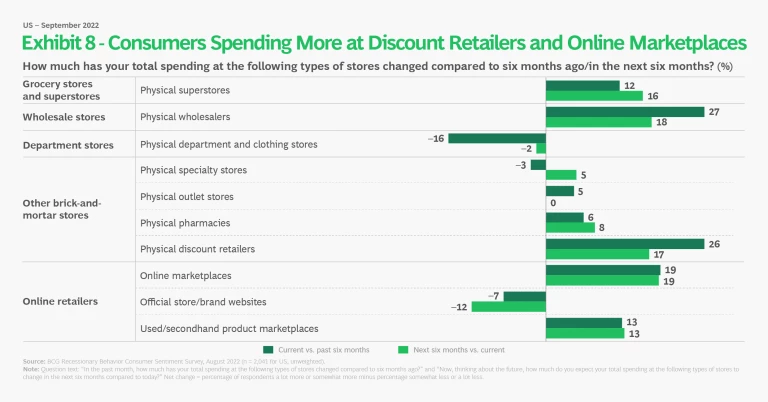

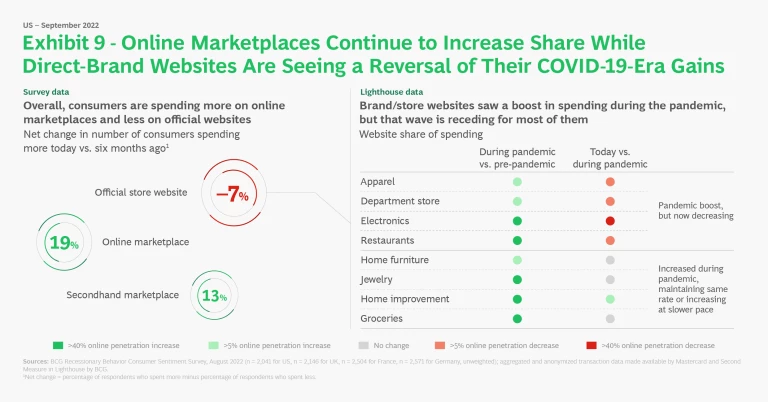

Shopping behavior is shifting as consumers not only look for deals and promotions, but also make fewer trips to the store or shop online more often, likely to avoid expensive gas usage. Increasingly, consumers are trying to save by cooking at home rather than ordering takeout or going to restaurants. (See Exhibit 7.) Relatedly, discount retailers and online marketplaces have seen a surge in spending at the expense of official store websites. (See Exhibits 8 and 9.)

Money Changes Everything

(Cindy Lauper, 1983)

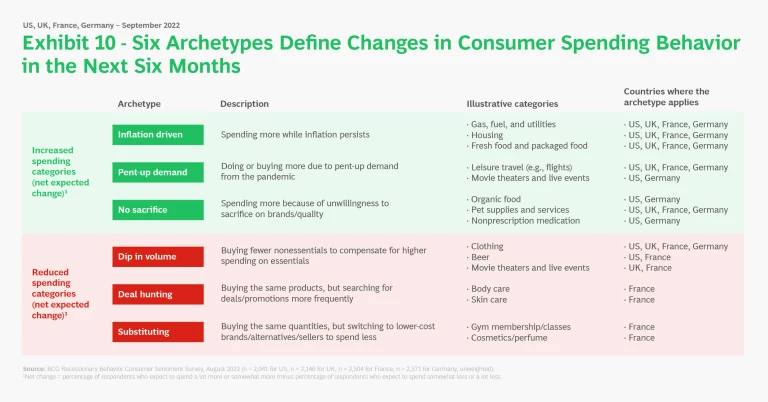

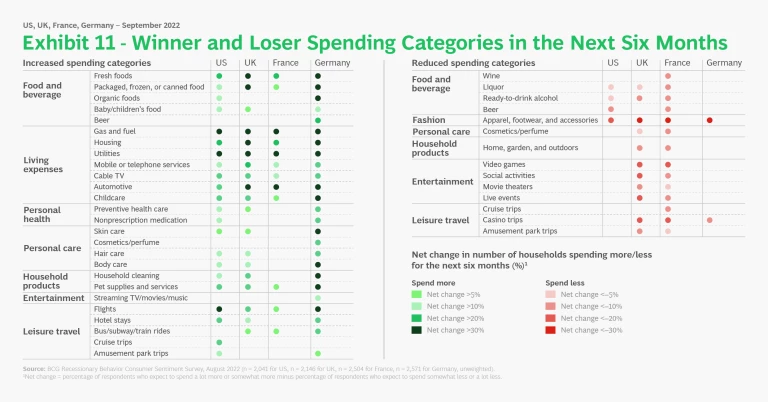

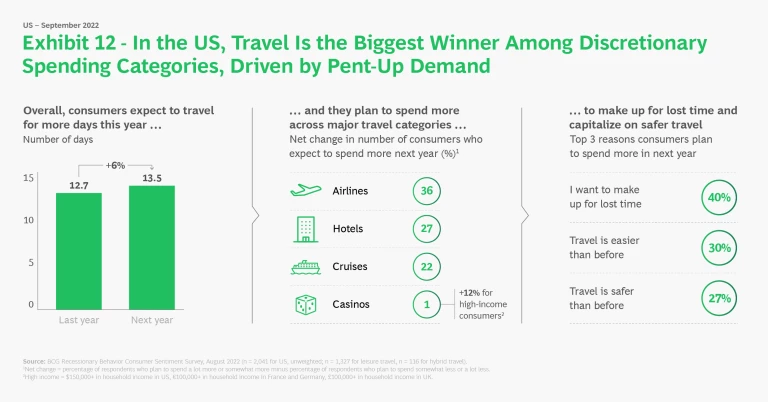

We have identified six archetypes of consumer spending behavior that define where consumers plan to increase net spending versus where they plan to decrease it during the next six months as they face inflation and a softer economy. (See Exhibits 10 and 11.) Consumers across countries say that they expect to increase their spending in inflation-driven essentials categories such as gas, utilities, food, and housing. Consumers continue to anticipate spending more in categories restricted by COVID-19, such as travel, a sign of pent-up demand. (See Exhibit 12.) Categories in which consumers typically do not reduce consumption during recessions—such as organic food, pet supplies and nonprescription medication—are also likely to see a lift in revenues, given consistent purchasing despite inflated prices.

Free Fallin’

(Tom Petty, 1989)

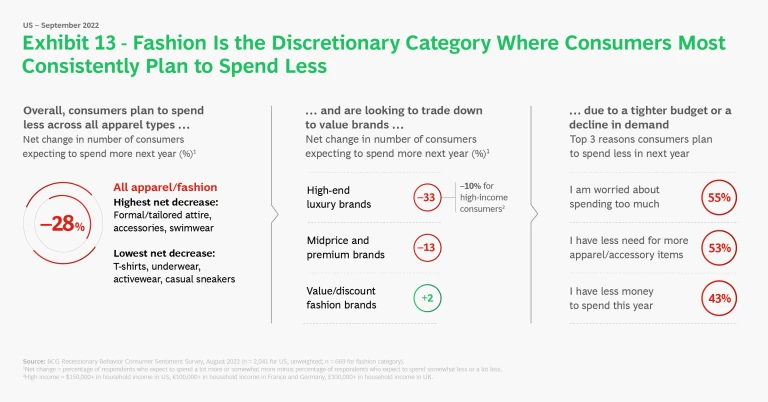

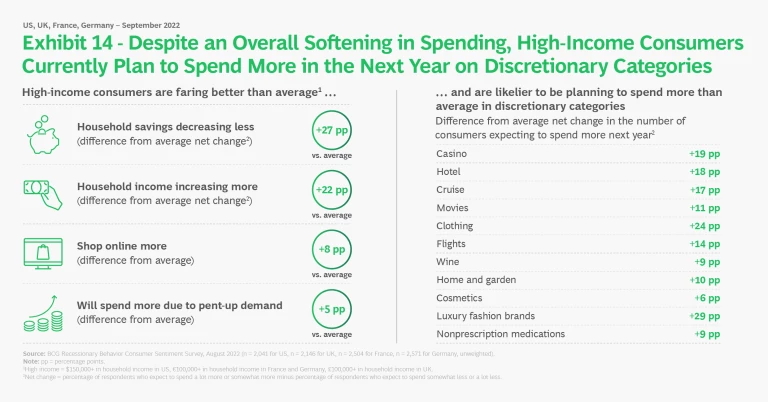

Predictably, consumers expect to decrease net spending on nonessentials such as clothing, increase deal hunting, and substitute lower-cost brands and alternatives. The category that consumers across multiple countries most consistently point to as an area where they are likely to reduce their spending is clothing. (See Exhibit 13.) But while average consumers plan to rein in their spending on nonessentials, many high-income consumers still express an intention to spend more in discretionary categories, suggesting that the recession has yet to impact this group. (See Exhibit 14.)

How Will I Know?

(Whitney Houston, 1985)

The question remains how long employment and confidence in employment will hold up in the face of inflation and shrinking GDP—and when changes in those metrics will impact average and high-income consumers. Given the prevailing uncertainty about when the tide may turn, it is critical for companies to prepare for consumer spending declines and to closely monitor consumer sentiment and behavior. We may well be approaching a moment when the economic environment will look a lot more like the recessions of the past—when we tuned in to MTV and blasted

Subscribe to our Marketing and Sales E-Alert.

About the Research

Legal Context

Acknowledgments

- Global consumer recessionary behavior team: Nancy Yu, Anshul Choudhari, Ryan Barbaccia, Grant Anhorn, Greg McRoskey, Gaby Barrios, and Mario Farsky

- Practice leadership: Jean-Manuel Izaret and Niki Lang

- Knowledge team: Kelly Kutas, Carolyn Armstrong, and Jacqueline Stratton

About the Authors/Research Study Leaders

Nick Zwemer is a project leader in the firm’s Miami office. He is a member of the Consumer and Marketing & Sales practices. You may contact him by email at zwemer.nick@bcg.com.

Claudia Ojeda is a managing director and partner in BCG’s Miami office. She is a member of the Consumer practice, and her work focuses primarily on the Travel and Tourism sector. You may contact her by email at ojeda.claudia@bcg.com.

Aaron Arnoldsen is a partner in the firm’s Seattle office, with a focus on advanced data analytics and software engineering. You may contact him at arnoldsen.aaron@bcg.com.