Against long odds, a well-tested approach achieves success 66% of the time.

Large companies worldwide are upping their emphasis on growth through innovation by building new businesses, products, and services. These efforts typically rely on leveraging a corporate asset, such as customer data or distribution channels, into adjacent opportunities or new lines of business—telcos expanding into media, fintech, or health care, for example. Often, the expansion involves adopting a potentially disruptive new business model, such as moving from manufacturing products to providing online services or acting as an ecosystem orchestrator.

But there’s a problem. The odds against breakthrough success in building successful corporate ventures are long, and large corporations have traditionally focused on sustaining their current business models and pursuing incremental rather than radical innovations. Their cultures, organizations, and incentives reinforce the status quo. Disruptive innovations come from nimble digital startups much more frequently than from big incumbent companies.

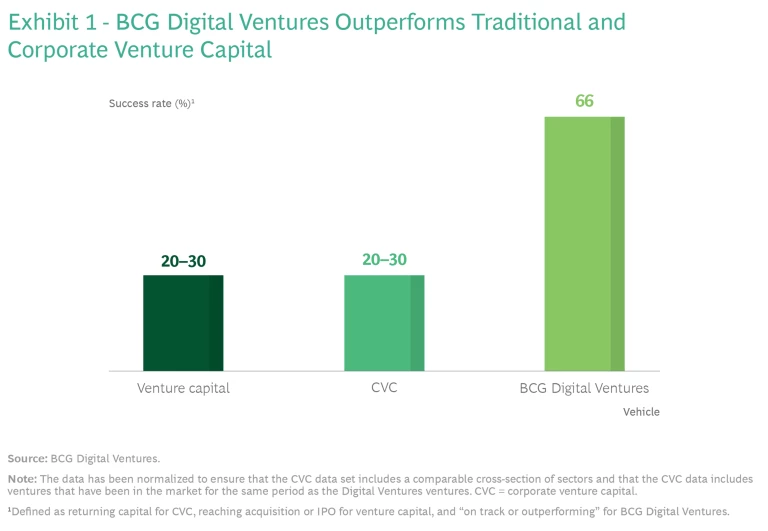

There’s also a solution: a model that BCG Digital Ventures and its corporate partners have pioneered and refined over the past eight years, marrying the strategic competitive advantages that most large companies have spent years developing with the lean approach and processes that most startups follow. Digital Ventures and its partners have successfully launched more than 200 ventures and achieved consistent success in both B2C and B2B businesses worldwide. The approach has delivered a success rate of 66%, compared with success rates of 20% to 30% by traditional venture capital and corporate venture capital.

For many companies, this model can help overcome what we call the superincumbent’s dilemma: high market share, low revenue growth, and investors that frown on corporate diversification. Incumbent companies need to grow—given that profitable revenue growth is the most common driver of shareholder value outperformance—but they must reckon with saturated traditional core markets or disrupted business models.

Moreover, the big challenges facing business—such as how to reduce greenhouse gas emissions and how to meet environmental, social, and governance goals—demand that companies innovate new products, processes, and business models. Early movers stand to gain multiple forms of competitive advantage, including hiring and retaining scarce talent, lowering regulatory risk, and reducing financing costs. But the venture-capital track record of large corporations in making the leap to new technologies and business models (which usually also involve new ways of working) has not been good. As incumbents prioritize innovation, they need to shift the odds in their favor.

The Digital Ventures model unlocks a powerful way for corporations to access growth through innovation. Here’s how it works.

Turning Long Odds Short

The stereotype of the big, lumbering, bureaucratic corporation is overplayed, as is the startup myth of two guys in a garage. To be sure, many big companies have mindsets molded by past experiences more than future opportunities. They lack entrepreneurial skills, their governance can be slow and risk-averse, and many have inadequate digital expertise and are hampered by complex legacy technology. But when it comes to building new ventures, big companies also have some major assets and advantages, including broad customer access; valuable data and billing relationships; established distribution channels, brands, and partnerships; access to capital; and industry knowledge.

Conversely, few successful new companies today are the brainchild of a couple of college dropouts. Far more often, startups follow a disciplined approach to building a new business—an approach that Eric Ries describes in his 2011 book The Lean Startup. Nevertheless, these processes, which involve validated learning, rapid testing, and failing fast and pivoting, are quite different from the methodologies that big companies follow. This is one reason why many large firms segregate their more radical innovation programs in freestanding corporate venture capital or incubator programs.

Such segregation does not guarantee success, however—far from it. The success rate for corporate venturing is hard to quantify, since companies typically maintain a mix of ventures and incubations (on average, around 15% of a venture portfolio), early-stage investments (on average, around 40%), and later-stage investments (on average, about 45%). But our research suggests that the success rates of corporate venture capital investments are similar to or slightly lower than the success rates of venture capital funds, which are well documented and fall in the range of 20% to 30%. This means that only one-fifth to one-third of ventures attract sufficient funding (typically through venture capital and strategic fundraising, acquisitions, or IPOs) to survive. The experts we talked with said that the natural advantages and disadvantages of corporate venturing versus traditional venture capital tend to cancel each other out.

The venturing model pioneered by Digital Ventures and its corporate partners has proven to be two to three times more likely to produce a success than the models used by traditional venture capital or corporate venture capital. (See Exhibit 1.)

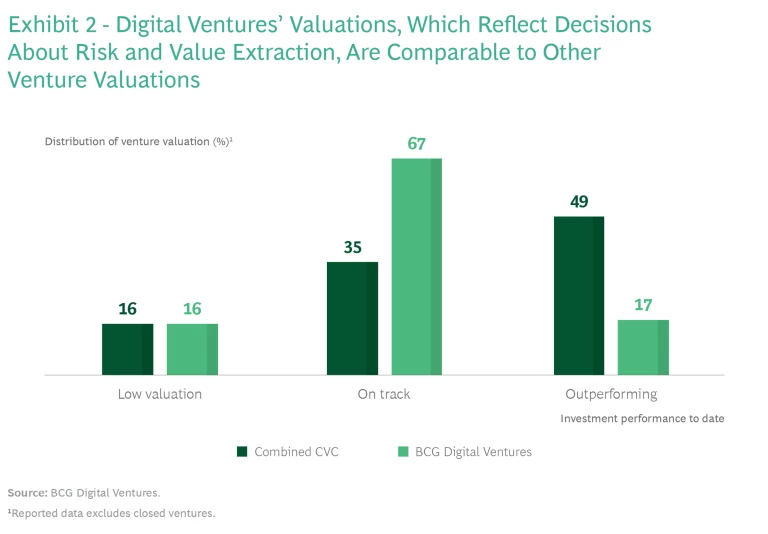

Moreover, the distribution of valuations for our corporate ventures yields a profile similar to that of other ventures when normalized for time in market. (See Exhibit 2.) Digital Ventures’ portfolio skews toward more “on-track” versus “outperform” investments, which likely reflects deliberate choices to have value accrue to the corporation—in the form of improvements in customer retention or operational productivity, for example—rather than to the new entity, as well as the effects of corporate backers’ more risk-averse governance and decision making.

The Key Components of Success

Building a new offering from scratch requires different skills, different experience, and a different approach than managing a complex established business does. Digital Ventures works with corporate partners to identify both an innovation that meets an unmet customer need and a corporate asset that can be leveraged in a new way. This combination gives the new venture a head start over standalone competitors.

This approach takes advantage of three key enablers:

- Top talent works in multidisciplinary teams and brings together digital skills (such as software engineering, design, and product management), creativity, and human-centred design. Teams are multidisciplinary, which ensures a diverse set of perspectives, especially early in the development phase.

- Rigorous methodology maintains unwavering attention on customers, their needs, and their points of friction. Teams focus on achieving rapid in-market delivery, usually launching an initial version of the venture within weeks rather than months.

- Agile governance, achieved by setting up small, senior investment committees, ensures fast decision-making and an environment that encourages teams to experiment and take risks, while ensuring high integrity in areas such as data, reputation, and legal and regulatory compliance. This approach circumvents often-complex corporate governance processes that slow or block progress because they lodge decision rights in many separate functions.

Here are three examples of how the model works.

Digitizing Service Teams in the Field

UK-based natural and green gas distribution company SGN wanted to remove cumbersome, paper-based ways of working (including “digital paper”) to improve productivity and provide faster, better customer service. The existing process required field workers to fill out repetitive forms by hand, delaying the transfer of necessary information to the right decision makers and depriving managers of vital context.

A multifunctional team composed of engineers and strategists from Koru (the Ontario Teachers’ Pension Plan venture foundry), Digital Ventures experts, and SGN personnel created FYLD, a digital platform designed to transform the safety and efficiency of field teams on the basis of real-time, data-driven decision making. FYLD’s business model includes several core features:

- AI-driven risk assessments to improve job safety

- Real-time collaboration between field crews and remote managers

- A high-quality source of data that enables companies to understand operational outcomes and resolve systemic issues

- Immediate safety and productivity benefits, with a platform for medium- and long-term efficiency gains

On site, SGN technicians now use a smartphone app designed by the FYLD design team that enables managers and others in remote locations to see and hear the service problem that needs to be addressed. Managers can approve work remotely, so they no longer have to incur the cost and delay of visiting the work site. Productivity has increased, and so has worker satisfaction, since employees can spend more time doing productive work rather than filling out forms. Similarly, managers can manage more teams. The most important improvement has been a significant decline in health and safety incidents because it is now much easier to assess potential safety issues in advance.

The digital platform has led to some £10 million in savings for customers, 140,000 hours of saved labor to date through improved productivity, and a 20% reduction in incidents and injuries. Ofgem, Britain’s independent energy regulator, has awarded FYLD a grant for a feasibility study focusing on predicting high-risk work sites, and FYLD recently launched a major effort with the international infrastructure company Ferrovial to improve safety and risk assessment at a $1 billion highway construction project in Texas.

A Digital Solution for a Digital Need

Malaysian telecom services leader Axiata Digital and its largest operating company, Celcom, wanted to move past dependence on nondigital distribution channels. In a nation where millions of users rely on prepaid mobile phone credit, Axiata was selling mobile reloads—a digital product—via physical cards with embedded codes. The manual process led to high, unnecessary distribution costs and customer inconvenience. The company also saw new growth opportunities in rethinking the way Malaysians reload their mobile phones and handle payment transactions, using peer-to-peer credit transfers as a first step toward a new fintech ecosystem.

The easy solution would have been to enable reloading on the company’s website. But research revealed that consumers weren’t comfortable using company sites for this purpose. Moreover, Axiata had the opportunity to make the recharging process a fun, gamified, cashless shopping and lifestyle experience, thereby increasing users’ trust in Celcom’s digital platform.

Axiata and Digital Ventures developed Boost, an engaging lifestyle venture that provides personalized deals and vouchers on popular brands and services, tracks credits and spending, and offers free money transfers. Boost has grown into a super app for users and merchants alike, with lending and credit features such as a three-minute know-your-customer capability based on insights into gross market value and a loyalty provision that extends across all services. Now users are not just topping up their minutes—they’re interacting and making mobile purchases across the entire Malaysian economy.

Boost has rapidly become one of the top three payment platforms in Malaysia, with 9.7 million users and gross transaction value of $1.23 billion in 2021, up almost 30% from 2020. In addition, revenue jumped 88% in 2021 over 2020. The platform has expanded into Indonesia with further expansion plans in process for the rest of Southeast Asia. Boost expects to receive its digital banking license in Malaysia shortly, which will enable further expansion and product innovation.

Rethinking Real Estate Closings

Endpoint, a digital title and settlement services company that reimagines the US real estate closing experience, is the brainchild of First American, a financial services company that provides title insurance and settlement services, and Digital Ventures. Together, they built and launched the company in just nine months. By guiding real estate agents, buyers, and sellers through property transactions with actionable tasks and features, Endpoint brings efficiency and cost savings to the closing process.

Endpoint’s new, digital-first approach to title and escrow, with flat rates and an easy-to-use platform accessible from any device, pairs innovative technology with a team of industry experts to deliver a seamless, fully digital closing experience from start to finish. It uses AI to expedite the process, allowing title and settlement services professionals to spend more time supporting buyers and sellers. In October 2021, in response to Endpoint’s success, First American invested an additional $150 million in the enterprise, bringing the total capital raised by the company to $220 million.

Lessons Learned

Digital Ventures’ eight years of experience in launching new businesses with corporate partners have yielded rich lessons. Among the most important are the following:

- Recognize that inventiveness and process discipline are compatible. Follow a structured process, but leave room to exercise creativity and to pivot to new directions as you accrue experience.

- Learn from experience in the market. Constantly challenge the team around speed to market, and incorporate rapid test-and-iterate loops in the process.

- Ensure that the venture has fit-for-purpose technology. Achieving the goal may entail building a standalone technology stack or leveraging APIs to access corporate systems and data.

- Be persistent. It often takes several iterations of the business to get it right. Watch for weak signals in the market reaction, and be prepared to experiment. The mindset to do this is very different from the typical corporate environment's approach to waterfall investments, where progress versus plan is all-important.

- Ensure that governance is agile. Follow the model of top-quartile VCs, as opposed to using standard corporate governance mechanisms, by focusing on milestones and deliverables, rather than weekly reports—and be prepared to pull the plug when things don’t work. Get comfortable with a lower level of certainty, but make sure that the investment boards understand the economics of the business and how it scales. Empower the management team to run the operations with the right level of freedom, especially from corporate processes.

- Look ahead. Think in advance about how to scale the business (such as IT systems, data models, channels, and recruitment) and how to avoid the need to customize technology and rework software down the road.

- Understand the difference between support and interference. Put your greatest effort into attracting and retaining outstanding talent and building a resilient, entrepreneurial culture. Identify the CEO and key positions early, challenge them but back them, and don’t punish people who take calculated risks.

Most companies have valuable assets that they can leverage into new business ventures. But they don’t always have the innovation muscles needed to successfully build such businesses. The right approach can help ensure success, enabling companies to grasp the technology disruptions taking place in their sectors and markets and take bold action to drive innovative growth.

The authors are grateful to Michael Brigl, Ajay Chowdhury, and Christoph Mueller for their contributions to this article.