Our detailed survey of Indian consumers investigates the country’s explosive growth in online shopping--with extensive implications for businesses, platforms, and channels.

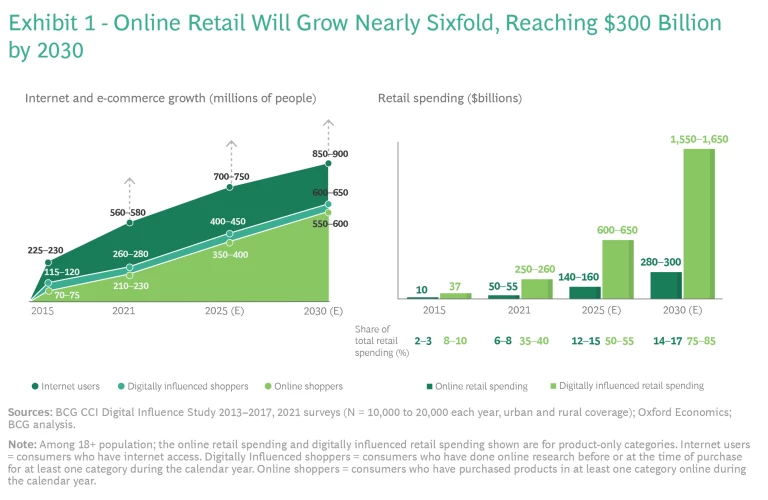

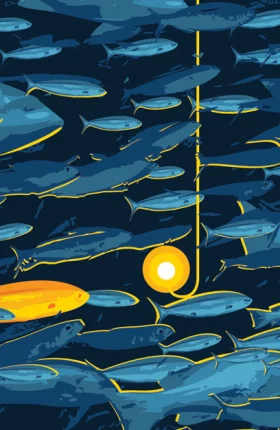

With the world’s lowest data and smartphone costs, growing internet penetration, and a proliferation of new online shopping channels, India is experiencing a dramatic rise in e-commerce and digitally influenced spending. In fact, the numbers of digitally influenced shoppers and online shoppers have grown rapidly in recent years, reaching 260 million to 280 million for the former and 210 million to 230 million for the latter in 2021. We expect these numbers to increase by 2.5 times over the next decade, accompanied by nearly sixfold growth in online retail spending. (See Exhibit 1.)

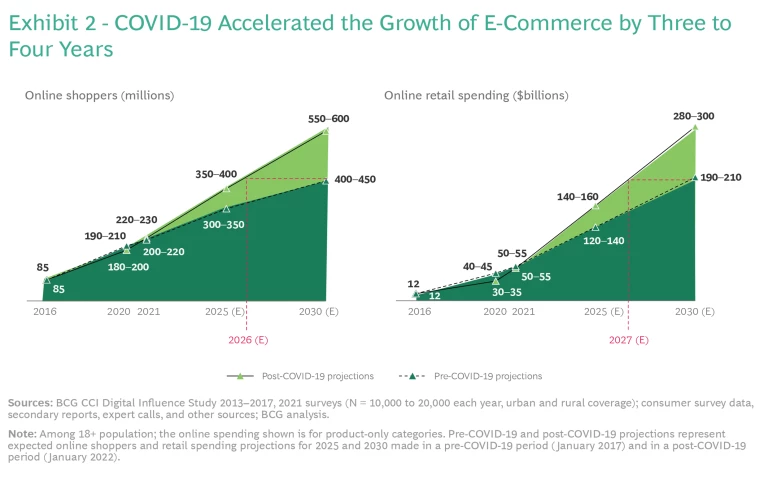

E-tail growth received a kick-start from the COVID-19 pandemic , which pushed many consumers to begin shopping online for the first time and encouraged existing shoppers to increase their online purchasing, as physical shopping channels closed or became difficult to access. The net effect was to accelerate growth in the number of online shoppers in India by approximately four years and in the amount of online spending by about three years. Shoppers who were new to online shopping made up 35% of total online buyers during the period from April to September 2020. (See Exhibit 2.)

To fully explore this growth in digital and digitally influenced spending, we surveyed more than 10,000 consumers in India across a range of geographies and incomes, analyzed the online transaction data of more than 200,000 online shoppers, and interviewed multiple industry experts. (See “Our Methodology.”)

Our Methodology

The survey covered more than 40 metro to tier 4 cities and 50 rural towns and villages and extended across a range of population strata—for example, the annual household income of those surveyed ranged from under ₹100,000 (approximately $1,300) per household to more than ₹5 million (approximately $65,000) per household—reflecting the breadth and depth of the country’s consumers.

The goal of the survey was to derive a comprehensive understanding of the current proliferation of digital purchasing channels in India, including internet penetration and digital influence on both in-person and online purchases for more than 90 categories of products and services.

We corroborated and substantiated our findings through extensive, real-time transaction data gathered and analyzed on the purchase transactions of over 800,000 consumers in India (including about 200,000 e-shoppers), along with multiple industry reports and expert interviews. The data covered 35 product categories across 15 leading online platforms over a period of more than two years and was analyzed using more than 30 metrics to understand multiple consumer, category, brand, and platform characteristics.

The results provide detailed and extensive insights into Indian consumers’ shopping patterns and preferences . They also reveal a number of intriguing trends, including changes in who is shopping, where they live, what they buy, and how they shop.

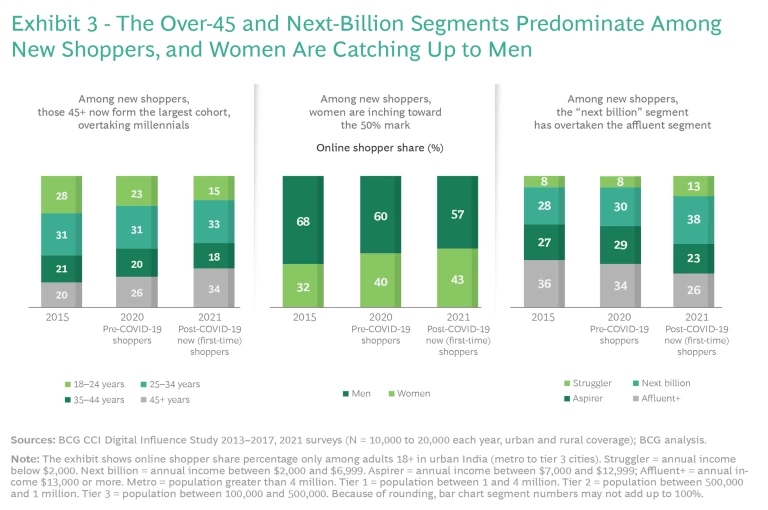

For example, in a surprising divergence from the traditional Indian e-commerce shopper—the metropolitan millennial male—several new shopper cohorts that previously were e-commerce laggards turned to e-commerce as the pandemic began. Two potentially overlapping cohorts dominate this new-shopper category: the over-45 age group, which now accounts for more than a third of new shoppers in India and is the fastest growing segment; and the “next billion,” or middle-income population, which accounts for 38% of new online shoppers. In addition, Indian women are rapidly increasing their presence in the internet marketplace, where they already make up about 43% of the country’s new post-pandemic shoppers. (See Exhibit 3.)

We found that smaller cities are also contributing a great deal to India’s e-commerce growth. However, rural shoppers—consumers who live on farms or in towns and villages with populations of no more than 50,000 people—may be the future of e-commerce. Our study indicates that 54% of online shoppers in India will hail from rural areas by 2030, and that they will account for 24% of online retail spending. (See Exhibit 4.) The primary sources of this growth are the youngest adult cohort (ages 18 to 24) and the rural affluent (incomes of at least $13,000).

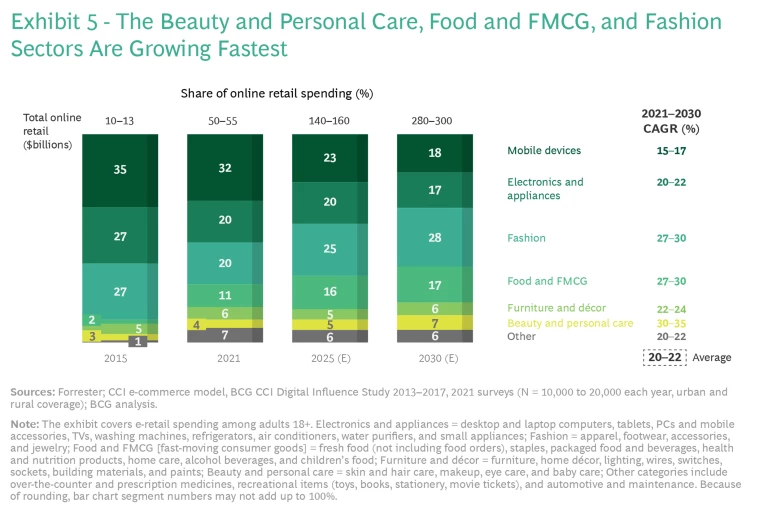

As more and more shoppers in India embrace the internet and e-commerce, they are also expanding the number of categories in which they buy online. Spurred by the onset of the pandemic , for example, they have added groceries and fast-moving consumer goods (FMCG) to their list of online go-to items. In fact, categories such as online food orders, FMCG, and beauty and personal care (BPC) items have seen sales grow by three to five times in recent years.

We expect the shape of e-commerce spending in India to continue to evolve along this path. Whereas mobile devices, electronics, and fashion once dominated e-commerce, food and FMCG will gain share from mobile and electronics. According to our projections, fashion and food and FMCG will account for nearly half of the e-tail market by 2030, up from just over 30% today. (See Exhibit 5.)

Our findings have extensive implications for businesses, platforms, and channels that cater to the evolving e-commerce buyer in India. These players can take a number of actions to keep abreast of the changing market , including understanding the needs of new cohorts and high-growth categories, adapting their e-commerce strategy to meet them, taking advantage of emerging opportunities, developing new go-to-market approaches, and working toward integrated and seamless customer journeys .

Whatever steps they choose, businesses should act quickly to attract consumers’ attention online, convert that attention into sales, and continue the conversation to keep their customers engaged.

Download the full report to read more about our detailed findings.