The world stands on the threshold of a new age of electrified mobility thanks to developments over the past year. Spurred by a renewed sense of urgency, regulators in Europe and the US have set far more demanding goals for curbing greenhouse gas emissions from cars and light vehicles. Automakers have also raised their game and introduced electric vehicle (EV) options in every part of their product portfolios. Together, these forces are turbocharging the global market for EVs.

The impact of these developments on sales of EVs will be dramatic. According to our forecast, pure battery electric vehicles (BEVs) will be the most popular type of light vehicle sold globally in 2028—three years earlier than we projected in our 2021 report on electric cars . Furthermore, we expect global BEV sales to exceed all types of hybrid vehicles combined, and far outweigh those of internal combustion engines (ICEs), by the turn of the decade.

Our revised modeling holds out greater hope for the health of the planet as well. The European Union’s announcement banning sales of new ICE vehicles from 2035 is a game changer for the global automotive industry . It puts the bloc on course to hit its 2050 emission reduction targets for transportation. The US, while it still has work to do to achieve its climate goals, is also in a better position than when we last reviewed the sector in early 2021.

There’s a sting in the tail of this rosy outlook, however. For some players, rising consumer demand is creating new challenges or exacerbating old ones. In particular, battery supply chain players and providers of charging infrastructure are racing to catch up with demand. To win in this market, automakers will have to find ways to resolve problems in their supply chains. They will need to take an innovative approach, collaborate more closely with other players, and build effective ecosystems.

A Bumper Year

The past year has been phenomenal for electric vehicles, including hybrids. These vehicles accounted for 20% of all light-vehicle production in 2021, up from 12% the previous year, even as volumes recovered from the COVID-19 pandemic. By contrast, the share of gasoline and diesel cars dipped 9 percentage points. Sales of BEVs and plug-in hybrid electric vehicles (PHEVs) were especially strong, doubling in the US (though from a lower base than in other regions) and tripling in China. Several factors explain the strong showing.

The regulatory pressures curbing the use of fossil-fuel-powered vehicles have increased in major Western markets. In the US, the Biden administration significantly tightened rules on tailpipe emissions. Nevada, Minnesota, and Virginia joined California and ten other states in agreeing to establish zero-emission vehicle quotas for new passenger cars. EU legislators drafted policies to reduce the average emissions of all cars in operation by 55% by 2030 (from 2021 levels). More important, by stipulating that emissions from new vehicles sold should be decreased to zero five years later, they set an end date for the ICE age in Europe. In both regions, governments have extended incentives encouraging consumers to switch to low-emission vehicles.

Automakers have thrown their support behind EVs like never before. Investments in hybrids and hydrogen-powered fuel cells have not disappeared entirely, but the focus of automakers’ development programs has shifted toward all-electric vehicles. Toyota and Volkswagen, the two largest automakers by sales today, have committed a combined $250 billion by 2030 to EV and battery programs. Jaguar and Volvo, meanwhile, are setting targets to sell only BEVs and hybrids from as early as 2025. Manufacturers in general are adding their most popular brands and vehicles to the electrification mix.

The past year has been phenomenal for electric vehicles, including hybrids.

As EVs grow in sophistication, it’s getting easier for automakers to market these vehicles on more than simply their environmental merits. Increasingly, EVs perform well on essential customer requirements such as towing capacity and low maintenance. But they can also offer benefits beyond the scope of ICE vehicles. For example, company marketing departments are spotlighting how a vehicle’s battery can serve as a backup generator for the home.

Falling ownership costs and incentives have helped drive consumer demand for EVs. The five-year total cost of ownership (TCO) for a midsize car is now the same for both BEV and ICE versions in China and many European countries. (Our TCO calculation takes into account the purchase price, maintenance costs, miles driven, and fuel or electricity costs.) And for much of the world’s population, EVs are heading toward purchasing-price parity with traditional ICE vehicles—a more important indicator of consumers’ car-buying behavior than TCO—by the end of the decade. The continuing decline in battery prices, which make up 30% to 40% of an EV’s cost of goods sold, is one factor leading to lower ownership costs. But so too are greater economies of scale due to increased production of EVs.

Consumer perceptions have also shifted significantly over the past year in leading markets. In China, new-age players such as Nio and XPeng dramatically boosted sales in 2021 and now sell 10,000 or more units a month. The success of these players has helped persuade would-be buyers that EV manufacturers have staying power and will be around to provide after-sale support and software updates, strengthening the companies’ customer proposition. It has also encouraged established automakers to focus more on developing their own EV offerings.

An Industry in Transition

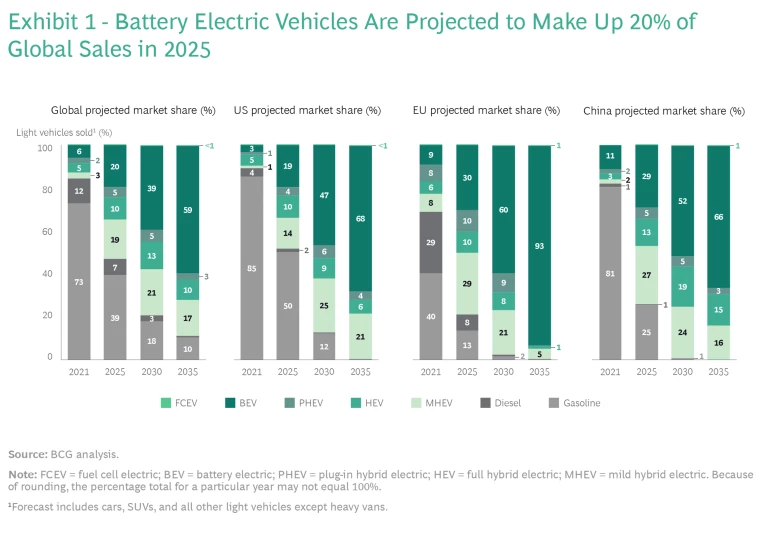

The future of the automotive industry is electric. The factors highlighted earlier will significantly accelerate the market dominance of BEVs—it will happen faster even than we anticipated in our previous forecast. We now expect BEVs to account for 20% of global light-vehicle sales in 2025 and 59% in 2035. (See Exhibit 1.) By comparison, in last year’s report, we projected a BEV market share of 11% in 2025 and 45% in 2035. In our latest outlook, the share of full hybrid electric vehicles (HEVs) and PHEVs remains largely unchanged compared with our prior forecast. The main differences are a shift away from full gasoline vehicles and a lower uptake of mild hybrid electric vehicles (MHEVs) across all regions, benefiting BEVs.

We expect the adoption of BEVs to progress at varying speeds in different regions of the world. The European Union’s stricter stance on environmental regulations will cause the bloc to lead the way, with BEVs accounting for more than 90% of European light-vehicle sales by 2035. Uptake in the US and China, while behind that of Europe, will also advance rapidly. But adoption will be far slower in the rest of the world: outside our three main regions, BEVs will account for only 35% of light-vehicle sales in 2035, while consumers in these countries will purchase more than 50% of all pure gasoline and diesel new vehicles sold worldwide by 2027. Global automakers will need to maintain cost-effective supply chains to support the strong demand for hybrids and ICE vehicles that will persist in many of these markets.

The consumer buzz around EVs is already such that the time between new models being available and sold out is often just a matter of minutes. Automakers are leaning into the excitement by, in some cases, dramatically increasing their original production volumes. The opportunity to serve this demand is continuing to attract a raft of new-age EV players seeking to emulate the success of more established players such as Tesla (whose market capitalization is bigger than any other automaker worldwide).

At the same time, the shift toward EVs is causing incumbent automakers to reconsider not just the transition from ICE power trains to electric ones but their entire business models. These companies are executing vertical-integration moves that improve access to battery cells, secure first rights to next-generation battery technologies , and drive higher performance of electric motors. The role of the dealer seems certain to evolve, given that EVs require less maintenance and new-age automakers are already using direct-to-consumer sales channels. And by presenting EVs as energy storage devices on wheels, automakers are creating new as-a-service models that extend into spaces traditionally served by utilities or fleet-services companies. In addition, tougher requirements on recycling components from end-of-life (ELV) vehicles are also spurring automakers to weigh new go-to-market strategies centered on circularity, such as battery remanufacturing.

Subscribe to our Automotive Industry E-Alert.

Automakers are also adopting simplified electronics architectures and a more software-driven approach to drive down costs, unlock new revenue streams, and offset lower near-term margins on EV sales. Through over-the-air updates (the wireless delivery of new software and capabilities), for example, manufacturers can remotely extend the range of EV batteries or enable EV owners to automatically pay for charging infrastructure through vehicle recognition technology. All told, savvy automakers—both incumbent and new age—are recognizing that the shift to EVs significantly boosts the size of the profit pools available to the automotive industry.

Finally, operators of new autonomous-vehicle (AV) fleets are also opting for vehicles with electric power trains, given the emissions regulations and lower per-mile cost of these vehicles compared with ICE-powered cars. We expect all shared AVs including fleet vehicles will be electrically powered, encouraging further adoption and acceptance of EVs.

Improved Progress on Climate Goals

The world is still playing catch-up to meet its climate ambitions for transportation. But the brighter outlook for EVs offers some good news, even though policymakers and automotive companies must still act with urgency to accelerate adoption and remove impediments to the EV revolution.

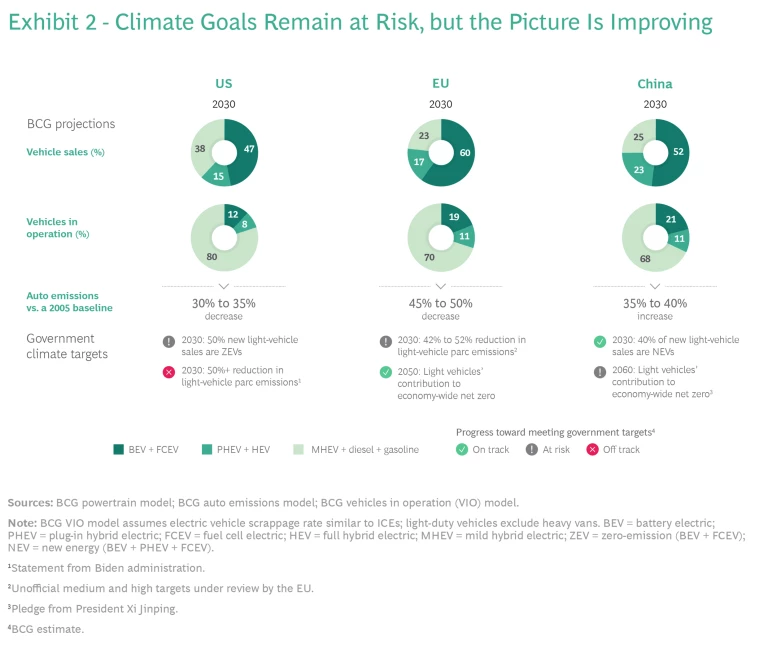

By preparing to stop the sale of new fossil-fuel cars from 2035 (the ban should become legally binding next year or in 2024), the European Union is on track to achieve its goal of net-zero CO2 emissions in its “car parc”—the total stock of vehicles in use—by 2050, provided the bloc also continues to invest in mass-transit systems and clean-mobility options such as e-bikes. By then, almost all vehicles on European roads should be zero emission. In addition, the EU still has a chance to meet its unofficial 2030 target of a 45% to 50% reduction in automotive emissions (versus 2005 levels), according to our latest forecast. Nevertheless, more forceful action is needed to ensure that the car parc turns over at pace, PHEV owners use electricity rather than gasoline to power their vehicles, and consumers who use their cars most frequently are spurred to buy EVs.

Given that EVs accounted for more than 20% of new light-vehicle sales in China earlier this year, we now expect that country to meet its 2030 target for 40% of vehicles sold to be pure electric. All new light-vehicle sales in China will need to be EVs by 2040 for the nation to achieve its 2060 net-zero goal.

The US, however, will require a major catch-up to hit its targets. While we believe a window of opportunity still exists for the country to meet its objective for all new vehicles sold in 2030 to be zero emission, the US car parc is unlikely to turn over rapidly enough for the administration to achieve its stated goal of a 50% reduction in economy-wide emissions by 2030 versus a 2005 baseline. The US will also need to ban sales of new vehicles other than zero-emission ones by 2035—just as Europe is doing—to fulfill its 2050 net-zero pledge.

Elsewhere, Japan is on course to reach net-zero economy-wide greenhouse gas emissions by 2050 owing to the high proportion of hybrid vehicles in its car parc, but will need to set clear targets for zero-emission vehicles to remain so.

Meanwhile, the Geneva-based World Business Council for Sustainable Development and more than 25 leading companies in India have called for 30% of new cars sold in the country to be all-electric by 2030. We forecast that the share of EVs in India will be less than 15% in 2030, or only halfway to the target, unless there is a paradigm shift in the country’s automotive market and regulatory environment. (See Exhibit 2.)

It’s not just vehicles that will generate zero emissions because of electrification. The entire automotive value chain is moving toward decarbonization. Charging companies, for example, are addressing the imperative for EVs to run on clean energy by installing solar-powered charging points and procuring energy from renewable sources. Battery makers are also taking steps to use more green energy in their manufacturing processes. But persistent consumption trends and EV-specific problems could still dampen consumer enthusiasm for EVs and hamper their positive climate impact .

Some Remaining Risks to EV Adoption

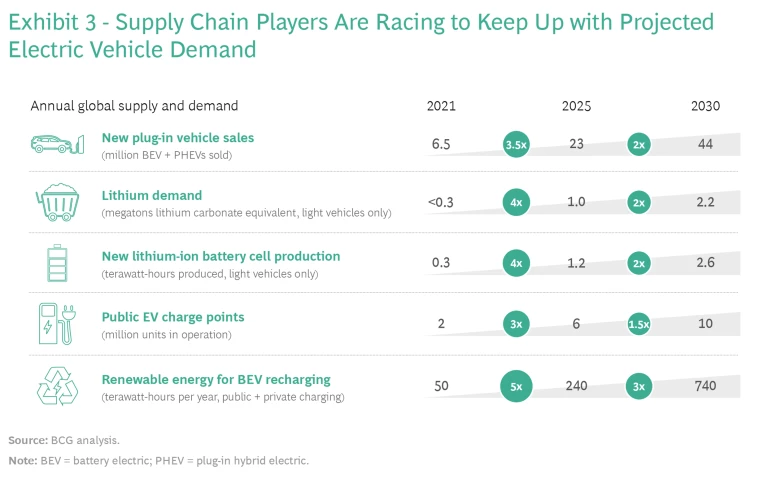

Although the transition to electrified mobility is quickly gathering momentum, we have identified two short-term supply risks that could limit the rate of industry change—or spur greater innovation as players seek to overcome these obstacles. First, a supply shortage has emerged during the past half year in the metals needed to make EV batteries, including lithium and nickel. Second, insufficient charging infrastructure over the next few years could cause EV adoption to stall in leading markets such as the US, especially in cities like Boston, where it can take time to bring additional power distribution capacity online because of logistical challenges and the limitations of existing power distribution infrastructure. According to our market outlook for global BEV and PHEV sales, supply chain players will need to accelerate their efforts in these areas to keep pace with future demand. (See Exhibit 3.)

Demand for lithium, for example, is expected to shoot up by a CAGR of more than 25% from now until 2030. But postpandemic supply chain constraints, rising energy costs, and accelerated EV growth have already increased the price of the lithium compounds used for battery production—and are set to push up average battery costs after years of steady declines. Meanwhile, war and economic sanctions have raised nickel prices and threaten to exacerbate shortages of the metal.

Closing supply gaps in these metals, and curbing price increases, will depend on producers developing new production sites to meet rising demand. But achieving this will not be easy because of the long lead times required to establish new production projects. As long as supply gaps persist, they could hamper the buildout of additional battery production capacity, hinder efforts to improve the battery range and lifespan of technologies, and delay—or even reverse—the declines in EV ownership costs.

A shortage of charging points in some countries looks set to worsen in the near future. In the UK, the automotive industry organization recently highlighted that current EV sales far outpace the growth in public charging stations. In the US, 1.1 million public charging sites will be needed in 2025 and 2.3 million in 2030, up from 100,000 in 2020, according to our analysis. The Biden administration is targeting only 500,000 public charging points by 2026, and the US Infrastructure Investment and Jobs Act is likely to fund less than one-tenth of these—leaving the private sector and state governments to fill the gap.

Insufficient infrastructure could have significant implications for EV adoption. A new wave of potential buyers is emerging who will need to lean more heavily on distributed, public infrastructure to charge their vehicles because they don’t have garages for home charging or don’t own a house. But concern about a lack of public charging sites is already the leading reason for US consumers to think twice about buying an EV, according to a recent survey from Consumer Reports, a nonprofit consumer organization. Germany, meanwhile, is scrapping incentives on the purchase of private chargers, a move that will encourage more EV drivers to rely on public ones.

A New Game

The rapid changes in the automotive industry, with BEV dominance likely to happen far sooner than we previously anticipated, are creating new choke points for industry players. Instead of proving that EV technologies and use cases are workable or valuable, these companies now must focus more on supply chain constraints and the threat that inadequate charging infrastructure could deter buyers.

At the same time, the accelerated pace of development is altering the actions that automakers and suppliers are ready to take to realize new opportunities and mitigate emerging risks. Innovations are emerging across the board, in areas including technology, the customer experience, and revenue and ownership models. Rather than causing the industry to converge on a single set of solutions, these advances are expanding the options available to EV players. As a result, companies are building strategies on the basis of many different market scenarios and possibilities.

Coordinated action will be essential to overcome the challenges we have outlined. Fortunately, there is reason for optimism that players across the automotive ecosystem are prepared to work together, instead of treating the development of viable solutions as a zero-sum game of winners and losers.

In the charging space, a raft of players are helping to accelerate the rollout of publicly available chargers. Governments are freeing up land and supporting ambitious projects such as wireless EV charging. Manufacturers are creating prefabricated charging sites to shorten installation times. And automakers and utilities are jointly working on pilots to add network capacity and flexibility so that EV owners can use their vehicles for home charging or to sell surplus power back to the grid. As EV-specific electricity rates, smarter vehicle architectures, and common standards are introduced, the cost of EV charging looks set to fall.

Through innovation, automakers are also taking EV battery recharging to the next level. They are developing new battery-swapping and battery-as-a service models, options that are already popular among drivers of electric two- and three-wheel vehicles. For example, China’s Nio offers customers a subscription-based service enabling them to exchange used batteries for new ones at one of its battery swap stations. Such models address consumer concerns about battery life and end-of-life rules, create a new revenue stream for automakers, and facilitate recycling.

Through innovation, automakers are taking EV battery recharging to the next level.

To improve supply chain resilience, automotive manufacturers and battery makers as well as cathode suppliers are forming joint ventures and investing in mines. Their goal: to guarantee the security of supply and gain a competitive edge. Fortunately, new technologies, such as direct lithium extraction, are under development and have the potential to open up additional sources of this crucial metal.

In the meantime, EV players are pursuing multiple technology paths to hedge their bets. Two years ago, automakers were abandoning lithium-iron-phosphate (LFP) battery platforms in favor of lithium-based batteries containing a higher proportion of nickel. Given recent market events, however, the demand for LFP platforms has rebounded, especially for entry-level vehicles, as a way to soften automakers’ exposure to nickel.

What these actions show is that—when confronted with significant challenges—the automotive industry is quick to innovate. The proof: leading automakers today are still delighting customers and creating value for shareholders. But they are also setting an example for other sectors on how to respond to the climate change challenge. We expect far greater innovation to emerge as automakers establish electrification as the dominant mobility technology. Strap in as the industry goes full speed ahead toward a zero-emission future.

The authors thank Ed Anculle, Benedikt Faessler, and Markus Viereck Garcia for their contributions to this report.