Listed companies are increasing their ESG (Environment, Sustainability, Governance) commitments, and more specifically deploying capital and talent on Climate & Sustainability (C&S) actions that account for a large proportion of ESG commitments. While it’s become standard practice to announce these actions to investors and stakeholders, a recent BCG study showed that corporate C&S announcements do not always generate favourable market and valuation reactions; in fact, they can do the opposite. On the upside, we also identified a clear pattern of success in announcements that do generate real environmental impact and shareholder value.

In this article, we look at the rapid rise in environmental communication to investors and measure its impact, and share five criteria that listed companies can look to meet to generate valuation credit for their C&S actions and commitments.

As we move towards net zero, listed companies will play an important role in generating and deploying the $100 trillion–150 trillion in investment needed by 2050 to transform the global economy and limit global temperature increases to 1.5°C.

We are already seeing rapid increases in the number of listed companies are making commitments to climate change and sustainability, and investing more into the capital and talent needed to capture the opportunities that C&S actions create.

At the same time, institutional investors are making investment decisions that incorporate more sophisticated ESG and climate metrics, such as scope 1 and 2 emissions reduction ambitions, WB2C (well below 2 °C) pathway compliance, and emissions intensity realised rate of change. Far from being viewed as a discrete part of a company’s operations, investors now consider these metrics as an explicit part of a company’s strategy, value proposition and business model.

For senior leaders, it has never been more important to incorporate transparent environmental commitments and actions into business strategy, value creation, and financial management. Making this shift is crucial for investors to accurately value a company as responsible and a stock as high performing.

Climate & Sustainability Announcements Are Growing Rapidly in Volume and Materiality

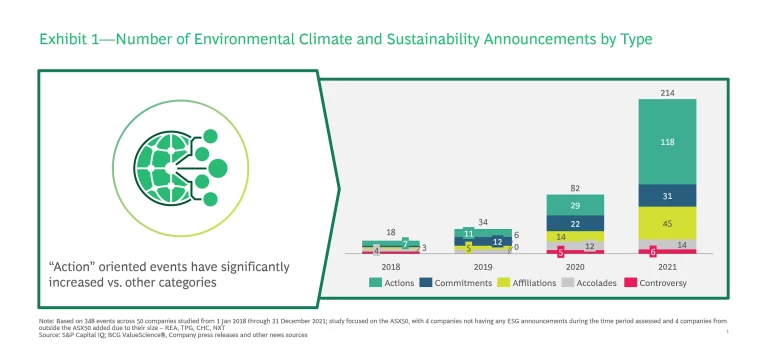

As investors increase their focus and weight environmental criteria against investment decisions, companies are making more frequent and material announcements. To understand their impact on value creation, we analysed corporate announcements (both ASX announcements and press releases) relating to C&S actions, commitments and events between 2018 and 2021.

Looking at changes over time, we believe that the rise in consumer, employee and investor expectations and urgency for C&S is reflected in the high growth in the number of announcements from 18 in 2018 to 214 in 2021 – which reflects that corporate Australia is actively addressing climate change and the transition to net zero.

After establishing that corporate announcements are increasing in number, we turned our attention to what companies are making announcements about:

- Actions – making organic investments, undertaking M&A activity, decreasing carbon intensity of operations

- Commitments – setting targets, such as net zero by 2030

- Affiliations – announcing partnerships or memberships

- Accolades – communicating rewards/ratings and acknowledgments

- Controversy – acknowledging environmental controversies and responses

The analysis showed that, beyond announcements related to C&S issues increasing, the number of announcements about specific actions is growing very rapidly – from 11 in 2018 to 149 in 2021.

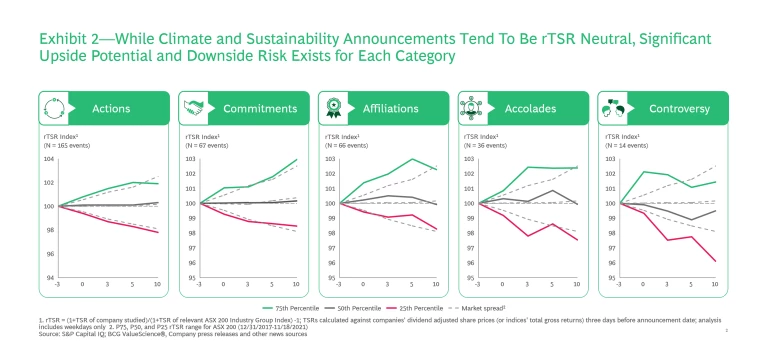

To understand the value creation, we then tested the relative performance of the ASX50 companies compared to their peers within the ASX200 after the announcements were made. Across the 8 industry sectors, median shareholder return was neutral relative to the comparable industry cohort. This finding held true on the day of announcement, as well as 30 and 60 days afterwards and when looking at all announcements and releases or just those targeted at shareholders.

Interestingly, announcements related to C&S actions and commitments did not automatically generate favourable valuation reactions in the short term, and many were followed by immaterial or negative returns.

While it’s important to note that a considerable amount of market noise such as industry trends and economic data contributed to movement in shareholder value over the 4-year timeframe, we also identified distinct patterns of success…and failure.

Announcements That Create Value Show Distinct Patterns of Success

The most effective C&S announcements were grounded in a company’s core business strategy and style of competition (how they differentiate and create value). They were also transparent about cost–benefit trade-offs. Effective announcements also clearly communicated how actions and commitments were integrated into the company’s value creation agenda, which made it possible for investors to ascribe appropriate value.

“It is quite simple: a fully integrated mindset on climate and sustainability will lead to stronger and more resilient performance."

—EQT CEO, Christian Sinding

Five Ingredients To Drive Tangible Value From C&S Announcements

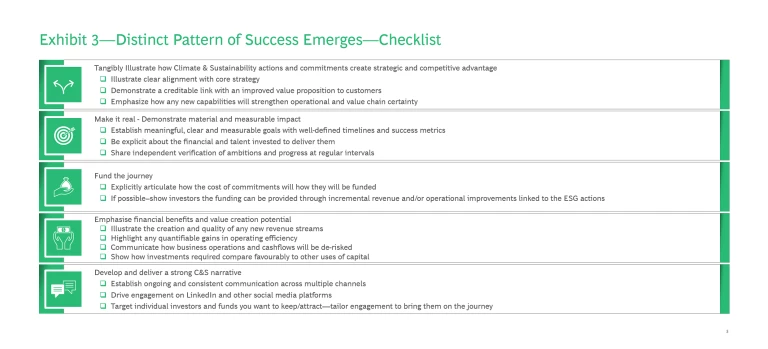

Based on our work with senior leaders on over 1000 projects worldwide integrating C&S into their strategy and operations and this study, we have identified 5 ingredients that listed companies need to include to generate valuation credit from their corporate C&S announcements.

- Tangibly illustrate how actions create strategic and competitive advantage – Communicate a direct link from commitment to action, and show how the action relates to your strategy and creates competitive advantage. Examples and testimonials will bring commitments and actions to life and make them tangible for investors.

- Make it real – Demonstrate material and measurable impact with well-defined targets that have been verified by a credible independent organisation. This will give investors comfort that progress is real, demonstrable, and will benefit society.

- Fund the journey – Connect your company’s ambition to financial reality by setting out how commitments will be funded, such as a combination of invested capital, incremental revenue, and operational improvements. Providing this level of detail will help investors understand how commitments will be funded.

- Emphasise financial benefits and value creation potential– Demonstrate improvements to risk and quality of cashflows. This will give comfort to investors that initiatives will have a positive impact on business performance and also compare favourably to other uses of capital.

- Develop and deliver a strong C&S narrative – Convey a crisp, clear and consistent investment thesis across multiple channels. An effective and well-aligned narrative will increase engagement and land your message with stakeholders – from investors to employees, customers and regulators.

The implications of the 5 ingredients are significant - there are no shortcuts when it comes to communicating compelling C&S actions and commitments. To get valuation credit from investors, listed companies need to connect their actions to their strategy, ground them in genuine competitive advantage, and provide a clear financial logic. No amount of communication can create value from superficial or hastily conceived actions which are often interpreted as greenwashing.

Top-Performing Companies Execute Action-Related Announcements With Depth and Precision

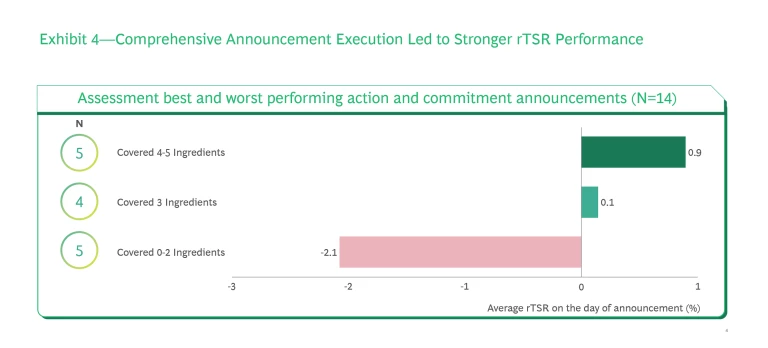

A look at only those announcements and releases with no other significant activity within 3 days either side such as changes in dividends, leadership, earnings beats or misses, shows that the ability to consistently apply the criteria corresponds to a positive market reaction versus peers, with the inverse being equally true.

Our analysis highlights that top performers for action-related announcements based on total shareholder return relative to industry peers (rTSR) explicitly communicated across four or more of the criteria.

Conversely, the bottom performers scored negative assessments on three or more criteria and consequently lagged the median rTSR on the day of announcement. Similar underperformance also endured after three and ten days.

As listed companies make more frequent and material environmental announcements, and investors demand more meaningful outcomes, companies need to focus on and articulate the intersection between ‘good for planet’ and ‘good for performance’. Senior executives need to provide transparency on how commitments and targets translate into action, and making sure performance can be witnessed and measured. There is no upside to providing information that leaves investors guessing as to the magnitude and direction of commitments.

Doing this well will set investors up with the information and ability to understand what listed companies are doing in the critical area of C&S, and in turn provide them with full valuation credit for their efforts.