A CFO must set unique near-term ambitions that are bold enough to motivate employees to achieve their full potential.

This is the second in a series of articles on the future of the finance function.

To evolve in today’s dynamic business environment, every finance function needs unique near-term ambitions that are bold enough to motivate the company’s employees to achieve their full potential. Even if the organization does not realize all of its stretch targets, such ambitions will inspire people to reach for greater heights of performance.

In our previous article , we presented five hypotheses for the function’s near-term future that were intended to serve not as a universal blueprint but as an inspiration and a starting point. We see the finance function as a company’s custodian of performance—steering activities and resource allocation at the enterprise level to achieve strategic objectives. In our view, many finance functions could fulfill such a role by the end of this decade.

To ensure that they set the right direction for their function, finance leaders should first gain clarity on the need for change. This provides the basis for the next step: defining ambitions for the future, with a compelling strategic story that promotes organizational support and drives change. The story should seamlessly flow from the company’s overall purpose and vision. With the direction set, the route may be adjusted in response to changes in the internal and external environment. By clearly understanding its starting point and ambitions for the future, the finance function can select the right focus areas and initiatives, iterating its approach on the basis of the lessons learned along the way.

The Need for Change

Finance functions need to spend sufficient time analyzing the challenges that the transformation will be designed to overcome. Otherwise, they risk pursuing initiatives to “put out fires” and neglecting other issues that should be addressed. A well-articulated explanation of the need for change motivates stakeholders to support the transformation and helps them develop the right aspirations and, ultimately, the best value-adding solutions.

Our experience, supported by BCG’s CFO Excellence Index benchmarking, indicates that a finance transformation is typically triggered by a variety of external and internal factors.

External Factors. Finance functions must help their companies address increasing regulations, such as those related to compliance and taxation, that add to the complexity of running the business. They must also support efforts to respond to capital market pressure and economic volatility—for example, by identifying and contributing to cost savings goals. At the same time, the shortage of high-caliber talent is driving the need to develop a more attractive working environment. Last but not least, the sunsetting of legacy IT systems creates an opportunity to redesign processes in conjunction with installing new systems.

Internal Factors. The need for greater efficiency and effectiveness to achieve a company’s purpose and vision is a strong motivation to transform. In many finance functions, efficiency may lag because the current setup is fragmented and complex and leads to wasted effort. Often, a failure to realize benefits of scale causes finance-related costs to grow excessively as the company’s sales increase. This reduces the financial flexibility needed to invest resources where needed. As to effectiveness, high-growth companies, in particular, want finance to provide support beyond its traditional roles of stewardship and scorekeeping. Many finance functions have significant room to improve as trusted advisers to the business, and they must advance even further to become its custodian of performance.

Many finance functions must advance to become the company’s custodian of performance.

Corporate transactions provide another impetus for change. In the context of a post-merger integration, companies seek to streamline the finance organization to maximize synergies and realize the benefits of scale. Additionally, the finance function of startups and other companies preparing for an initial public offering needs to establish a new finance infrastructure to support the reporting and compliance requirements of a public company.

Finally, many CFOs may be strongly motivated to transform their functions. For a new CFO , in particular, a finance transformation is an opportunity to gain transparency into current capabilities, as well as to create a legacy by taking the finance function on a transformation journey.

Roche Emphasizes the Need for Agility

For Roche, the main triggers are external business and technological disruptions. Three of Roche’s major brand-name biologic drugs are under competitive pressure from biosimilars, while technological advances are creating new opportunities across the value chain. To improve flexibility, the company is transforming from a traditional organizational model based on divisions and operational units to a more agile model. As people throughout the company seek to respond, they need the finance function to be more adaptable and focused on adding value. Accordingly, it is committed to experimenting with agile ways of working , encouraging its personnel to act as entrepreneurial spearheads and further leveraging its shared-services organization. A well-designed digital backbone (including an enterprise resource planning system) provides stability as the finance function increases flexibility and speed in this agile setup. Additionally, the finance function is analyzing and digitizing its processes end to end with the goal of reinvesting the savings generated in R&D.

A Compelling Story and an Iterative Approach to Driving Change

To truly transform their organization, finance leaders must first craft a compelling story that promotes support for the changes to come. They can then develop an approach to pursuing those changes, while being ready to adapt specific initiatives on the basis of internal and external developments.

The finance function’s story must be specific enough to guide decisions but easy for employees to internalize.

Craft an inspiring and actionable story. The finance function needs a story that is specific enough to guide decisions but easy for employees to remember and internalize. Although striking this balance is challenging, it is essential to promoting the long-term support of the finance organization. The entire finance leadership team and organization, not only the CFO, must be fully committed to this story, which provides the foundation for the ensuing transformation. The story must also make sense from a business perspective and align with the company’s purpose, as CFOs typically need board approval for any investments in the transformation.

The strategic story usually articulates messages covering three topics:

- The Finance Function’s Contribution to the Company’s Purpose. The entire finance organization, including internal and external stakeholders, should be inspired by the function’s contribution, which sets the direction. The organization should recognize the contribution as appropriate and integrate its objectives into daily decision making.

- The Desired Future State of the Finance Function. The ambitions should be bold but realistic, as well as actionable and measurable.

- The Initiatives Needed to Achieve the Future State. The first set of initiatives should be based on a strong understanding of the path to the future state. Adaptability needs to be built in to allow for changes in the internal and external ecosystem, along with new knowledge gained along the way that creates clarity around the next steps.

Together, these elements should constitute an easy-to-tell story that inspires the finance community and motivates action.

Define an iterative approach. A well-thought-through approach to implementing the finance strategy begins with building momentum. To celebrate early successes and motivate employees, the organization can use pilot projects. To set the stage for wide-scale change, the finance community should prioritize early initiatives, taking into account that some might be pursued simultaneously. On the basis of the lessons learned, new initiatives can be identified that enable the company to take the next bold move. Members of the finance community should co-own and drive the changes to promote sustained impact. At the same time, colleagues across functions should work together to develop fit-for-purpose solutions or, at the very least, to test them. Early investment in enablers (people, technology, and data) will help to build the capabilities needed throughout the transformation.

Roche Focuses on Explaining Why, What, and How

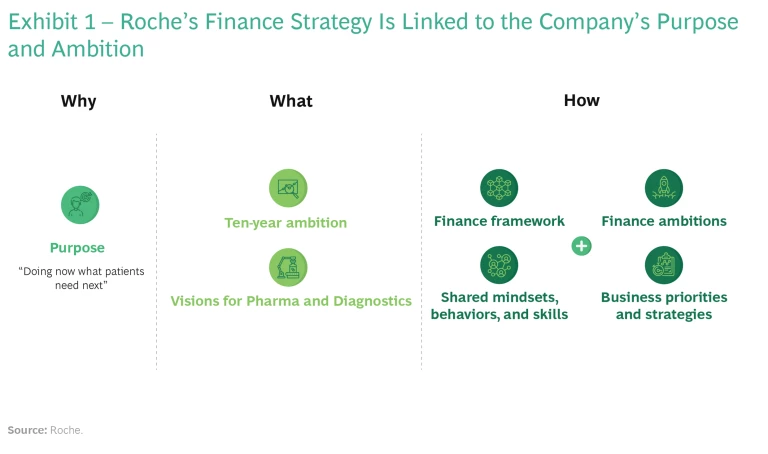

Roche’s finance function is following a similar, iterative process to be well positioned for the future of finance. Although the details are unique to Roche, the company’s approach demonstrates the value of thinking deeply about the future state, adopting an iterative approach to concrete initiatives, and considering potential implications. The approach results in three main elements: why, what, and how—which are continuously refined when needed. (See Exhibit 1.)

The first two elements are at the corporate level and apply companywide. “Why” is the company’s purpose (“Doing now what patients need next”). “What” is reflected in the company’s ten-year ambitions, which call for contributions from all parts of the business, and the vision for its Pharma and Diagnostics divisions. “How” is specific to finance and sets out the various ways that the function supports the company in achieving its purpose, ambitions, and divisional visions. It has four components:

1. The finance framework consists of the contributions that every finance employee is expected to make:

- Connecting the dots as entrepreneurs—for example, by designing and implementing initiatives from a comprehensive company perspective

- Serving as a guardian for stakeholders—for example, by safeguarding assets, providing transparency, and ensuring compliance

- Providing specialist expertise—such as in accounting and taxation

- Owning processes and systems end to end—such as by leveraging technology and automation

The extent of each employee’s contribution may vary by role.

2. Shared mindsets, behaviors, and transferable skills aim to enable personal and professional development and flexible careers within and beyond the finance function.

3. Finance ambitions include both quantitative and qualitative objectives—for example: “Analyzing end-to-end business processes across functions and aiming for a digitization ratio of 80%” and “Ensuring that finance personnel act as entrepreneurial spearheads, maintain an external focus, and take smart risks.”

4. Business priorities and strategies (parts of which may build on aspects outside of finance) are defined, and actions are identified to drive them.

The Right Focus Areas and Initiatives

The finance function’s starting point strongly influences which initiatives will have the greatest impact and help to achieve its ambitions. For some finance functions, the bundling of transactional tasks or the automation of monthly reporting could constitute a step-change improvement. In contrast, mature functions could be ready for more ambitious initiatives, such as comprehensively revamping their activities and processes to promote greater business impact.

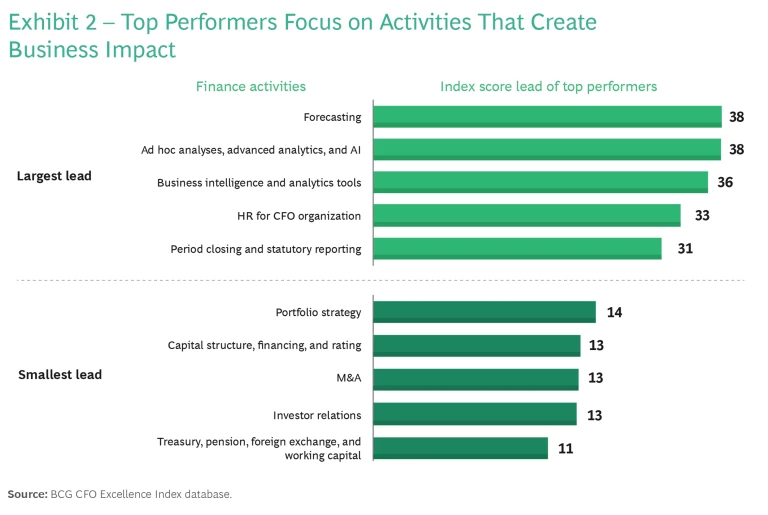

BCG’s CFO Excellence Index confirms that finance functions have a wide variety of starting points and improvement opportunities. Although the benchmarking finds relatively small performance differences among industries, we see significant differences between the best- and worst-performing finance functions in each industry. Top performers have highly efficient finance functions and focus on activities that create business impact. (See Exhibit 2.) These findings mean that there is no one-size-fits-all way to select the right initiatives.

In our experience, successful finance transformations are comprehensive programs that encompass the function’s operating model and value-adding processes, as well as enablers related to technology and ways of working. To identify initiatives, it is useful to answer the following questions:

- How does the finance function’s setup need to change to achieve the future state? Issues to consider include the right mix of centralization and decentralization, the role of shared services and centers of excellence, the approach to partnering between finance and the business units, and the positioning and structure of the digital backbone.

- How can the finance function create more value? For example, it may need to redesign its processes to promote greater business impact, such as by integrating processes within and beyond the finance function to improve efficiency and effectiveness.

- What new capabilities does the finance function need to drive step-change improvements? Decision makers should consider data and technology as well as skills. To inform decisions, the function needs high-quality finance data that is easy to access and use.

Transparency regarding each initiative’s value creation potential and resource needs will help to promote open discussions about prioritization. Moreover, continuous communication is essential to ensure that teams are aligned in their pursuit of disruptive change. This will help in continuously challenging the as-is initiatives to ensure bold thinking. Otherwise, there is a strong risk of developing siloed solutions that cannot operate interactively. In the worst case, a function has initiatives that look good on paper but fail to realize the envisioned value.

Roche Links Finance Initiatives to Its Strategy

Roche’s finance function links its bold ideas closely to the components of its strategy. It has extended the scope of shared service centers beyond traditional end-to-end processes to include, for example, project management and elements of performance management. It also aims to digitize 80% of end-to-end business processes across functions and shared services, thereby eliminating many repetitive and time-consuming tasks. To establish and sustain the new ways of working, the finance function has systematically broken down silos, removed hierarchies, and eliminated non-mission-critical activities.

Finance functions need to continuously evolve to keep pace with the changing business environment. A function’s starting point provides the basis for determining the right level of ambition to promote disruptive change without overburdening the organization. By following the iterative approach we have outlined, CFOs can gain clarity and embark on a successful journey to the finance function of the future, building organizational knowledge and adaptive capabilities along the way.

About Roche

The Roche Group, headquartered in Basel, Switzerland, is active in over 100 countries and in 2020 employed more than 100,000 people worldwide. In 2020, Roche had a market cap of CHF ~300 billion, invested CHF 12.2 billion in R&D and posted sales of CHF 58.3 billion.

About the Center for CFO Excellence

They focus on improving capital allocation to ensure a productive return on investments and to outperform competitors. Aiming to orchestrate company-wide transformations, BCG helps drive the corporate value agenda, identifying the best strategy for renewing the organization’s finance systems and increasing transparency and insight. If you would like to learn more about CFOx, please contact one of the BCG authors or visit cfox.bcg.com.