Modern partner ecosystems offer multiple advantages to software firms—but many struggle to build one. Here are five critical strategies for success.

As technology becomes ever more crucial for business, companies face many challenges in realizing its benefits. Buying centers proliferate across their enterprise, data security and privacy face increasingly sophisticated threats, and modernizing legacy systems and moving to cloud is a protracted process that becomes more complex each year. By building a robust ecosystem of partners, software firms can better help their customers navigate these challenges—and enjoy a clear competitive advantage.

Competitive advantage is possible because of the diverse capabilities of robust, modern ecosystems.

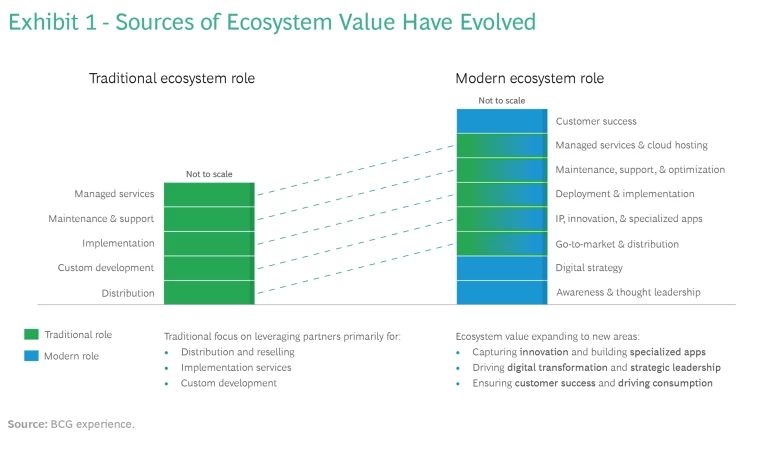

This is possible because of the diverse capabilities of robust, modern ecosystems that have emerged with the shift to cloud and subscription models. No longer are software firms’ partners merely “channels” for transacting and fulfilling sales in traditional sell-and-service business models. Instead, they can now play an end-to-end role across the entire lifecycle, helping customers accelerate their digital transformation .

These ecosystems deliver real benefits for software firms. Partners can:

- Expand reach by generating demand in new customer segments, markets, and industries. Partnerships have always allowed software companies to extend their footprint in markets where they have limited presence—a faster and simpler alternative to starting up their own sales team. But many partners now also possess the expertise to help companies gain credibility in specific sectors like health care or financial services where buyers’ expectations are impacted by specific regulations.

- Evangelize and influence purchasing decisions to create opportunities for products; for instance, if the partner is driving a large-scale digital transformation. This can be particularly helpful for new players whose partners can win influential customers that may otherwise be wary of relying on software from market entrants.

- Co-innovate and expand solution capabilities to add depth, relevance, and stickiness to software vendors’ offering. Software businesses may build on partner offerings, integrate them with their own, or extend them. More companies are turning to strategic partnerships and alliances to tackle innovation rather than risking unproductive efforts and missed opportunities in rapidly transforming business and technology landscapes.

- Accelerate time to value for customers by advising customers on how to migrate and manage their deployments. This is particularly true in X-as-a-service business models.

The result is a step change in how partners add value (see Exhibit 1).

Welcome to the Multipartner Environment

As the partner ecosystem model has demonstrated its value, the agency of partners has increased. Customers have embraced partners in roles across tech strategy, design, vendor selection, migration, adoption, and management for the differentiated value that they bring. Often these partners help connect a project to broader digital initiatives.

There are often multiple partners engaged across the life cycle of a single piece of software.

This means there are often multiple partners engaged across the life cycle of a single piece of software. In addition, CIOs are increasingly deploying a myriad of approaches to managing their software and cloud estate, further multiplying the number of potential relationships. In this complex environment, it is vital that all partners have the skills and expertise to deliver the proper advice and work harmoniously with in-house talent.

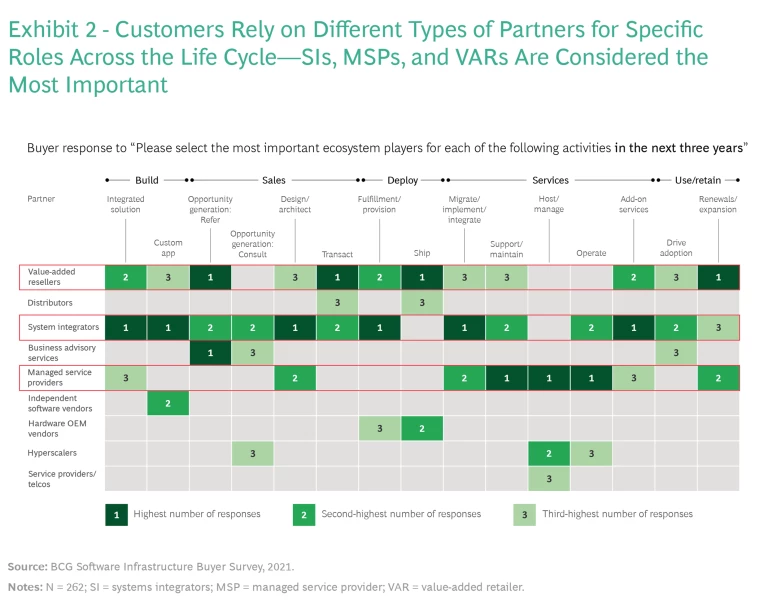

Not surprisingly, customers see some partners as delivering more value than others. Our survey of buyers of software and cloud infrastructure conducted in 2021 showed that partners vary in importance as the customer buys and then uses solutions—underlining the importance of coordination among the different parties (see Exhibit 2.)

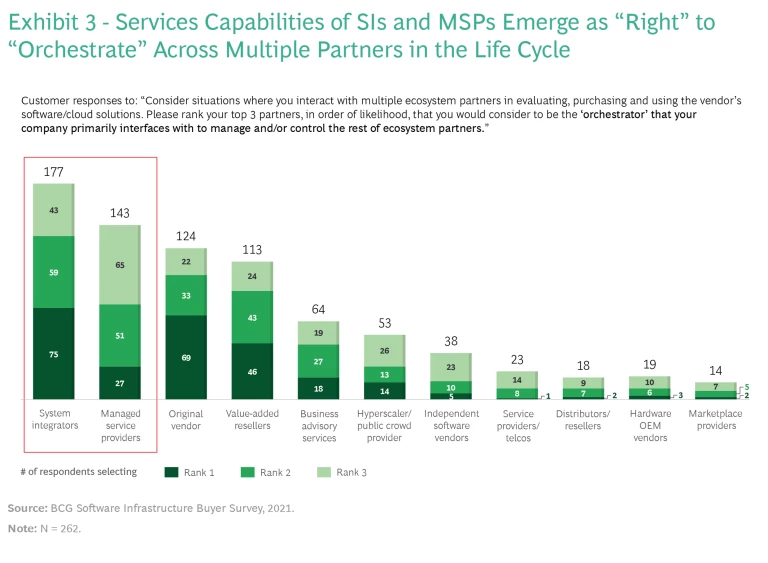

Systems integrators, who play right across the project from strategy formulation and roadmapping all the way to usage, are seen as the “orchestrators” of the ecosystem, with some 68% of buyers allocating them this critical role (see Exhibit 3.)

Managed service providers (MSPs) were a close second, reflecting their important role in managing today’s complex cloud and application environments. It is noteworthy that customers rank systems integrators and MSPs as more important orchestrators than the software and cloud vendors themselves. Astute tech players have been quick to leverage this trend by attracting and investing in partners with these services capabilities. Other tech organizations can capture value in analogous ways, underlining the possibilities inherent in a vibrant ecosystem with a broad mix of partner capabilities.

The Barriers to Ecosystem Growth

Building and maintaining the right ecosystem can be challenging for tech companies, large and small.

Larger, more mature software firms are often insufficiently equipped to evolve their ecosystems and get traction with partners at crucial inflection points in their businesses, such as launching new products and changing business models. They must recruit new partners while helping their existing partners transform. In addition, they may face problems of internal buy-in shifting to the full ecosystem model.

Smaller companies often have a limited network of partners, preferring to interface directly with customers. This is easier than ever in the world of cloud and subscription software and leads some to believe, incorrectly, that partnerships are unimportant. However, we often see these companies struggle to maintain growth beyond a particular stage. At this point, they need to assemble an ecosystem quickly. These companies then face the “chicken and egg” challenge of an ecosystem. They struggle to get the attention of the largest, most influential players and lack the critical mass to attract other partners.

Both types of players can overlook or underestimate the time and effort needed to establish a robust ecosystem. Building an ecosystem or taking it to the next level requires driving change externally and internally—and this can be a 12- to 18-month journey.

Five Vital Levers for Creating a Robust Ecosystem

Our work with B2B technology companies and interviews with several ecosystem executives has uncovered five critical levers that companies must pull to design, build, and scale their ecosystems.

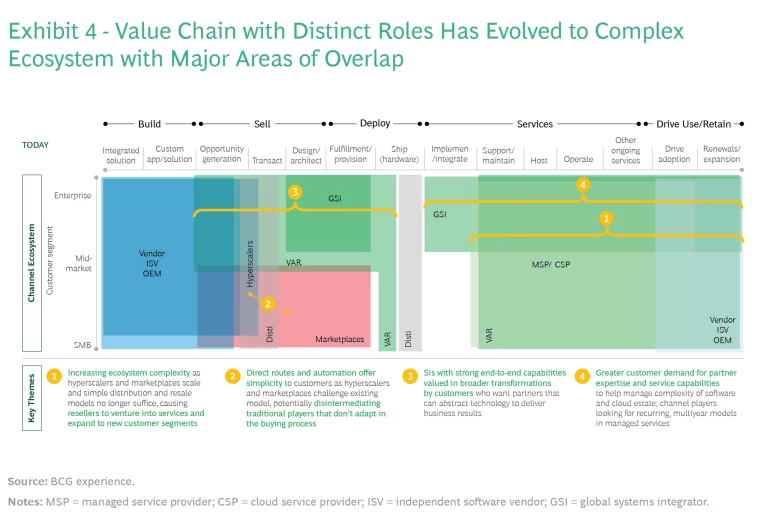

Think about partnerships in new ways. In the past, each partner had its distinct place in the customer life cycle and an associated, identifiable label such as “systems integrator” or “value-added reseller.” As seen in Exhibit 4, however, these lines continue to blur in modern ecosystems.

With many partners pursuing multiple business models, as highlighted by the exhibit, it is time to take notice. For example, most resellers are moving away from “buy-sell” models to professional and managed services. Most global systems integrators continue to develop solutions solving customers’ business problems through collaboration with independent software vendors. And public cloud players, with their marketplaces and enterprise sales teams, are now an essential route to market for software vendors, becoming “resellers” that also aim to drive consumption of their underlying platform.

To capture the full potential of ecosystems, software companies need to think about partners in new ways.

Despite this evolution, we still often find software companies mired in a legacy, single-role mindset. To capture the full potential of their ecosystems, they need to embrace the shifts that are occurring; they need to think about partners in new ways and no longer typecast them with restricting labels.

Software firms need to take a more partner-centric approach that encompasses the whole range of economic and business models each partner may be deploying. They then need to consider the specific business outcomes their partners can deliver and how these fit within a deliberately designed ecosystem.

Attract and support partners in the right way. Getting attention from key players such as global systems integrators and leading cloud providers may be challenging for smaller players. Indeed, even the largest software firms may find that potential partners would prefer to link up with a big cloud provider. The result: getting partner mindshare is tougher than ever.

So instead, many firms try a “follow the rabbit”

Larger companies have an additional balancing act: while winning the partners of tomorrow, they must maintain relationships with the partners of today. This requires a holistic view of partners’ capabilities—an area we find many software companies lack. They need to step back and prioritize the partners that matter most to their business.

In the wake of new models of partnering, companies also need to nurture their ecosystems in new ways. Partners such as independent software vendors drive co-innovation and co-development—creating joint solutions such as tailored software for specific industries or use cases. This solution generation requires more profound technical collaboration as partners build with, or on top of, each other’s technology. The skills needed here are often scattered or don’t exist in traditional partner/channel or product teams. To ensure success, a clear cross-functional mandate is required to bring together or build the resources to support partner co-innovation.

Harmonize partner programs and incentives. As software firms work through the substantial shifts outlined above, they typically find that the complexity of partner programs increases fast. In a very short time, companies may have multiple, disconnected legacy programs that partners must navigate. This places an additional burden on partners that are pursuing different business models.

In our conversations with partner executives, the same friction points arise repeatedly:

- Program complexity

- Lack of predictability and flexibility

- Some partner business models are perceived to get better treatment

Partner incentives, both monetary and nonmonetary, also tend to resemble reseller agreements, focusing on discounts and rebates. But these incentives may not make much sense for some partner business models. For instance, independent software vendors are most interested in accelerating and promoting their solutions. Professional services players are keenly focused on offsetting the direct and opportunity costs of training their workforces. And MSPs are most interested in predictable pricing to help scale their businesses.

The best incentive structures accelerate and reward the business models that partners pursue. So, we see the pioneers with an “ecosystem-first” strategy lead with unified, inclusive frameworks that eliminate unnecessary complexity yet give partners the flexibility to pursue the business models that are most attractive (or best fit) for them.

Optimize go-to-market strategies. Just like partner incentive structures, go-to-market strategies need to be flexible to accommodate each partner’s business model. Ecosystem players must throw away outdated playbooks and clearly define roles on their go-to-market teams, both partner-facing and seller-facing. They must also create new types of action such as co-selling across business development and sales teams.

To avoid conflict with partners, incentives for direct sales teams must be structured to encourage ecosystem-first behavior. Reciprocity is helpful here—for instance, routing sales leads to partners best placed to deliver value to customers.

Keep in mind that partners have complex go-to-market structures of their own. Systems integrators in particular often have intricate arrangements, with some teams organized by solution, others by industry, and a regional/country structure that frames both. Interfacing with these will require tapping into multiple points of the systems integrator’s organization—a complexity that immature organizations often fail to fully grasp.

An added layer of complexity in ecosystem partnership is the vital role of partners in driving adoption and consumption. The go-to-market strategy must consider how partner-led post-sales activities can empower customer success and complement the software company’s own professional services capability. Clear rules of engagement on service opportunities can prevent unnecessary friction—and in turn help forge even stronger partnerships.

Create the human and technology foundation for “ecosystem first.” One of the hardest challenges software vendors face when building a successful partner ecosystem is the shift to an ecosystem-first mindset. We see successful players making a conscious effort to bring this about. For instance, internal and external communications often highlight and celebrate partners’ roles in company successes. As elementary as this sounds, it can be a seismic shift for companies that start with a strong direct-to-customer culture conditioned to go-it-alone thinking.

Moving to an ecosystem-first mindset also involves finding the right talent in the organization to identify and recruit powerful partners—and build long-term relationships. There will need to be extensive internal rewiring to forge new ways of working, create joint solutions, and enable cross-partnership teams to develop the powerful, end-to-end solutions that ecosystems can deliver. All this is much easier if the staff driving this evolution has the right mindset. Partner-facing teams need to understand the real-world challenges of running a partner business. It may not be sufficient to just move talent with some experience in a non-partner environment into ecosystem teams; a deliberate talent strategy is necessary.

Don’t forget that the already complex go-to-market technology stack must keep pace with how ecosystems are evolving. As companies sell in new ways with partners, fresh systems are needed to support the joint sales process. Teams will handle prospects jointly with partners, run integrated campaigns, and pioneer other collaborative ways of working. New capabilities, such as unified, partner-facing portals and digital sales through marketplaces, will be needed. These capabilities should be integrated with processes and supporting tools of other internal organizations the partner team will interface with, such as marketing, sales, and finance to name a few.

While we’ve seen companies struggle with the complexity of swift expansion of sales and marketing technology, the good news is that tech products to support ecosystem business models are being rapidly developed. Companies must ensure they’re integrating the right technology to support their desired ecosystem outcomes.

Software companies face many challenges, from skills shortages to problems in the funding market to slowing global growth. To some, intensifying efforts to build a vibrant and well-rounded ecosystem may seem like a job for tomorrow, not today. But the business benefits are overwhelming. Being a partner in such ecosystems means not only working together; it means being successful together.

As we have already noted, this transformation from winning as a lone player to winning together is not easy and takes time. However, customers will increasingly demand the end-to-end solutions and services that are difficult to deliver any other way. For any software firm that wants to thrive amid future challenges, it is time to double down on the ecosystem journey.

The authors would like to acknowledge Alexandre R. Mounier, Ashwin Halgeri and Aniruddh Padia for their help in conducting the research for this article.