By helping steelmakers curb their greenhouse gas emissions, iron ore miners can advance their own decarbonization efforts.

Decarbonizing steel production, which generates about 7% of global CO2 emissions, is a vital step toward achieving a net-zero world. For mining companies that supply the iron ore needed to produce steel, helping steelmakers reach this goal could remedy their own emissions problems.

Many iron ore mining companies are already taking steps to address Scope 1 and Scope 2 greenhouse gas emissions that arise from their own operations. However, they are under increasing pressure to tackle downstream Scope 3 emissions stemming from subsequent use of mined products—for example, in smelting and refining iron ore to make steel. Scope 3 emissions account for approximately 90% of mining industry emissions.

Fortunately, greener ways of producing steel are creating an opportunity for iron ore mining companies to curb these hard-to-reach emissions. What’s more, they offer iron ore miners the chance to build new and more sustainable businesses, forge closer relationships with their customers, and create value.

Steelmakers Face Growing Pressure to Act

Like miners, steelmakers face mounting pressure from multiple stakeholders—including investors, activists, end users, and governments—to curb their carbon emissions . Last August, the Institutional Investors Group on Climate Change, a coalition of European asset managers, accused the steel industry of failing to set firm net-zero emissions commitments.

Governments, meanwhile, are adopting measures designed to incentivize high-emissions industries, such as steel, to act. Europe is leading the way. The European Union’s new Carbon Border Adjustment Mechanism (CBAM) is essentially a tariff imposed on steel imports on the basis of the amount of carbon embedded in them. CBAM will require importers to report embedded emissions starting in 2023 and will become fully operational in 2026. The mechanism aims to create a level playing field between EU producers and importers of steel from outside the bloc to prevent strategic carbon leakage (efforts to move production offshore in order to avoid EU climate costs or to replace EU products with more carbon-intensive imports).

China, the world’s largest steel-producing country, has created a national carbon-pricing system that is expected to take steel emissions into account within the next few years. Meanwhile, President Biden has announced that the US intends to reduce its emissions by at least 50% by 2030 (compared with 2005 levels) on the way to net-zero emissions by 2050.

The Road to Green Steel Won’t Be Smooth

In response, recognizing that a proactive approach could give them a competitive advantage, leading steel players are setting their own emissions reduction targets and formulating strategies for reaching them.

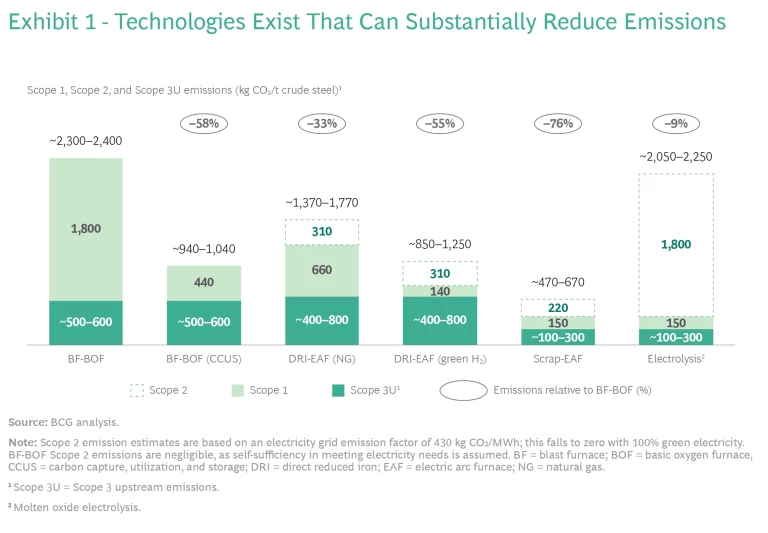

Three main pathways exist for incumbent players to decarbonize steel production. (See Exhibit 1.)

Direct-Reduced Iron with Electric Arc Furnaces. Replacing the blast furnaces and basic oxygen furnaces (BF-BOFs) of a traditional integrated steel producer with production based on direct-reduced iron and electric arc furnaces (DRI–EAFs) is one mature technology option. DRI production facilities consume high-grade iron ore pellets and run on natural gas (NG). Eventually, however, they are likely to use green hydrogen (H2). This technological improvement could reduce emissions by 33% to 55% compared with the BF-BOF production route, taking into account Scope 1, Scope 2, and upstream Scope 3 emissions. Over 100 million tons of NG-based DRI-EAF production capacity is already in place worldwide.

As an alternative to EAFs, some integrated players are exploring the use of submerged arc furnaces (SAFs) as smelters to melt solid DRI and remove impurities prior to transferring the iron to their existing BOFs.

Steel Scrap. Using EAFs to process scrap steel is a proven pathway to decarbonize the production of commodity-grade steel. To produce higher grades of steel, companies must use DRI-EAFs. Europe already heavily recycles steel, but other regions, such as China, have significant untapped potential to use recycled scrap. Even so, at a global level, scrap will likely be in short supply and so cannot fully replace ironmaking.

Carbon Capture, Utilization, and Storage. Another decarbonization option involves capturing carbon emissions from steel production and then either sequestering them or using them in industrial processes. The technology faces public resistance in many regions, however, and sequestration requires access to a limited number of geological formations.

Significant uncertainty exists about which of these three pathways offers the most viable way to reduce emissions in the difficult-to-abate steel sector. All face challenges today, for reasons that range from dependence on immature technologies to significant cost to lack of feedstock availability.

For example, DRI-EAFs require high-grade iron ore pellets, but the supply of such pellets is limited by constraints on the supply of high-grade ore and on pelletizing capacity. Players equipped with SAFs can use slightly lower-grade blast furnace pellets. In addition, research is underway in using iron ore fines to make DRI in a fluidized bed furnace; if successful, this process could enable companies to use low-grade iron ore to produce high-grade steel. As yet, however, only one pilot project exists worldwide. Iron ore electrolysis is another technology that might be able to use lower-grade fines as source material, but it is still at the laboratory stage.

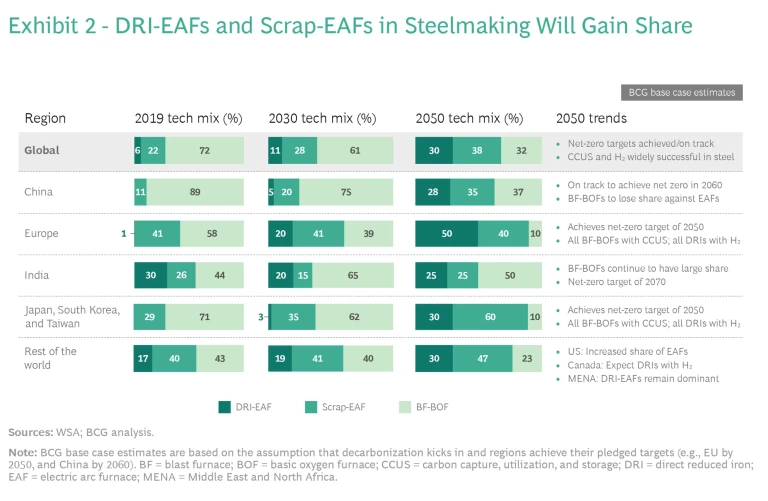

In light of the challenges associated with the three pathways outlined above, we expect the solution to net-zero emissions in the steel industry to involve a mix of all three. (See Exhibit 2.) How that mix will evolve remains uncertain. Nevertheless, across our scenarios, we expect the DRI-EAF pathway to gain in importance over the foreseeable future, provided that it receives the necessary support from growth in high-grade iron ore pellet supply, scrap, and green H2 to achieve its full carbon-reduction potential.

How Iron Ore Miners Can Participate in Steel Decarbonization

In reconfiguring their production processes to make them more environmentally friendly, steel producers will need access to greater quantities of scrap metal and high-quality ores and pellets for use in DRI-EAF plants. Mining companies have a key role to play in meeting these requirements. And by adopting new approaches—such as partnerships and other forms of forward integration—to serve their customers, they can forge closer relationships with steelmakers and create greater value.

Here are three actions they should consider taking.

Accelerate high-grade production. Iron ore mining companies already prioritize the production of better-quality ores, but they need to do more. Ores with more iron content and fewer impurities enable manufacturers to produce higher-value-added green steel efficiently. Demand for such ores will grow as steel makers shift away from BF-BOF plants and toward DRI-EAFs. Miners need to anticipate the requirements arising from this shift and position themselves to access and develop high-grade resources.

Move downstream. The industry practice of producing iron mostly onsite at steel-making plants will change as steel companies increase their use of DRI. With DRI likely to be in short supply, miners can help mitigate the shortage by building and operating DRI plants in optimum locations for leveraging regional low-cost renewable energy and NG resources and logistical advantages. But to succeed, they will need to navigate the downstream ecosystem. That means securing access to cost-competitive renewable electricity and green H2, and securing a partnership or offtake agreement with a steelmaker.

Given the war in Ukraine's impact on NG prices and supplies, DRI production in Europe using NG appears to be less feasible in the near term. This could further the case for decoupling DRI production from steel making, with access to low-cost NG outside Europe outweighing the advantages of hot-charging DRI onsite. Another possibility would be for players to take advantage of the newly announced Hydrogen Accelerator program—part of the EU’s REPowerEU plan to diversify gas supplies—to kick-start DRI production based on green H2 in Europe.

Participate in scrap recycling. As steelmakers ramp up their decarbonization efforts, mining companies have the opportunity to offer their steelmaking customers a complete range of low-carbon metallics, including supplies drawn from scrap sources. By expanding into scrap, miners can mitigate the risk to primary metal demand that scrap poses, and they can participate in the megatrend toward circularity over the coming decades. However, a deep understanding of the subsegments of the scrap value chain is critical to developing an actionable entry strategy and building a concrete, investable business model. By leveraging their relationships with steelmakers and extending their current value-in-use models to scrap supplies, mining companies can differentiate themselves from incumbent scrap suppliers. Because the scrap industry is fragmented, they may also derive value by advancing transparency and capturing synergies and economies of scale through consolidation. In addition to opening a new source of revenue, moving into scrap recycling would improve mining companies’ overall sustainability.

Iron ore mining companies have a clear incentive to become part of the decarbonization solution for steel, but they must act with urgency. By taking steps today, they can gain access to increasingly valuable resources and build effective partnerships for the long term. The investment decisions that mining companies make now will last for decades, so they need to move boldly to help their steelmaking customers chart a course to a net-zero future.