As governments decarbonize their economies through renewable energy generation, volatility in electricity prices will surge. Players can use multiple levers to mitigate it—but they must act carefully to avoid damaging industrial competitiveness and increasing costs.

This article is the second in a series exploring changes to our electricity and broader energy systems—and the implications for consumers and governments—that will arise from the massive shift to electrification and variable renewable energy needed to achieve our net-zero emission ambitions. In the first article, “Why Your Company Needs to Be an Electricity Trader,” we examined how this transformation of our electricity systems and markets will offer a competitive edge for companies that can be more flexible in the way they consume electricity. In this one, we explore the impact of renewables on price volatility in electricity markets, how this can be managed, and the implications of greater volatility for governments and electricity-intensive users.

The world is observing an extreme political and humanitarian crisis in consequence of Russia’s invasion of Ukraine. The war has had severe flow-on effects for regional and global energy markets and prices. These have, in turn, amplified the push for greater energy security and price stability. Yet in some electricity markets, we are also starting to observe periods when electricity is free or even negatively priced. Could electricity ever be free? That is one of the aspirations for the growth of renewable energy—large blocks of time when abundant solar and wind resources will generate zero marginal-cost electricity. Over the last year, we have been investigating the effect of high penetration of renewable energy on electricity markets: how it leads to volatility and, during the transition, how it increases the exposure of electricity markets to shocks in upstream gas markets as seen in Europe.

High penetration of variable renewable energy (VRE) generation (principally solar panels and wind turbines)—will drive price volatility in electricity markets. This is already apparent in front-runner markets like South Australia and California. Learning to live with volatility will be increasingly important as governments decarbonize their economies. But the relationship between variable renewables penetration and price volatility is not an obvious one and warrants further investigation.

As markets and policymakers introduce greater renewable capacity to achieve climate change goals, forcing out conventional generators, we also expect far greater volatility to assert itself.

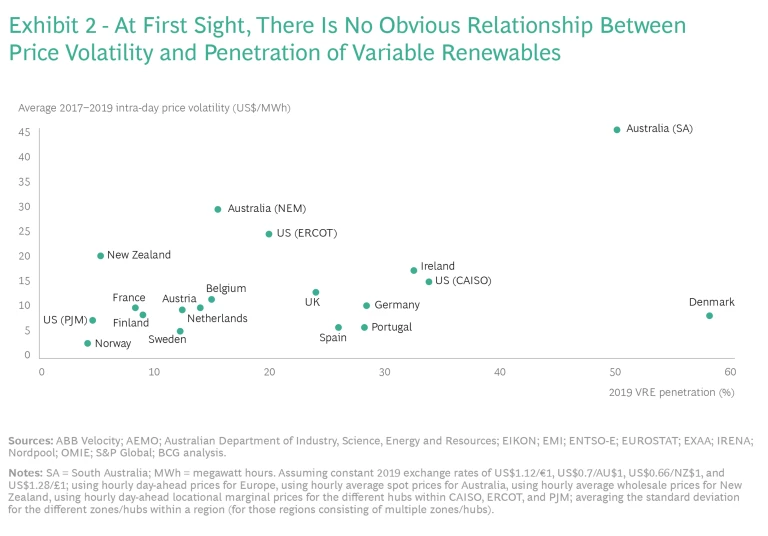

To examine this important phenomenon, we looked at a decade of hourly electricity prices in 19 liberalized electricity markets. The impact of variable renewables on price volatility is visible across markets but it is nuanced, varying in degree from one market and region to the next. Some markets with moderate or high renewables penetration, including markets in Central and Western Europe and Scandinavia, have yet to experience the same degree of price volatility as others with similar levels of variable renewable generation.

This might seem surprising—after all, the drivers of volatility are the same across markets. On closer inspection, however, it becomes clear that a confluence of factors is working to mitigate price volatility. These factors include interconnections with neighboring markets (with lower levels of VRE or diverse forms of generation); some form of capacity markets or payments; high levels of pumped hydro capacity; and stringent price caps and floors. How price volatility plays out in different markets depends on the presence of these factors.

Yet as markets and policymakers introduce greater renewable capacity to achieve climate change goals, forcing out conventional generators, we also expect far greater volatility to assert itself in these markets. Unless designers and operators in all markets take steps to mitigate volatility, energy users could be faced with an environment of feast or famine: electricity will be free—except when it’s really needed. There will be a greater risk of outlier events with very high electricity prices, and electricity systems will be more exposed to natural gas costs, as seen in several markets globally in 2021.

I f, as we expect, more-volatile prices are experienced more broadly, it will present opportunities for industrial consumers to gain an advantage by flexing their demand while increasing “insurance” costs for consumers that cannot (or will not) take this route.

Governments and market designers that don’t manage price volatility, or that alternatively impose significant costs in doing so, can damage local industrial competitiveness and development. There are multiple levers available to limit the impact of greater volatility. But many come with hidden costs—so they need to act carefully. While grid developments and the introduction of liberalized markets have separated supply and demand over the past decades, we believe governments should: (1) once again consider supply and demand together (not necessarily in terms of location, but in terms of the timing of generation and consumption) by creating combined energy-industrial solutions and (2) ensure that barriers to demand-side flexibility are removed.

Renewable Energy Is Creating Volatile Electricity Markets—but Not Universally

There are several factors at play that are increasing price volatility in some electricity markets.

Price volatility is a feature of liberalized electricity markets.

Price volatility is both a normal and desirable feature of today’s liberalized markets. Price fluctuations provide important signals for the development and dispatch of flexible power plants and storage facilities. Hedging markets, with varying levels of liquidity, allow participants to insure (at a cost) against the risk, if they choose. And by agreeing to pay a fixed tariff to their energy retailer, many industrial—and most commercial and residential—users can shield themselves from the day-to-day volatility.

Electricity markets are undergoing a fundamental change.

However, electricity markets worldwide are poised for rapid change as governments aim to achieve net-zero emissions by 2050. According to the International Energy Agency’s net-zero pathway, VRE will need to make up close to 70% of the global generation mix by midcentury, compared with about 9% in 2020, even as the total amount of electricity generation increases more than two and a half times.

As volatility surges in markets with high penetration of variable renewable generation, questions are being raised about the impact of variable renewables on electricity prices. One of the promises held out is that “electricity will be free,” because it costs nothing for the sun to shine or the wind to blow. But based on the evidence from these markets, one needs to add “except when you really need it”—and then it will be expensive relative to the average price.

Front-runner markets are already experiencing extreme price volatility.

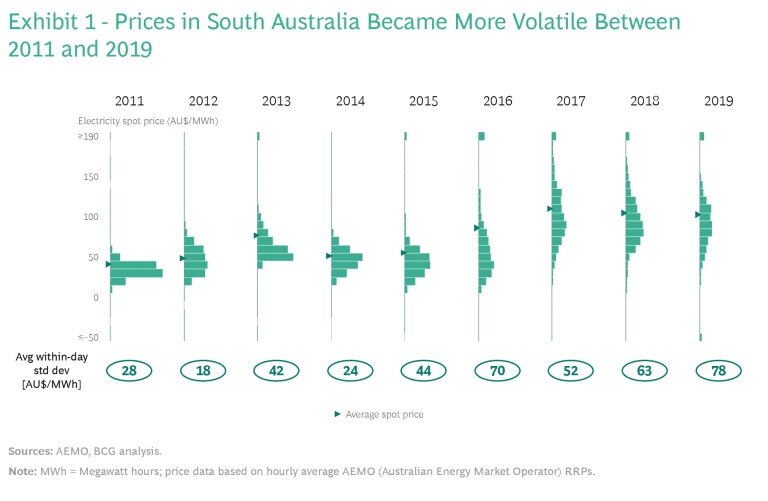

In South Australia, for example, the share of solar and wind in the generation mix rose from around 24% to 50% between 2011 and 2019. Over the same period, average yearly within-day price volatility increased by around 180%. (See Exhibit 1).

This increase was driven roughly equally by a combination of more extreme periods when prices were either zero or negative (“electricity is free”) or more than twice the average (“except when you really need it”) and by more generalized day-to-day volatility owing to the varying availability of solar and wind throughout the day and across seasons (impacting the residual demand, or residual load, which is the demand met by dispatchable generators—that can be turned on and off according to demand—after subtracting variable renewable generation). This increase in volatility has posed challenges for inflexible dispatchable generators, which have been forced to accept low or negative prices for their electricity, and inflexible consumers with fixed tariffs that have been forced to purchase electricity at very high prices or pay a higher average price to their retailer to accommodate the risk of volatility. (For insights into the mechanism whereby VRE impacts price volatility and a case study of the South Australia market, see the sidebar “Understanding the Drivers of Volatility in Electricity Prices.”)

Understanding the Drivers of Volatility in Electricity Prices

Fluctuations in prices have always been a normal part of liberalized electricity markets. They arise because:

- Demand varies at different times of day, week, and year due to changing weather conditions, consumer behaviors, and societal factors.

- Electricity is difficult/expensive to store in large quantities and for extended periods of time, in contrast to other energy commodities like gas and oil. For this reason, additional dispatchable generation must be available to supply the peak demand periods.

- The marginal cost of the power stations that generate electricity differs widely between technologies, so prices rise and fall with the changes in demand.

- Merit Order of Dispatchable Generating Sources. This is equivalent to the supply curve of dispatchable generation, arranged in order from lowest marginal cost to highest. Generators are dispatched in order; those with the lowest marginal cost are generally deployed first.

- Residual Load Frequency Curve. The load on an electricity system is equivalent to the demand at any point in time. The residual load represents the demand that must be met by dispatchable generators after subtracting variable renewable generation. The residual load over the course of the year can be displayed as a frequency distribution.

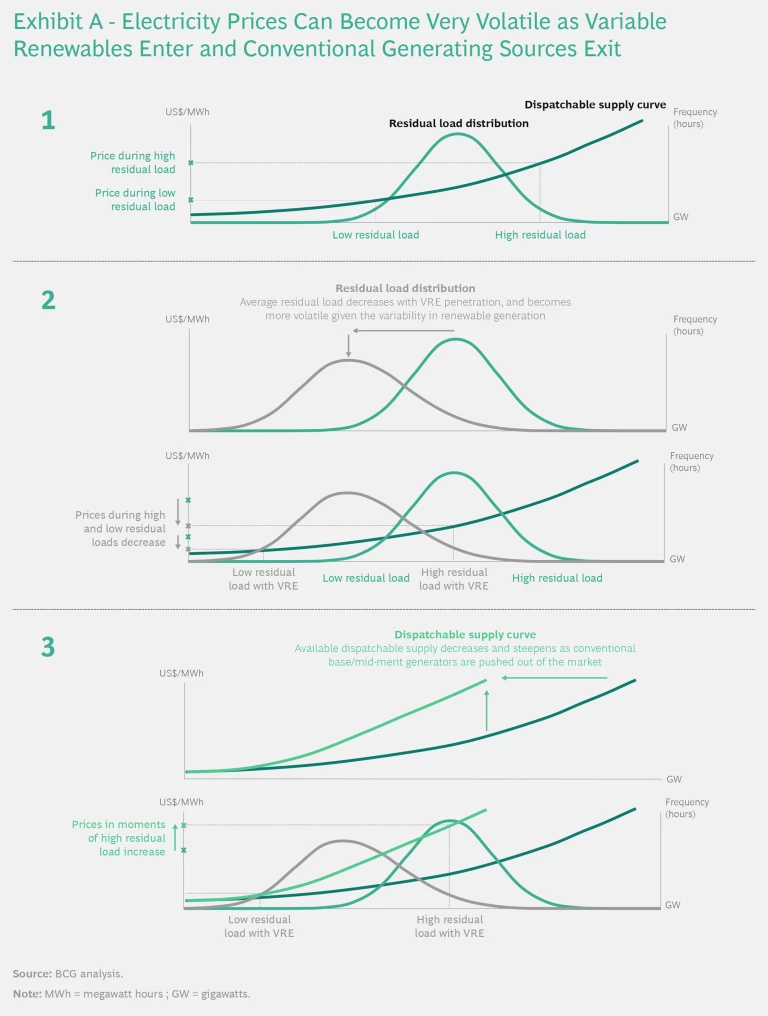

Volatility occurs due to the combination of a very small number of occasions when the electricity price reaches the cap or floor and far more frequent variability within a standard range. This second, “everyday” volatility is more substantial in markets with a steep merit order of dispatchable sources, a broad distribution of residual load, or both (Exhibit A, Box 1).

Variable Renewable Energy Exacerbates Electricity Price Volatility.

The introduction of meaningful levels of variable renewable energy (VRE) affects electricity markets in a two-step process (a broader distribution of residual load, followed by a steeper merit order of dispatchable sources). Over time, these factors lead to higher price volatility. But in the first instance, variable renewable generation can potentially have the opposite effect.

First of all, introducing VRE reduces the average residual demand in the system (Exhibit A, Box 2). And because the amount of variable renewable generation varies with the weather, not with demand, it also has the effect of broadening the distribution of residual demand: residual demand peaks don’t reduce much, while during periods of strong wind or sun so much renewable electricity can be generated that residual demand becomes negative. For example, in South Australia, peak demand often occurs late in the afternoon of a hot summer day, when there is very little wind and solar generation has begun to tail off. Conversely, there have been periods where the entire demand of the state, and more, was met by local solar production. The lower average residual load that results from this dynamic tends to dampen both average prices and price volatility as the residual load is less exposed to the steep tail of the merit order: generators with high marginal costs are less likely to be deployed.

This leads to the second development: mid-merit plants—often powered by black coal or natural gas—exit the market because the low average prices they receive and a reduction in their operating hours mean they cannot cover their fixed costs (Exhibit A, Box 3).

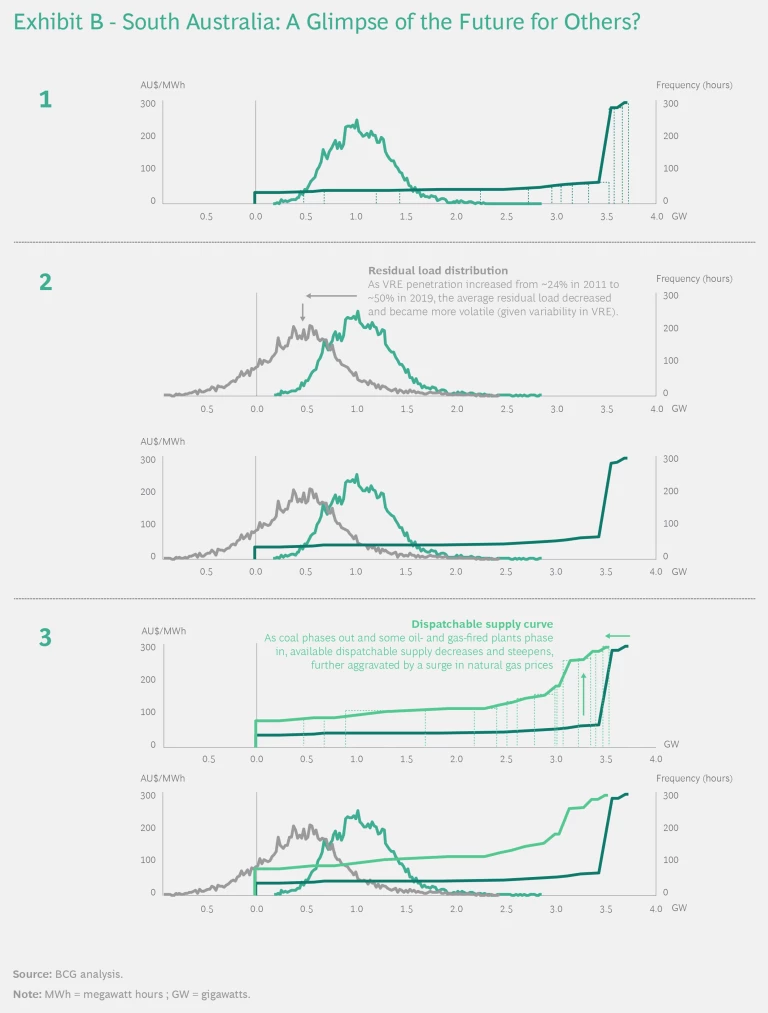

The net effect of the two developments outlined above is a steep “hollowed-out” merit order that, together with more variable residual demand, leads to far more variable electricity prices. These features can be clearly seen occurring in the South Australian market over the last decade (see Exhibit B).

South Australia: A Vision of the Future for Energy Markets?

The impact of VRE on electricity prices can already be seen in South Australia (Exhibit B, Box 1). Between 2011 and 2019, variable renewable generation reduced the average yearly residual load from around 1,050 MWh to 465 MWh and made it more volatile, with its standard deviation increasing from around 325 MWh to 440 MWh (Exhibit B, Box 2).

Because of this new residual load profile, over 2,500 MW of coal-fired generation in South Australia and the neighboring Victoria region has exited since 2011. This withdrawal of coal plants, together with a surge in natural gas prices from around AU$3.5 per gigajoule in 2011 to over AU$9 per gigajoule in 2019, drove up the marginal cost of gas-fired plants and steepened the supply curve (Exhibit B, Box 3).

In markets where renewables are established, periods of high renewables generation cause electricity prices to fall sharply, whereas periods of low renewables generation drive prices up to very high levels. In South Australia, it was this dynamic that led the average within-day price volatility throughout the year to increase by around 180% between 2011 and 2019.

The phenomenon of extreme volatility is not (yet) universal.

But while a high penetration of variable renewables leads to significant price volatility in some markets, that’s not the case for all markets. We analyzed 19 liberalized electricity markets from 2011 to 2019, excluding 2020 and 2021 due to the anomalies resulting from the COVID-19 pandemic and subsequent rebound, though the extent of those fluctuations is in itself instructive of volatility in energy markets. (See the sidebar “Scope of Analysis” for details). We found that the relationship between variable renewables penetration and price volatility is not straightforward. Some markets, such as Denmark, have very high levels of VRE and enjoy relatively stable prices; others, such as Texas, have lower levels of variable renewables but higher price volatility. (See Exhibit 2). Why is that?

Scope of Analysis

To quantify price volatility, we have used the day-ahead hourly price as the reference wholesale electricity price for markets in Europe and the US. For Australia and New Zealand, we have used real-time hourly prices, as day-ahead markets do not exist. It is worth noting that volatility also manifests in other short-term markets. These include intra-day markets (where traders can adapt their day-ahead positions), real-time balancing markets (where real-time deviations from scheduled positions are settled at the imbalance price), and ancillary services markets such as those for frequency control.

Volatility in these markets is often higher than in day-ahead markets. For example, Belgian and Dutch real-time imbalance prices between 2011 and 2019 experienced within-day volatility that was three to five times higher, on average, than in the day-ahead market. This is also shown in scientific research that estimated that arbitrage potential was about five times larger in the Belgian and Dutch real-time imbalance markets than in the day-ahead markets.

We Expect Volatility to Assert Itself Even in Markets That Have Avoided It So Far

Exhibit 2 includes several markets that already have meaningful levels of VRE yet have avoided the worst price volatility. These markets possess distinctive volatility-reducing features that work by either flattening the merit order (supply curve) or narrowing the variability in residual demand (electricity demand less VRE production). These features include:

- Capacity markets that retain mid-merit plants by providing them with fixed payments

- Interconnections between markets that pool demand and supply, reducing variability

- Energy storage, usually in the form of pumped hydro generation

- Market design constraints such as price caps and floors

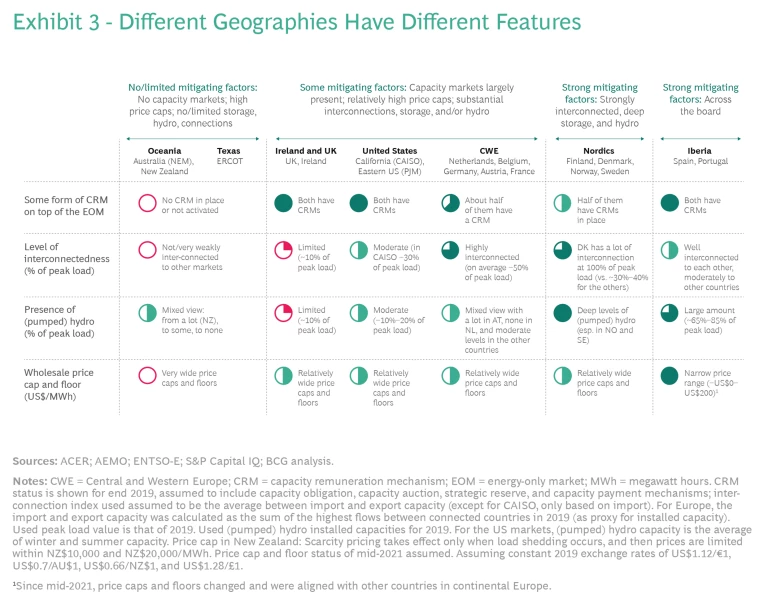

We clustered the markets based on the extent to which these features are present and found that three groups emerged. (See Exhibit 3.)

The first group consists of electricity markets that (during the time frame of our analysis) didn’t yet have capacity markets, did have very high price caps in line with what power system economists call the “value of lost load” (typically $10,000 to $20,000 per MWh), and had limited interconnections with neighboring markets and/or limited storage and hydro generation relative to the size of the market. Examples include Texas (Electric Reliability Council of Texas—ERCOT), Australia’s East Coast (National Electricity Market—NEM), and New Zealand.

The second set of markets is characterized by substantial interconnections with neighboring markets, lower regulatory price caps (typically still a few thousand US dollars per MWh), and generally some form of capacity market in addition to the energy-only market. They include most countries in Central and Western Europe; Ireland and the UK; California (California Independent System Operator—CAISO), and the eastern US (PJM Interconnection).

In the third group, some or all of the features that have a mitigating effect on price volatility are strongly present. For example, Spain and Portugal have relatively high levels of hydro and pumped hydro plants; Spain provides capacity payments that have supported an excess of mid-merit plants; and both markets had stringent price caps and floors of €180/MWh and €0/MWh, respectively (although, since mid-2021, both markets have aligned their price caps and floors with other countries in continental Europe). Another example is the Scandinavian countries, which are strongly interconnected and have significant levels of dispatchable hydro dams and pumped hydro storage.

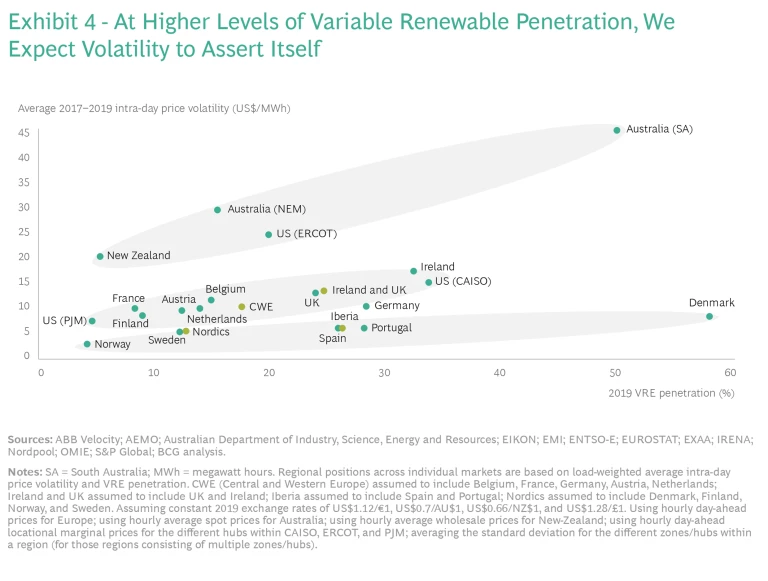

Within each of these three groups, there is a clear relationship between greater levels of VRE and higher price volatility. (See Exhibit 4.) The first group of markets behaves in a similar way to the South Australian example (described in the sidebar “Understanding the Drivers of Volatility in Electricity Prices”), with very high price volatility in all of them. But even in this group, volatility increases as the penetration of variable renewables rises. The pattern is repeated in the other groups, which share a similar degree of volatility-reducing features.

While most markets in the latter two groups have escaped the highest levels of price volatility (during our time frame, excluding the events occurring in the second half of 2021) despite integrating higher levels of VRE sources, we expect volatility to increase as VRE generation grows and more conventional plants exit.

Based on our findings, it may be tempting for countries with strong connections to neighboring markets to conclude that they are immune to the price volatility caused by high VRE generation. However, in a future where most, if not all, neighboring countries have much deeper penetration of renewable energy resources, with similar (even if not fully correlated) generating patterns, they will not be able to rely on each other to balance out variability in their own electricity systems. We expect even countries in Central and Western Europe, which benefit today from strong interconnections, to experience higher price volatility.

In these markets too, governments and electricity system designers cannot afford to be complacent. They must also plan ahead to avoid the worst effects of price volatility. In addition, governments and designers will need to be aware that increased penetration of VRE will leave their national power systems facing a greater impact from rises in natural gas prices as well as electricity price volatility. (See the sidebar “An Important Side-Effect: Exposure to Natural Gas Prices.”)

An Important Side-Effect: Exposure to Natural Gas Prices

Once mid-merit plants exit the market, demand during unexpected events—such as renewables droughts (a persistent lack of wind or sun) or outages at base-load generators or interconnectors linking one market to another—must be met by peaking generators with higher marginal costs, which are typically gas-fired. The electricity system is then exposed to a trio of reinforcing impacts:

- Higher demand for natural gas depletes reserves and pushes up local gas prices in the short term.

- This run-up in gas prices increases the marginal cost of gas-fired power stations and therefore the price they bid to supply electricity to the market.

- These more expensive bids set the price for the entire market more frequently because they run more often.

Similarly, in the second half of 2021, many European countries were exposed to very high gas prices. These were driven by a confluence of factors, including lower stored gas levels because of an unusually cold winter and spring, higher gas demand due to wind generation being far below average, and high gas demand on the back of a strong post-COVID economic recovery, according to a study from Columbia University’s Center on Global Energy Policy. European natural gas spot prices were about six times the level seen in autumn 2019. These elevated gas prices flowed through to electricity prices, driven by Europe’s shift over recent years toward greater gas-fired generation and away from coal.

Five Mechanisms to Manage Electricity Price Volatility: Proceed with Caution

Normal price volatility is not necessarily a phenomenon to be avoided. Extreme price volatility, however, can increase the cost of managing risk for energy customers and generators.

We’ve identified five ways that stakeholders can manage the impact of VRE generation on price volatility. Not all approaches are equal. Some incur hidden costs, while others are effective only temporarily and need to be supported by more permanent measures.

Consume renewable energy when it is produced and produce when it is consumed. Price volatility creates an incentive for consumers to shift their demand to periods when there is sufficient generation from solar and wind. This will require companies to invest in assets and alter their operations so they are more flexible in how they consume electricity. The payoff: a large share of electricity demand could be met at a relatively low cost.

At the same time, it is important that the mix of VRE generation is optimized, especially when subsidized by governments. Rather than just encouraging renewables that provide the lowest levelized cost of electricity, governments and electricity market designers should ensure a mix of renewable technologies, designs, and locations that correlate well with existing and planned demand. On the flip side, there is also an opportunity to encourage new industry with flexible demand that is well-matched to locations with low-cost VRE resources.

One potential option for markets with extremely low-cost VRE will be to overbuild the renewable generation needed to supply current demand and to introduce new, highly flexible forms of demand—most notably green hydrogen production—that can soak up excess power generation.

Reduce residual demand ahead of closing dispatchable generating capacity. Curbing residual demand—either through lower consumption or by introducing excess renewables—prior to the closure of fossil-fueled plants tends to keep the market oversupplied with energy and thus reduces both electricity prices and volatility.

The use of energy efficiency measures to lower consumption is welcome. But deliberate demand destruction (for example, allowing an aluminum smelter to close) comes with industrial and social costs. And while introducing renewable generation ahead of the closure of dispatchable generators can curb prices and volatility, this is likely to require government incentives or subsidies.

Both solutions are only temporary, however, until the weakened economics of dispatchable generators force the closure of these plants. In addition, both mechanisms can be costly. In some cases, the early introduction of renewables has resulted in the seemingly perverse situation where renewables are subsidized to enter the market and dispatchable generation is simultaneously subsidized to remain open.

Flatten the merit-order curve. Ensuring that there is sufficient mid-merit and peaking power capacity remaining in the market, and that their fuel costs are low enough, results in reduced price peaks. One way of achieving this is to make capacity payments to operators of dispatchable plants to support their income despite lower running hours. This approach has enabled Spain to maintain combined cycle gas turbine (CCGT) plants in its generation mix, for example.

Maintaining capacity is not enough on its own. Access to affordable fuel is also necessary. As recent spikes in European gas prices have shown, high fuel costs for marginal suppliers can translate into high and volatile electricity prices, even when sufficient mid-merit capacity exists.

Maximize interconnections with neighboring markets. Interconnections with markets that are larger or have a different mix of energy resources can help reduce price volatility. As we have seen, Germany is a prime example: its connection to, for example, France’s nuclear resources, Denmark’s abundant wind resources, Austria’s hydro power, and Poland’s coal-fired generation results in more stable prices despite its high proportion of variable renewables. Maximizing interconnections remains a viable means of tackling volatility. But it comes with significant costs and is of diminishing benefit as more interconnection is added, unless the connections release diverse sources of generation.

Integrate electricity storage. Storage in electricity markets serves to shave peaks and flatten troughs. While they remain relatively expensive, batteries could serve to reduce within-day price volatility. Today, batteries are not supported by revenues from daily arbitrage alone but are funded primarily though frequency control services. The downside of the latter is that the demand for these types of ancillary services is limited.

Managing weekly, monthly, and seasonal volatility requires solutions that can store energy for longer periods; for example, large pumped hydro reservoirs and hydrogen-based storage. Except in the best locations, these options remain expensive and may face geographical limitations. Therefore, they need a high residual level of market volatility to justify investments.

Considerations for Governments and Market Bodies

As the shift to variable renewable energy continues, we see two moves that governments and market players can make as they seek to control price volatility.

Take supply and consumption into account together.

Before today’s extensive power grids were created, it was common for the supply and consumption of electricity to be decided together. To minimize costs, large customers located their facilities close to a source of reliable, cheap electricity. As grids became more widespread, this became less necessary. In the future, however, we believe that governments should once again consider both sides of the equation. One way to do this is by developing energy-industrial solutions that take into account the nature of energy resources and demand on a regional basis. For example, cheap but variable energy resources, such as low-cost solar, could favor flexible industries like green hydrogen production, whereas higher-cost but more dependable resources might favor less-flexible industries.

Governments should be cautious when adapting their energy markets.

Electricity market designers are increasingly looking toward capacity markets as an effective means of ensuring reliability of supply and managing price peaks. We believe designers should approach them with caution to avoid crowding out market participants such as demand-side flexibility providers, thereby increasing overall system costs.

At their best, capacity markets reward (firm) capacities for being available at critical moments. At their worst, they maintain costly excess capacity by supporting generators that are not fit for purpose and lack adequate flexibility. And depending on how the charges that fund capacity payments are levied on market participants, they can reinforce volatility (for example, through critical peak pricing) or dampen signals for greater demand flexibility (through smeared costs).

To curb price volatility, market designers can also be tempted to impose more stringent price caps and floors. But these are temporary solutions at best. They counteract the market’s ability to signal situations of scarcity and surplus, thereby removing necessary incentives for investment and dispatch.

Consumers and businesses in some energy markets have been lucky. They’ve avoided the significant price volatility that generally arises from high variable renewable generation, thanks to factors such as strong interconnections with neighboring countries and abundant storage. But governments and system designers cannot afford to be complacent. As conditions change and countries ramp up renewables generation to meet climate goals, keeping a lid on electricity price volatility will become increasingly difficult. Governments will need to consider new steps to ensure that their consumers’ interests are protected and that their industries remain competitive.

The authors thank BCG’s Thomas Baker, Antti Belt, Eric Boudier, Christophe Brognaux, François Candelon, Sergio Figuerola, Ignacio Hafner, and Lars Holm, with whom they have exchanged ideas during the preparation of this publication. These rich and engaged discussions have allowed the authors to push their thinking further. The authors also thank Charlotte De Causmaecker, Pieter Ediers, Sander Claeys, and Konstantinos Spiliotis for their contributions. They are also grateful to Matthew Fletcher for writing support and Monica Jainschigg and Kim Friedman for editorial and design support.