M&A dealmakers have a long history of considering environmental, social, and governance (ESG) issues when pursuing targets. In many cases, however, ESG issues were secondary considerations—often assessed as risks to be avoided rather than as factors in favor of a deal. That attitude is now changing. During the past decade, some dealmakers have increasingly focused on the opportunities for ESG-related value creation, such as by investing in the clean energy transition or gaining a competitive edge through sustainable sourcing.

A recent BCG study confirms that ESG dealmaking is on the rise. Nevertheless, many companies remain on the sidelines. We focused our in-depth analyses on environmental-related—that is, “green”—deals because they are important tools for achieving climate goals and, ideally, offer opportunities to create value. Our study used a proprietary approach based on 550 ESG-related keywords to identify a list of approximately 120,000 ESG-related transactions since 2001 for analysis. (See “About the Study.”)

About the Study

We found that although the share of green deals still represents only about 5% of all M&A transactions, it has increased significantly over the past three years. Digging deeper, we found that the share is much larger than average in the energy and utilities industry and among companies based in the Middle East and Asia-Pacific. In other industries and regions, a do-it-yourself approach to building environmental capabilities continues to dominate. Clearly, many companies can make greater use of green M&A as a strategic lever to relieve intensifying ESG-related pressures.

Buyers should be aware, however, that green deals command a significant price premium: the average acquisition prices for these deals have exceeded the overall market average by approximately 7% over the past three years, according to our analysis, with premiums of 20% to 30% in some industries. The premiums likely reflect not only growing competition for targets but also targets’ better underlying growth prospects compared with other companies in their sector.

ESG-Related M&A Trends Upward

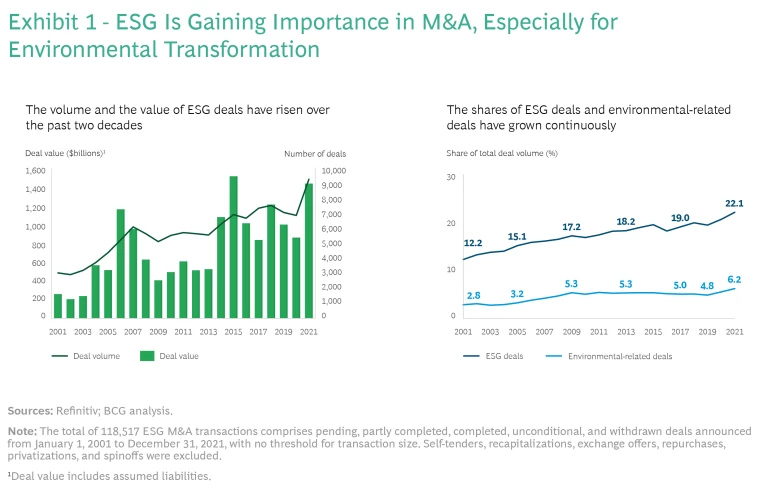

Our analysis identified a clear upward trend over the past decade. The annual volume of ESG deals globally rose from approximately 5,700 in 2011 to an all-time high of approximately 9,200 in 2021—a 60% increase. The acceleration in activity was especially strong in 2021, as deal volumes jumped by 35% following two softer years for broader M&A activity and ESG transactions. (See Exhibit 1.)

This upward trend reflects, in part, a generally favorable M&A environment that has lifted volumes across the board (overall deal volumes grew by 28% from 2011 to 2021). But the picture is even clearer in relative terms: the volume of ESG-related deals as a share of all deals rose from 12% in 2001 to 17% in 2011 and to 22% in 2021.

The share of social-related transactions (for example, those involving health care or social entrepreneurship) as a percentage of all deals increased from 12% in 2011 to 16% in 2021, owing to a continuous rise in the relative volume of health care deals. Governance-related transactions account for a minuscule share of deals—about 0.2%. This suggests that governance is rarely a primary motivation for a deal but is instead treated as a risk factor considered during due diligence.

Environmental-related deals, in contrast, can play a major role in helping companies achieve their climate and other environmental goals, and thus warrant further study. The share of such green deals as a percentage of all deals has been small and stable—it hovered at 5% from 2011 through 2019 and rose to 6% by 2021. Although the share is still relatively low, especially considering the ubiquity of environmental issues, the 20% increase over the past two years suggests that more dealmakers have recognized the value-creating potential of these transactions. The increasing prevalence of ESG reporting requirements may have contributed to this uptick in activity as well. Even so, our analysis reveals that the growing interest in green M&A is not broad based.

Spotlight on Green M&A

The growth of green M&A has been fastest in industries at the forefront of the energy transition and in emerging markets.

Energy and Utilities is the Leading Sector

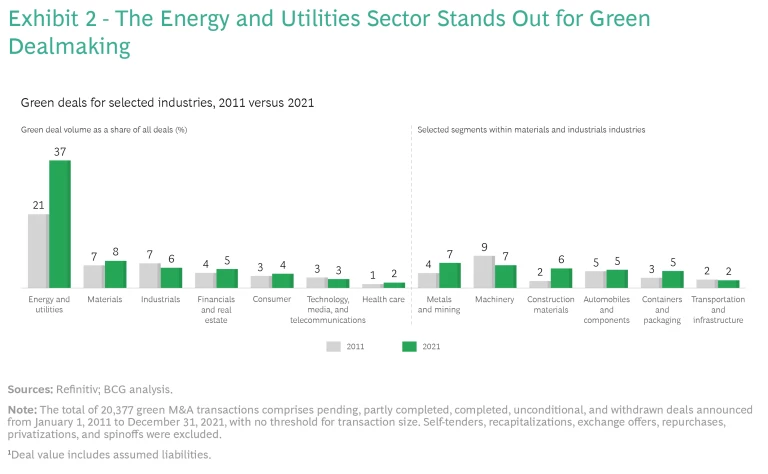

Not surprisingly, the energy and utilities industry had the highest share of green M&A and the strongest increase over the past ten years. The share of environmental-related deals increased from about 20% in 2011 to almost 40% in 2021. (See Exhibit 2.) The increase is a sign of growing pressure on companies in this industry to reduce their traditional carbon-intensive activities.

In power generation, for example, almost 80% of green deals comprised acquisitions of alternative generating capacity, including solar plants, wind turbine farms, hydroelectrical dams, and biomass plants. The picture is similar in oil and gas, where companies have used M&A to establish a foothold in alternative energy or adjacent segments such as biofuels.

Overall, roughly two-thirds of deal activity in the energy and utilities sector in 2021 came from companies with “brown” or “gray” (that is, non-environmentally focused) business models buying green targets (such as alternative energy providers). The remaining one-third of deals in 2021 involved green buyers acquiring their peers. These consolidation moves indicate that green M&A is entering a more mature phase in the industry.

The industries with the lowest levels of green M&A are rarely viewed as leaders in the clean energy transition. These industries include telecommunications , retail, health care, real estate, and media and entertainment . Their share of green M&A has been fairly stable in recent years, topping out at 3% of total transactions. In many of these industries, companies recognize the need to reduce their carbon footprint—such as by improving the energy efficiency of power-hungry data centers, air-conditioned shopping centers, or poorly insulated rental units. Nevertheless, companies tend to see targeted organic investments as better ways to achieve these goals than M&A, which they consider supplementary for this purpose.

Between the extremes of green M&A activity are industries that, at first glance, appear to be prime candidates for emphasizing environmental-related deals. These include materials industries (for example, those engaged in CO2-emitting cement production or environmentally impactful mining) and the broader industrials space. Among industrials companies, manufacturers of transportation modes—including automobiles, airplanes, and ships—have drawn the closest public scrutiny regarding their carbon footprints. These companies have responded by significantly redesigning their business models and value chains and are using various technologies and approaches to reduce their carbon footprint and achieve milestones toward net-zero emissions.

Delving into the deal data associated with the materials and industrials sectors, we see a mixed picture. For both sectors, the share of environmental-related M&A is considerably below 10%, and an upward trend is apparent in only a few industries. For example, in metals and mining, the volume share of green M&A deals increased from 4% to 7% during the period from 2011 to 2021. Acquisitions across a range of themes, from renewable energy to recycling activities and wastewater treatment, helped promote the increase. We also see an upward trend in the construction materials industry—albeit from a very low base—as companies have sought, for example, waste heat or recycling facilities to make their production processes more sustainable.

For most types of companies in the materials and industrials sectors—including producers of machinery, automobiles, and transportation and infrastructure—the trend is at best sideways. These companies typically develop a significant share of the capabilities to deal with environmental challenges in-house or organically. For example, automotive OEMs often invest in their own battery manufacturing plants. But companies in these sectors appear to be overlooking opportunities to use M&A to support their green transitions.

Emerging Markets are the Regional Frontrunners

The geographic region with the highest level of green M&A activity was the Middle East, where more than 10% of deals were environmental-related in 2021, following a steady share of around 3% to 5% since 2014. Because the region hosts a disproportionate number of carbon-intensive industries, such as oil and gas and petrochemicals, the pressure to transition to clean energy is more intense there than elsewhere. Some companies have recognized that M&A is a quick way to diversify into alternative energy and build new business models. Domestic and intra-regional transactions account for approximately 55% of the Middle East’s green deals. Increasingly, however, companies are also looking for targets outside their region, primarily in Western Europe (23% of green deals) and North America (12%).

The second-most active region is Asia-Pacific (especially China), with a green deal share of approximately 8% in 2021. A steep upward trajectory since 2019 followed a five-year plateau in relative activity versus the overall market. Again, the energy and utilities industry is in the vanguard, with environmental-related transactions representing 50% of deals in that segment in 2021. Materials and industrials also claim much higher shares of deals in Asia-Pacific than in North America and Europe.

In Europe, the share of green deals has been languishing at approximately 5% to 6% of total deal volume since the depths of the financial crisis in 2009. It did not budge materially even when the COVID-19 pandemic led to substantial upticks in green deal activity elsewhere. The relatively small share of green deals may come as a surprise, given that many people regard Europe as the global leader in climate action. The comparative de-emphasis on green deal making may, in part, reflect European companies’ stronger innovation capabilities and organic investment capacity, which make M&A a supplementary tool. It is clear, though, that the vast majority of European M&A activity is not directly related to environmental issues—and this may be a missed opportunity.

Finally, in North America, and particularly in the US, green deal activity ticked up in 2020 and 2021 after trailing European levels since 2016. The Biden administration’s regulatory and industrial policy priorities may have promoted higher levels of activity in 2021.

The Bottom Line

Our analysis shows that green M&A already plays a significant strategic role for companies in certain industries (particularly energy and utilities) and regions (such as the Middle East). For these companies, the pressure to transition to environmentally friendlier technologies is highest, and companies have already deployed the relevant technologies successfully. Other companies may still rely more on in-house innovation and R&D, as well as on nontraditional transactions such as corporate venturing and joint ventures, to build their environmental capabilities. But green M&A activity is likely to accelerate in all sectors and regions as the pressure to address climate change rises and as more targets with sufficiently developed technology become available.

Green Deals Command a Premium

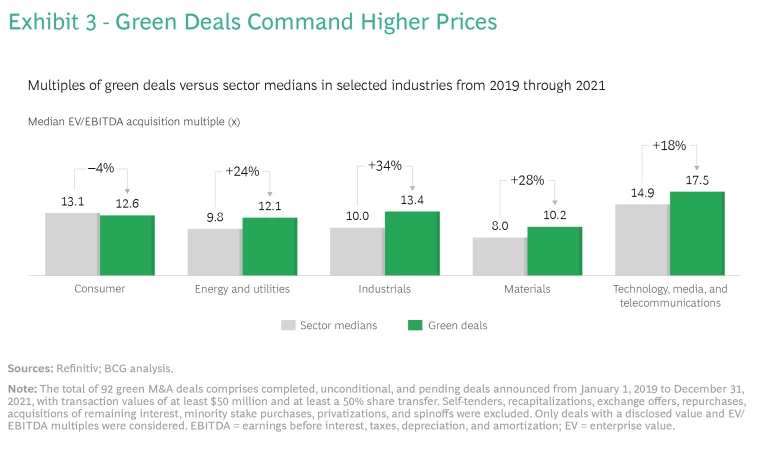

As dealmakers pivot toward a greener M&A strategy, they should expect to pay a substantial premium for green targets. For the years 2019 through 2021, we analyzed the enterprise-value-to-EBITDA ratios of green targets in majority acquisitions valued at more than $50 million. The median ratio was 13.0 for green deals, versus 12.2 for overall multiples in the same sector. The premium of approximately 7% represents a considerable uptick compared with previous periods.

The existence of the premium is not surprising. As green M&A deal activity has heated up over the past few years, competition for green assets has likewise increased, driving up prices. In addition, green targets typically have better growth prospects than their nongreen peers, warranting higher valuations. The trend also broadly coincides with the launch of the European Green Deal, a set of policy initiatives designed to make the EU climate neutral, and with the introduction of the EU taxonomy, a classification system establishing a list of environmentally sustainable economic activities. Both events arguably increased the relevance of ESG-related activities to many companies and industries.

Recognizing the potential limitations of the cross-industry analysis, we de-composed the averages to the level of individual industries and evaluated them over time. This exercise broadly confirmed our overall findings. (See Exhibit 3.) In energy and utilities, the premium is among the strongest and most persistent over time. Almost without exception, green deals have commanded higher multiples than other sector-level deals since 2013. From 2019 through 2021, the average multiple for green deals was 12.1, versus an average multiple of 9.8 for the sector overall—a 24% premium. In this relatively mature market for green M&A, an ever-increasing number of bidders are chasing green targets, driving up valuations.

Other sectors show a similar picture. In industrials, for example, green targets have been more expensive than their nongreen counterparts since 2018, with a substantial average premium of 34% over the past three years. The telecommunication, media, and technology sector—though not at the forefront of the green M&A trend—posted higher multiples from 2019 onward.

Although we see significant variations among industries and regions, green dealmaking is gaining traction as a strategic lever for environmental transformation. But as green deals become more popular, they also become more expensive, in many cases commanding a substantial premium. Are the higher prices justified in terms of the value that the deals create for shareholders in the short and long terms? The answer is often yes, as we discuss in the next article in this series.

The authors are grateful to Ashish Baid and Dominik Degen for their valuable insights and support in the preparation of this article.