Amid a backdrop of increasing commodity prices, investors are optimistic that the oil and gas (O&G) industry can continue its recent streak of strong short-term shareholder returns. Yet they also want leadership teams in the industry to think through value creation during the looming energy transition to more environmentally sustainable options. Those are the key findings from a recent survey of 250 institutional investors in the O&G industry conducted by BCG’s Center for Energy Impact. (A similar analysis was conducted in 2020.)

Survey respondents reflect a range of geographic markets, investment styles, and areas of focus in the O&G value chain.

Strong Optimism in the Near Term

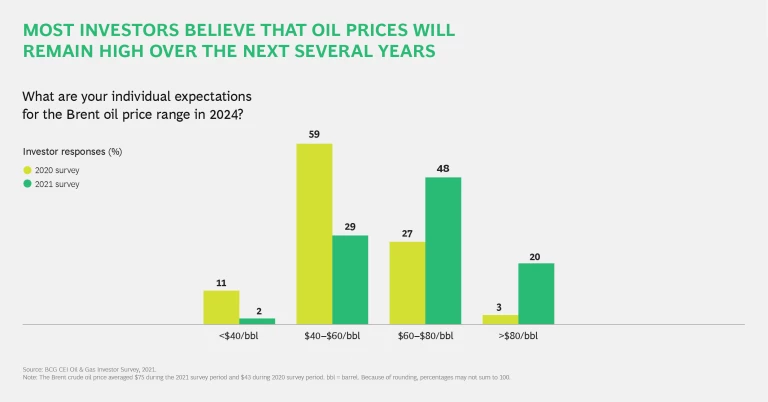

Despite the global energy crisis, energy company stocks are surging—up 50% year to date through late October 2021—on the back of high commodity prices. Our survey results show that investors expect prices to remain robust. Approximately 70% of respondents expect oil prices to remain above $60 per barrel through 2024. That is significantly higher than reported in last year’s survey, in which the majority of investors projected an oil price between $40 and $60 per barrel.

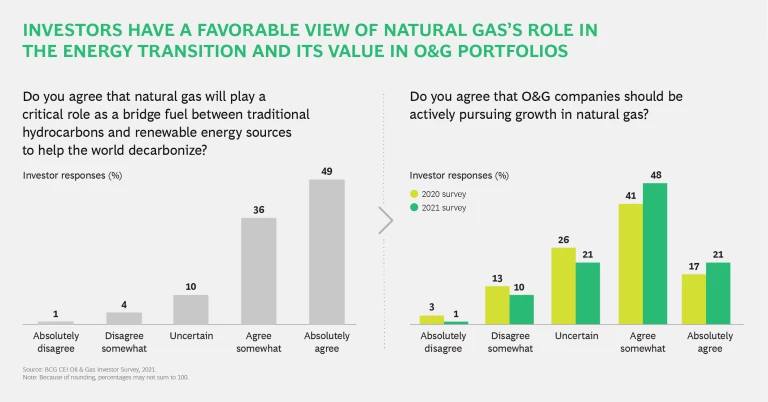

Notably, investors are just as optimistic about natural gas; 85% agree that it will play a critical role as a bridge fuel between traditional hydrocarbons and renewable energy sources to help the world decarbonize, and 70% want O&G companies to pursue growth in natural gas. For management teams seeking some clarity about how natural gas fits into their portfolios, these results are a clear signal of growing support for continued investment as part of longer-term capital allocation strategies.

The optimism regarding commodity prices translates into total shareholder return (TSR). Roughly 60% of investors expect a continued recovery in TSR over the next two years. Most respondents (68%) believe that to meet that expectation, O&G companies need to maintain strong capital discipline. They also need to focus on profitability over the next three to five years (according to 60% of investors).

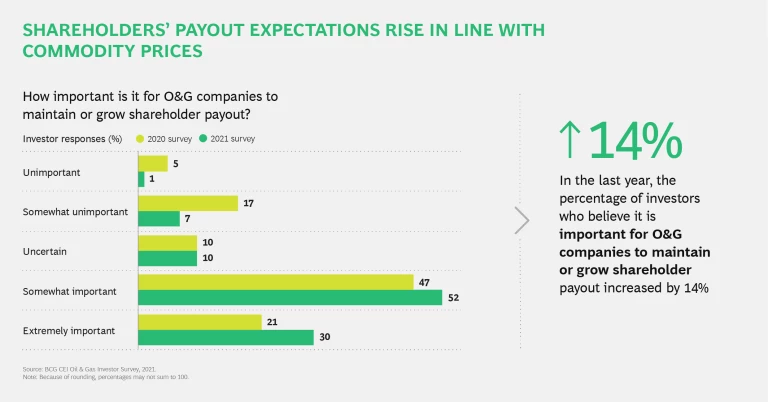

And, critically, these firms need to maintain or increase their payouts to investors, primarily through dividends but also through buybacks. Regardless of whether oil and gas prices are high or low, maintaining dividends and growing the top line remain central elements of Big Oil’s value proposition for shareholders. In our findings, more than 80% of investors said that it was “somewhat” or “extremely important” for companies to maintain or grow their investor payouts.

Creating Value in a Low-Carbon Future

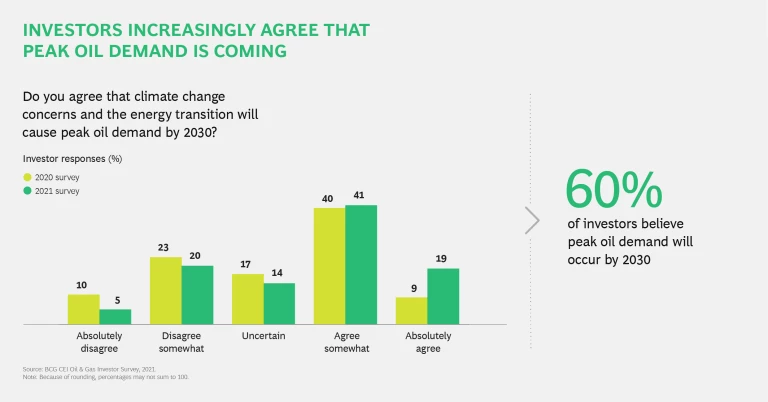

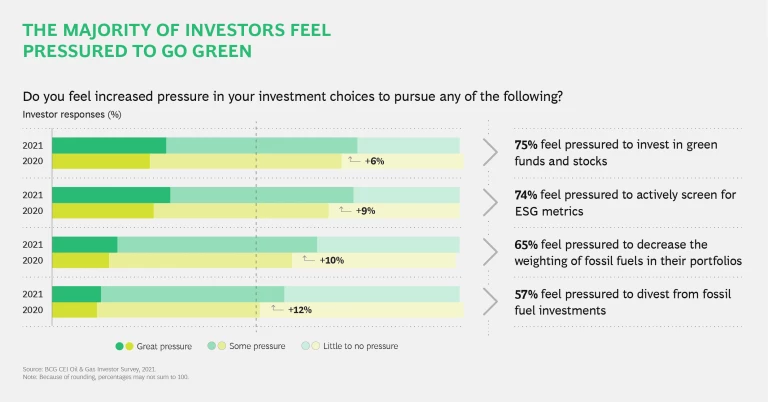

If short-term sentiment is positive, the longer-term feeling among investors is decidedly mixed because of increased attention on environmental sustainability . Nearly two-thirds of investors say that peak oil demand will occur by 2030—a slight increase from last year’s estimates. Only 30% think that O&G stocks will take on an increasing role in their portfolios in the next decade, and nearly 60% feel pressure from their clients to divest their fossil-fuel investments.

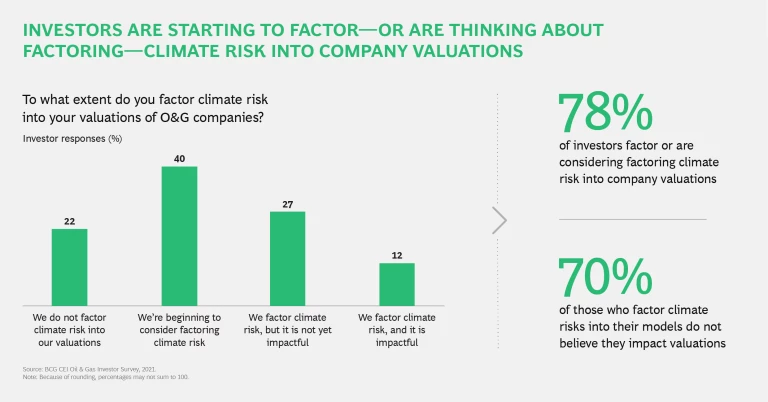

In 2020’s survey, we highlighted the potential for increased shareholder activism in the sector. That has only accelerated in 2021. Investors continue to seek clarity regarding emissions reduction in the industry, along with a clear strategy for the energy transition. The pressure on the industry will likely grow; only 39% of respondents currently factor climate risk into their valuations of O&G companies, but another 40% say they plan to follow suit.

Given the growing pressure, investors believe that companies need to take several steps:

- Set and meet emissions-reduction targets (cited by 80% of investors).

- Invest in clean energy to enhance their long-term value propositions (cited by 82% of investors).

- Collaborate beyond the O&G sector to set cross-industry standards regarding emissions targets (cited by 73% of investors).

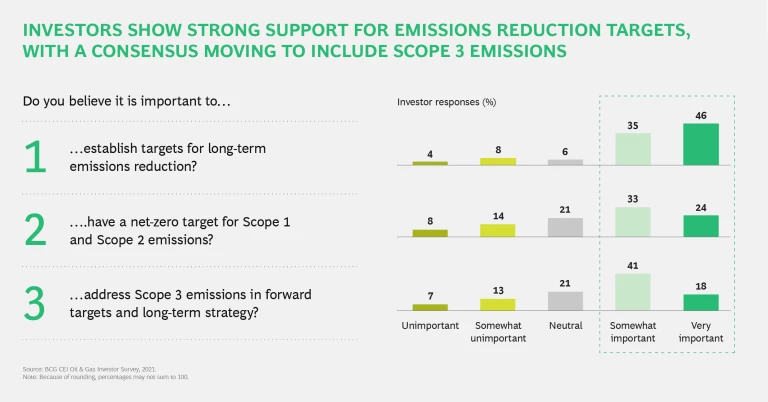

There is less agreement on the types of targets that should be set, but over 50% of respondents want to see net-zero targets established for Scope 1 and Scope 2 emissions (which reflect a company’s internal operations and the energy it consumes to run those operations, respectively). And 59% think Scope 3 emissions, which encompass the upstream and downstream value chain, should be addressed.

More broadly, 80% of investors want clarity on companies’ plans for the energy transition. Most acknowledge that O&G companies have taken some initial steps to improve their environmental performance. Yet those measures, while noteworthy, will not be enough. Investors also want to see results—hitting emissions reduction targets and showing EBITDA growth from companies’ low-carbon businesses in the next three years.

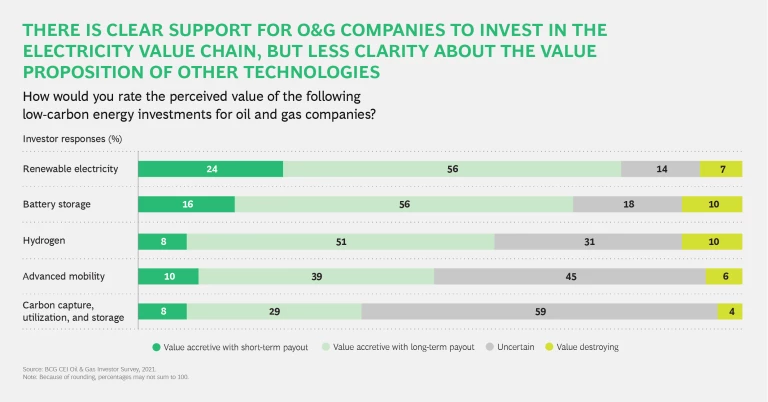

Among specific types of low-carbon initiatives, investors are more likely to see the value proposition in accessible electricity sector segments like renewable power generation and battery storage. In contrast, emerging technologies—carbon capture, advanced mobility solutions (such as car sharing and rapid-charging stations), and hydrogen production among them—are seen as far less certain in terms of value creation. As a result, O&G companies upping their investments in these areas may need to communicate more directly with external investors about the business case for making such moves and how the technologies fit into overall portfolios.

Given the level of long-term uncertainty in the industry, the current period of high oil and gas prices and strong TSR gives companies a critical window to make changes. Our survey data gives management teams an indication of what investors believe is the right course for O&G companies today.