Top retailers are tapping into the high-growth, high-margin business of retail media to aggressively fund strategies that boost their priorities and competitive position. In so doing, they are not only disrupting the digital advertising industry, but also transforming the retail landscape . So far, large companies have led the way in retail media, creating urgency for companies of all sizes to seize and maximize this opportunity or risk losing out to the early adopters.

As retail media continues to transform and grow at an accelerated pace, BCG has partnered with Google to understand how companies can best position themselves to expand their retail media business. BCG interviewed and surveyed more than 50 retail media leaders and experts across the sectors of omni-retail, pure-play e-commerce, travel, and auto. Our research offers a deep dive into market dynamics and the tactical next steps that businesses of various sizes should take to capture this opportunity as they plan for the year.

The Retail Media Opportunity

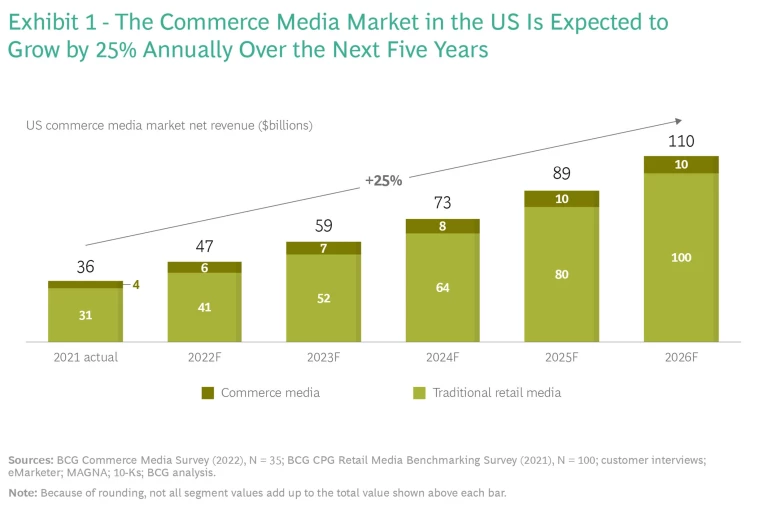

We estimate that the retail media market will grow by 25% per year to $100 billion over the next five years and will account for over 25% of total digital media spending by 2026. Seemingly every week, a news headline trumpets the launch of a new retail media network, from Michael’s (arts and crafts supplies) to Nordstrom (department store). A retail media network is essentially an advertising business that a retailer sets up in order to allow advertisers to buy advertising space across the retailer’s owned (onsite) properties and paid (offsite) media, using consumer data to connect with consumers throughout the buyer journey.

The strength of retail media reflects the fact that advertisers like the visibility of performance provided by closed-loop measurement capabilities—the ability to tie a media campaign back to omni-channel sales. Its success both as a business opportunity and as a marketing channel is prompting other industries, such as travel and auto, to boost investment in this area. We estimate that media revenue from the expanded group of industries that we call “commerce media” could add $10 billion on top of the baseline $100 billion net revenue estimate for retail media in the US over the next five years. (See Exhibit 1.)

While many larger entrants began their retail media initiatives by monetizing their owned channels, many small or midsize players have used offsite channels to enter the retail media market quickly. In fact, offsite offers major advantages for players of all sizes because it simultaneously expands a company’s reach to a larger audience and drives that audience to the company’s own website, thus helping it scale its onsite business. These dynamics enable a company to save money by, in effect, cofunding its own advertising. Because onsite and offsite reinforce each other so powerfully, a company needs both in order to establish a mature retail media network.

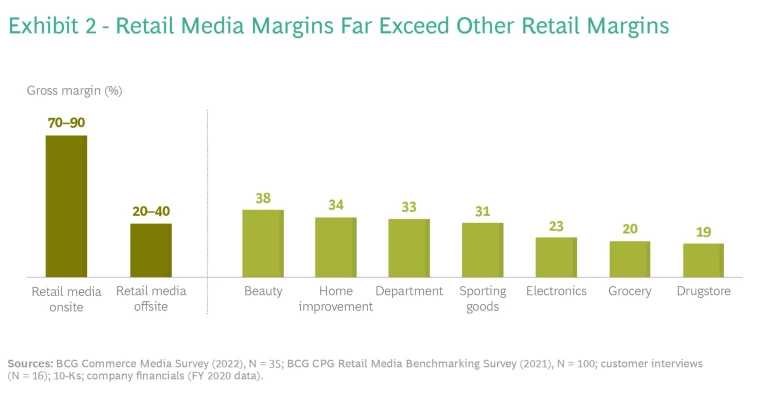

A particularly compelling aspect of this retail media opportunity—and part of what makes it so transformative—is the potential to achieve enormous profit margins. By our estimate, the $110 billion commerce media market will yield almost $75 billion in profits in 2026. Our research suggests that spending by advertisers on retailers’ owned channels will grow at a rate of 22% per year over the next five years, with robust margins of 70% to 90%. Offsite media spending is growing even faster—at 35% per year—with margins in the range of 20% to 40%, after media costs and/or agency management fees. Significantly, even though the gross margin range for offsite spending is lower than the corresponding range for onsite spending, it is competitive with the gross margin for most retail categories. (See Exhibit 2.) Because of the differential growth, we anticipate that the proportions of onsite and offsite spending over the next five years will shift toward offsite, at approximately 70% and 30%, respectively.

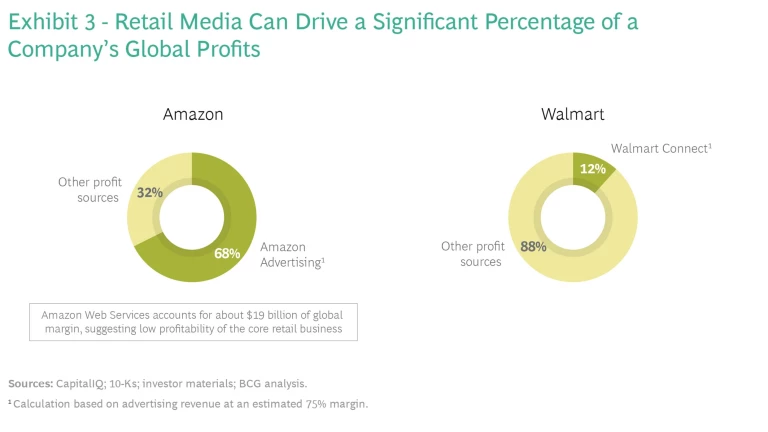

Leading companies are reinvesting the profits from these high margins in their business. They are lowering prices, updating technology, and improving marketing to enhance the customer experience. This year, for the first time, Amazon and Walmart reported results specifically for their advertising business, revealing the degree to which retail media is subsidizing these companies’ broader strategy. This is especially true of Amazon, where retail media profits offset losses in the broader retail business. (See Exhibit 3.)

Playing Both Defense and Offense

Companies of all sizes need to devise a retail media offering as both a defensive strategy (to hold their proportional share of historical trade dollars) and an offensive strategy (to capture the new money on the table).

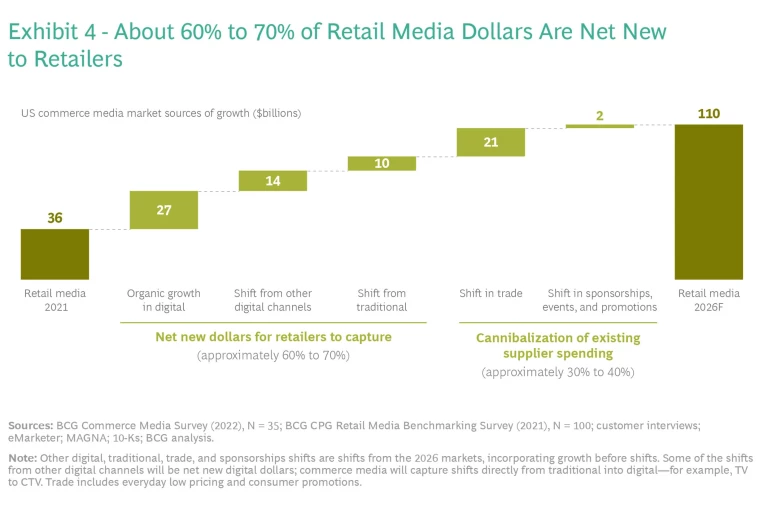

Control and transparency are orders of magnitude better in retail media businesses than in traditional approaches to trade spending, sponsorships, events, and promotions. This advantage enables brands to measure and monitor performance closely and to adjust spending allocations in channels or ad units. The benefits are so great for marketers (which are under pressure to demonstrate returns) that companies without a retail media offering are sure to lose out to competitors. Having a retail media offering will therefore become a critical defensive strategy for holding onto trade dollars.

On the offensive side, retailers are going after new dollars. We estimate that 60% to 70% of the projected $100 billion in 2026 retail media revenue will be net new spending over and above historical trade dollars. (See Exhibit 4.) New sources include organic growth in digital advertising, as well as a shift from incumbents and traditional channels. Each of these funding pools represents an opportunity for retail media businesses to promote themselves to marketers and advertisers looking for channels with promising ROI and first-party audience targeting that avoids customer privacy issues.

Leaders Have Emerged

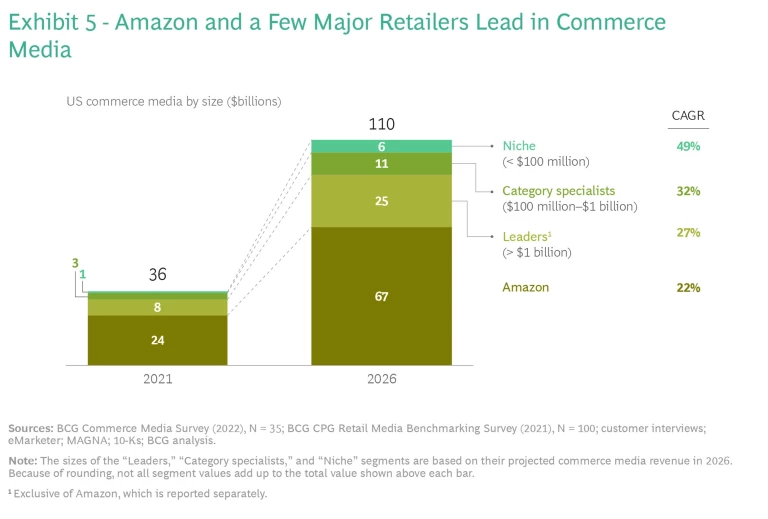

Leaders have already emerged in retail media. Amazon will continue to be the biggest player in the space, accounting for 60% of retail media. (See Exhibit 5.) Behind Amazon a few major retailers, such as Walmart and Target, will mount media networks in excess of $1 billion, accounting for 25% of the space. Going forward, however, we anticipate significant growth among smaller players; in fact, we estimate that they will grow more rapidly than Amazon or any of the other leaders over the next five years.

Although growth will accelerate for smaller players, three factors will continue to be favorable to early entrants:

- Strong Customer Data and Relationships. The value of a retail media business rests largely on the strength of the consumer relationship . Retailers with rich consumer databases and deep relationships can deliver personalized advertising that creates a targeted and seamless experience for consumers and high returns for advertisers.

- Rapport with Media Buyers. Each new retail media business creates the need for media buyers to invest in training and communication. Companies that entered early, with large reach and simple buying interfaces, have an advantage and will likely maintain their appeal to media buyers as the market matures.

- Building a Technology Stack for Scale. Armed with strong customer relationships and solid rapport with media buyers, early entrants in retail media are already generating scale, giving them the confidence to invest in technology and people to accelerate growth. Core components of the technology stack include a user interface, data management platform, ID resolution, audience building, order management, ad serving and impression tracking, campaign measurement, and billing/payment processing.

These three factors (customer, media buyers, and technology) will certainly benefit current leaders, but it is not too late for others to find success—if they act quickly. Marketers and advertisers will need ways to reach unique customers in different places, and we expect multiple leaders to emerge in each industry. In addition, the trade reallocation share of retail media (30% to 40% of the $100 billion market) is likely to mimic current trade allocations if companies’ competitive offerings are similar. Thus, we anticipate opportunities for category specialists with media networks of between $100 million and $1 billion, as well as for niche players with media networks of less than $100 million. Companies that don’t put a retail media strategy in place soon are likely to lose out to a rival in their category that does.

Tactical Steps for 2022

Each industry in the broader definition of commerce media is at a unique point of maturity. For example, the travel vertical has a variety of mature media networks, retailers are accelerating their involvement to maximize their massive customer access, and most auto aggregators are nascent but looking for growth opportunities.

Our survey indicates that companies of different sizes are at different points of maturity in three key dimensions: data, product and technology, and people. In all three dimensions, larger players are generally more mature than segment specialists, which in turn are more mature than niche players. On the basis of what we’ve learned, we suggest the following initiatives going forward.

Subscribe to our Marketing and Sales E-Alert.

For leaders, the focus should be on centralization of data, effective use of application programming interfaces (APIs), and expanding scale:

- Data. Connect customer and advertising data in a centralized database to power unified personalization and drive an integrated customer experience between internal and vendor marketing. Develop “extract, transform, and load” (ETL) projects that integrate with existing data science capabilities across the value stream to build enhanced capabilities in pricing, inventory forecasting, and the relevance of served ads.

- Product and Technology. Focus on APIs to automate and integrate the value chain, creating more connectivity for core functions. One useful project would be to develop a product ad API to ease integration into owned web channels. Form external paid media partnerships to secure rates and premium inventory for offsite campaigns to enhance product portfolio and build inventory. Investigate and develop perspectives on bidding and yield capabilities, internally or with partners.

- People. Look for economies of scale as teams grow. As the retail media effort matures, monetization roles will emphasize maintaining technology and products rather than underwriting new initiatives. Similarly, in sales, expect a shift away from lead generation and toward account management. Establish clear career paths for strong performers in the retail media organization, inside or outside the group (other areas could include digital, personalization, or marketing generally). Preplan for this shift from startup to steady state to ensure operational success as the business matures.

For category specialists, investing in audience-building capabilities, articulating the value proposition, and adopting agile methodologies are paramount:

- Data. Identify unique first-party data sets that drive competitive advantage in your category for targeting and segmenting capabilities. Ensure that the data is clean, and start investing in data enrichment—for example, through a loyalty program. Invest in audience-building capabilities, either developed in-house or obtained through a third-party vendor.

- Product and Technology. Clearly articulate the value proposition: why does your company, rather than the overall leaders, deserve an outsized piece of the retail media pie? Create a robust omnichannel product roadmap, and consider automating elements of the value chain to prepare for scale. Order management, ad ops, and billing solutions can be major pain points as you jump from a nascent network to one operating at scale. Leverage offsite campaigns to bolster inventory and fuel website traffic to support your owned-channel offering and to create more cross-channel connectivity with retargeting products.

- People. Accelerate the hiring of suitable talent for product development, technology infrastructure, operations, and in-house sales and account management. Invest in adopting new ways of working that focus on agile methodologies. Senior leaders need to promote an entrepreneurial “growth tech” mindset, encouraging teams to test new ideas and permitting them to fail fast and move forward.

For niche players, priorities should include developing rapid forecasting capabilities, deploying proofs of concept (POCs), and bolstering sales and monetization roles within the company:

- Data. Leverage channel analytics—both owned and paid—and customer databases to rapidly forecast and assess areas of opportunity for ad product deployment (for example, impressions, audience size, and historical costs).

- Product and Technology. Develop an initial set of product use cases, and prioritize and deploy POCs. Research and define a set of core technology capabilities to execute POCs, and consider how to scale the POCs over the long term. Assess and select technology vendors for ad serving, order management, measurement/reporting, and billing solutions. Use historical paid media data to set pricing for paid media products. Leverage offsite campaigns if the company’s owned channel has limited reach.

- People. Assign or hire for roles in sales and monetization. Sales should focus on generating demand and managing alpha/beta accounts, while monetization should focus on deploying early-stage ad product MVPs. Ensure that these teams get the support they need to deploy and test efficiently with cross-functional units (such as web experience or performance marketing).

Retail media is a rapidly growing, high-margin advertising channel. But success in retail media is about more than just mastering this new channel. It involves using this enormous new profit pool to reinvest in the business and redefine the company’s competitive advantage in its core business. These conditions create urgency for companies of all sizes to enter the space quickly and grow their retail media revenue, or risk losing out to competitors that do.

The conclusions in this article represent BCG’s views only and not those of any third party involved in the supporting study. Many thanks to Vincent Ho and Maslen Ward, who supported this research.