Only about half of companies that undergo organization design during a post-merger integration say it was successful. Leaders can flip those odds by focusing on five imperatives.

Once a company executes a deal, post-merger integration (PMI)—particularly the organization design component—will determine whether that deal succeeds or fails. The merger of two companies, potentially with very different operating models, structures, and cultures, can be tough. When the organization design is handled poorly, the two businesses can remain misaligned, alienating talent and destroying value. Conversely, when organization design is done well, leadership teams can capture the full projected value from a deal and set up the new entity for long-term success.

What are the key drivers of success for organization design as part of a PMI? Based on our experience working with companies in all industries and transaction types, we believe that leadership teams need to focus on five imperatives. By following them, companies can capitalize on M&A as an opportunity to create a fit-for-purpose organization.

Organization Design Is Tough. As Part of a PMI, It’s Even Tougher.

Organization design is challenging in any context. Only about half of the companies that undergo organization design during a PMI say it was successful, according to a sample of more than 200 companies interviewed by BCG over the past few years. Considering the massive amount of time and effort that goes into organization design initiatives, it’s sobering to think that the odds are roughly equal to flipping a coin.

Considering the time and effort that goes into organization design initiatives, it’s sobering to think that the odds of success are roughly equal to flipping a coin.

There are several reasons why the challenge is greater when the organization design happens as part of a PMI effort (which is the trigger for about 30% of all major design initiatives):

- Most deals are announced before the management team has determined the future operating model for the new company. As a result, the executive team must make decisions about the new organization under significant deadline pressure, often with significant uncertainty that includes not knowing the other organization well enough. Additionally, the two companies may have material differences across their operating models, which can further complicate the alignment of scope and responsibilities.

- Deals have different underlying rationales, yet some organizations apply a universal design approach. For example, deals aimed at building scale or finding efficiencies require management to eliminate redundancies—often by reducing the size of the workforce. Deals aimed at boosting growth, by contrast, focus less on headcount reduction and more on building and investing in the right capabilities to grow the integrated company. Applying the wrong approach can significantly undercut a deal.

- There’s relatively little visibility into key talent before the deal closes. People tasked with designing the new organization often don’t have complete information about employees in the acquired company, including their specific roles and responsibilities, performance assessments, career experiences, personal growth aspirations, and other relevant data. This makes it more challenging to make talent selection decisions before the close.

- The senior leaders overseeing the organization design may not collaborate directly with other groups—such as those tasked with integrating networks, systems, and processes—that are working on different aspects of the integration. Those workstreams have interdependencies in terms of priorities and timelines, but without proper alignment, each team focuses on its own agenda.

- Some companies underestimate the importance of change management, particularly when cultures are not aligned. Critical talent may resign if they feel they are being unfairly treated or when there is lack of communication that creates uncertainty in the integration.

Five Imperatives for Organization Design

Those are significant challenges, but they’re not insurmountable. Based on our experience, CEOs and M&A leaders can address many of these issues and use organization design to unlock the full potential of their deals by focusing on five imperatives:

- Articulate the value thesis for the deal up front and translate that into the operating model.

- Set up an organization design program that aligns with the goals of the deal.

- Build the senior leadership team early on and ensure that everyone is fully engaged.

- Identify and retain talent that’s in line with deal objectives.

- Set up a rigorous culture and change management program.

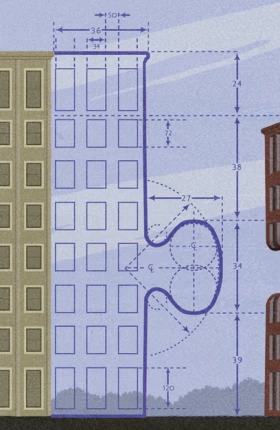

Articulate the value thesis for the deal up front and translate that into the operating model. First, leadership teams need to spell out the underlying rationale for the deal. Is it aimed at achieving efficiencies? Building capabilities? Accelerating growth? Based on BCG experience across many deals, we have defined a set of deal archetypes for most M&A transactions, and each has a corresponding set of considerations for the PMI process, including organization design. (See the exhibit.)

Armed with a clear value thesis for the deal, executives need to start designing the right operating model for how the two organizations will come together. The goal of this first step is to design the operating model for the new entity, while also defining the leadership team across the top layers of the organization and ensuring clarity of roles, accountabilities, and decision rights. Critically, companies must consider the differences between the two standalone organizations, in terms of their pre-deal operating models, their geographic coverage, portfolios of products and services, culture, and ways of working.

Only an operating model that truly reflects the original thesis of the deal will be able to ensure proper value capture. This might mean ensuring the right focus of business units for growth deals or creating an agile and efficient organization in deals where cost synergies are critical. When a global tech company bought one of its competitors, the management team needed to address several key issues in defining the right operating model. The team spent significant time weighing the trade-offs from specific options. It worked to articulate the overarching objectives for the operating model in order to realize the deal value and strengthen competitive advantage. This included increasing scale, retaining creativity and entrepreneurship in the business units, and making customer service more consistent. For example, management assessed how best to organize the marketing function to optimize customer analytics and performance marketing across all businesses of the combined company. The team also determined which technology elements would be centralized (such as core technology or cybersecurity) and which would be housed in the business units that shaped the user experience.

Key considerations for this step include:

- How will customer-facing business units be organized? By products, clients, geography, or functional areas?

- Should business capabilities and support functions be embedded into business units, centralized in corporate-level departments, or outsourced?

- Will functions be fully integrated into the acquiring company, left to continue operating as they did previously, or managed using a hybrid model?

Set up an organization design program that aligns with the goals of the deal. Next, based on the initial operating model decisions and the strategic intent of the deal, management needs to define how best to design the full organization across all layers. That process includes establishing overarching objectives and consistent design principles and guidelines (for example, regarding spans of control), all in accordance with the larger goals and aspirations of the integration process. (See the sidebar “The Organization Design Approach for Growth-Oriented Deals.”)

The Organization Design Approach for Growth-Oriented Deals

The Organization Design Approach for Growth-Oriented Deals

- What specific support is required from the sales organization to maintain growth momentum and minimize distraction?

- Which accounts will be prioritized, and how will account planning, incentives, training, support, and order placement be handled?

- Which opportunities and leads should sales teams pursue?

- Will sales managers be generalists or specialists?

- Who will “own” customers that the legacy companies had in common, and how will the new entity give these customers a consistent, coherent experience?

- How will sales teams from the target and acquirer interface with each other, and what level of support will they need?

- Gauging current and future talent needs and adjusting the organization’s headcount baseline to support growth

- Reallocating or hiring new talent as needed to meet increased resourcing needs

- Hiring contractors as required to augment in-house talent in areas of the business that need more resources quickly to sustain service levels or revenue growth

Several factors will influence the acquiring company’s approach to organization design:

- How aligned are the legacy operating models of the acquiring company and the target? How much will they change as part of the integration?

- Which countries do the companies operate in? Does the organization design team need to consult with works councils or similar entities regarding potential changes to the employee base?

- Are there constraints on where employees in specific functions or business units must work?

- How much time does the management team have until the deal closes? How much should the company achieve before that happens? How much is the target willing to share with the acquirer in terms of access to leadership and data prior to close? (See the sidebar “Defining the Operating Model and Organization Structure for Day One.”)

- Will some aspects of the target company remain independent after the close to minimize disruptions (as sometimes happens with sales functions) or to retain a more agile and entrepreneurial culture (as with an R&D function)?

Defining the Operating Model and Organization Structure for Day One

Defining the Operating Model and Organization Structure for Day One

- Finalize senior leadership roles to ensure ownership and accountability, and possibly design even more layers of the organization, depending on the time to close.

- Provide clarity to the organization about new reporting lines and, if possible, changes coming further down the line.

- Consider the perspective of all employees as part of the interim design, including contractors or temporary roles that are critical for the functioning of the organization.

The answers to these questions will determine the scope and approach of the effort. Although every organization effort starts with critical inputs from the operating model and headcount baseline and then evolves into the design of each layer of the business, it may vary significantly in terms of speed and level of redesign to fit the context of the deal.

An effective approach to organization design will clarify up front what must be redesigned and what will remain unchanged in the legacy company.

Some companies (typically those undergoing large, transformational deals) opt for a full design approach, which starts with the most senior leaders and cascades down through each management layer, creating clear accountability. In other cases, specifically those aimed at boosting growth or adding new capabilities, companies will “lift and shift” the acquired organization into the buyer with minimal adjustments—an approach that can be much faster and less complex, while preserving some critical characteristics of the target company. Still others adopt a hybrid approach, with a formal redesign for a subset of business units or functions and a “lift and shift” for others. An effective approach to organization design will clarify up front what must be redesigned and what will remain unchanged in the legacy company.

Build the senior leadership team early on and ensure that everyone is fully engaged. Successful organization design requires direct engagement by the senior leadership team—the CEO and the top two layers of the organization. For that reason, it’s critical that the senior team appoint the future leaders of the new combined organization as early as possible, to remove speculation and anxiety, retain key managerial talent, accelerate planning and change management processes, and empower new leaders. This kind of leadership engagement is also absolutely critical for culture alignment, accountability, and managing change.

Once the newly appointed leaders are in place, they should drive the design of their respective business unit, region, or function, in addition to coordinating all integration-planning activities. Because organization design and PMI typically require multiple teams working on different aspects of the initiative simultaneously, there are often integration strategy or functional setup questions that need to be resolved as early as possible to ensure that the process can move forward effectively. For that reason, it’s critical for leaders to be fully engaged and aligned in their efforts to address interdependencies and to ensure the original deal rationale remains the central factor in all decisions.

Identify and retain talent that’s in line with deal objectives. Assessing talent during PMI is complex, because managers know very little about employees from the acquired company, especially prior to the close. Before starting to make decisions about individual employees, it’s important to define a talent strategy that supports the nature of the deal. Leaders should consider the following points:

- Is the deal primarily focused on acquiring assets such as physical sites, technology, or intellectual property—in which case the buyer only needs to retain some talent from the target company for a short period of time?

- Does the acquirer’s talent always take precedent over people in a similar role at the acquired company, or can leaders select the best person for each role?

- Does the acquirer need a major talent upgrade across the organization or in certain units?

- Are there other strategic talent objectives to address through the integration, such as succession planning or diversity, equity, and inclusion?

- How important is location in setting roles? Which people can work remotely?

- How can the company retain and motivate talent that may be required only during the integration period?

Once the broader talent strategy is clear, companies must shift their focus to selection and retention as quickly as possible, given the heightened uncertainty during the PMI phase. The selection process must be fair to employees from both organizations, with clear guidelines and rules. (See the sidebar “Setting the People Strategy for the Technology Function.”) The HR function from the target company should be involved, since that team will have more-specific information about their own employees. When relevant, the HR team should also engage with labor unions early in the process to create buy-in.

Organization Design Will Make or Break a Deal

Setting the People Strategy for the Technology Function

To address these challenges, the leadership team developed a people strategy for the combined future organization, including the right level of outsourcing. The team first analyzed the current-state baseline across the two organizations, including their operating model and talent distribution by location, level, and job family. Then, the CIO and integration team mapped key job families to skills in order to properly allocate talent across the combined organization.

Based on that exercise, the team designed a roadmap for implementing the people strategy, ensuring that the mix and deployment of talent would deliver the intended cost savings and organization effectiveness. And, critically, the CIO launched the company’s first-ever, data-driven approach to diversity, equity, and inclusion.

While engaging in the talent selection process, acquiring companies have a wide range of retention tools. For example, they can use contingent offers for talent that they want to retain long term or financial retention packages and enhanced severance for employees that are being retained only during the transition. Most important, companies should use non-financial retention measures such as engaging and communicating with key talent to make them aware of future opportunities in the new company.

Finally, decisions about where the target’s employees will be placed and how they’ll be managed merit careful thought. Positioning them too low in the acquirer’s reporting structure could unwittingly send the message that they’re not considered valuable, possibly leading to regrettable attrition. Acquirers should also weigh the trade-offs that come with decisions about how much independence a target will have post close—and for how long. Independence may help foster a positive employee experience in the target organization, thus improving retention of key talent. But it can also come with a price: less ability to collaborate across the two businesses, which could make achieving the deal’s full potential more difficult.

Set up a rigorous culture and change management program. M&A can be stressful and disruptive to employees, and a lack of communication can increase anxiety and uncertainty, potentially causing critical talent to leave. For that reason, senior leaders need to set up a structured change management program to implement the new organization design, including clear and consistent communication to the workforce.

Providing clarity to employees about the future operating model, organization design, and selection process for specific roles can reduce uncertainty, mitigate rumors, and motivate key talent to engage with the overall process. Structured communication also helps senior leaders engage with their new teams and makes people from the acquired company feel welcome.

A misalignment between cultures can prevent the organizations from building trust, collaborating, and eventually becoming a team.

Last, it’s critical to consider any potential cultural differences between the two companies when forming the change management and communication plan. A misalignment between cultures—or a key communication from the acquiring company that doesn’t mesh with the target’s culture—will increase stress. More important, these kinds of missteps can prevent the organizations from building trust, collaborating, and eventually becoming a team. For this reason, the senior team needs to develop a baseline understanding and raise awareness of cultural similarities and differences across the two companies, to develop the future culture of the combined organization. Leaders also need to define a clear culture roadmap that is aligned to the value thesis of the deal. For example, if a key goal is to synchronize the sales forces of a target and acquirer, the new culture should deliberately reinforce collaboration.

M&A can be a strategic lever, but ensuring that a transaction delivers measurable business value is no easy feat. The organization design that PMI leaders establish for the new company can spell the difference between a successful deal and a disappointing one. By explicitly linking the overall organization design process to the strategy and value drivers of the deal, PMI teams can dramatically increase their odds of success.