Large industrial energy users have traditionally procured electricity under long-term, low-cost, fixed-price contracts. This approach has enabled them to minimize costs and maximize utilization over decades. But in the future, as variable renewable energy (VRE) becomes the main form of power generation, these same large energy users will be exposed to increasingly volatile electricity prices. In this environment, companies will need to find new ways to create advantage and maximize profits from their energy-intensive operations.

How can CEOs best navigate such volatile electricity market conditions? We think they can derive inspiration from asset-backed energy traders.

Leading companies have started adopting the mindset of energy traders to build a competitive advantage out of volatile electricity prices.

Asset-backed energy traders make money by operating assets with built-in physical flexibility to create value in markets with volatile input and output prices. Leading companies have started adopting the mindset of these energy traders, creating and accessing flexibility in their production processes to build a competitive advantage out of volatile electricity prices. This approach also has knock-on benefits for the broader electricity system, helping to manage demand peaks and congestion and allowing greater usage of renewable generation.

When we speak to companies about using electricity flexibly, many tell us that this approach is difficult. As well as physical process barriers to flexibility, they must make fundamental changes to their business models to overcome other barriers including organizational, contractual, and informational barriers. By examining how leading companies have solved these problems, we have identified a multistep approach so that other organizations can do the same. In short, they must secure physical flexibility in their assets and processes, expose the business to market fluctuations, rewire the organization to respond to external market signals, and use digital technologies to understand and respond to variability. This journey needs to be driven by the leadership and doesn’t happen overnight: companies start with small changes and over time make more fundamental changes in the way they operate.

This article is the fifth in a series exploring changes to our electricity and broader energy systems. (See sidebar, “Other Articles in the Series.”)

Other Articles in the Series

Volatile Electricity Markets Alter the Most Profitable Way to Operate

Companies in energy-intensive industries have historically gained competitive advantage by sourcing a low-cost, around-the-clock supply of electricity, often from a nearby captive coal-fired or hydro generator. This allowed them to operate continuously and strive for a unit cost advantage by maximizing the utilization of their facility.

However, as electricity systems decarbonize, the penetration of VRE increases, and fossil fuel-powered generators exit, the level of volatility in electricity markets will rise. We are already seeing this effect in markets today. It has been most pronounced in energy-only markets with high renewables penetration like New Zealand, South Australia, and Texas. Other markets, such as those in Great Britain and in the EU, have experienced extreme volatility as a result of the current energy crisis. We expect that volatility will become more common in these markets even during more stable times.

Companies that can be flexible about when they use electricity will be able to significantly lower their energy costs.

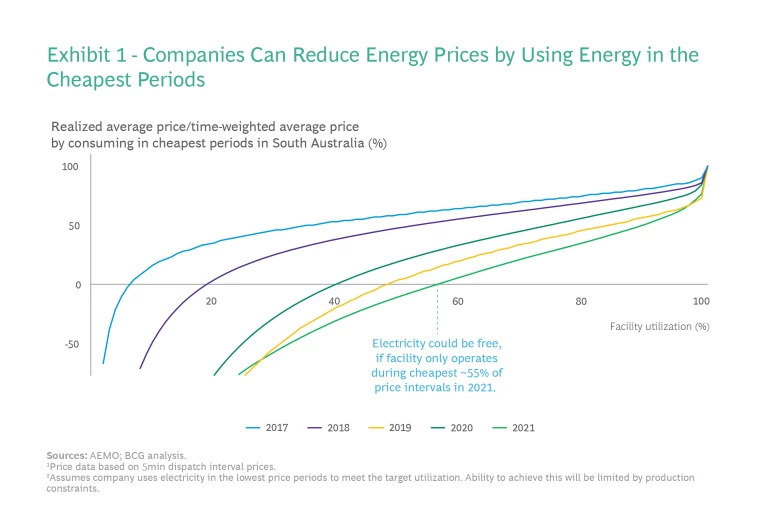

In increasingly volatile electricity markets, companies will no longer have the option of contracts that are both low cost and fixed price. Consequently, the value of using energy flexibly is becoming far higher. Companies that can be flexible about when they use electricity—by using less when it is expensive and more when it is cheap, free, or even negatively priced—will be able to significantly lower their energy costs. South Australia is at the frontier of this trend and provides an example of the benefits of flexibility in the face of rising price volatility. (See Exhibit 1.)

In 2021, if a company located in the state had been able to avoid periods during the year when electricity prices were most expensive (which was about 20% of the time), it could have reduced the average electricity price it paid over the course of the year by more than 65% compared with companies that didn’t vary their electricity usage or were on fixed-price contracts. Taking this example to an extreme, a company in 2021 that used energy only when it was cheapest (about 55% of the time) would have enjoyed free electricity, on average.

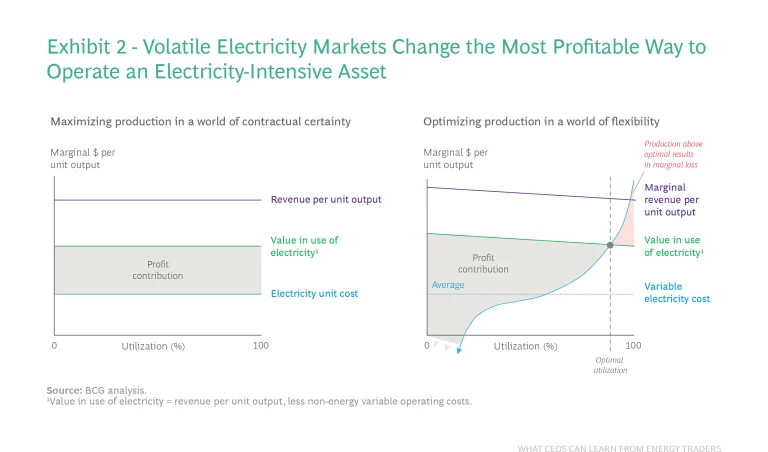

Such market volatility changes how companies should operate electricity-intensive assets in order to maximize profitability. When companies treat electricity costs as a constant, they maximize profitability by achieving full utilization. By comparison, companies that operate in volatile electricity markets and use energy flexibly maximize their profit margins by operating plant at the optimal utilization rather than the maximum utilization. (See Exhibit 2.)

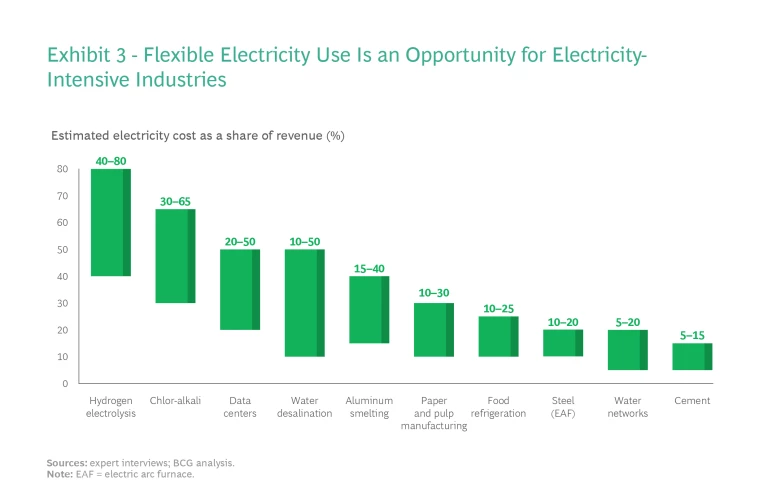

Nyrstar, an international producer of critical minerals and metals with a number of zinc smelters worldwide, is a good example of an energy user which doesn’t target 100% utilization. They have a clear view of the “value in use” of electricity in operating their plant and do not run the plant when the cost of electricity exceeds this, participating both in day-ahead and imbalance markets to optimize between electricity price and zinc production. This approach can also be relevant for other companies that operate assets where electricity costs are a large percentage of revenue. (See Exhibit 3.)

Changing From a Producer Mindset to a Trader Mindset to Create Value from Volatility

If we are moving to a world of high volatility, we might draw inspiration from organizations that profit in times of volatility: asset-backed traders. These organizations operate assets with physical flexibility in response to market conditions to create value in markets with volatile input and output prices. The “trader mindset” of an asset-backed trader differs fundamentally from the “producer mindset” of a manufacturing company. They treat their operations as a real option rather than just a production facility. This gives them the ability—but not the obligation—to produce depending on whether the market pricing at that time means the output is profitable.

Archetypal asset-backed energy traders include gas-fired power generators and oil and gas producers. Gas-fired peaking generators, for example, consider the decision to operate a particular plant as an option based on the “spark spread”—the difference between the revenue from selling electricity and the cost of burning natural gas to produce it. Similarly, many oil and gas companies have developed a trading business for their products and use the optionality in their physical production, refining, and storage facilities to capture the benefits of volatility. For example, by changing the crudes they process or the products they refine in response to market prices.

The trader mindset of an asset-backed energy trader is very different to the producer mindset of most energy users. Companies that adopt a trader mindset:

- Seek asset flexibility (trader mindset) rather than utilization (producer mindset).

- Design processes for responsiveness rather than consistency.

- Enter contracts that give them optionality rather than certainty.

- Manage their operations for profitability rather than throughput.

- Create advantage through information rather than unit cost.

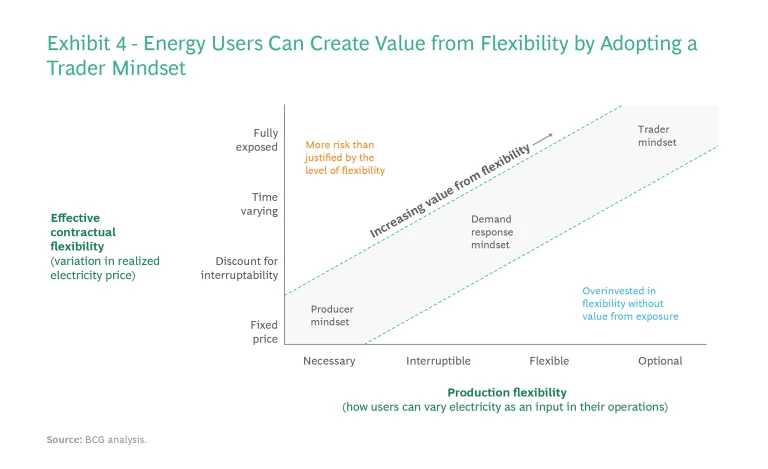

In general, the more energy users can become flexible and act like energy traders, the more value they can extract from volatile electricity markets. (See Exhibit 4.) There are two important caveats to this. First, energy users must ensure that any additional investments are justified by the value of the flexibility. And second, energy users should match their exposure to market prices to their ability to physically respond. True asset-backed traders are not taking unhedged bets on price evolution. Rather, their approach is to capture value from volatility using asset flexibility.

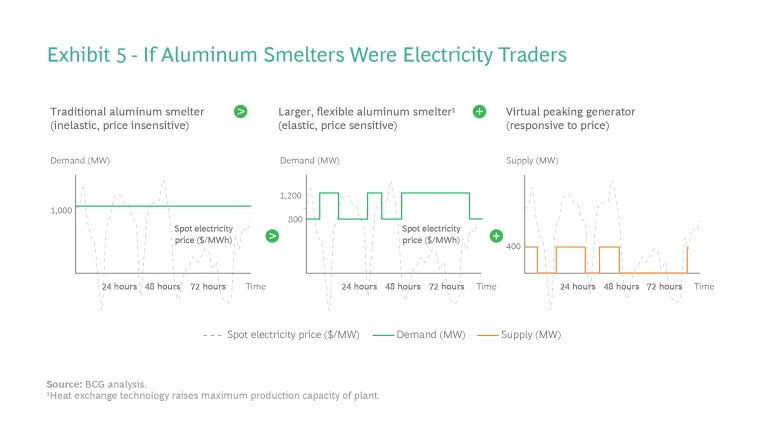

Adopting a trader mindset is far more than just providing demand response during critical moments in the electricity market. For example, a flexible aluminum producer with a trader mindset might treat its smelter as an option on the difference between aluminum and electricity prices. Instead of operating the smelter at a constant output independent of the market price for electricity, the company could increase production when electricity is cheap and reduce production when electricity is expensive. To achieve the same output over the long term with a lower plant utilization, the company invests in assets that are flexible and have a higher maximum production capacity.

This approach gives the flexible aluminum smelter the ability to create additional value similar to that of a virtual peaking generator. (See Exhibit 5.)

Like a peaking generator, the smelter can change production levels quickly and sell electricity back to the market. It bases the decision to alter production on the electricity price and its “fuel cost.” In the case of a real peaking generator, the fuel cost is the price of gas; in the case of our smelter’s virtual generator, the “fuel cost” is foregone margin from aluminum production. As a result, the flexible energy user (the aluminum producer) can think about the electricity market in a similar way to electricity generators—as a source of value rather than a cost. The approach also tends to support the broader electricity system: by selling electricity back to the system at times of peak demand, or during congestion, companies can help reduce the impact of these events.

Traditional aluminum smelters are not flexible enough to operate in this way. But German aluminum producer TRIMET is an example of a company that has demonstrated a flexible smelter to manage electricity cost. TRIMET has invested in upgrades to improve the physical flexibility of a part of its smelter in Essen. This has included introducing new heat exchange and magnetic compensation technologies, as well as better process simulation and controls. This combination of technologies allows TRIMET to vary the smelter’s electricity consumption and aluminum production in both directions by up to 25% (whereas typically the limit is less than 5%) for extended periods (targeting up to +/-1000 MWh for a 100MW smelter, rather than the +/-100 MWh capacity for a typical smelter) based on the electricity price.

Energy Flexibility Means Companywide Change

Companies that we’ve spoken to about flexible energy usage tell us it’s hard. The biggest obstacle to flexibility is, in the first instance, moving away from the producer mindset. But beyond changing the way they think about their operations, there are four practical actions that companies can take to systematically address barriers to flexibility.

Secure Physical Flexibility in Assets and Processes. Constraints arising from asset design, technologies, and processes can restrict physical flexibility. These can be due to inherent limitations in the process or with equipment, which is the case with old, inflexible assets, or the requirement to manage for specific criteria (such as quality and safety). But they can also be due to a lack of understanding about process limits (especially for old equipment) and inflexible upstream or downstream processes (which can lack the ability to stockpile sufficient products and input materials, for example).

To overcome these challenges, leading companies take the following actions:

- Find the hidden flexibility in existing assets by better understanding their true process limits, including the impact of these limits on output quality and maintenance costs.

- Invest in making existing assets more flexible; for example, by upgrading equipment.

- Unlock flexibility in upstream and downstream processes by isolating energy-intensive processes so they can create flexibility in these parts of the business and creating storage buffers.

- Design new assets to have inherent physical flexibility.

UPM, Holmen, and Oz Minerals illustrate ways to tackle these barriers. (See sidebar, “Overcoming Physical Barriers.”)

Overcoming Physical Barriers

Holmen, a Swedish forestry, pulp, and paper company, uses intermediate product storage and excess capacity to unlock flexibility in its energy-intensive thermomechanical pulping (TMP) process while managing existing physical interdependencies with upstream and downstream processes. Upstream, the supply of wood into the mill must be continuous due to a limited area for stockpiling and the need for fresh materials to ensure the end product is of a high quality. The downstream paper production process must also remain continuous and is unable to vary production rates. But by maintaining apparently excess TMP capacity and investing in additional pulp storage, Holmen is able to increase pulping at times of low electricity prices and use stored pulp in its papermaking process when electricity prices are high, without affecting production targets and while meeting customer demand.

Australian mining company Oz Minerals is designing its new West Musgrave copper and nickel mine in Western Australia to use vertical roller mills (VRMs) instead of traditional semi-autogenous grinding (SAG) mills when processing materials. While VRMs have a higher capital cost than SAG mills, they are able to use electricity more flexibly which enables the facility to match production with the generation profile of on-site renewable energy sources, minimizing the need for costly energy storage and reducing the environmental impact of diesel backup power.

Stay ahead with BCG insights on climate change and sustainability

Expose the Business to Market Fluctuations. Many companies have contractual or market arrangements which protect their business from volatility but, in doing so, prevent them from creating value from flexibility.

Electricity supply arrangements or constraints caused by existing market structures can limit companies’ exposure to price variability. These include fixed-rate electricity contracts, the absence of an electricity market in some regions, restrictions on demand-side market participation, or very low caps on prices in wholesale electricity markets (for example, as part of a capacity market arrangement). Constraints can also take the form of barriers to participating in the full range of electricity markets to monetize the value of flexibility, such as restrictions on energy users participating in frequency or reserve markets.

Inflexible offtake contracts and supply contracts for key materials, such as fixed volume or take-or-pay arrangements, can also be a major barrier to flexibility.

To overcome these challenges, leading companies take the following actions:

- Enter contracts which expose their business to market variability that can be managed using their assets. They can start by moving from fixed-price electricity contracts to variable-price electricity contracts or to fixed-price contracts with demand response requirements during high-price periods.

- Participate directly in energy markets and be exposed to real-time variability.

- Monetize the value of flexibility across a broad range of electricity markets, including day-ahead spot markets, intraday markets, reserve markets, or frequency markets, that reward companies for providing different speeds and durations of flexibility. Energy market aggregators and forward-thinking electricity retailers can potentially help companies access these markets.

- Understand and then seek to increase the optionality in input and output contracts that give them greater volume flexibility and access to variable market prices for inputs and outputs.

Holmen, Google, Nyrstar, and Nobian illustrate ways to tackle these barriers. (See sidebar, “Overcoming Contractual Barriers.”)

Overcoming Contractual Barriers

- Directly entering power purchase agreements (PPAs) with renewable energy providers, knowing that response flexibility will allow consumption to closely match renewable energy production.

- Day-ahead spot markets, that allow companies with a daily planning process to align the next day’s production with electricity prices that have been locked in for that day.

- Intraday trading markets which reward companies that can respond during the day to changing circumstances, like an alteration in renewable electricity production or a significant deviation in consumption from demand across the electricity system.

- Reserve or frequency markets, which handsomely reward companies that can respond very quickly to events like unplanned outages of generating plants.

Holmen’s pulp and paper operations take this a step further. They are directly exposed to spot electricity market prices and continuously adjust pulp mill production based on these prices. Another example is Google, which has a goal of targeting “24/7” carbon-free energy at all times of the day and in all of its locations. It contracts directly with renewable energy providers and uses its flexibility to consume at times of high renewable energy production. To help achieve this objective, Google now alters the time when it processes noncritical data, such as adding new words to Google Translate, as well as where it carries out this activity.

Nyrstar participates in a wide range of electricity markets. They started by participating in high-value frequency markets and then expanded to others such as the day-ahead, intraday, and imbalance markets. Nobian is another company that has used its flexibility to participate in high-value markets. The Dutch producer of chlor-alkali participates in frequency response markets in Europe and rapidly adjusts its electricity consumption in response to electricity market events. Nobian currently nominates around 15% of their capacity into the frequency markets, with plans to expand to 30%–35%.

Rewire the Organization to Respond to External Market Signals. An organization’s existing capabilities, structures and processes can prevent companies with dynamic input costs from using energy flexibly. These limitations can start with not having the required capabilities or expertise in energy markets and trading. In many cases, the capability does exist, but the relevant individuals are not involved in day-to-day decisions regarding operations and product sales. Furthermore, performance incentives tied to production targets rather than profitability and long lead times in the production planning process can hamper flexibility.

To overcome these challenges, leading companies take the following actions:

- Develop energy management and trading capabilities. For example, to understand and interpret electricity market data.

- Take decisions about production levels and energy purchasing in tandem. At the extreme, this could require having a single team responsible for operations, energy management, and product sales. But it may just involve ensuring that energy specialists have a say in production decisions on a day-to-day basis.

- Ensure that incentives for teams that make production decisions are linked to profitability and not just volumes.

- Reduce the lead time of the production planning process and ensure all the necessary input information—such as forecast electricity market prices and the profit contribution of additional production—is at hand.

SA Water and UPM illustrate ways to tackle these barriers. (See sidebar, “Overcoming Organizational Barriers.”)

Overcoming Oraganizational Barriers

Among their day-to-day work, SA Water’s Operations Control Centre uses energy market intelligence and price forecasts provided by an energy analyst to manage these assets, empowering them to optimize operations jointly across water delivery and electricity prices.

Operations teams in many companies are incentivized to maximize production and asset utilization above all else. This was the case at UPM, until the company altered production unit incentives to focus on profitability and introduced specific metrics also related to energy costs. UPM also adjusts its production schedules dynamically based on both operational needs, contractual requirements, and electricity market costs.

Use Digital Technologies to Understand and Respond to Variability. Companies without the right information and control systems struggle to make timely decisions or respond to market volatility, exacerbating the other barriers to flexibility they encounter. In short, physical flexibility can be inhibited by needing to use manual processes to control assets. Organizational flexibility can be held back by a lack of visibility over production data or insufficient information about the tradeoffs involved in reducing energy costs. Meanwhile, contractual flexibility can be hampered by a lack of visibility over electricity market prices, and prices and volumes for key inputs and outputs.

Fortunately, new technologies, such as smart meters, advanced analytics, and automated process controls, are increasing energy users’ ability to address these barriers.

To overcome information and control barriers, leading companies use digital tools to:

- Automate or remotely control key processes. For example, using process control technologies to respond within seconds allows companies to participate in frequency and reserve markets.

- Collect and use data to improve their understanding of dynamic production costs, such as through the granular monitoring of energy usage via smart meters.

- Employ advanced analytics, such as a digital twin, to better understand the tradeoff between incremental production, electricity costs, and the impact on plant operations.

- Access electricity market data and other contractual information in real time.

Nyrstar, Google, TRIMET, and Flexcity illustrate ways to tackle these barriers. (See sidebar, “Digital Enablers in Electricity Planning.”)

Digital Enablers in Electricity Planning

Companies can also use data, digital tools, and simulations to understand the value tradeoffs between changes in output and electricity costs and create an information advantage over peers. By using a real-time feed of production data and building a digital twin of its Essen smelter, TRIMET was able to understand the complex, nonlinear effects on production caused by smelters reducing their electricity usage.

Creating a digital feed of real-time electricity market data to guide or automate decision making is a critical step for managing electricity price volatility—you can’t respond to variations in market prices if you don’t know what the market price is. Electricity market aggregators can help companies access and interpret this data. Flexcity, a European aggregator, enables its customers to realize value from flexibility by helping them participate in a range of electricity markets (including frequency markets), understand market data and respond to market events. It provides customers with a live feed of electricity market data as well as a range of digital tools to facilitate flexibility in their businesses, including control and optimization systems. The company’s smart control system, the Flexcity box, allows customers to monitor their electricity consumption, optimize their response, and control their asset in real time.

Five Questions for CEOs to Ask

Companies that successfully develop a trader mindset transform all aspects of their business to become more flexible, a process that often takes years. UPM is an example of a company that has taken this journey and today embodies the trader mindset. (See sidebar, “Embracing the Energy Trader Mindset in Pulp and Paper Manufacture.”) Although the process starts with small changes, companies move on to make fundamental changes in the way they operate.

Embracing the Energy Trader Mindset in Pulp and Paper Manufacture

The company began by systematically reviewing the physical flexibility of thousands of pieces of equipment at one of its Finnish paper mills. As its approach became more sophisticated it gained greater insights into the sources of flexibility. In addition, UPM invested in new assets, such as a (hydrogen-ready) gas-fired CHP plant and an electric boiler at one plant, so that it could dynamically manage fuel usage and electricity costs—sourcing electricity to create and store heat from the grid when prices were low and self-generating when they were high.

To help unlock the value of its newfound flexibility, UPM sought to understand whether the types of flexibility it could provide worked across different markets (such as day-ahead markets, balancing markets, and frequency markets) and began participating directly in these markets. It also adapted incentives for the production units’ teams to focus on profit rather than volume to ensure these units captured the gains from flexibility. These teams retained the decision rights over production, but they are supported by an energy trading team and incorporate energy (and other input) costs into their production planning decisions.

To support its employees, UPM started by providing mill operations managers with a simple digital heatmap of forecast electricity prices. However, these digital tools have evolved over time into sophisticated automation controls and a production platform which optimizes multiple sources of flexibility across the company’s operations based on variable input and energy costs, the value of sales, and operational constraints.

What are the initial steps that companies can take? To start with, CEOs should ask themselves these five questions:

- What is the value of the trader mindset for my operations in my market? Companies should quantify the potential future value of flexibility by modeling different scenarios for market variability, physical flexibility, and the cost of different technological solutions. This will help them decide how much to invest in the journey and what types of actions will be most valuable.

- What hidden flexibility do I already have in my operations? Many assets offer greater physical flexibility than companies are currently using. Identifying this hidden flexibility will help companies to get started on the journey by participating in energy markets before investing in equipment upgrades or new assets.

- What market exposure and flexibility do I have in my contracts today? Before companies can monetize the value of flexibility, they need to understand how much flexibility they have in their current contracts. This will enable them to decide whether contractual changes are necessary to create value from flexibility.

- How can I get basic information to operators in charge of production? Providing basic information on electricity market prices and consumption—such as the electricity price forecast for each day and the breakdown of electricity consumption by company asset—can help operators to make effective decisions straight away. Companies can supply this information to managers and plant operators using a daily report or a dashboard to help them make more profitable decisions.

- What metrics can I use to track my organization’s energy flexibility? Introducing simple performance metrics and incentives can result in significant changes in behavior. Companies can begin by using metrics such as the load-weighted electricity prices versus market average or daily electricity costs to monitor their energy performance even if these aren’t yet incorporated into formal performance reviews.

As more and more electricity systems achieve high penetrations of VRE, companies are becoming exposed to significant levels of market volatility. Although it is tempting for energy users to maintain a producer mindset toward their electricity supply and contract away the risk from electricity price volatility, this approach comes at a premium. Today, leading companies are adopting a trader mindset to create competitive advantage from volatility while benefiting the broader electricity system. To do this, they are transforming their whole business to overcome barriers to flexibility. This involves not just their physical assets but also changes to their contracts and organizational set-up and the use of digital tools. Adopting a trader mindset is not easy or quick, but the rewards for leaders who are bold enough to transform their business around flexibility are substantial.

The authors are grateful for the exchanges with the representatives from the companies referred to in the article. The authors thank BCG’s Antti Belt, Christophe Brognaux, Jonas Geerinck, Frédéric Geurts, and Marc Schmidt with whom they have exchanged ideas during the preparation of this publication. These rich and engaged discussions have allowed the authors to push their thinking further. The authors also thank James Merabi for his contributions. They are also grateful to Matthew Fletcher for writing support.