The recent global semiconductor shortage has spotlighted the need to boost the resilience of the entire semiconductor ecosystem. The constrained supply and booming demand of 2020–2022 underscored the disruption that a deficit of semiconductors can cause across the global economy. Even beyond the economic impact, the effects of potential shortages in semiconductors for aerospace, defense, energy, and other essential arenas of infrastructure are of particular concern.

The semiconductor industry has come to rely on a complex global ecosystem to thrive. The US has long been a significant contributor; however, manufacturing capacity has shifted over the past 30 years and the US ecosystem has weakened relative to other regions.

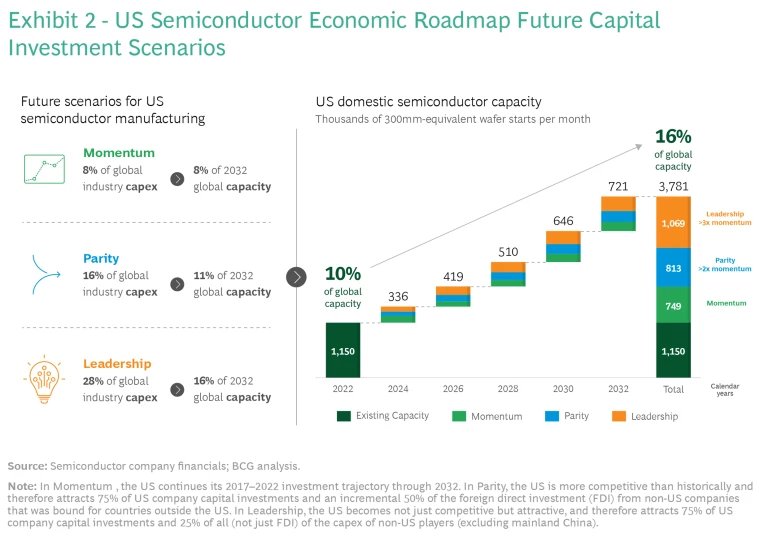

Based on recent patterns of global investment, the US would have captured an estimated 8% of global capital expenditure from 2023 to 2033 and seen its overall share of global semiconductor manufacturing capacity decline from approximately 10% in 2022 to 8% by 2033.

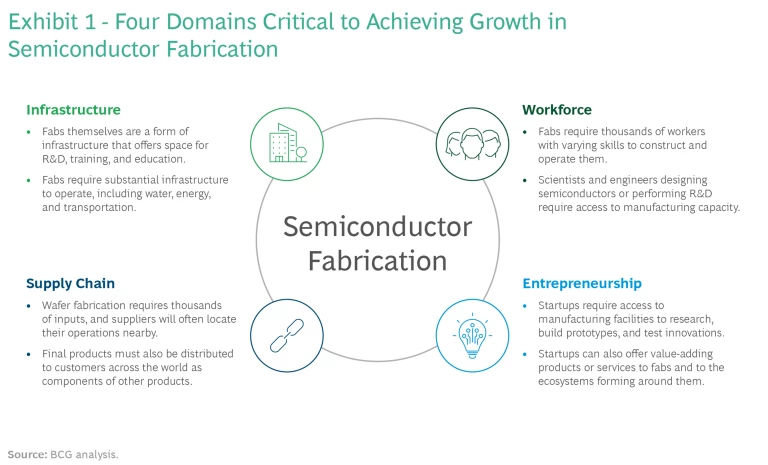

However, in a significant bipartisan step, the CHIPS and Science Act (popularly known as the CHIPS Act) was signed into law in August 2022. The CHIPS Act provides $52 billion and creates a five-year investment tax credit to support expanding the US semiconductor industry. To realize the full value of the CHIPS Act and meaningfully strengthen both US competitiveness and global resilience for decades to come, policy makers, industry players, academia, and other stakeholders must work together to improve and support the entire manufacturing ecosystem, broadly grouped into the domains of infrastructure, supply chain , workforce, and entrepreneurship. (See Exhibit 1.)

Released December 2022, the National Semiconductor Economic Roadmap (NSER, pronounced “answer”) establishes a baseline and a target state for the four domains using rigorous data and analyses. NSER was conceived and commissioned by the Arizona Commerce Authority (ACA) and developed by industry leaders, academic institutions, public entities, and Boston Consulting Group. The NSER action plan to achieve these targets serves as a single source of information for all semiconductor industry players as well as other private and public stakeholders.

If the path laid out in NSER is followed, the US could reasonably capture two to four times more investment than it otherwise would have—16% to 28% of global industry capital rather than 8%—and anticipate its share of global capacity to be 50% to 200% higher, translating to 11% to 16% of total global capacity in 2032 instead of 8%. (See Exhibit 2.)

Infrastructure

Infrastructure is perhaps the most critical domain. As defined in NSER, it includes facilities for supply chain activities such as fabs; infrastructure for training and R&D; and supporting infrastructure such as water, energy, and waste utilities.

NSER has identified three actions to strengthen the infrastructure domain:

- Align the domestic regulatory and incentive environment with competing global capital destinations to increase the financial attractiveness of the US.

- Invest in and create a suitable environment for R&D within the US to encourage collaboration and cooperation.

- Transition and modernize the utility infrastructure to increase resiliency and water reclamation and reduce manufacturing-related carbon emissions with the end goal of reaching net zero.

Supply Chain

Semiconductor manufacturers rely on access to a global supply chain of materials, equipment, and package, assembly, and test capacity, as well as open access to end markets.

NSER has identified three actions to strengthen the supply chain domain:

- Establish dependable supply chains and support multiple qualified vendors for raw materials, consumables, intermediary products, and equipment to sustain domestic manufacturing.

- Increase domestic manufacturing capacity for advanced and mature semiconductor devices.

- Maintain US access to global markets and improve visibility into the supply chain to promote innovation.

Subscribe to receive the latest insights on Technology, Media, and Telecommunications.

Workforce

The industry’s ability to meet the demand for talent is a persistent concern among industry leaders—not surprising, given the global shortage of construction workers, technicians, operators, scientists, and engineers. Without the necessary workforce, sustainable competitiveness in the industry will be impossible.

To overcome these challenges, NSER has identified the following actions to strengthen the workforce domain:

- Increase the number and diversity of students who pursue education in the semiconductor-related fields and support their transition into the industry.

- Retain skilled workers in the semiconductor industry by addressing select causes of attrition, such as improving DEI efforts and creating clear development paths.

- Ensure that the workforce has the competencies required to support the continued advancement and needs of the industry.

Entrepreneurship

Entrepreneurship—both across the value chain and in supporting industries—is crucial to ongoing innovation and competitiveness. However, startups face tremendous challenges in this space, including a lack of investment, access to research facilities, and cross-sector collaboration.

To overcome these challenges, NSER has identified the following actions to strengthen the entrepreneurship domain:

- Increase private equity, government, academic, and company investment in semiconductor entrepreneurs.

- Increase access to government, academic, and private facilities and resources needed to conduct critical R&D.

- Generate a spirit of collaboration between research universities, startups, and industry players and create bridges of collaboration between these groups that are focused on semiconductor innovation.

The current semiconductor shortage has prompted not only the US but many other countries to adopt measures to boost resiliency and safeguard their own national and economic security through greater innovation, reshoring, and trade controls.

With the passage of the CHIPS Act, the US has a generational opportunity to increase its competitiveness and global market share across the semiconductor value chain in a way that also improves global resilience. If it is to capture this opportunity, the US must pursue a course of rapid and disciplined execution of the key actions laid out in NSER.

This research was commissioned by the Arizona Commerce Authority. To contact BCG and ACA about the report, please email NSER@AZCommerce.com .

Read the full report for more information about the challenges facing the semiconductor industry and the steps the US must take to become a competitive destination for semiconductor value chain activities long term.