Expanded use of low-carbon hydrogen and the fuels derived from it is critical to slowing global warming. Can we develop the renewable energy needed to make them?

The challenge is clear: worldwide efforts to reduce global warming to an increase of 1.5°C above pre-industrial levels, the goal of the Paris Agreement, depend largely on substituting renewable energy for the fossil fuels that currently power most of the world’s industries. Barring significant advances in technology, however, electricity alone will not be able to satisfy the energy needs of industries such as shipping, aviation, and cement and steel production.

Our best hope for meeting the climate-friendly energy needs of these and other critical industries lies in a range of low-carbon fuels, including low-carbon hydrogen (H2) and an assortment of climate-friendly hydrogen-based low-carbon fuels such as ammonia, methanol, and kerosene—notably, so-called power-to-X (P2X) fuels that use hydrogen produced exclusively from renewable energy sources. Together, these fuels must provide from 10% to 12% of global energy consumption if we are to reach the Paris Agreement’s net-zero goal by 2050, according to the International Energy Agency (IEA).

In this article, we examine three critical questions:

- How much low-carbon fuel will the world need to support the global energy transition over the next three decades?

- How much of that quantity must consist of P2X fuels, and how much renewable energy will be necessary to make them?

- How can producers generate that amount of renewable energy?

The answers will help illuminate the world’s ability to meet its net-zero goals.

Supply and Demand

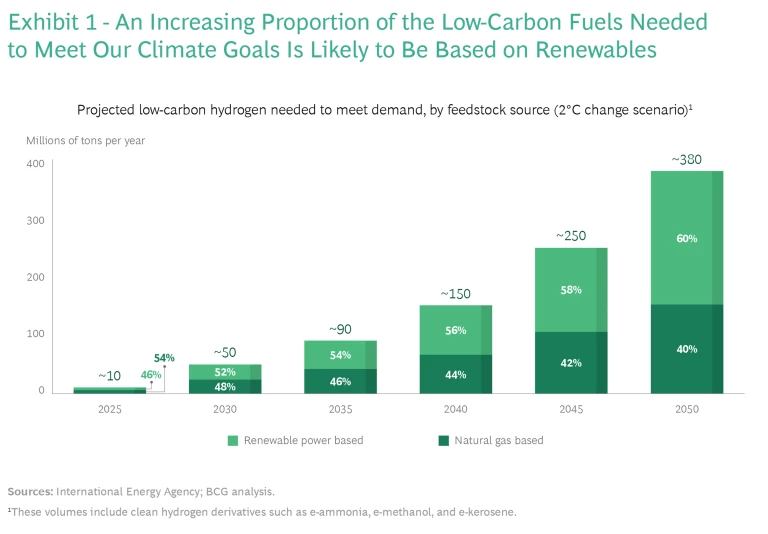

According to our analysis of the future need for low-carbon fuels, 380 million tons per year of low-carbon hydrogen and its derivatives will be required to limit global warming to 2°C, rising to 565 million tons per year in order to reach the Paris Agreement goal of a 1.5° increase.

Meeting this need will require development and implementation of a combination of production technologies for low-carbon hydrogen and derivative fuels. Producing low-carbon hydrogen involves using either natural gas and carbon capture technologies or electrolysis powered by renewable energy—a lot of it. (See “The Future of Fuels.”) No single technology is likely to dominate, as future access to cheap and abundant natural gas or cheap and abundant renewable power will depend on local conditions and on innovations in production and transportation technologies.

The Future of Fuels

The Future of Fuels

Fuels from Natural-Gas-Based Hydrogen. Gas-based hydrogen is made from natural gas, through a process that uses carbon capture and storage (CCS) technologies to sequester the CO2 emissions generated during production. Further development of these technologies will depend in part on governments’ willingness to store CO2 underground and will play an essential role in the growth of gas-based hydrogen and of the low-carbon fuels that are made from it.

Power-to-X (P2X) Fuels. The primary constituent of P2X fuels—also called e-fuels—is hydrogen produced by using renewable energy to power electrolyzers that split water into hydrogen and oxygen. Renewables-based hydrogen makes up between 60% and 90% of the production costs of such P2X fuels as e-ammonia, e-methanol, and e-kerosene. Hydrogen also plays an important role in its own right, especially for industrial applications such as steel production and several chemical processes.

As noted above, there are three main subcategories of P2X fuels:

- E-Ammonia. This fuel is made by using a high-temperature chemical synthesis process to combine renewables-based hydrogen with nitrogen. E-ammonia has a higher energy density than hydrogen, so it is easier to transport and trade internationally. E-ammonia’s ability to replace current fossil fuels is limited, however, which reduces its usefulness with the current installed base of transportation engines.

- E-Methanol. This P2X fuel is made by combining renewables-based hydrogen with sustainable CO2 in a chemical synthesis process. It has a strong drop-in capability, which makes it especially suitable for fuel blending. But its cost-competitiveness depends on the producer’s ability to source sustainable CO2 cheaply.

- E-Hydrocarbons. This subcategory of P2X fuels includes alternatives such as e-gasoline and e-kerosene, both of which offer significant benefits because of their full drop-in capability across all existing fossil fuels. Several processes for manufacturing them exist. For e-kerosene, the dominant method is the Fischer–Tropsch process, which involves converting a mixture of carbon monoxide and hydrogen into liquid hydrocarbons through a series of chemical reactions. E-gasoline can be made by converting low-carbon methanol into liquid fuel and a small stream of liquefied petroleum gas. Before e-hydrocarbons can be commercially feasible, producers must reduce the associated costs to a level similar to that for fossil fuels and carbon-free alternatives.

The need for supplies of low-carbon hydrogen to meet the requirements of the IEA’s 2°C scenario is growing. (See Exhibit 1.) We expect renewables-based hydrogen production to increase relative to natural-gas-based hydrogen production as technology improvements and carbon-related policies make it more competitive. Nuclear-energy-based hydrogen production is also likely to play a role, although nuclear energy faces significant political challenges in many locations, and the cost of the energy produced is high relative to the alternatives.

Four Challenges

Meeting the impending demand for low-carbon hydrogen will be no easy task. Producing enough low-carbon hydrogen by using either natural gas or renewables will require government action—applying taxes or other mechanisms to set the price of carbon high enough to ensure cost competitiveness with incumbent, fossil-intensive hydrogen and potentially subsidizing its production in order to close the cost gap between it and other low-carbon fuels.

The production of gas-based hydrogen will also require securing abundant supplies of inexpensive natural gas and establishing strict policies to limit the release of fugitive methane emissions. Producing enough renewables-based hydrogen will require the availability of an adequate supply of cheap renewable power and the land or offshore locations where it can be generated.

Today, almost all available and anticipated renewable power from wind and solar sources is reserved for direct electrification, which, from an abatement cost perspective, is the most beneficial decarbonization pathway. To avoid cannibalizing available renewable power, policymakers and other stakeholders must ensure the existence of a suitably large source of renewables dedicated to the production of hydrogen and P2X fuels. Already, the EU is considering requirements to source renewable energy for P2X production under separate, dedicated power purchase agreements and to locate the necessary power sources near P2X production to limit the need to make additional investments in the power grid in order to supply P2X production.

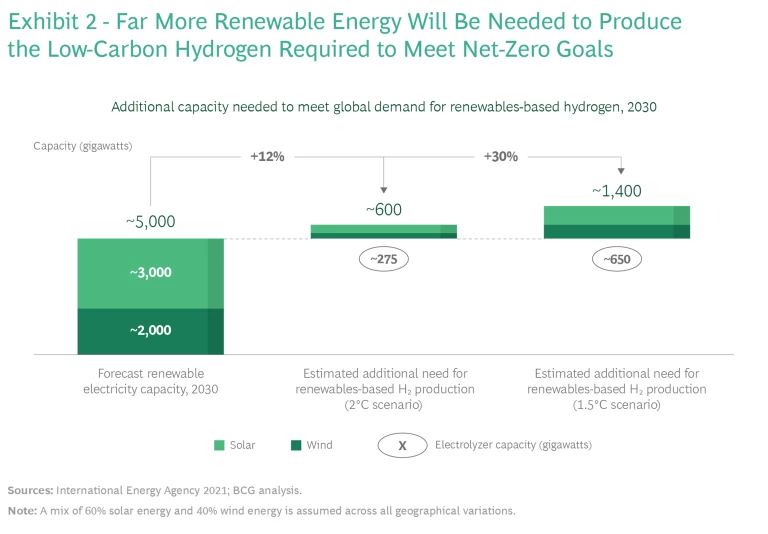

Supplying enough P2X fuels to meet the IEA’s 2°C scenario will require at least 12% more renewable energy by 2030 than is currently forecast to be available, and supplying enough to meet its 1.5°C scenario will require fully 30% more. (See Exhibit 2.)

Europe faces perhaps the greatest challenge in meeting the coming demand. If the EU is cut its dependency on natural gas from Russia, it will have to produce 10 million tons per year of renewables-based hydrogen locally, and import another 10 million tons per year, by 2030. Achieving this goal, however, will require between 100 gigawatts (GW) and 125 GW of electricity from solar and 80 GW to 100 GW from wind—about 30% more renewable capacity than the EU had set as its target prior to the war in Ukraine. This amount is additional to the increased renewable capacity needed to replace natural gas currently used to generate electricity in the region, which will likely take priority, since abatement costs are lower for converting from gas to renewables than for using renewables to produce hydrogen-based fuels to generate power.

Furthermore, land-based wind and solar projects can take up to six years to plan, permit, and build, and offshore wind projects and the accompanying high-voltage long-distance transmission connections can take up to eight years. This makes developing significant amounts of additional renewable capacity a challenge that calls for fast-tracking the permitting process and providing subsidies such as tax credits to reduce developers’ risk. Policymakers must take an active role in promoting development of the extra renewable generation and distribution capacity needed to produce hydrogen, and they must help reduce the additional investments in the power grid needed. P2X plants could even sell back to the grid their power demand flexibility, a potentially significant by-product income for hydrogen and P2X producers.

Other regions will likely experience similar challenges—most notably regions such as Japan and South Korea, where hydrogen is likely to be vital to net-zero goals, but where access to cheap natural gas and renewable energy is limited.

In addition to the difficulties associated with any attempt to increase capacity, the effort to meet future demand for renewable power to use in producing hydrogen and P2X fuels must overcome hurdles related to cost, infrastructure, supply chains, and feedstocks.

Cost. Access to large volumes of low-cost renewable energy is a prerequisite for the growth of P2X fuels. The amount of land required to produce enough renewables is huge: using solar energy to produce half of the 565 million tons of hydrogen and equivalents would require up to 30,000 square kilometers, roughly the size of Belgium. In addition, only about 20% of the world’s land is suitable for the production of solar energy at a cost of less than $30 per megawatt-hour over the life of the facility—the level needed to make P2X competitive with alternative low-carbon solutions and fossil fuels. And more than 75% of that land is located in Latin America, the Middle East and Africa, where demand for low-carbon fuel is limited.

It will therefore be necessary to develop inexpensive methods of transporting hydrogen and its derivative fuels over long distances if P2X fuels are to become economically viable. Long-distance transportation of hydrogen derivatives such as ammonia, methanol, and liquid fuels such as kerosene is already cost effective, but the infrastructure to transport H2 itself will depend on further development, de-risking, and scaling up of technologies such as ammonia cracking.

Infrastructure. As demand grows for renewable power to produce P2X fuels, major investments will be needed in the power and gas grid infrastructure to handle them. We recently completed studies for Germany and the Scandinavian countries showing that improvements in the power and gas grids there will account for between 25% and 35% of the total energy transition investment needed to reach net-zero. Any lack of infrastructure improvements will hamper local and regional development of P2X production and may trigger far more costly ship-based imports to demand centers such as Japan, South Korea, and Western Europe. Some developing countries are likely to opt for more decentralized solutions, such as leveraging the existing fossil fuel infrastructure to transport P2X fuels, if they cannot manage the massive infrastructure costs—especially the cost of renewable electrification.

Supply Chains. The additional renewable energy needed to meet future demand for P2X fuels will likely stress the supply chains of manufacturers of equipment for producing H2 and wind and solar energy. Access to cheap rare-earth materials is expected to be a constraint on some technologies, such as proton exchange membrane (PEM) electrolyzers, where platinum is pivotal for high performance. However, producers may be able to mitigate this through innovations in materials science and the development of second-generation electrolyzer technologies such as solid-oxide systems.

Feedstocks. Close to half of the demand for H2 will likely have to be met through increased production of gas-based hydrogen. This in turn will require more natural gas and the development and scaling up of carbon capture and storage (CCS) technologies to produce it while minimizing emissions. Already, some governments, including Germany’s, have demonstrated a reluctance to increase their dependence on gas, and thus on the use of CCS technologies. However, the energy crisis triggered by Russia’s invasion of Ukraine may encourage Germany to change its current policy regarding domestic gas-based hydrogen production and carbon storage.

Step by Step

The hindrances to adequate supplies of renewable energy and economically viable renewables-based hydrogen are real. Overcoming them will require technological advances and policy changes on four fronts: efficient technologies, other types of hydrogen, global production hubs, and global H2 supply chains.

Efficient Technologies. Several technologies now in development can significantly increase the efficiency and supply stability of renewable power while reducing the investment and footprint needed to produce the energy needed. Three are especially noteworthy:

- Solar. Floating photovoltaic cells could reduce dependency on land-based systems and, together with coastal wind power, generate power equal to land-based solar farms without requiring the massive land footprint. In addition, the natural cooling effect of water can increase the efficiency of floating PV cells by 5% to 10% compared to land-based solar. Newer technologies such as multijunction cells promise further efficiency gains—as much as twice the efficiency of traditional PV cells—but they require further development.

- Wind. Smart rotor systems are being developed that permit the use of larger and more productive wind turbines, driving down the cost of electricity and the need for space. Farther in the future, floating wind turbines could provide access to new wind production areas—especially where cheap fixed-bottom offshore and land-based wind and solar farms haven’t yet been built—and 10% to 20% greater capacity than fixed-bottom turbines offer. We expect floating wind technology to become cost competitive by around 2030, enabling producers to locate megascale P2X production offshore, where the average level of wind energy is higher than on land and along the coast. Floating turbines alone offer the potential to produce more than 9,000 gigawatts of electricity near large-demand centers.

- Electrolysis. Compared to incumbent technologies such as polymer electrolyte membrane and alkaline electrolysis cell methods, new electrolyzer systems such as solid-oxide technology promise 20% to 30% greater efficiency—a key factor in reducing the investment amount and physical footprint size required to meeting the coming demand for renewable energy.

Other Types of Hydrogen Production. Accelerating the technological development and commercialization of low-carbon hydrogen production methods other than gas- and renewables-based hydrogen would boost the overall supply. The following three production methods show considerable promise:

- Nuclear-Based Hydrogen. Using nuclear energy as a source of electricity to produce hydrogen faces significant political challenges, as well as a high cost of electricity, in many locations. Still, a modern large-scale nuclear plant combined with a solid-oxide electrolyzer that can use both the heat and the power from a nuclear plant might become cost competitive in regions with fewer political obstacles, such as India. In the longer term, power production based on small modular reactor systems could enable producers to locate H2 production closer to demand, but much will depend on future regulatory conditions.

- Natural Hydrogen. Mining hydrogen from natural formations offers the potential to provide hydrogen cheaply and efficiently, but the volume of global natural hydrogen reserves is not yet clear. Reservoir discoveries in Brazil, the US, Canada, and Australia, for example, along with actual production in Mali, suggest that the potential is there. Expected production costs would be highly competitive with those for man-made hydrogen.

- Bioenergy-Based Hydrogen. There is some opportunity to produce hydrogen from waste, although other uses of waste, such as for biofuel production, are likely to be more profitable. In this area, local policy conditions may make the use of waste as a feedstock for hydrogen production economically viable.

Global Production Hubs. The availability of cheap land with favorable conditions for solar and wind energy production is decreasing, even as limitations on new infrastructure to accommodate the expected growth in P2X volumes are increasing. Together, these factors may force producers and regulators to rethink their strategic approach to hydrogen production and transportation. We see two strategic pathways:

- Offshore and Floating Wind and Solar Production. In principle, the potential for renewable power from offshore wind and solar facilities is virtually unlimited, especially if such facilities can be located beyond the near shore. In addition to floating production technologies for wind and solar, offshore infrastructure such as energy island hubs could provide a way to scale up renewable energy and low-carbon fuel production; developmental hub projects in the North Sea are ongoing.

- Megascale Onshore Renewable Power Production. Renewable power hubs are particularly suitable for hydrogen production. By combining wind and solar generation, they can produce energy at more than 70% of full capacity, significantly increasing the cost competitiveness of renewables-based hydrogen. Relatively few developers have undertaken projects that produce 10 gigawatts or more of renewable power, however. Government support for developers to further exploit the potential of these hubs—in windy desert areas, for example—is essential, as is support for pipeline and grid infrastructure. Megascale production in locations such as the Middle East, Australia and Latin America can be cost-competitive, and companies are already beginning to acquire land there with an eye toward future development.

Global H2 Supply Chains. A further critical enabler for global production hubs—and for low-carbon and P2X fuels generally—is the existence of a global H2 supply chain capable of cheaply and safely transporting H2 across long distances. Several technologies are under development for such transportation, including in the form of ammonia or liquid organic H2 carriers, in much the same way that liquid natural gas is transported today. Both technologies require further development, de-risking, and scaling up, but they could drive down the cost of low-carbon fuels and enable them to be produced where feedstocks are cheapest and most abundant.

Action Plans

Every stakeholder in the effort to generate hydrogen and P2X fuels—including power producers, renewable developers, oil and gas companies, production technology manufacturers, and governments and policymakers—needs to prepare for the coming hydrogen economy. This includes carefully identifying any potential limitations on feedstocks, land, and infrastructure that are likely to emerge in the coming decades and making plans to mitigate them.

The critical players in this process should determine the measures they can adopt to ensure that the hydrogen economy contributes the most it can to achieving net-zero emissions. Following are specific actions that each interested party should consider taking.

Power producers and renewable energy developers:

- Secure access to critical feedstocks—including renewable power (and the land or offshore sites needed to generate it), natural gas, and sustainable CO2—at competitive prices.

- Use current nuclear plants to power hydrogen production in new P2X markets, and exploit nuclear capabilities to build hydrogen-production capacity in markets that have limited access to cheap gas and renewables.

- Seek additional income by selling P2X byproducts such as excess electricity and heat to the grid and by leveraging production flexibility to participate in power reserve capacity markets.

Oil and gas producers:

- Secure access to critical feedstocks—including renewable power, natural gas, and sustainable CO2—at competitive prices.

- Extend current capabilities in the transportation and distribution of low-carbon molecules, and develop economical ways to transport hydrogen and other low-carbon fuels.

Production technology OEMs:

- Accelerate R&D capabilities to develop and commercialize more efficient hydrogen production and transportation technologies, including technologies that have reduced requirements for critical minerals.

- Support R&D efforts to develop and commercialize renewable power technologies to boost efficiency and extend offshore capacity.

Policymakers and regulators:

- Accelerate the buildup of needed infrastructure, possibly through public-private partnerships and frameworks for private capital investments.

- Make more land and offshore locations available for low-cost production of renewable energy.

- Institute standards for transporting and using low-carbon fuel molecules.

- Support partnerships between low-carbon fuel export hubs and demand centers.

- Create and support markets for trading hydrogen and low-carbon fuels.

- Support de-risking large capex investments.

It will not be easy to supply the renewable power that will be needed over the coming decade to produce P2X fuels, on top of the demand for renewable sources of electrification generally. In the longer term, however, as more plentiful and lower-cost supplies emerge, the global hydrogen supply chain will undergo a transformation. Already, some players are establishing attractive competitive positions in the P2X value chain, some through strategic partners. The strategic costs of not securing timely access to land and sea development opportunities—as well as to shared infrastructure and funding—will only increase. Companies looking to put themselves in an attractive competitive position must begin making the right strategic decisions today, while collaborating with other stakeholders to develop an effective ecosystem of strategic partners.

When, where, and how should they participate in the value chain? How can they use their current and future customer, production, and infrastructure footprints and partnerships to gain a competitive advantage? And how can they best use new technologies to gain a cost advantage? The answers to these key questions will determine the winners in the development of these critical new power sources.