For health insurance payers, success in Medicare Advantage (MA) depends on the stars.

Established in 2008, the Star Ratings for Medicare Advantage program helps consumers evaluate Medicare insurance plans by providing a consistent set of criteria to assess plan performance. As MA enrollment has grown (topping 24 million members in 2020, or nearly 40% of all Medicare beneficiaries) and the market has become more competitive, a strong star rating has become essential for insurers. Higher plan ratings lead to bigger bonuses and rebates from the Center for Medicare Services (CMS), and ratings often feature in plan marketing. In 2016, about two-thirds of MA members were enrolled in 4- or 5-star-rated plans; by 2020, that number rose closer to 80%. Our analysis shows that moving up from a 3.5- to 4-star rating is worth an additional $400 per member per year on average for MA plans—an upside of $60 million in revenue, for example, for a plan with 150,000 members.

Now, in a major shift, CMS is increasing the weighting it puts on member experience in the stars rating.

Plans have improved, and the bar to receiving a score of 4 or 5 has continued to rise. Now, in a major shift, CMS is increasing the weighting it puts on member experience in the stars rating. It is doubling the weight it places on measures of member experience, such as those captured by the CAHPS (consumer assessment of healthcare providers and systems) survey, starting in 2023. The consumer survey that will feed into the 2023 rating is being fielded in 2022. CMS has also announced various technology-enabled enhancements to the stars program that are designed to encourage health plans to further improve the customer experience . (See “Boosting the Customer Experience with Technology.”)

Boosting the Customer Experience with Technology

In addition to the increased CAHPS weighting, CMS has made several technology-related changes that will have a significant impact on how MA plans are rated. These changes include:

- The CMS Interoperability and Patient Access Final Rule, published in May 2020, establishes policies that “advance interoperability and access to health information across all stakeholders.” Specifically, certain payers will be required to build standardized APIs so they can exchange data with other payers. The goals are to make members’ health data portable if they switch health insurance plans and to help new plans more quickly enroll members in any necessary care management programs.

- CMS has made changes to improve members’ ease and access to information, as well as potentially lower out-of-pocket costs, through the increased use of digital tools.

- The Healthcare Effectiveness Data and Information Set (HEDIS), a tool used by more than 90% of health plans to measure care and service performance, now includes telehealth information. During the pandemic, CMS increased the number of diagnosis codes eligible for telehealth reimbursement by 80%.

- Plans must have in place a real-time benefit-comparison tool for members to get information on lower-cost alternatives under their plan.

- Plans will need to support new electronic transaction standards that enable providers to see what drugs require prior authorization and submit clinical information before the prescriptions are sent to the pharmacy. This change is designed to ensure consumers receive the authorizations they need before attempting to pick up their prescriptions.

Set a solid data foundation, leverage analytics, engage effectively with members, partner with providers, and establish an optimal operating model for earning stars.

Our research shows that consumers themselves have developed strong views on what they are looking for in the experience factors that drive star ratings, which escalates the impact of the broader CMS changes. These attitudes point to five steps that payers should take now to protect or improve how they perform on CAHPS and other consumer-driven measures: set a solid data foundation, leverage analytics, engage effectively with members, partner with providers, and establish an optimal operating model for earning stars.

To help MA-plan executives think through how to take advantage of the CMS changes, we examine the drivers of consumer satisfaction with MA plans, the five capabilities required to win under the new stars system, and how to get started.

The Drivers of Satisfaction for Consumers

The annual CAHPS survey, the results of which will account for 33% of the 2023 stars-rating criteria, assesses consumer satisfaction across a range of metrics related to how people access, receive, and pay for care, including prescriptions drugs. Scoring well on this survey is critical. Because stars measures are very precise (for example, the CAHPS survey measures consumer satisfaction in specific areas such as care coordination, drug plans, and getting appointments and care quickly), even companies with high net promoter scores do not necessarily receive strong scores.

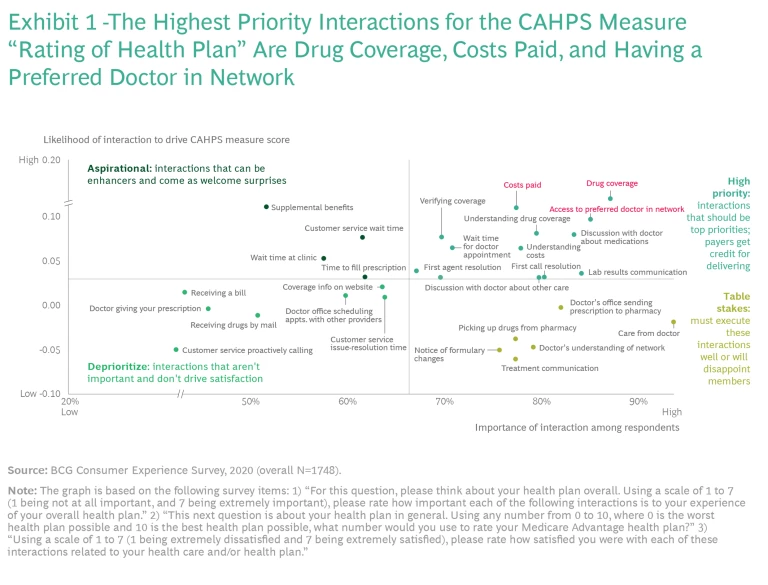

We surveyed more than 2,500 MA members about 35 interactions along the

health care

journey to identify which interactions drive satisfaction and have the greatest impact on how members respond to the CAHPS survey. We plotted interactions based on the importance that members ascribe to each one and the likelihood of each interaction to drive the CAHPS score. The analysis helps MA plans prioritize their efforts by grouping interactions into four categories:

- Top priorities, or interactions that payers get credit for delivering and should prioritize

- Table stakes, or the interactions payers must execute well or risk disappointing members

- Aspirational, or interactions that are a welcome surprise and can enhance member relationships

- Low priorities, or interactions that aren't important and don't drive satisfaction

The nine interactions with the greatest impact on eight critical CAHPS measures (those that most affect survey results) are:

- Verifying coverage or receiving authorization for care

- Discussions with a doctor about medications

- Wait times for an appointment with the desired doctor

- Postcare communications about test or lab results

- Prescription drug coverage

- Member understanding of prescription drug coverage by plan

- Actual-versus-expected cost of care

- Ability of a customer service agent to resolve an issue

- Ability of a customer service agent to resolve an issue in one conversation

More than 70% of survey respondents assigned each of these interactions the highest levels of importance, and each drives satisfaction with four or more CAHPS measures. Collectively, they provide a clear roadmap for plans to assess their CAHPS performance, reinforce areas of strength, and shore up areas of underperformance. For example, the analysis reveals that when it comes to the CAHPS measure “Rating of Health Plan” drug coverage, costs paid, and having a preferred doctor within the insurance network are the top priorities. (See Exhibit 1.)

Aligning the Stars

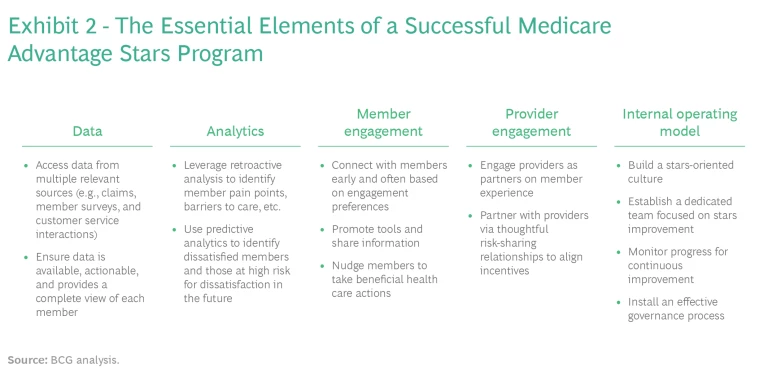

Based on the research and the changes that CMS is implementing, we have identified five essential elements that payers must get right to position themselves to achieve strong star scores. (See Exhibit 2.)

Set a solid data foundation. Payers must have a solid data foundation, meaning that they can access the data that provides a complete picture of member needs, that the data is readily available to those in the organizations who need it, and that the data is easy to use.

Plans should expand the use of data from multiple sources, such as claims, member surveys, customer service interactions, care management interactions, incentive programs, and vendor engagement, to create a complete view of each member. They can supplement internal medical data with member satisfaction data from surveys and focus groups; SDOH (social determinants of health) data; and data from member touchpoints (such as customer service calls), health-risk assessments, in-home assessments, and supplemental benefit touchpoints. Data should also be updated continuously—by consistently measuring consumer satisfaction to identify member issues as they arise, for example—to ensure relevance.

Leverage analytics. Organizations need to embrace and democratize the use of analytics capabilities, applying these tools more broadly to create deeper insights and better understand member needs and preferences. Retrospective analytics can help plans understand member pain points and the barriers to better care. They can also help plans improve health outcomes and members’ experience. Predictive analytics can help identify medically high-risk or dissatisfied members before major issues arise.

Analytics can also be used to determine areas requiring priority attention based on such factors as anticipated changes to star thresholds (also known as “cut points”), weighting changes in CAHPS measures, and how well a plan has performed in the past on a particular measure. For example, if a health plan has received 4 stars on a CAHPS measure and is scoring very close to the threshold for 5, and it appears that the 5-star threshold has been stable over the past few years, then a good analytical tool would automatically highlight this measure as a priority area for attention.

Engage with members on their terms. Plans that engage effectively with members do three things well. First, they communicate early and often using the member’s preferred channels and by providing personalized content.

Second, plans that engage effectively promote digital tools and information sharing. An easy-to-use member portal and app can provide cost and coverage information as well as access to virtual care options, such as telehealth. The tools can also be used to educate members on their benefits and benefit changes throughout the year, communicate annual plan changes (such as rate changes and changes in drug coverage), and explain potential impact and options.

Third, they find ways to nudge members toward beneficial actions, using each interaction as an opportunity to remind members of gaps in care or to offer help in scheduling needed appointments. For example, plans can use an inbound billing call as an opportunity to remind a member to get a flu shot.

Some of the largest MA payers use such advanced technologies as augmented intelligence, voice recognition, and remote monitoring to improve the digital experience for members.

Some of the largest MA payers use such advanced technologies as augmented intelligence, voice recognition, and remote monitoring to improve the digital experience for members. Humana’s Studio H has built technology platforms for population health, digital health, and machine learning that serve its own teams as well as members and providers. Humana’s Go365 program offers rewards points, much like a hotel or restaurant loyalty program, for healthy behaviors. Similarly, UnitedHealth Group’s Renew Active program provides members with an annual personalized fitness plan and free gym membership. It also provides access to group classes, digital on-demand workout videos, and live-streaming fitness classes. The company’s OptumHealth service offers providers a full analytics and tech toolbox to help improve care and system performance.

Partner with providers. Earning a high star score is a team effort. The more progressive plans are exploring new types of relationships with providers, including relationships through which the partners can share investments and rewards. While the financial stake may vary by the type of partnership, MA plans can work toward improved care and higher stars scores with such initiatives as:

- Provider-incentive programs (in addition to risk contracts) that encourage desired provider behaviors and promote closing gaps in care

- Educational materials that explain the importance of the stars program and its performance measures and set out best practices for achieving higher scores

- Tools for providers and pharmacists that help improve care for members in a manner consistent with the member’s plan benefits, such as a prescription-formulary tool or a prescription-prior-authorization tool

Establish an optimal operating model for earning stars. Plans need the entire organization to understand the importance of stars and how direct interactions with members and supporting initiatives affect performance and scores. This means working toward a stars-oriented culture in which everyone understands that they have a stake in promoting consistently high ratings.

One way that leading plans drive improvement is by dedicating a senior-level leader and cross-functional working group to direct the stars effort. The high-level executive oversees cross-functional member- and provider-outreach teams staffed by clinicians (such as nurses and pharmacists), analytical talent, and those employees with other relevant skills. Teams monitor progress in stars-related initiatives using the data and analytics described above to identify priority areas for attention. A good performance management system enables continuous improvement. Dashboards include reporting tools that track leading indicators (or relevant proxies) for each stars measure.

Leading plans also have an effective governance process for implementing new initiatives, securing funding, and tracking the initiatives in an agile manner. Management evaluates the value being delivered by each initiative with systematic assessments of its goals and the underlying economics.

What to Do Now

The actions described above are not quick fixes, and the industry is hardly standing still. A BCG analysis conducted earlier this year found 900 startups active in areas related to stars measures: 19% are focused on patient education solutions, 13% on clinical data analytics, and 12% on risk adjustment and coding solutions.

Since CAHPS is an annual survey, plans looking to make material improvements to secure higher star ratings must act with urgency. They should develop a portfolio of needed initiatives, prioritize those that can have the earliest impact, and make further improvements over time. Here’s a brief check list of questions plan executives should ask themselves to get started:

- Do I have a mock CAHPS survey?

- Have I analyzed the drivers of member responses to CAHPS?

- Do I have the data and analytics capabilities in place to identify and evaluate stars programming and initiatives?

- Can my organization act quickly when it needs to make stars-related improvements?

- Is a dedicated team responsible for owning these improvements?

- Does my organization broadly understand and feel a sense of ownership over stars scores?

These are the table stakes for stars improvement. Negative answers on any of the above highlight immediate areas for attention.

For MA plans that are ready to act with decisiveness and speed, the changes under way in earning stars—and particularly changes in CAHPS criteria—offer a win-win opportunity. By boosting their star ratings, plans will improve existing service to members and add new features. They will also receive financial rewards that can fund further improvements for members in the future.