As digital technologies move to the next stage of advancement— the metaverse —there are two questions companies should ask: How will the metaverse change our business? And how can we get ahead of the change and shape it to our advantage? This is our perspective on both.

The Data and Technology Universe

There’s plenty of debate about the definition of the metaverse, but we find it more useful to take a practical view and focus on the productive use cases that it enables. The metaverse is based on the convergence of multiple technologies and the proliferation of data and content, which combine to create value for users. In the case of consumers, the result might be a virtual-reality (VR) gaming platform, while for business it could be a machine-learning algorithm that incorporates multiple diverse data sets to provide better insights and improve decision making.

In this sense, the metaverse encompasses broad categories of technology (including computing, connectivity, artificial intelligence , and machine learning) that come together in rich ways to create new and unprecedented value. It’s an aircraft engine technician connecting via the company’s help line to an expert 3,000 miles away. It's the digital twin of an electrical grid that highlights maintenance needs or security vulnerabilities. It's a smartphone app that integrates with an augmented-reality-enabled windshield to serve up driving directions, which it feeds to the car’s self-driving algorithms. It’s the technology that enables emergency services to respond when a phone or watch belonging to an injured person automatically sends an SOS.

It’s hard to pinpoint where the metaverse ends. It is flourishing, in part, thanks to continuing advancements in technologies such as augmented reality (AR) and VR, big data, artificial intelligence, machine learning, and blockchain. Just as our understanding of the universe and what it encompasses has been vastly expanded by the Hubble space telescope, the nature of the metaverse is a work in progress. Were we able to define its boundaries today, some future technological advance would almost certainly cause us to reassess.

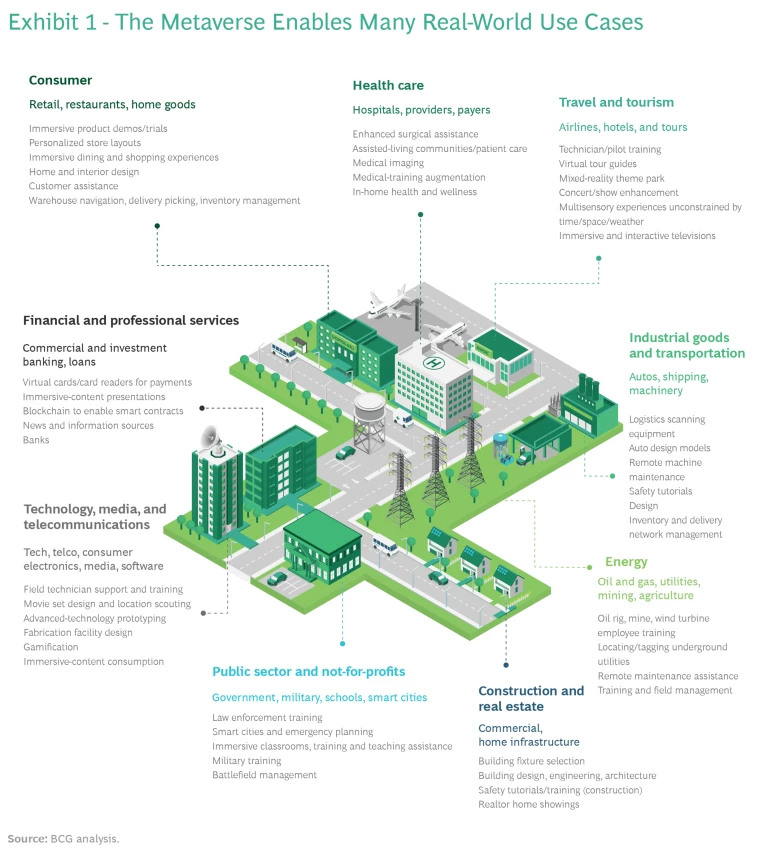

If the metaverse seems a bit amorphous, its use cases are easier to spot and are multiplying fast. (See Exhibit 1.) Many companies already see the metaverse as an opportunity to connect with consumers in new ways. But for both B2C and B2B enterprises, it really represents a new way to do business and an opportunity to reinvent everything from customer journeys to operational processes. We can point to dozens of use cases for companies in all sectors and industries—and the technology underlying these applications is still only in its infancy. Their impact ranges from greater convenience and efficiency (remote maintenance, for example) to the life-changing and disruptive (enhanced surgical assistance and in-home health care). The new use cases can lead not just to quicker and easier ways of doing things but to whole new industries and business models.

The metaverse is experienced on digital devices (such as laptops, tablets, smartphones, and AR or VR headsets), but these are only the means of entry. The immersive potential of the metaverse can be experienced in different ways, through AR or VR goggles or the rich data sets produced by AI or machine-learning algorithms. In the metaverse, the physical world is converted into digital data and recreated or represented digitally, either as a reflection of reality (digital maps or images, for example) or as fiction or fantasy (a video game).

For B2B companies, in particular, the power of the metaverse lies in the data that makes up these virtual representations. This data can come from human users and their digital devices and from myriad other sources. Many of these are embedded in the internet of things (IoT ) and include cameras, sensors, gauges, detectors, and medical devices, among many others. While the physical world, and the economic possibilities connected to it, are constrained by the laws of physics, the metaverse is a universe of interacting physical and digital worlds, and its associated economic potential is correspondingly amplified and infinite.

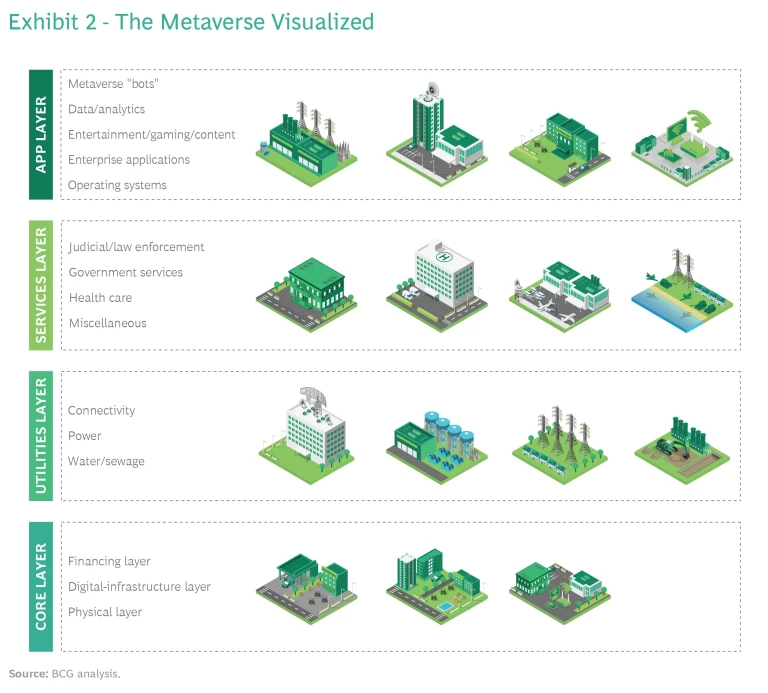

The metaverse consists of multiple layers of data, their interconnections, and mechanisms to ensure users' trust in each use case. (See Exhibit 2.) The data layers and connections include:

- Digital content or data, such as digital twins in B2B and gaming and movies in B2C

- Technology connecting the layers of digital data, such as machine-to-machine learning

- AI, machine learning, and blockchain capabilities to enhance, link, translate, and optimize data for specific use cases and ensure that users trust the security and privacy of their experience

- Connections between digital layers and the physical world via all kinds of devices (these connections are what make the metaverse useful to human beings)

The metaverse is present today in our everyday lives. The always-on connectivity of its systems makes the metaverse persistently available, which, in turn, is making it a part of daily life and business as well as the driver of significant, albeit often unnoticed, value as a fully functioning economy.

The Phases of the Metaverse

Technology is only as good as its weakest link. The metaverse is now evolving rapidly because the technologies that are converging to enable it are improving fast. Moore’s law continues to drive increases in computing power. Comparable “laws” named for George Gilder and Martin Cooper are driving increases in bandwidth and spectrum, respectively, fueling faster and better connectivity and providing higher-fidelity renderings that better mimic real-world latency.

As a result of these improvements, growth in both the consumer and enterprise metaverse markets has been robust. In the first phase—the game-centered metaverse—consumers seeking more diverse experiences moved from play-to-win games to play-to-earn “gameability,” triggering an explosion in engagement. Gaming platforms such as Fortnite and Roblox attracted hundreds of millions of users. Axie Infinity now boasts a steady stream of users who “work” and earn their living in the metaverse. In the second phase, as the layers of the metaverse developed and users applied them to multiple aspects of work and life, the spread of AR and VR devices and the evolution of game engines and computing power drove deeper immersion.

In the third phase, now underway, a broader ecosystem is developing thanks to continually expanding and faster connections. It is seeing monetization through crypto ecosystems, including the birth and rapid growth of cryptocurrencies (both governance tokens and utility tokens) and economic systems and virtual assets (such as decentralized finance and nonfungible tokens). Even as crypto currencies undergo a period of turbulence, these instruments—which can still be owned, bought, and sold—bridge virtual reality and the real world and promote the use of the metaverse for an increasing variety of purposes, such as in work and health care. As virtual assets become more portable and exchangeable across different metaverse platforms, the metaverse will develop into a more integrated, interconnected ecosystem with more diverse functions.

How to “Play”

If we think of the metaverse as a digital representation of the physical world organized into layers, similar to a technology stack, we can see how companies will participate at the different layers. Some will be active in the bottom layers, building the digital infrastructure, providing financing, and delivering connectivity or key services. Most, however, will focus on the top, app layer, where they will interact with users (either B2B or B2C) in metaverse environments. Much of the action to date has been in B2C, especially gaming and, increasingly, providing immersive virtual experiences, such as concerts. But B2B applications are catching up fast and may ultimately be where much of the business value is generated.

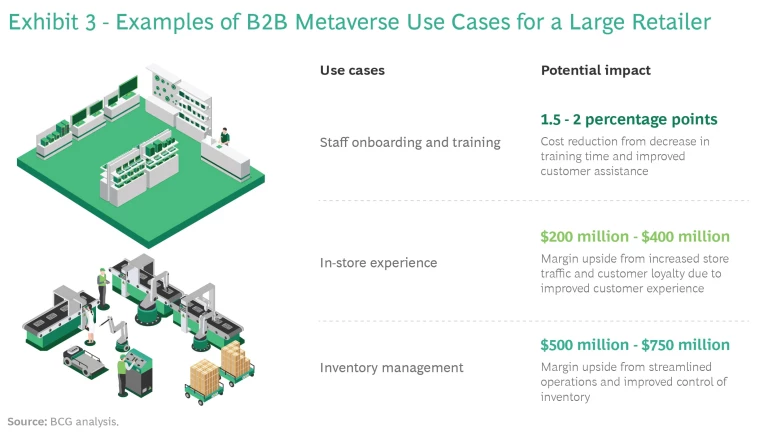

Retail, fashion, and apparel companies have been among the first movers, but a growing list of major companies in the technology, telecommunications, health care, and automotive industries, among others, have become active in the metaverse. The numbers get big fast. Microsoft is spending almost $70 billion to acquire Activision Blizzard, in part to be better able "to put people, places, things [in] a physics engine and then hav[e] all the people, places, things in the physics engine relate to each other,” as CEO Satya Nadella told the Financial Times. There are plenty of reasons for nontech companies to pay attention. For example, at an operational level, we estimate that a Fortune 500 retailer could realize 1.5 to 2 percentage points in margin improvement from improved staff onboarding and training, $200 million to $400 million from increased store traffic and customer loyalty owing to improved in-store experience, and $500 million to $750 million from streamlined operations and improved control of inventory. (See Exhibit 3.)

Companies looking to play need to first understand how their strategy and sustainable advantage may have to change as the competition develops. They should assess the metaverse assets and capabilities that they have, how their current value propositions will evolve, and how they can defend their current position and monetize metaverse assets going forward. They will also need to grapple with such issues as protecting the digital identity of their customers in the metaverse, providing linkages across data layers to enhance connectivity services, and creating winning metaverse solutions for specific industry-vertical use cases.

From a technology perspective, winning in the metaverse will depend on three things for both B2C and B2B companies:

- Most important, owning—or otherwise ensuring ready access to and control of—data and content and the surrounding “geography” on the app layer of the metaverse

- Providing robust linkages between digital layers and the physical and virtual worlds (human-machine interface), including IoT sensors to enable human-to-metaverse connectivity and blockchain technology to create authentic and unalterable ledgers for purposes of trust

- Providing the tools needed for both consumers and businesses to spend more time in the metaverse, such as computing power; low latency to ensure timely access to information; AI to provide continuous learning, fault tolerance, and enhanced contextualization; and privacy and permissions to ensure proper controls

Tech + Us: Monthly insights for harnessing the full potential of AI and tech.

Ten Steps to Building Your Metaverse Capability

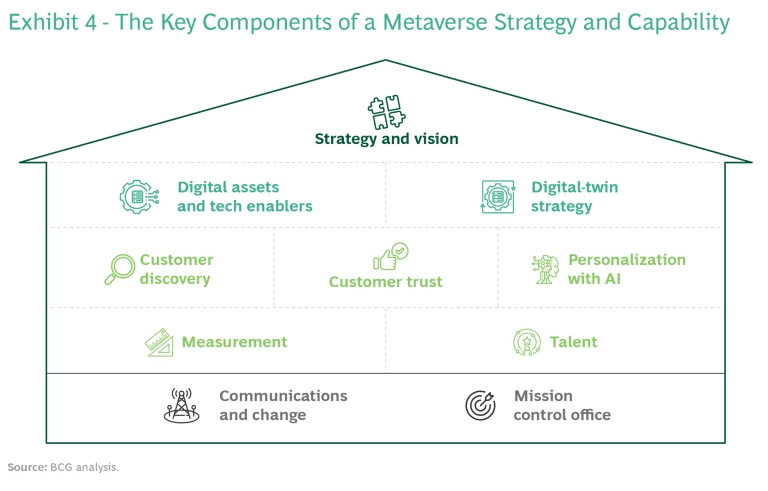

Here are ten steps companies can take to get started on building a robust metaverse strategy and capability. (See Exhibit 4.)

Set a broad vision. As the metaverse evolves and matures, many more use cases will join the dozens that already exist. At this early stage, companies should set a broad vision for what they want to achieve, including clear definitions of what to do and what not to do. Experience suggests that it’s critical to push broad alignment through the organization so that teams can act with autonomy as they experiment with potential applications. The willingness to experiment, fail, learn, and move quickly to the next use case is key.

Build the necessary digital assets and tech enablers. Start with a technology audit across the metaverse stack to identify gaps that could hinder achievement of goals. Build the technical platforms and tools (such as a data capability) that will facilitate implementation of the strategy and expansion of the effort over time as it generates results.

Create a digital-twin strategy. It’s important to start embedding metaverse use cases into regular operations early. Look for opportunities to automate or digitize operations and develop IoT use cases across verticals that support the current and future business roadmap. For example, digital twins using real-time data from current facilities or operations can be used for managing and monitoring, training and development, or design and improvement purposes.

Pursue metaverse customer discovery. To demonstrate the value of the metaverse to the business, address specific customer pain points and develop use cases that can drive new sources of revenue. In-depth research into how customer journeys are evolving will lead to important insights that can help define a business’s metaverse roadmap.

Build metaverse customer trust. The metaverse is new, and many customers will be wary and take a wait-and-see approach. Companies need to carefully think through how they will build customer trust. Demonstrating good Web 3.0 data stewardship and showing how the company is leveraging blockchain technology to ensure privacy and security are just the beginning.

Provide personalized attention with AI. The combination of the metaverse and AI enable segment-of-one offerings that can be a powerful differentiator in increasingly competitive sectors. But to build these capabilities, companies must develop the ability to continuously update their understanding of evolving customer needs in order to deliver ongoing personalized attention and engagement.

Monitor and measure progress. Developing a clear definition of what winning looks like in the fast-changing metaverse can be difficult. Try creating dashboards of transparent, real-time metrics, including Web 3.0 forward-looking frameworks, to monitor and assess product, team, customer, and operations performance.

Develop the capabilities to compete. Assess internal talent capabilities (the right engineering teams, for example) and identify gaps. Establish a plan to hire or otherwise acquire the necessary skills to ensure success.

Engage the organization. Companies can engage employees in the metaverse journey and enhance the employee experience by using the metaverse in hiring, onboarding, coaching, and training. If employees experience the metaverse firsthand, they will be more likely to accelerate change.

Establish a mission control office. Set up a metaverse mission control office with a clear mandate and processes to monitor and oversee the metaverse effort. A strong management capability can define the target path, highlight dependencies across teams, and de-risk the overall plan.

The metaverse represents a broad opportunity that encompasses much more than avatars, gaming, AR and VR, and consumer applications. Devices provide the window, but success will require a robust understanding of the confluence of business strategy, traditional and virtual digital assets, and the new tools and assets of a Web3-enabled environment. The time to start gaining that understanding is now.