Acquirers need robust due diligence to inform valuations, negotiations, and operational decisions. Six imperatives guide the effort.

Technology issues are often the thorniest to resolve when private equity (PE) firms consider acquiring businesses that must be carved out from the seller. Because PE firms will operate the carved-out businesses as standalone companies, they must ask two essential questions:

- Does the deal include all of the required systems and technology infrastructure, as well as the supporting data, intellectual property (IP), contracts, and people?

- If not, what are the implications for the deal and the practical measures needed to ensure business continuity?

Effective due diligence is critical to answering these questions. Due diligence teams can provide vital analyses to help PE dealmakers assess the scope of technology included, risks and opportunities, one-time costs, and requirements for transitional services, among other issues. Applying our experience in helping PE firms make thorough assessments of carve-outs and establish standalone operations, we have identified six imperatives for technology due diligence teams.

What’s at Stake?

In acquisitions of entire companies, the scope of the deal includes all of the technology required for operations on day one after the closing.

Carve-outs

are different. Because the business formerly operated as part of a larger enterprise, it may not have, for example, its own enterprise resource planning (ERP) system or customer-facing web site. And unlike corporate acquirers, PE firms cannot use their own existing technology infrastructure to support the carve-out’s operations. As a result, the stakes are high for gaining clarity about the technology scope and its implications across several key topics:

- Valuation. A PE firm’s ability to achieve the cost base and revenue required to support its valuation of the carved-out business depends on having the right technology in place to run operations and pursue strategic goals.

- Timing to Achieve Valuation. Replacing out-of-scope technology may delay the timeline for value creation measures and thus extend the timeline for achieving the valuation target, potentially delaying the planned exit.

- One-Time Costs. PE firms may have to pay for costly and time-consuming technology projects to replace out-of-scope technology and maintain business continuity once transitional services agreements (TSAs) expire.

The Six Imperatives

To avoid getting tripped up by unforeseen technology issues, PE firms should ensure that due diligence teams address six imperatives.

1. Know What’s Included—and Excluded

Start by understanding what technology is included in the seller’s proposal for the carved-out business—and what technology is not. Consider the strategic, operational, and commercial implications of the exclusions. Apply this knowledge to negotiate a deal contract that includes the technology necessary to run the business or the transitional services you will need from the seller while you install essential technology that is excluded from the deal.

In some cases, a particular technology is fundamental to a carve-out—if it is an integral part of the company’s service delivery to its customers, for example, or if the business uses it to create competitive advantage in core operations. As such, its inclusion in the scope of the deal is a strategic necessity. Often, however, less strategic types of technology, such as off-the-shelf systems, are important operational details that must be clarified in order for the acquiring PE firm to plan for separation and ensure business continuity. In addition to identifying the technology systems themselves, it is important to determine whether the carve-out includes the people who run them, the underlying infrastructure on which the systems run, and the data and IP that are essential for operating the business.

For example, a recent carve-out of a business from a major retail chain excluded a strategic technology: the central ERP system. The seller had tailored the system to promote operational efficiencies with a bottom-line impact reaching millions of dollars. Because the buyer recognized that it needed to install a replacement system to run the carved-out business, it made sure that the deal included the IP (such as software tools and processes to optimize stock levels) that would allow it to tailor a similar new system.

Failing to acquire data can hobble efforts to operate a carved-out business. In one case, the seller of a consumer goods carve-out refused to provide any historical pricing data. As a result, the buyer had to renegotiate contracts with supermarkets around the world from scratch—without insight into even the most fundamental terms of previous agreements.

Sellers describe in their marketing documents what technology a carved-out business includes. But it is not always easy to discern from these materials what is included and what is excluded. For example, a marketing document might say that “technology infrastructure” is part of the carve-out—but this broad term may or may not include data centers, networks, cloud infrastructure, and end-user devices, among other assets. To prevent misunderstandings, the parties must develop a more precise description during the deal process.

2. Consider Both Risks and Value Creation Opportunities

Assess the risks of operating the carve-out as a standalone business, along with the opportunities to create value through cost optimization and business transformation . By right-sizing technology as part of the separation process and using the transition as a catalyst for digital transformation , you can unlock value to offset potential negative scale effects.

The valuation of the carved-out business depends in part on expected future running costs. Because technology running costs can be significant, the risks may be high. This is especially true when technology is the core of the business and represents a major share of the cost of sales. The financials in carve-out marketing documents are often hard to interpret in this regard. Allocations of technology costs from the seller to the carved-out business may not accurately represent the expenses that will be required for standalone operations. In highly integrated environments, the buyer would need to replicate almost all of the existing technology—leading to significant dis-synergies and much higher future technology running costs than the allocations would imply. In addition, some sellers take an aggressive stance when preparing carve-out financials and keep projected costs as low as possible to boost valuations. We have seen sellers reduce future overhead costs by 30% or more when preparing financials for a deal.

In developing a valuation, it is important to avoid the trap of focusing primarily on the risks—especially the costs arising from loss of scale. Such a focus sometimes results in a lower valuation that leads to a losing bid. Although it is vital to understand negative economies of scale, they are only one side of the coin. Robust carve-out due diligence can reveal opportunities to run the business more efficiently and generate new revenues. For example, we often see opportunities to optimize costs by replacing bloated technology landscapes. Due diligence teams should explore the potential to replace overly complex and unnecessarily expensive systems with more modern, better suited, and less costly ones.

Beyond scrutinizing technology costs, buyers should consider how they could use technology and digitization to reduce business costs and generate more value. Digital roadmaps for the carve-out process and standalone operations should be in place from the outset. For example, due diligence teams should understand the strategic importance of digital sales channels that the seller and the carved-out business share. They should assess the technical feasibility of separating or re-creating these channels and redirecting web traffic to the new channels, as well as the opportunity to enhance and expand the digital channels and boost sales. The strategic plan should also address the technology enablement of various other business topics, including supply chain optimization, digital marketing, pricing, revenue management , and automation of manual processes.

3. Assess the Impact on Existing Initiatives

Understand how projects that are necessary to set up the carved-out business as a standalone company will affect the technology organization’s ability to complete its existing and proposed value creation initiatives. Adjust the phasing of value creation in the deal model to take into account delays that may arise as a result of efforts to avoid overloading the organization with a combination of separation projects and ongoing improvement initiatives.

Many value creation initiatives rely on changes to technology systems—the same systems that the business may need to separate or replicate as part of the carve-out work. When assessed individually, a set of proposed value creation initiatives and separation projects might appear feasible. But when considered as a program of activities run simultaneously, completing the entire change program in a short period of time may not be feasible, given the organization’s finite capabilities and management bandwidth. Interdependencies and the need to complete separation projects before TSAs expire may affect the phasing of value creation initiatives or require the business to put them on hold.

4. Evaluate One-Time Costs

To avoid nasty surprises, put a price on the one-time costs of separating technology and establishing standalone capabilities. These costs can be can substantial, in many cases exceeding expectations. Adjust the valuation model to reflect realistic estimates.

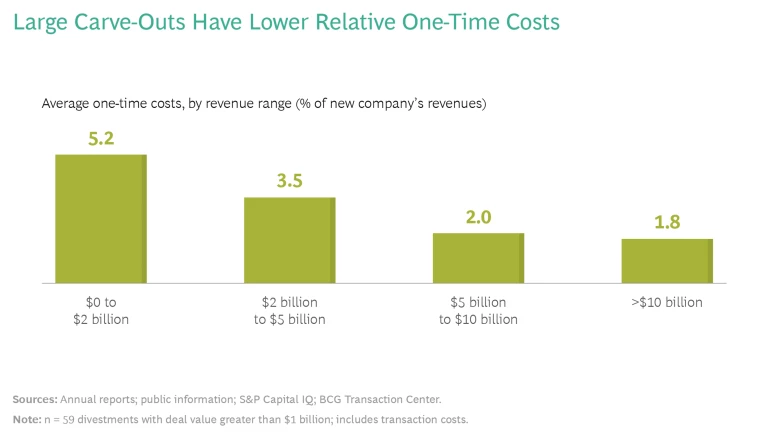

Our research indicates that total one-time costs—including those for separating and replacing technology and other capabilities and for restructuring the business—typically range from approximately 1% to 5% of the carve-out business’s revenues. Complex deals may have one-time costs that reach or even exceed 10% of revenues. Because the effort and costs involved in separating a business are often similar regardless of deal size, it is common to see lower one-time costs (as a percentage of revenues) for larger divested businesses. (See the exhibit.) Technology is usually a very significant component of these costs. As a rule of thumb, one-time costs for technology separation are typically about one to two times the size of annual technology operating expenses in highly integrated environments.

Due diligence teams should assess where within this range costs are likely to fall, considering the complexity of the carve-out and the specific initiatives needed to establish a standalone company. It is also important to understand how the buyer and seller will split the one-time costs. The parties should agree on which separation tasks the seller will perform by day one and which the buyer will perform thereafter, as well as whether the seller will reimburse the buyer for any of the latter’s expenses.

5. Don’t Overlook the Details

To ensure day-one readiness and business continuity, assess the details of the technology separation thoroughly and systematically. A broad-brush approach is not sufficient to identify which topics are important in setting a valuation and conducting negotiations. Overlooking seemingly minor details can have a significant business impact.

PE firms need to be comfortable that the seller will hand over a well-functioning business on day one. The buyer and seller must agree on what infrastructure will be in place by day one and which organization will pay for the work. This work might include, for example, cloning specific systems, establishing new legal entities and associated systems, and implementing compliant “logical separation” solutions for sharing systems during a transition period.

Buyers need to consider which separation tasks to ask the seller to perform— bearing in mind that the parties’ incentives may not align. In one recent example, the buyer asked the seller to secure software licenses on its behalf. However, the seller had no incentive to negotiate good terms for the carved-out business and was simultaneously negotiating its own software licenses. The buyer was understandably concerned that the seller would negotiate better terms for itself at the expense of worse terms for the departing carve-out.

In addition, the buyer should insist on having the right to monitor the seller’s performance of separation and day-one readiness tasks, so that it can pursue remedial measures where necessary.

6. Ensure That TSAs Have the Right Scope, Price, and Duration

Examine the comprehensiveness of TSAs proposed by the seller, and ensure that the pricing, duration, and other terms are reasonable. Apply insights gained during due diligence to specify and negotiate the right TSAs with the right terms.

Because, in most situations, the carve-out will not have a full set of standalone technology and digital capabilities on day one, the parties use TSAs to set out the terms for critical services that the seller will provide for an interim period. In carve-out transactions, TSAs are a necessary evil—they ensure day-one business continuity but frequently lead to disputes and friction.

In many cases, the parties negotiate the details of transitional services during the period between signing and closing the deal. Because the buyer has already committed to the deal, this timing may erode its negotiating position. In many instances, a buyer can retain more leverage by finalizing TSAs as part of the deal negotiations and using an “omitted services” clause to add services later if needed.

Carve-outs often provide attractive opportunities for PE firms to unlock value from a business that the parent company has underinvested in. Having technology in place to run a standalone business is table stakes for pursuing these opportunities. Robust technology carve-out due diligence establishes the fact base to inform valuations, negotiations, and operational decisions. The ideal due diligence team comprises experts from across disciplines who can assess technology carve-out issues, identify technology-enabled opportunities for driving business performance, and understand how technology underpins the strategic roadmap. This combination of broad and in-depth experience is essential to ensure that PE firms gain the right insights when assessing and negotiating carve-out deals.