Our fourth survey reveals that IT buyers won’t stop funding long-term strategic priorities—especially digital transformation—despite some concerns about a potential downturn.

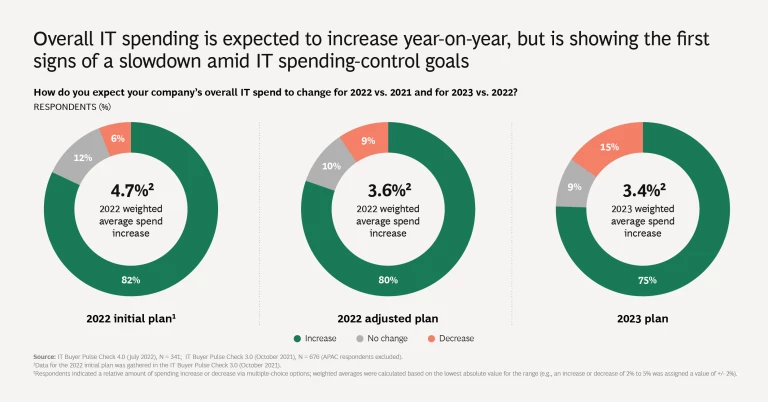

IT buyers across the US and Europe are showing signs of caution as they anticipate a potential downturn in 2023 or beyond. In our fourth IT spending survey, which took place in July, respondents reported a slowdown in their initial 2022 outlay plans, from a 4.7% spending increase to just 3.6%—with only a 3.4% increase anticipated for 2023, including inflation. (See “Our Methodology.”)

Our Methodology

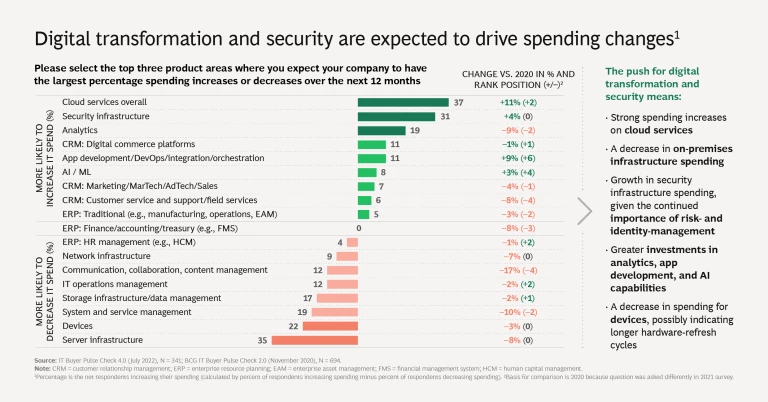

Nonetheless, buyers say they won’t stop funding their long-term strategic IT priorities. In our previous surveys, conducted in April-May 2020 , October-November 2020 , and October-November 2021 , buyers indicated a growing focus on migration to the cloud, digital transformation, and cybersecurity. That focus continues, with survey respondents expecting to increase their spending on cloud services, automation, and security even while easing back in areas such as devices and server and storage infrastructure.

Potential Downturn Slows Plans

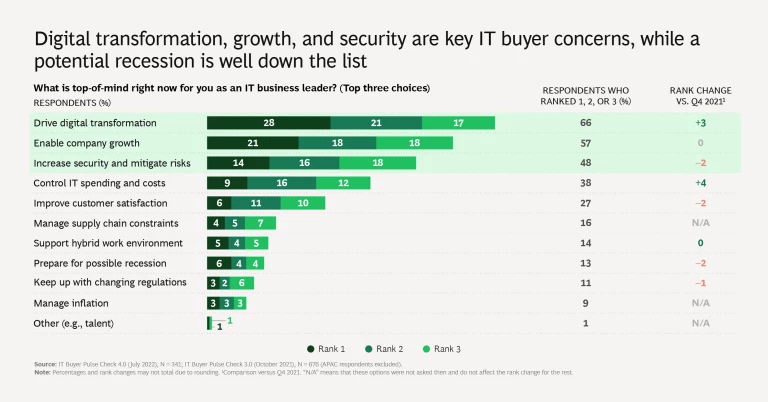

Despite this caution, buyers are not planning to freeze their spending as dramatically as they did in the early days of the pandemic, when nearly 60% of our survey respondents paused deployments of new technology and 54% delayed hardware upgrades. In addition, only 13% of buyers in our new survey ranked a potential recession among their leading concerns, while 61% said that they had not made any spending adjustments in preparation for one.

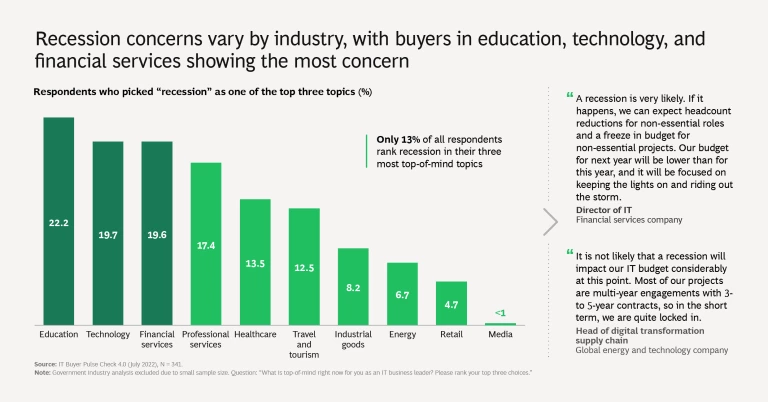

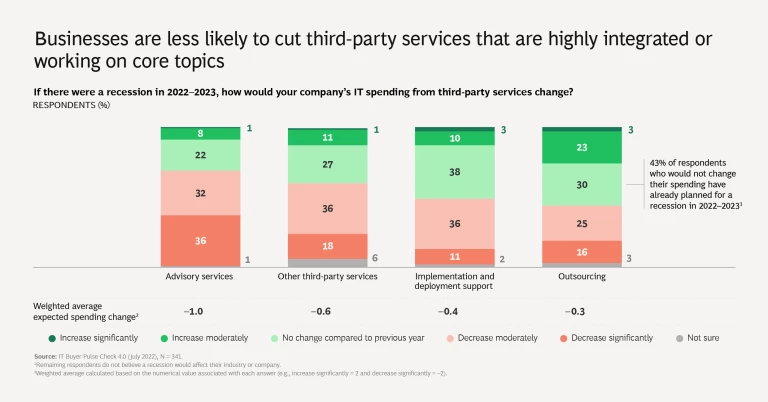

Nonetheless, nearly three-quarters believe the onset of a market-wide recession is likely in the next one to three years. Executives in education, technology, and financial services are more concerned than most, with some anticipating budget freezes and headcount reductions in their fields. And many buyers are beginning some general belt-tightening in areas such as third-party services—although those that are highly integrated into the business and working on core topics will likely be spared.

After a general expansion phase in the supplier base over the past two years, we also found many buyers beginning to consolidate their purchases, often choosing integrated offerings over best-of-breed. To win in this environment, IT vendors will need to offer a distinctive value proposition in terms of both productivity and efficiency. Larger incumbents will naturally be better-placed as consolidation continues, while those offering cutting-edge or single best-of-breed products—who were likely more successful in 2021—may now find the going a little tougher. (See slideshow 1.)

Key Priorities Remain Consistent

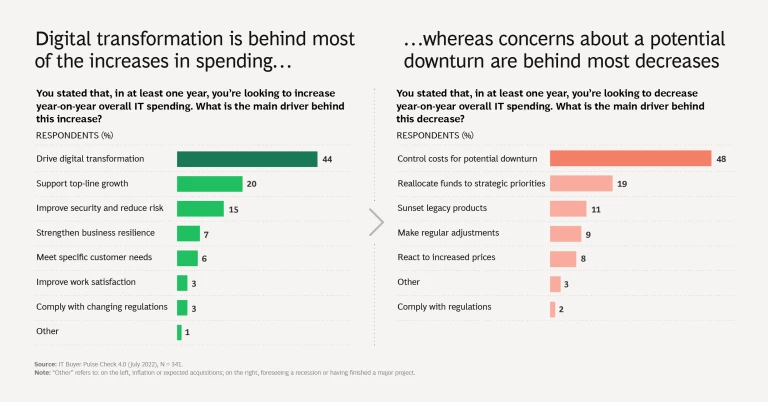

Despite any recessionary fears they may have had, IT decision-makers on the whole recognize that returns on many of their key projects are still healthy, as is business demand. As a result, they remain focused on their long-term priorities, particularly the ongoing push for digital transformation, and are boosting their investments in cloud, analytics, app development, and AI capabilities. In addition, cybersecurity is still an imperative, with 31% of respondents saying they are more likely to increase their IT spending on security infrastructure than they were in 2021.

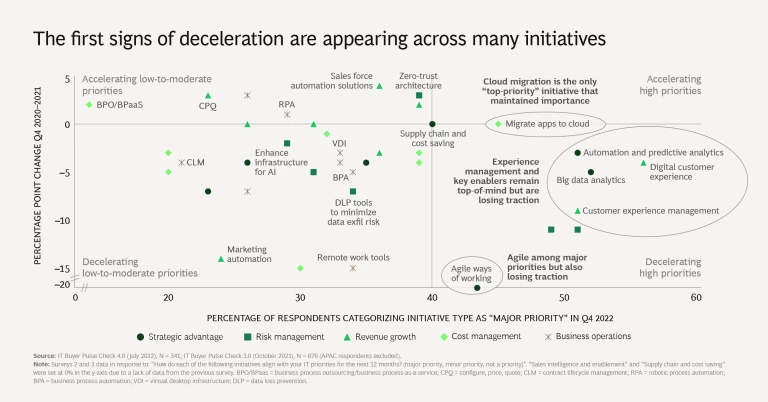

While we found priorities remained generally the same as in our prior survey, the hurdle rate for most IT projects had risen in the previous six months. Even though data analytics is still top-of-mind for IT executives across the board, for example, the number of respondents who say it’s a high priority is 5% lower than last year’s survey. The same is true for several other initiatives, including the digital customer experience and predictive analytics—although each remained a high priority relative to other initiatives. In contrast, zero-trust architecture, which is essential to cybersecurity efforts, and salesforce automation solutions, which can boost efficiency and cut costs, both increased in priority. (See slideshow 2.)

Inflation and Supply Shortages Continue

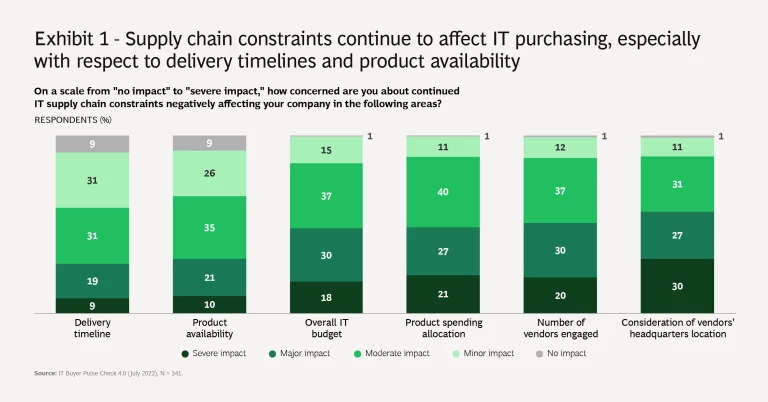

Perhaps unsurprising, most of our buyers were already encountering inflation and supply shortages in July, with over 80% of respondents stating that many or almost all of their suppliers had increased prices in the last 12 months. About 60% of buyers also reported that their suppliers had deployed two or more measures to combat rising inflation, including delaying deliveries and renegotiating contracts and SLAs—the most common mitigation measures. Given this context, delivery timelines and product availability were still an issue as of our survey, although only about 23% of IT buyers believed that supply chain constraints were significantly affecting their IT purchasing decisions. (See Exhibit 1.)

Looking to 2023, IT buyers anticipate overall inflation as well as tech pricing to continue their upward trend, along with extended delivery times and cancellations. In fact, over 80% said they expect more of their suppliers to raise prices in the coming year than did last year, while 51% expect inflation to rise above current levels. Many have begun ordering in advance, while some have begun to prioritize vendor reliability over price.

Technology companies can expect a tougher market over the coming year, although pockets of resilient demand will be available to those able to exhibit a robust value story and satisfy customer priorities. On the bright side, businesses can continue to use pricing strategies to manage inflation and limit the impact of supply chain disruptions.