Youth unemployment is rising in Africa. To address it, governments need to identify the most-promising digital jobs and lay the foundation for their creation.

With record levels of venture capital funding, significant infrastructure investments, and dramatic increases in internet usage, cities across Africa are laying the foundation to digitize their economies. As they do, a key goal of municipal and other leaders is to address high unemployment, particularly among younger people, by creating future-proof jobs.

BCG recently analyzed the economic development efforts of more than 20 cities in emerging markets around the world, each of which has capitalized on digital technology to attract investment and create tens of thousands of high-quality, high-paying jobs. Based on that analysis, we have identified the most promising digital segments that African municipal and provincial governments can focus on. With the right approach, cities in Africa can digitize economies, create jobs, and build resilient societies overall.

Digital Transformation as a Solution to Youth Unemployment

Rising youth unemployment is a major problem in Africa. About 60% of the African population is below age 25, and many African countries face a shortage of high-quality jobs. Unemployment among people aged 15 to 24 across sub-Saharan Africa increased from 12.8% in 2018 to 14.8% in 2021, according to the World Bank. The COVID-19 pandemic exacerbated the situation by depressing economic activity, reducing household incomes, and pushing an estimated 40 million more people on the continent into poverty.

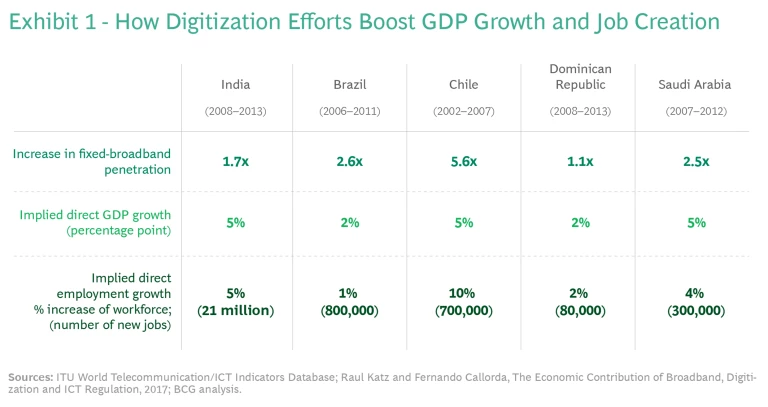

The traditional pathway for economic development is to advance from agriculture to manufacturing to services. But digital technology enables countries to leapfrog straight from agriculture to services. Brazil, India, and other countries have followed this approach to digitize their economies, create jobs, and generate sizable macroeconomic benefits. For example, improving broadband penetration leads to a corresponding lift in GDP and employment. Countries in Asia, South America, and the Middle East that implemented digitization strategies improved employment by as much as 10%. (See Exhibit 1.) Additionally, our analysis shows that attracting investment into the digital economy creates a virtuous cycle of economic development across sectors. Countries become more productive and thus more competitive, and, in turn, drawing in even more investment to enable further gains.

African countries can follow this path, using digitization to create jobs in areas such as data analytics, AI and machine learning, and digital marketing. These digital jobs often pay better than traditional roles, favor younger candidates, support local economies of small- and medium-size enterprises, and are less vulnerable to future disruptions. The signs are already positive in terms of attracting investment, with venture capital flows into Africa hitting a record $5.2 billion in 2021—even during a pandemic. Cities from Cairo to Cape Town have already taken steps to forge partnerships between the private and public sectors to accelerate this digital transformation.

Which Digital Job Clusters Are the Most Relevant for African Cities?

One thing is clear from our study of cities that have successfully created digital jobs: Investors look for critical mass. Rather than a scattershot approach of trying to develop jobs in all digital realms, governments will be more successful if they focus their energies on a small number of promising areas and address the foundational requirements needed for success. In that way, cities can develop hubs of companies in related technology fields, creating synergies in financing, suppliers, industry-specific knowledge, and talent—all reinforced through dedicated government policies.

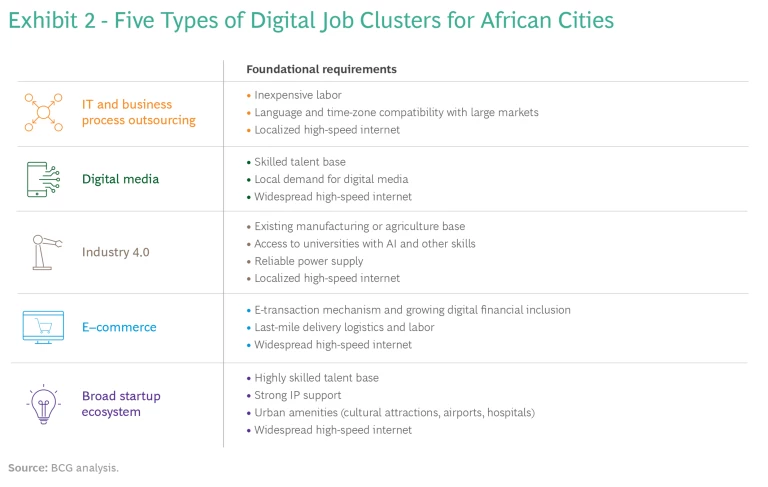

Based on our study, we have identified five major clusters of digital jobs that are particularly relevant for Africa: information technology outsourcing and business process outsourcing, digital media, Industry 4.0 (such as 3D printing), e-commerce, and a broad startup ecosystem. Exhibit 2 details the foundational requirements for each, with some form of high-speed internet being a constant for all. Some of these clusters will be more relevant for certain African cities than others, based on factors such as local education levels. Our goal with this analysis is not to prescribe a specific, continentwide solution but to offer relevant examples of what has worked elsewhere to create digital jobs.

Information technology outsourcing and business process outsourcing. The first cluster is business process outsourcing (BPO), including call centers, document handling, and IT outsourcing (ITO) such as digital infrastructure management or application development. Governments can kick-start clusters in these areas by outsourcing some of their own back-office functions to local ITO/BPO providers while developing a clear branding strategy to attract two to three anchor clients from the private sector. Notably, African ITO/BPO providers have an important advantage over competitors in Asia and some other markets: Africa has a minimal time difference with potential clients in Europe.

Governments can also ensure that broadband access and cybersecurity regulations are in place, and they can partner with companies on skills-based development such as online accreditations, in-person skills workshops, and on-the-job training.

Bangladesh set out to create an IT outsourcing cluster by offering incentives and targeted promotions to big tech firms, starting with a pilot partnership with IBM. The government of Dhaka, the capital and largest city in Bangladesh, launched centers of excellence to accelerate innovation and strengthen the ecosystem for emerging technologies. Those efforts have now attracted multiple large ITO/BPO firms and generated more than 20,000 jobs in Dhaka.

Digital media. Digital media jobs generally fall into two categories: animation and visual effects for the entertainment industry and game development for the videogame industry. To support a digital media cluster, governments can ensure that critical infrastructure is in place, such as 4G connectivity, and then help local providers negotiate contracts with global media and entertainment companies (such as Disney and Fox), creating incentives for the transfer of intellectual property and upskilling to make the sector sustainable.

City governments interested in creating digital media jobs can look to examples like Seoul, South Korea, which turned a former landfill into a vibrant digital media city with anchor multinational corporations, small- and medium-sized entities, and startups. To build the ecosystem, the municipal government promoted Seoul as a digital media leader, provided tax incentives and real estate subsidies for the first companies to move in, and required animation and visual effects courses to be included in STEM-related degrees at local universities. Digital media businesses based in Seoul now generate approximately $30 billion in annual revenue and have created more than 40,000 high-quality jobs.

Industry 4.0. Companies worldwide are implementing Industry 4.0 applications such as 3D printing, augmented reality, autonomous robots, the Internet of Things, and simulation to improve manufacturing productivity by up to 35%. Cities in Africa can capitalize on this trend to grow the local manufacturing industry where it exists and create jobs by promoting smart manufacturing practices, developing a roadmap for adoption, and establishing technological standards. Governments can also provide incentives and technical assistance, with the goal of establishing two to three local champions (including multinational corporations) that can show the benefits of these applications and persuade other firms and suppliers to invest.

The Hong Kong government used this approach to promote smart manufacturing. It set up a special economic zone with benefits such as free advanced lab equipment, shared facilities, and consulting services in areas such as IP protection. To be clear, Hong Kong has been an established global manufacturing hub for decades, whereas most African cities are starting from a much less mature manufacturing base. Yet even small improvements to local facilities—such as equipping factory equipment with inexpensive sensors—can have a disproportionate effect on performance and give cities a competitive advantage in working both with African industrial companies and international companies that operate on the continent.

E-commerce. When it comes to e-commerce, Africa is about where the United Arab Emirates were five years ago or the US was 10 to 15 years ago. But local leaders can accelerate broader adoption by establishing coherent regulations and tax codes to allow business models that mix traditional channels and e-commerce. Governments can also use their own procurement to provide foundational contracts to the local e-commerce industry and invest in infrastructure to support digital payments, logistics, efficient export, and last-mile delivery.

Taobao, which is owned by the Alibaba Group and is the leading e-commerce website in China, is a good example. Given the country’s large rural population and pool of emerging online entrepreneurs, Taobao has worked with local communities on what it calls a “Taobao Village” model. In this model, small firms and vendors leverage Taobao’s online platform to reach customers beyond their local geographic region by offering e-commerce training, operational tools, and other support.

Broad startup ecosystem. Last, rather than focusing on one technology segment, countries can create the right conditions for startups in all segments to thrive. Cities such as Cape Town, Lagos, and Nairobi are launching innovation hubs with an enabling environment for startups across sectors to solve inherent consumer or business issues with a clear path to scale. Localities looking to create jobs through a startup ecosystem can begin by putting the right connectivity infrastructure in place (including helping small firms provide cloud services and data centers) and streamlining the administrative process required to launch a new business. They can spur tech innovation by coordinating clear regulations and standards in areas such as payments, data and security standards, public-private API exchanges, and IP protection.

For instance, to build the digital ecosystem in Bangalore, India, the state government of Karnataka, built top-quality broadband infrastructure and offered funding-match programs, tax reimbursements, and other direct incentives for startups. As a result, the city has created approximately 600,000 startup jobs as of 2021.

Proactive Policymakers Are Key to a Thriving Digital Economy

All five categories that we identified share a common aspect: They require that local/regional governments be proactive in both the short term (attracting investment from the private sector) and the long term (building ecosystems that can address both supply and demand constraints). To strike this balance, policymakers should take a systematic approach based on four steps.

- Identify the most suitable tech ecosystem for a given area. First, policymakers should assess the feasibility supporting various ecosystem categories and identify the most promising options for their local area, weighing factors such as long-term R&D, upskilling, and living standards required to meet the demands of employees. Policymakers can also communicate with citizens and the private sector to understand constituent desires and development priorities. It’s critical to identify specific stakeholders prioritize one category (or several), while preserving the flexibility to adapt over time. Fact-finding missions to cities elsewhere that successfully applied that approach can help identify lessons learned.

- Launch quick-win measures to build momentum. Once a government has settled on a specific segment, it should identify short-term priorities to build a critical mass. The right measures will vary by segment and by a city’s unique circumstances. For example, a city seeking to kick-start ITO/BPO or e-commerce can revamp its procurement processes to create a flow of work to fledgling providers.

- Identify longer-term measures to sustain growth. Next, governments can consider the right set of policy measures to grow the segment and attract continued investment. These measures should address all areas of the business environment: market, labor/education, legal/regulatory, and enabling factors such as technology or trade infrastructure.

- Activate the specific cluster. Last, with a clear set of short-term and long-term policies, governments can start to develop an implementation roadmap with detailed policies or financial incentives and begin reaching out to relevant private companies to attract investment. Not all actions require significant investment; rather, they entail smart policy development, planning, and partnerships. For example, cities can partner with federal or international agencies such as the African Development Bank’s Jobs for Youth program or the UN’s African Girls Can Code initiative.

Together, the four steps outlined above provide a roadmap for the development of a vibrant digital sector that opens new job opportunities, especially for Africa’s youth.

From Bangalore to Seoul, many cities around the world have used digital technology as a means of developing economies and creating jobs. African cities can capture this opportunity as well, following the same proven playbook to generate faster progress and increase their odds of success.

The authors would like to acknowledge the Accelerated Covid-19 Economic Support (ACES) Programme funded by the United Kingdom’s Foreign, Commonwealth & Development Office for support in the initial stages of research for this article.