Scaling Digital Ability

As any CxO will tell you, pilots are easy but scaling up is hard. It’s true for all types of transformation—digital, agile, technology, or data. Pilots produce great initial results, but efforts to move those results into the market or embed them across an organization often fall short.

Only digital solutions that scale can generate significant value, and the ability to scale digital solutions at speed differentiates companies that realize value from their digital transformations from those that do not. The urgency of successfully scaling rises in times of business volatility or economic turbulence. Companies that scale digital solutions drive near-term gains in revenue, cost, and speed—and increase long-term resilience. Our latest research into digital scaling and enablement found that digital leaders are much more likely to navigate successfully through crises and emerge stronger. For example, over the past two years of the pandemic, digital leaders gained 5 percentage points (pp) or more of market share and over 5% more market capitalization than their peers. A full 70% of digital leaders expect to gain another 5 pp or more of market share in the coming three years.

The scaling process should be straightforward: companies develop a set of digital solutions that can generate value, and then they identify which solutions can create the most value if scaled across the organization. But there are a couple of significant organizational hurdles to implementation. Many companies try to scale too many digital solutions whose potential impact is limited, particularly because the solutions focus on specific domains. Other companies remain locked in vertical silos of data, algorithms, and technology that inhibit their ability to scale.

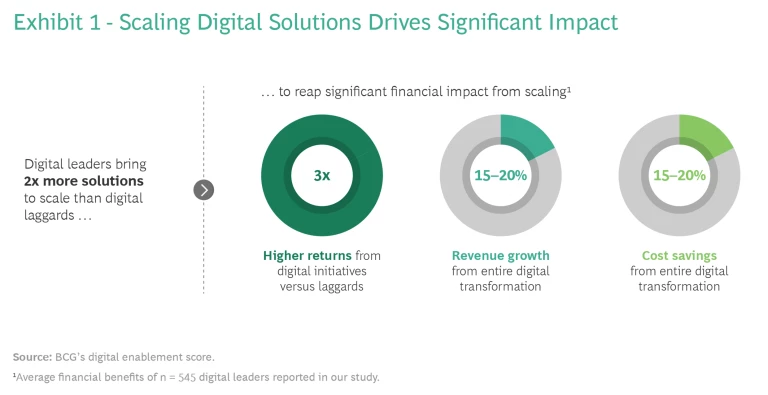

Companies that do scale successfully are seeing their performance advantage widen over those that struggle. Digital leaders today achieve three times higher revenue growth and cost savings from their digital transformations than laggards, and they bring twice as many digital solutions to scale. (See Exhibit 1.) These companies are solidifying their positions as overall business leaders in their sectors.

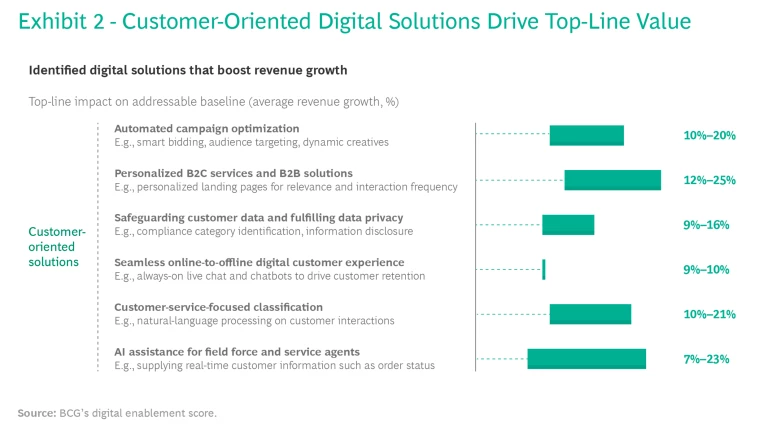

Digital leaders achieve the biggest impact from customer-oriented solutions (those related to improving customer experience, sales, and marketing). Common examples include automated campaign optimization, such as smart bidding and personalized B2C or B2B services (customized landing pages, for example). (See “Improving Customer-Oriented Solutions.”) Our research found that leaders scale more customer-oriented solutions than they do either operational or functional solutions.

Improving Customer-Oriented Solutions

Successful personalization of the customer experience is a common strategy in customer-centric marketing that seeks to turn customer loyalty and satisfaction into revenue growth. According to our research, the most-often-adopted customer-oriented solution is personalized B2C services or products or customized B2B solutions (such as customized customer landing pages), which 30% of all companies have scaled. The next-most-commonly scaled solution involves safeguarding customer data and protecting data privacy. Almost one-third of all companies have scaled this solution.

A leading European bank wanted to improve its mortgage offering for existing customers and as a way to attract new customers. The company conducted extensive market research, piloted about 40 digital initiatives, and then selected four workstreams to expand and scale. The company first set up paid media accounts, leveraging data collected from its social media presence, to increase incoming traffic and target new audiences that had shown an interest in its products. It then improved the online user experience on its websites and provided easy access to relevant information and tools to maximize conversion rates and increase bookings for first mortgage meetings. By successfully scaling these two digital solutions, the bank saw a 30% increase in sales within six months.

Digital leaders have achieved 2.4 times higher digital maturity on average than laggards in the capabilities necessary to scale customer-oriented solutions. Companies that scale more than 70% of their customer-oriented solutions have more mature data ecosystems, staff cross-functional lighthouse teams, use clear value-steering, and view cloud cybersecurity as a C-level priority.

In these companies, management of product experiences, the customer journey, and data analytics is cross-functional. As a result, the roles of the CMO, CTO, and CIO can overlap. As our past research has shown, CMOs are particularly well placed to champion alignment and to scale customer-oriented solutions, since the CMO often owns the design and operation of the customer experience journey. But as our current study indicates, CMOs can’t do it alone; they require full C-suite support to scale and execute solutions successfully.

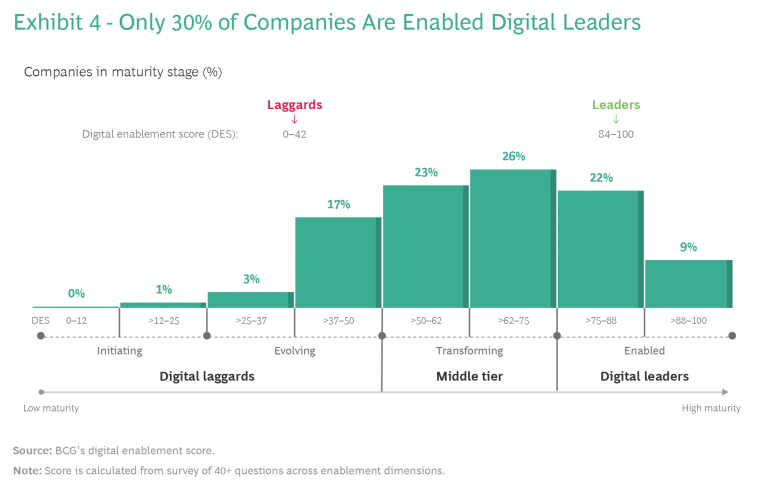

The new research also found that only 30% can call themselves digital leaders (companies scoring in the highest stage of our digital enablement maturity assessment). (See “About Our Research” and Exhibit 4.) These companies successfully move past the pilot stage to fully operationalize and embed digital solutions across an organization and its markets and regions. They embed cultural and operational change, develop new capabilities, work in new ways, and identify new approaches to engaging with customers. The remaining 70% of companies do not scale digital solutions beyond pilots or their solutions remain stuck in organizational silos. Their transformations cannot reach their full enterprise-wide potential.

About Our Research

BCG and Google (which commissioned this report) recently decided to study digital enablement—specifically, how some companies have become more digitally proficient than others by scaling digital solutions such as digitally enabled processes, digital products, and digital services. Scaling means moving past the pilot stage of a digital initiative to fully operationalize and embed the solution throughout the organization and its markets and regions.

We conducted interviews with experts and thought leaders and surveyed 2,000 companies globally to gauge the impact of the key enablers that companies employ to drive their digital agendas.

As part of the study, we calculated an aggregated digital enablement score (DES) based on BCG’s digital acceleration index (DAI) assessment for each company. The DAI assessment considers a company’s digital solutions (products, services, and processes), its technology adoption, and the maturity of key capabilities. The DES assesses companies on 15 dimensions that are critical to unlocking and scaling digital solutions to maximize value. We also evaluated how the relevant enablers affect a company’s ability to succeed in digital transformation across the entire C-suite.

Our research confirmed that levels of digital maturity vary considerably among organizations, as does their ability to scale digital solutions. Companies tend to fall into one of four maturity levels:

- Initiating. The company has not fully defined its strategic approach to digital transformation, and it has not yet established the necessary capabilities to unlock the potential of digital solutions.

- Evolving. The organization has a strong awareness of the value of digital, pursues prioritized lighthouse solutions, and is building the necessary capabilities.

- Transforming. With scaled lighthouse solutions using strong data resources, a skilled workforce, and cloud platforms in place, the company has passed an inflection point and become digital at heart.

- Enabled. The company is successfully executing a fully aligned, enterprise-wide digital strategy, with prioritized digital solutions widely adopted for high-value impact.

On the basis of this ranking, we split companies into three tiers in order to compare the top 30% of most-enabled companies (digital leaders) with the bottom 20% (digital laggards). These comparisons inform much of this report.

So, how do digital leaders do it? How do 30% of companies successfully scale digital solutions while others struggle? Our research reveals three key factors:

- C-Suite Alignment. The members of the top management team (for example, CEO, COO, CIO, CDO, CFO, CMO, and CHRO) align on a unified, business-oriented digital strategy to galvanize action and drive enablement from the top down. They also hold one another accountable for that success, working collaboratively and supporting each other.

- Building Capabilities. To support the scaling effort, leaders build the capabilities they need in critical areas—high-quality data, a skilled workforce, and cloud adoption.

- Always-On Execution. Digital is not a one-time program. Leaders steer with an always-on execution mindset to adapt and improve as the market evolves, continually evaluating the success of new pilots to determine which ones to scale.

This report examines how leaders make each of these success factors a reality in their companies.

C-Suite Alignment: It Starts at the Top

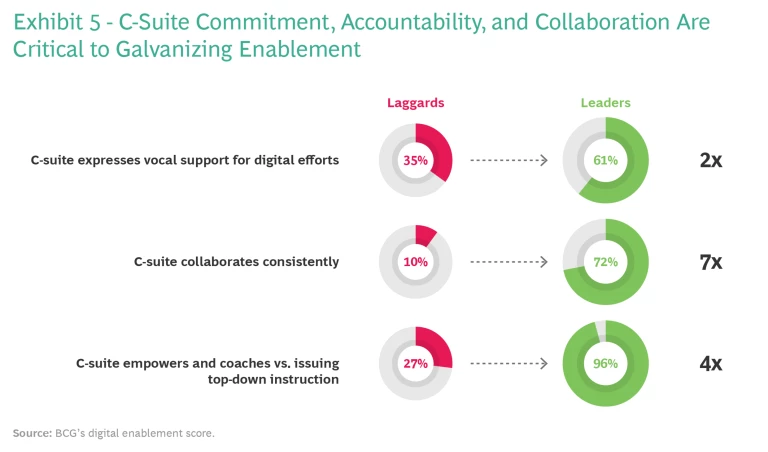

Becoming a digital leader starts at the top of the organization—but not just with the CEO. The full C-suite must align on a common vision, strategy, and roadmap to galvanize action and drive enablement and execution through the organization. Commitment, accountability, and collaboration are critical. Digital leaders are far more likely to secure all three. (See Exhibit 5.)

In many companies, siloed CxOs blame each other for hobbling the overall transformation by not digitizing faster or by failing to scale digital solutions. More than half (55%) of laggards report that their C-suites operate entirely in silos and fail to communicate with each other on their respective digital initiatives. In contrast, digital leaders hold individual CxOs accountable, and consistent C-suite collaboration is the norm for 72% of digital leaders.

A common approach is to establish a global chief digital officer role with responsibility for shaping the entire organization’s digital transformation. In too many cases, however, CDOs turn out to be toothless tigers who can propose digital solutions but have little ability to enforce them because they don’t own the budget. If, instead, digital becomes the responsibility of every CxO, the entire C-suite must drive the digital agenda collectively. And every CxO must be accountable for achieving the intended business outcomes. Our research found that only digital leaders (82%) align across the C-suite on the digital vision, investment portfolio, and resources needed to drive the digital agenda forward. Besides setting the ambition and guiding the entire organization, the C-suites at more than 60% of digital leaders express active support for digital efforts and communicate progress across the entire organization.

Another issue can be the sheer number of CxO roles today, many of which involve digital initiatives, technology, and data. In addition to CEOs, CFOs, CHROs, COOs, and CMOs, a proliferation of CDiOs (digital), CDOs (data), and CTOs are joining the leadership mix. The demarcation lines often blur because digital transformations cut across functions. This makes collaboration between C-suite roles all the more important to ensure that they bring the right capabilities and perspectives to the table to achieve companywide objectives.

In many organizations, a single C-suite member’s digital agenda becomes a catalyst for collaboration. For example, CMOs are increasingly involved in tech, finance, data privacy, and analytics . They are well placed to promote digital transformation and champion change. In some companies, they collaborate with CFOs to manage marketing as an investment for increasing returns by setting business KPIs. Often, CMOs drive customer-oriented solutions within the organization, which can also catalyze cross-functional leadership collaboration.

To become truly digital organizations, leaders need to embrace agile ways of working, embedding agile in large parts of or the entire organization, starting with making the transition to working in cross-functional teams. CxOs can struggle to scale agile for several reasons:

- They are focused on responsibilities within their own teams.

- They do not break down silos that isolate functions.

- They do not encourage business and tech leaders to jointly prioritize the digital roadmap.

Leaders have processes for conducting regular reviews of their portfolios to ensure that they align with their visions. They also look continuously for new opportunities to pursue. For about 80% of digital leaders, business and tech prioritize the digital roadmap as a joint effort and regularly update their plans with evaluations of new opportunities.

Establishing agile at scale often requires senior executives to change their own ways of working . The idea that “leaders lead, managers review, and doers do” does not apply to truly digital companies. This adaptation can be a tall order, as agile behaviors are not the ones that propelled these people into senior leadership positions in the first place. Moreover, good leaders involve the relevant middle managers in planning and executing the transformation program to ensure that they buy into the goals and strategy. Without this commitment, middle management may tend to slow the process, defending functional silos and power bases.

Tech + Us: Monthly insights for harnessing the full potential of AI and tech.

The Capabilities That Enable Scaling

Our client work and our research have consistently shown that companies need critical capabilities in place to scale digital solutions. Being a digitally enabled leader means developing capabilities to generate insights from data, leverage the cloud, and build a skilled and enabled workforce.

Generating Insights from Data

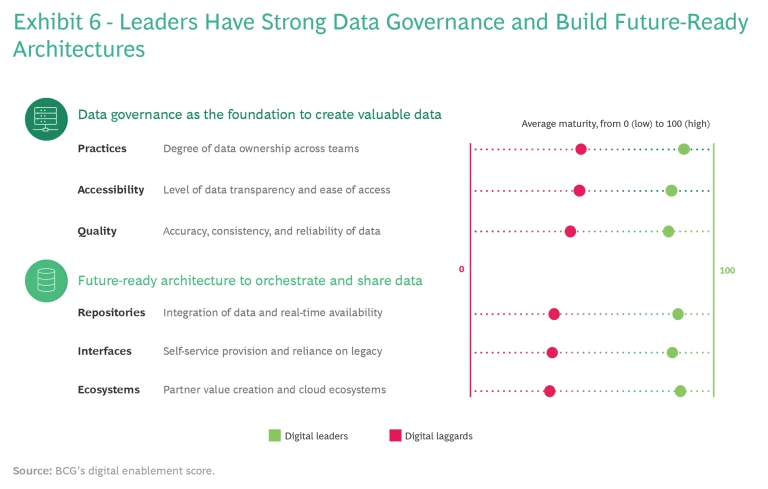

The ability to access high-quality data from multiple sources, share it with partner organizations, and apply advanced analytics to generate insights for long-term impact is a multipurpose enabler for everything else. Data enablement is the most important basis of competitive advantage today because it has the greatest impact on a company’s ability to scale digital solutions. Nevertheless, in most organizations, it is the least exploited asset. Even among digital leaders, those with the highest data maturity can scale twice as many solutions as those with relatively low data enablement. To be a data leader, companies need privacy-compliant, high-quality data that is accessible throughout the organization. This requires strong data governance, proper data infrastructure, and respect for customers’ demands for privacy. (See Exhibit 6.)

Companies should prioritize and manage data proficiency much as they do infrastructure, with forward-looking investment and a fully funded investment plan. Accessibility is key, and tapping into data-sharing enablers, such as cloud services , helps organizations ensure access to high-quality data from different business ecosystems. This kind of data leads to superior insights and customer engagement as well as the ability to scale digital solutions.

Proper data governance underpins access to accurate and useful data. Digital leaders combine effective data ownership and governance procedures, which help ensure that a continuing supply of high-quality data is available and that people use the data appropriately and consistently. Many common challenges such as data breaches occur not because of technological shortfalls but because of human error.

Most digital leaders build future-ready architectures with data repositories and API provisioning, and many operate data ecosystems with multiple partners. In fact, our research found that 60% of digital leaders have mature infrastructure in place to facilitate the seamless exchange of real-time data with partners. In contrast, most laggards are still building their data infrastructure and have no data governance in place.

Data also needs to be portable —decoupled from, rather than restricted to, specific applications. The idea is to create pools of shared data from which users, applications, and partners can leverage the same information, instead of vertical data islands. Hoarding data limits insights and value creation to a small sliver of what might otherwise be possible, and different underlying architectures and technologies lead to vertical data silos. Such data silos can be deceptively attractive, since they may facilitate implementation of solo digital solutions. But at the same time, they limit the ability to scale solutions across the wider business unit or company.

A leading agricultural equipment manufacturer sought to become a tech leader by improving its use of data. It collected accurate, real-time data by attaching sensors to its products so it could provide richer information to growers and optimize performance of its products. The company also developed an open platform with modern architecture to consolidate data collected from customers and external partners. The platform enables farmers to use advanced data analytics tools to manage their equipment better and realize cost and operational efficiencies while also connecting with players throughout the agricultural ecosystem.

The new data strategy gave farmers a superior customer experience and provoked a data-driven revolution within the company and the agricultural equipment industry. To successfully scale this solution, the company had to make the transition from being an equipment manufacturer to being a generator and custodian of data. In the second quarter of 2021, net sales and operating profit from its production and agricultural business increased by more than 35% and 75%, respectively, over the year-earlier quarter.

One of the biggest drivers of digital maturity is the use of first-party data —data that companies collect directly from consumers, including browsing behavior, transaction history from a CRM database, and loyalty program activity. Sophisticated companies understand that first-party data is differentiating (because it is proprietary), relevant (it directly relates to the company and its customers), and consistently high quality (it comes from customers directly). Almost 50% of leaders use first-party data to derive insights that create better customer value propositions, but just 5% of laggards do. Previous BCG research found that while nine out of ten companies say that first-party data is important to their digital marketing programs, less than a third of marketers consistently and effectively access and integrate first-party data across channels. Very few are good at using data to create better outcomes for customers.

A global cosmetics brand that wanted to use data and technology to accelerate growth faced challenges related to poor data availability and a lack of necessary technology capabilities. Using public cloud services, the company developed an enterprise-wide data strategy that focused on using its own first-party data to target audiences better. For example, the new model customized marketing for website visitors identified as most likely to purchase online. The company also increased data accessibility and analytics proficiency throughout the organization and encouraged data-driven innovation. The strategy enabled the company to increase revenues from campaigns using data-driven insights by 25% and to scale its data solutions globally within two years. It also helped the company build an organization-wide culture that appreciates and seeks to leverage the value of data and analytics .

Leaders also prioritize data privacy because it is a priority for customers. One common challenge that companies face in making data more accessible is increased data risk. Properly identifying, assessing, and managing risk through shared platforms is a strong driver of security. Almost all digital leaders (97%) are proficient in addressing this risk, and more than two-thirds of leaders make effectively managing it a C-suite priority.

Leveraging the Cloud

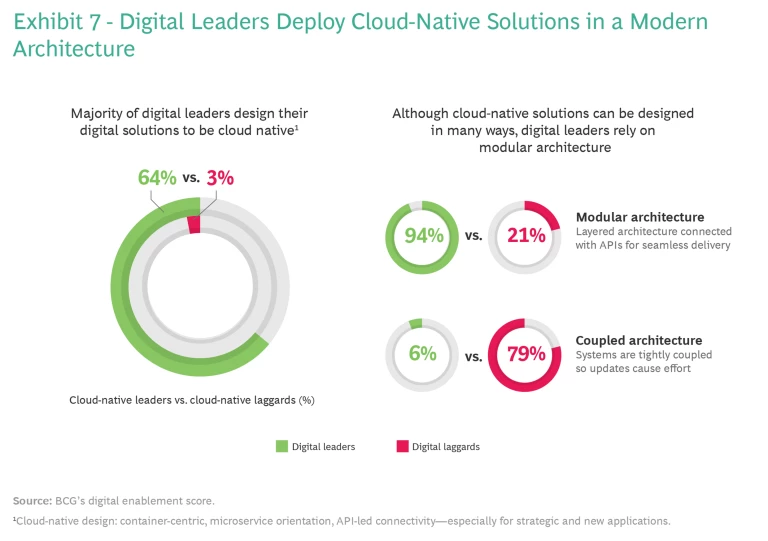

To power their scaling of digital solutions, leaders use the cloud, which serves as a technological foundation for building and expanding other enablers, such as data. Most leaders (64%) design solutions to be cloud native so that the cloud can host every new digital solution right away. (See Exhibit 7.) Leaders deploy these solutions in a layered architecture connected with APIs and, often, employing two or more clouds. A multicloud approach delivers a number of benefits, including increased agility, greater flexibility, higher innovation rates, and the ability to deploy cutting-edge technology and platform strengths from various providers. This approach decouples digital delivery from legacy systems, which in turn enables easier testing, deployment, and maintenance. Digital leaders also reduce the costs of digital scaling.

By 2025, up to 60% of consumer-facing applications, almost 40% of data warehouses and analytics workloads, and more than 30% of core business applications will be running on public clouds that major technology organizations operate. More than 90% of digital leaders can connect digital solutions to their tech stacks, which are API ready and use microservices. In contrast, 80% of laggards still rely on tightly coupled legacy systems with complex interfaces.

Three factors make the cloud a powerful booster of digital capabilities:

- The cloud permits instant scaling of tech capacity (infrastructure, storage, and processing).

- Solutions provided by cloud service providers (CSPs) usually include the latest cybersecurity mechanisms and patches.

- CSPs have the expertise and people—both of which are in short supply—to customize solutions for clients efficiently.

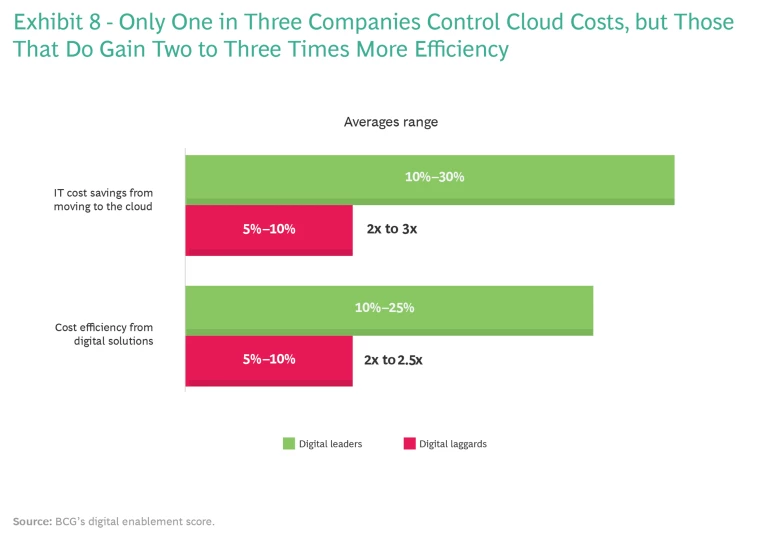

Although the cloud can function as a supercharger for scaling digital solutions, controlling its cost is a key consideration, as is complying with national regulations and data governance requirements. Companies have followed multiple paths to mainstream cloud adoption. Decisions about which capabilities to move to the cloud when to move them, and which cloud service models to use do not always follow a deliberate strategy. As a result, clarity on what constitutes an efficient and effective multicloud approach can be hard to come by. It is therefore not surprising that only one in three companies controls cloud costs. But 68% of digital leaders reported that they optimize cloud spending with advanced cost analyses. In doing so, they realize two to three times more cost efficiency and tech cost savings than laggards do. (See Exhibit 8.)

A satellite imagery provider needed to redesign its imagery platform for scale and speed to meet growing customer needs and to sharply reduce a delay of several hours that customers trying to access images had to endure. The company moved to a cloud-based platform that gave customers data after minimal delay, without compromising on quality or range of coverage. The cloud platform scaled data better, processed images faster, and provided more fit-for-purpose images for different customer groups. Customers can now stream images after a half-second delay compared with the old system’s wait of hours or even days. The cloud also gives the company a scalable storage solution for adding images covering millions of square kilometers every week.

Building a Skilled and Enabled Workforce

Digital leaders build highly skilled organizations through upskilling and targeted recruitment to fill talent gaps. BCG research into the factors underlying digital transformation success found that only one in four organizations have the skills and expertise they need. Our current study found that digital leaders are addressing this gap at speed through their hiring and training plans. Leading organizations also equip teams with technology tools such as productivity apps, DevOps (a type of continuous software development and IT operation), and AI analytics to make the most of their capabilities and to innovate and drive change. Reorganizing in cross-functional teams that include business, digital, tech, and other functional skills (such as HR, legal, and finance) is also critical.

Digital leaders do not try to do everything in-house. Instead, where they can, they outsource capabilities—such as tapping into public cloud platforms—to drive to scale more quickly. Because many digital skills (such as DevOps) are in high demand, leading organizations choose strategic partners to fill skills gaps and embed partner personnel in their product teams. Many companies adopt a hybrid approach, developing the critical capabilities they need to innovate in-house and filling the remaining skills gap through partnerships. Leaders that scale solutions successfully through outsourcing to partners and agencies generate 20% more cost savings and 20% higher revenue growth than laggards.

Almost half of the leaders say that the expertise of their workforce is significantly greater than that of their peers because they have built best-in-class capabilities, such as developing cloud-native apps and optimizing user experience through personalization, and because they rely on cross-functional teams. But this finding also means that more than half of leaders do not see their workforce’s expertise as being significantly above that of their peers. They recognize that they still have a strong need for talent and organizational development. Little surprise, then, that 72% of leaders plan significant HR investments to hire and upskill their workforce.

Leaders also foster a culture of innovation through data-driven decision making and rapid adaptation. More than three times more leaders than laggards democratize data, institutionalizing data accessibility for all. Many leaders charge an empowered chief data officer with embedding data-sharing policies through the organization and enforcing good data governance and practices. These companies also promote a strong learning culture by prioritizing digital literacy and agile ways of working . And they organize around a product-led operating model to realize economies of scale and scope: teams are responsible for client engagement, innovation, and service delivery.

A leading US health insurance company decided to pivot to a product-led operating model to upgrade its customers’ experience and improve their health outcomes. The company had based its prior operating model on functional needs that emphasized efficiencies, but the company struggled to retain customers over the longer term because members found the organization difficult to navigate. To provide a more seamless experience for customers, the company moved from siloed operations to collaborative, cross-functional teams. These integrated teams identified key customer pain points and built solutions that drew support from all parts of the organization. The cross-functional teams also encouraged greater accountability, more innovation, and accelerated time to market for new services. The teams launched 18 new customer experiences and created $50 million of customer lifetime value (a metric that estimates how much value any given customer will bring to a business) in the first six months alone.

Always-On Execution

Digital proficiency is not a permanent state, nor is digital transformation a one-off project or program. Technological advances, competition, and disruption mean that organizations need to continually improve to reinforce their competitive positions and resilience. Companies need effective governance and an always-on mindset to continue scaling current digital solutions while also searching for the next solutions to scale. Execution requires organizing around product-led agile teams that work on lighthouse projects, using flexible budgets. Teams must constantly test and improve minimum viable products until the extent of their value becomes apparent. Organizations should adapt their priorities as context changes and as challenges occur. Leaders need to address roadblocks quickly and drive “fail-fast-learn” behavioral change into the wider organization. Each challenge that they successfully tackle contributes to the achievement of broader strategic goals, not just to the incremental improvement of a unit or function.

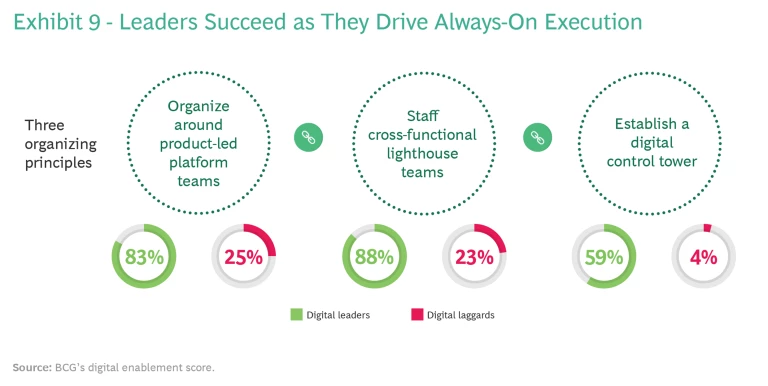

As our research shows, digital leaders follow three organizing practices to ensure they have in place the governance processes necessary to drive change. (See Exhibit 9.)

First, more than 80% of leaders have established an operating model that consists of cross-functional business and tech teams, and about 60% organize around product-led platform teams. The benefits are numerous and substantial:

- Better business and tech collaboration for improved product development

- Agile product launch cycles that can double, triple, or quadruple speed to market

- Lower overhead and more built-in mechanisms for continuous improvement, which can multiply productivity by a factor of two to four

- Digitization of operations and customer experience, to improve the cost-income ratio by 10% to 15%

- A more agile work environment that appeals to high-performing employees and aids recruitment

A leading logistics company wanted to transform itself from an asset-driven organization into a digital customer-focused service organization and reduce its costs and time to market. It shifted to a product-led operating model with joint tech and business ownership through cross-functional teams. The company organized technical capabilities into product domains reflecting different customer needs, with underlying systems feeding into multiple products. This approach enabled the company to offer more standardized products and customer solutions. The cross-functional teams worked in an agile setup, encouraging innovation and making it easy to scale up teams when new products were released. The company reduced time to market by 30%, improved customer satisfaction, and scaled tailored customer experiences more quickly, while lowering unit costs by 20%.

The second organizing practice, followed by almost 90% of leaders, is to pilot innovations using cross-functional lighthouse teams. In our experience, transformations are most successful when they initially focus on one or two lighthouse projects that can illuminate a path for others, and then iterate and adapt until they can successfully scale. Leaders exercise discipline in determining quickly which projects have value (or the most value) within a preset time frame and concentrating on those while terminating others in favor of new lighthouses.

Third, about 60% of leaders use a digital control tower or center of excellence—a centralized team in charge of all digital initiatives—to steer value by allocating resources to meet value-creating targets while cutting funding for unsuccessful or slow-moving initiatives. Businesses that transform successfully leverage fast and simplified decision making. They use the right KPIs—often all new ones—to monitor progress toward outcomes. An effective control tower that tracks the KPIs and keeps everyone on the same page with respect to progress smooths the journey and helps identify and remove obstacles quickly and effectively.

A top industrial goods manufacturer implemented its digital transformation strategy by identifying high-visibility lighthouse projects in each of its strategic priority areas and securing strong CXO alignment and support. Using an MVP approach, the company developed and released multiple new digital products within six months, radically improving its GTM capability and surpassing its main competitor in key performance metrics within one month of launch. All new projects were built on cloud-native data platforms and cloud-based infrastructure. By scaling these lighthouse projects, the company drove significant customer experience improvements across the digital commerce channel.

The Path to Digital Value

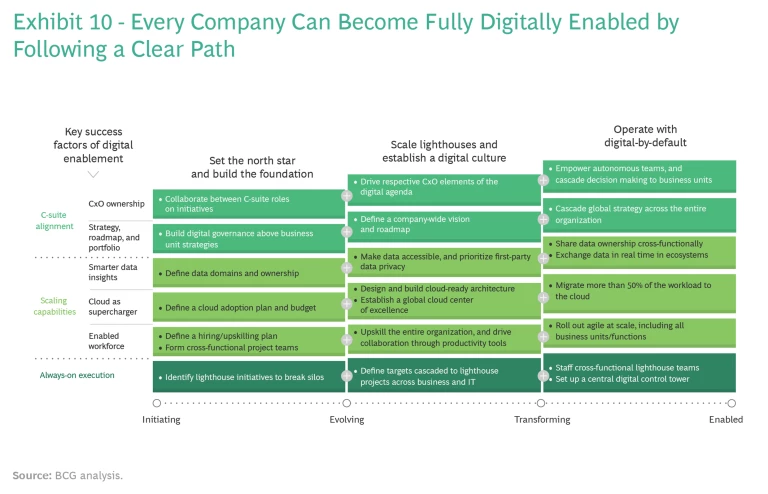

Delivering digital value at scale can be achieved. The process begins with embarking on a digital transformation. Implementation has many steps and takes time—successful transformations may take several years or more to complete, and they require drawing on three key enablers: ensuring C-suite alignment, developing the necessary capabilities, and maintaining always-on execution. (See Exhibit 10.) Companies that establish these enablers will be able not only to scale digital solutions successfully but also to embed digital approaches and ways of working into their operating models. They will be the most likely to benefit from the value-creating journey that started with their digital solutions.

The authors are grateful to Anuthya Nambirajah, Abhinav Gupta, Valerio Gardelli, and Michael Leyh for their assistance in the preparation of this report.