Unless companies’ climate targets align with the latest science, they won’t be sufficient. Leaders must embrace bold action internally, within their value chains, and beyond.

The devil is always in the details—and the race to

net zero

is no exception. While more and more companies are announcing ambitious net-zero commitments every day, translating those ambitions into corporate action will be challenging—requiring targets that are based on the latest

climate

science. Those targets must be clear on several critical (and, in some cases, hotly debated) dimensions, including what emissions scopes are covered, the specific reductions required, how offsets should be used (or not), and any variations based on the sector

The lack of alignment on some of these dimensions is already raising concerns about comparability and the risk of real or perceived greenwashing by companies announcing net-zero commitments.

The reality of the radical changes necessary to achieve net zero is coming into view.

Progress is certainly being made toward consensus on a net-zero standard, albeit slowly. Broad areas of agreement have emerged, including a primary focus on emissions reductions (as opposed to relying primarily on offsets, for example), the need to reduce emissions across Scopes 1, 2, and 3, and the necessity of setting short-, medium-, and long-term targets (with an ultimate deadline of

We have spoken to companies that are out in front in adopting rigorous science-based targets to understand what would be required to meet strict standards such as those put forth by SBTi. The companies outlined the challenges they face. And they shared how they are charting a path forward: by adopting a mindset that achievement of net zero will enhance their competitive advantage and by taking aggressive action internally, within their value chain, and beyond. As the impacts of climate change become increasingly evident and the need to transform the world’s energy systems grows more urgent, many more companies must follow their lead.

The Gap Between Ambition and Action

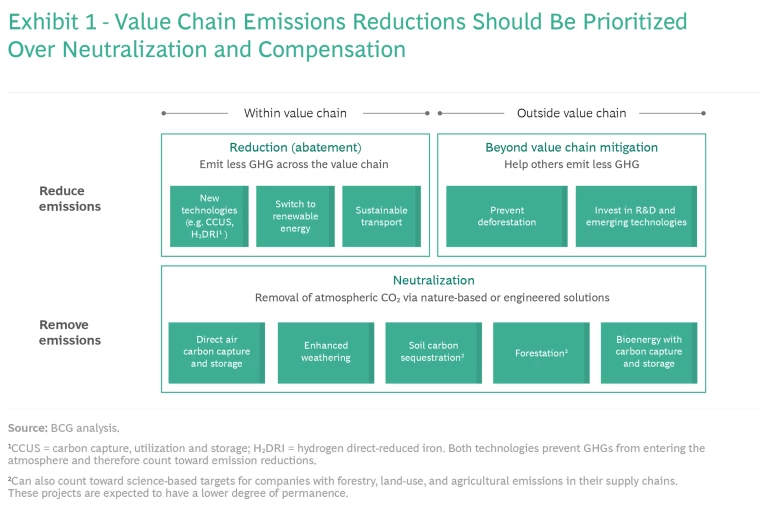

As companies outline plans to achieve net zero, they are typically drawing on three sets of actions (see Exhibit 1):

- Reduction. Abatement of emissions within a company’s value chain is, and must remain, the highest priority.

- Neutralization. This involves the removal of emissions, such as through direct air carbon capture and storage, for a period that is sufficiently long to neutralize the impact of any residual emissions. Neutralization can be achieved within or outside of the company’s value

chain.3 3 The same neutralization action may fall within the value chain in one industry and outside the value chain in another. For example, reforestation would be within the value chain of an agriculture company, but outside the value chain for a professional services company. Even so, there is a high bar for neutralization projects, including the likelihood of their permanence as well as the traceability of the carbon removal theypromise.4 4 Per the New Climate Institute, “a sufficient guarantee of permanence requires a high likelihood that the captured carbon will remain stored over a timeframe of centuries to millenniums.” - Beyond Value Chain Mitigation. Companies can help society move towards global net zero by providing financing for climate projects outside their value chains. These investments often help companies compensate for remaining emissions and/or develop the solutions society will need to successfully transition to net zero in the future. This can include, for example, nature-based solutions that serve as carbon sinks, such as forests and mangroves, or investments in emerging climate technologies.

Offsets can play a role in both neutralization and beyond-value-chain mitigation, but they are only considered a credible lever by SBTi and many NGOs when companies procure high-quality credits only and use these alongside—or beyond—science-based

SBTi Raises the Bar on Net Zero

The recently published net-zero standard from SBTi focuses on broad emission reduction. Under the standard, companies must reduce their value chain emissions (Scopes 1, 2, and 3) over the next five to ten years in line with an SBTi-defined 1.5℃ pathway, reduce those same emissions by at least 90% (depending on the industry) by 2050, and neutralize the impact of any remaining emissions that cannot be eliminated by investing in equivalent carbon-removal solutions. As companies work toward their near- and long-term targets, they are encouraged to make additional investments in beyond value chain mitigation—but SBTi is clear that these should not be a substitute for a company’s own reductions.

While the term “carbon neutral” is often used interchangeably with net zero, under the SBTi net zero standard the two goals are quite different. Carbon neutral typically implies achieving a state where any emissions are completely offset by other actions—for example, planting trees. In that case, however, companies could still be emitting large volumes of greenhouse gases (even though they are offsetting them) and therefore not sufficiently contributing to solving the climate crisis.

The high levels of required emission reductions in the SBTi standard reflect a harsh reality: offsets can only get us so far. There are real constraints related to offsets—in terms of the projected available supply, their permanence and verifiability, and the degree to which some offsets could negatively impact natural ecosystems and hinder progress toward the Sustainable Development Goals.

So where do companies stand compared to the ambitious targets outlined by SBTi?

More than 4,500 entities—including 3,000 companies as well as governments and NGOs—had set some form of net-zero commitment by November of 2021. These commitments include those made individually or as part of coalitions or campaigns, such as the Race to Zero. Among the Forbes Global 2000, 21% of companies (420 in total) have set a net-zero ambition, according to ECIU data and BCG analysis.

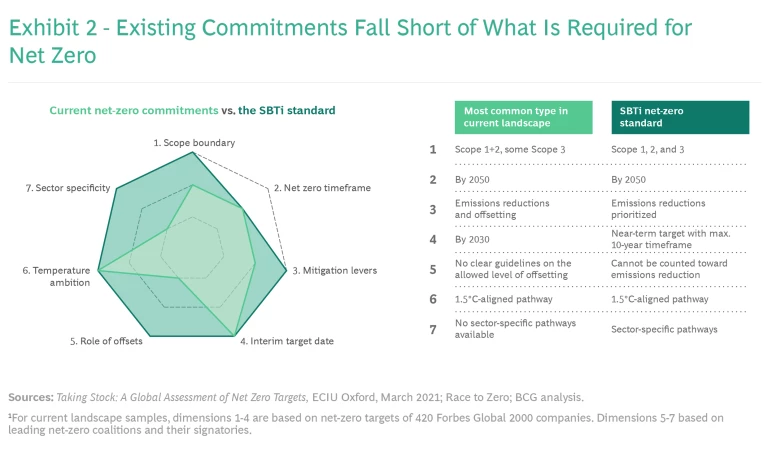

But the specifics of those commitments vary significantly—and often come up short of the science-based net-zero approach outlined by SBTi. While 93% of those 420 Forbes Global companies have committed to achieve net zero by 2050, just 63% have actually set the kind of interim targets that are critical to reaching that goal. In addition, only 30% of those companies cover all scopes of emissions, including Scope 3. And just 33% restrict or prohibit the use of offsets—a position that ensures that a company pushes more aggressively for emission reductions. (See Exhibit 2.)

The bottom line: in order to meet the consensus goal of limiting global temperature increases to 1.5℃, corporate action must be ratcheted up significantly, including both the number of overall credible commitments to net zero and the actions being taken to make good on those promises.

Challenges to Progress

So, what accounts for the gap between the ambitions reflected in science-based targets and the actions most companies have taken thus far? To understand the challenges, we conducted in-depth interviews with executives who manage sustainability and climate efforts at more than 30 large multinational companies in a variety of sectors and regions. Those interviews shed light on two primary issues: implementation and the broader context in which companies operate.

Implementation Challenges

It has been difficult to achieve consensus on how to set net-zero targets that reflect the latest climate science, in part because it will be unquestionably difficult to meet those requirements. Our interviewees cited three primary implementation challenges.

Reducing Scope 3 Emissions. Companies—particularly those with complex supply chains such as consumer packaged goods, electronics, and industrial equipment manufacturers—said that accounting for and controlling Scope 3 emissions were significant challenges.

The current process of accounting for both emissions and reductions across a company’s supply chain is time consuming and prone to error. In particular, resource-strapped small- and medium-sized enterprises have trouble creating the necessary data transparency for accurate Scope 3 accounting. And supply chains can be very fluid, with suppliers or the materials needed changing continuously in response to shifting costs, demand, production capacity, and new product development. That fluidity, which has increased recently due to pandemic-related shocks, makes it difficult to not only account for supplier-related CO2 emissions but also to predict and manage how those emissions will evolve in the future.

The good news is that there are efforts underway that will likely make the process easier in the years ahead. Among those efforts: platforms that enable the exchange of Scope 3 data to accelerate decarbonization within ecosystems and Gold Standard’s Value Change initiative, which focuses on developing and scaling credible Scope 3 solutions. In addition, companies are beginning to deploy AI to monitor, predict, and reduce emissions across their value chains. Furthermore, the likelihood that companies will be required to disclose (among other things) their emissions footprint in a standardized way is increasing, thanks to efforts from the US Securities and Exchange Commission and the International Sustainability Standards Board, among others. Standardized disclosure will make Scope 3 accounting somewhat easier, at least for upstream-related emissions.

Efforts are underway that will make it easier to account for emissions and reductions across a company's supply chain.

In addition, companies noted that they have limited control over certain upstream and downstream Scope 3 emissions—particularly downstream. The manufacturer of a dishwasher or mobile phone, for example, can certainly design products to use less energy—but they will likely have little ability to influence how often consumers use those products or whether, in doing so, they rely on coal-fired or renewable energy . And companies frequently have limited influence over “tier n” suppliers, players that don’t supply the company directly and are further up the line in the supply chain. For some companies, in fact, the Scope 3 emissions they can more easily control or reduce are those that contribute relatively little to their overall carbon footprint.

Complicating the task of accounting for and controlling Scope 3 emissions are some potential negative ripple effects. In our interviews companies noted, for example, that aggressive Scope 3 reductions could come at the expense of a just energy transition by prompting companies to shift toward larger suppliers, who are more likely to have the resources to comply and to provide the required transparency, and away from small- and medium-sized enterprises with fewer resources.

Dependence on At-Scale Deployment of New Technologies. Certainly, near-term net-zero targets are considered feasible by some companies through steps such as improvements in energy efficiency and fuel switching. However, longer-term targets, particularly those in high-emitting sectors such as cement manufacturing and aviation, require new technologies. And the companies we interviewed noted that deploying those technologies at scale comes with some significant obstacles.

For one thing, companies cited uncertainty about the projected costs and effectiveness of these technologies. In addition, current assets in these sectors have long life spans and high capital expenditures, making it likely that companies that adopt new technologies will incur significant losses if they need to decommission those assets before the end of their lifecycle. Cement-manufacturing plants, for example, typically stay in operation for 20 or more years before they are decommissioned. Consequently, cement manufacturers are likely to explore alternatives such as fuel switching (which is compatible with existing plants) rather than mothballing relatively young plants and investing in new facilities based on emerging, low-carbon technologies.

The right market regulations and policies will help enhance the business case for new technologies that help reduce emissions.

The right market regulations and policies will help enhance the business case for continued investment and adoption of these new technologies. This can include the widespread use of a price on carbon (or similar mechanisms, such as emissions trading schemes) as well as investing heavily to lower the cost of new lower-carbon emitting technologies. Without such regulations, policies, and investments, there is a risk that abatement progress stalls in heavy-emitting sectors after the easy-to-abate emissions sources have been eliminated. The right policy environment can also help avoid an unintended consequence of net-zero efforts, wherein companies in heavy-emitting sectors divest from the dirtiest plants or operational areas to achieve their targets. While these divestments improve the company's emission profile, if such assets are bought by companies that face less scrutiny the ultimate impact on global emissions may be negligible.

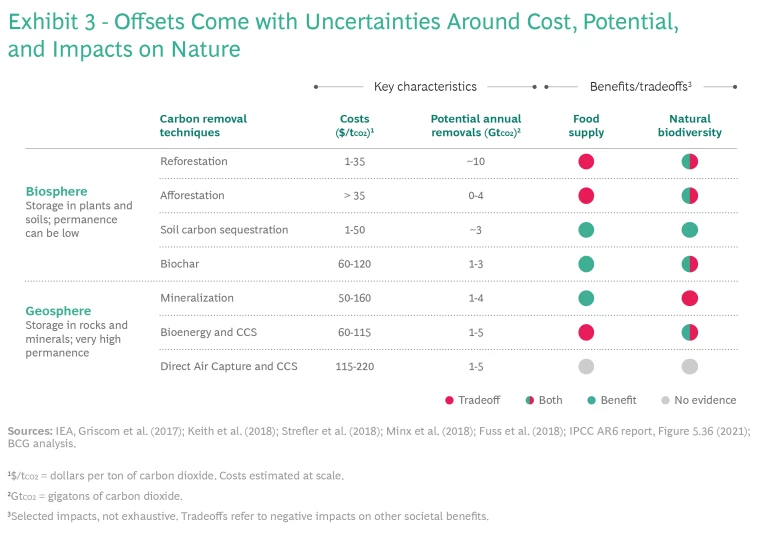

Use of Offsets as Part of the Mitigation Strategy. Interviewees identified the topic of offsets as another challenge. Offsets come in many forms, from afforestation to emerging technologies such as direct-air carbon capture and storage. But while there is nearly uniform consensus around the need to maximize emission reductions, there remains a lack of clarity around offsets. This includes uncertainty about future costs, the carbon-removal potential of each offset type, complexities related to possible tradeoffs for each offset type, and the overall role offsets should play in a company’s decarbonization journey. (See Exhibit 3.)

Certainly, organizations such as WWF, Gold Standard, and the Voluntary Carbon Markets Integrity Initiative are working to bring clarity to the topic, including by defining what constitutes a high-quality offset and how to integrate offsets into a credible climate strategy. And new players such as Carbon Direct are emerging to help companies navigate the world of carbon removal solutions. But for now, companies say the uncertainty related to offsets makes planning exceedingly difficult.

In particular, companies report that they lack clear guidance on if and how they should incorporate offsets into their net-zero strategies, especially when it comes to the balance between compensation and

Context Challenges

The companies we spoke with identified a couple of meaningful challenges stemming from the broader environment.

Significant Variation in Regional Laws and Regulations. When it comes to sustainability efforts, regional levels of maturity exist on a wide spectrum, as do the laws and regulations related to climate. Companies that have operations and supply chains partially or entirely in regions at the lower end of the spectrum face challenges in quickly and cost-effectively reducing their emissions.

In high-maturity regions, a combination of public and governmental pressure creates significant external incentive for companies to act, and this accelerates the development of low-emission products substitutes. The pressures include regulations (such as mandates on low carbon products), carbon prices (such as taxes or emissions trading schemes), financial incentives (such as direct subsidies or tax credits), and shifting patterns of consumer demand. The European Commission, for example, has crafted the “Fit for 55” legislative package to accelerate Europe’s move to net zero.

In low-maturity regions, meanwhile, citizens and governments have limited options for aggressively addressing the climate threat—or a low willingness to do so—both of which foster an overall environment that is less supportive of action across different value chains. Consequently, companies that move quickly to slash emissions in these regions can be disadvantaged competitively. In some markets, local politics can create additional barriers, including hindering the deployment of renewables.

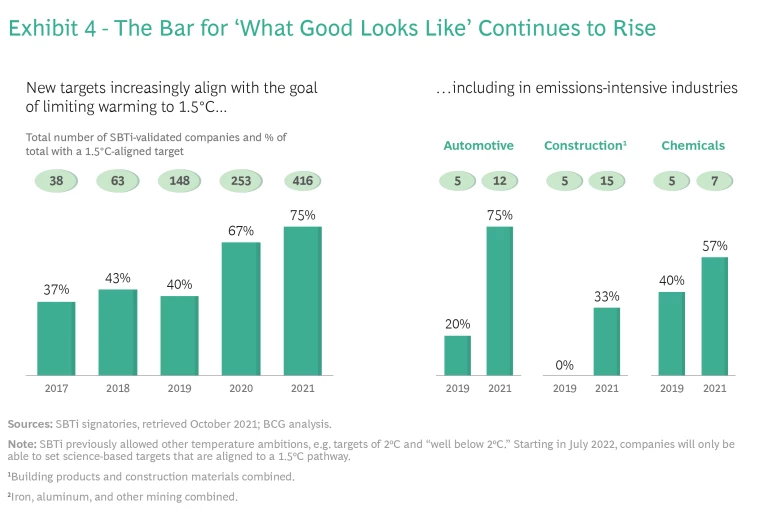

Climate Action as a Moving Target. As climate science has evolved and the understanding of the impact of rising temperatures becomes clear, the ambition for limiting temperature increases has shifted. (See Exhibit 4.) While limiting the temperature increase to 2℃ was seen as reasonable a few years ago, today the consensus view is that the increase must be limited to 1.5℃ to avoid potentially dire consequences—a view that is, for example, reflected in the updated SBTi guidance taking effect in July 2022. However, that is increasingly difficult as global emissions continue to rise, making more aggressive reductions necessary going forward. Both factors have driven a recalibration of what constitutes appropriate targets for companies.

In the years ahead, as the rate of actual temperature increase and the pace of emission reductions evolve, abatement targets and pathways will potentially need to change yet again. Companies noted that making commitments and setting the targets to meet them in that shifting landscape is a considerable challenge.

How the Leaders Do It

Despite these challenges, the need for urgent action is greater than ever. And there are companies that are taking a much-needed leadership role , including some of the 30 companies we spoke to. In fact, we noted a bifurcation in their responses—between companies that are setting ambitious targets (including updating previously set objectives based on emerging scientific evidence) and those taking a more cautious approach.

The leaders cut across sectors and geographies, but they share some characteristics others would do well to emulate—in terms of mindset, internal actions, and steps they take within and outside of their value chain.

The Net-Zero Mindset. Leaders believe that decisive action is required in this decade and that companies need to step up to meet the challenge. They do not wait to have all the answers before committing to achieve net zero. Rather, they take a well-informed leap of faith—accepting that they will inevitably make mistakes along the way but also recognizing that there will be advancements in areas such as technology cost and performance, regulatory clarity, and data transparency. They foster an always-on transformative attitude to drive them forward. And they frame their net-zero targets as north stars, starting with what the science requires and working backwards to achieve that. Just as critically, they hold their own feet to the fire—setting concrete near-term targets on which the current management team will need to deliver.

These companies see climate action as a business opportunity rather than as a compliance burden. At the same time, they proactively look beyond themselves and their value chains and engage with a broad range of stakeholders and investors to help solve larger challenges to reaching net zero.

Internal Company Actions. Leaders take steps to drive emission reductions within their own organizations, including setting an internal carbon price to ensure sustainable decisions—for example, reducing business-travel spending. They set financial incentives for reaching net-zero targets, and they establish criteria for buying and selling goods and services aimed at reducing Scope 3 emissions.

These companies also do detailed planning in the near term, including using regional maturity indices to monitor the policy environment in various regions—a process that allows them to shift into detailed road mapping of emissions reductions when the environment supports it. They also push for continued emissions reductions, even in cases where those efforts come with high initial costs. Such actions are based on a recognition that first movers’ investments to curb hard-to-abate emissions can have a high ROI and can enable companies to secure sustainable resources that are likely to grow scarce in the years ahead. Leaders also leverage digital tools—for example, “digital twin” computer models of supply chains and operations, which use real-time data to run simulations that show how emissions in a supply chain will change under different scenarios.

Actions Within and Beyond the Value Chain. Within their value chain, leaders promote positive climate action by engaging with suppliers, buyers, and end users to educate and provide help where needed. With small suppliers, for example, they may provide financial assistance and expertise in accounting for and abating emissions. They also leverage their power as buyers, including through strict standards in their supply chains and by teaming up with other buyers or sellers to form groups that drive positive climate action.

A number of large multinational companies led the formation of the Renewable Energy Buyers Alliance, for example. The Alliance, which was formed in 2018 and now includes more than 200 members, supports the scale-up of the renewable energy marketplace, providing resources and tools to help energy buyers expand their procurement of clean energy. And some large companies are looking to create demand for low-carbon materials and products by making forward commitments to buy such inputs. The First Movers Coalition is a group of companies committed to using their purchasing power to enable the development of critical climate solutions that are not yet operating at scale. And companies participating in Breakthrough Energy’s Catalyst Program will provide investments to accelerate the development of emerging climate technologies while also committing to buy those new solutions.

At the same time, corporate leaders are pressing for action even beyond their own value chains. They work with governments and engage with the public to develop a political and economic context that will enable concerted climate action and green technology adoption in the regions in which their companies operate. And in already mature markets, they push to maximize impact—including by working with a diverse group of stakeholders to advance and scale up critical next-generation technologies. In cement, for example, the first CO2 neutral cement plant is being built in Sweden with financing from the Swedish government. And a joint public- and private-sector effort in Spain aims to build the world’s first green steel plant.

Finally, leaders are actively shaping the net-zero environment through research and information sharing. Several steel makers formed the Net Zero Steel Pathway Methodology Project to start building consensus and guidance around how steelmakers can decarbonize. Meanwhile, a number of companies are partnering with the Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping to decarbonize the shipping industry.

The window to achieve a 1.5℃ pathway is closing. For corporate actors to have a meaningful impact on moving the world to net zero, they must set clear targets that are based on the science, include interim targets for the next ten years, and cover the entirety of emissions, including their supply chains and how customers use their products.

This will most certainly be difficult. But the companies that are leading the charge to net zero are moving ahead undaunted. They have adopted an always-on approach to transformation that will allow them to adjust as technologies evolve, regulations tighten, and the science requires bolder actions. And they have a firm conviction that any challenges to achieving global net zero can—and must—be surmounted.

The authors thank Emma Watson at the Science Based Targets initiative for her assistance in the development of this publication. They also acknowledge Sanne Bitter, Alise ter Haak, and Zenas Van Veldhoven for their support.