Rather than see B2B inflation as a dire threat, companies should view it as an ideal opportunity to make long-overdue changes to pricing practices. The attention of senior leaders will never be more focused on pricing than it is right now.

Leaders of B2B companies are describing the current wave of input-cost inflation as the worst they’ve seen in 30 years. In fact, even most algorithms and pricing tools can’t account for such extreme price changes.

The US producer price index for processed goods for intermediate demand rose by 24.4% in 2021, the index’s largest calendar-year increase since 1974. The International Monetary Fund’s All Commodity Price Index increased by 49% in the same 12 months. Supply chain issues, such as the shortage of computer chips and other raw materials, compound these price pressures and make it even harder to estimate whether inflation will peak in a few months or a few years.

This inflation wave has shed even greater light on an open secret in most B2B pricing practices. They aren’t equipped to handle rapidly rising input costs because they are built on an underlying presumption of stable economic conditions rather than volatility, uncertainty, and constant change. When change does happen or volatility strikes, legacy pricing practices turn out to be too slow, too lax, and too undifferentiated.

The silver lining is that B2B inflation has catapulted the topic of pricing from the backroom to the boardroom. Senior leaders are keenly aware that inflation has a swift, corrosive effect on the profits of companies that don’t manage it well. Simply put, when input costs rise significantly, a company’s profits will decline unless it can pass along significant price increases quickly.

How companies respond will determine much more than their ability to weather current input-cost inflation.

But instead of viewing inflation narrowly as a signal to raise prices, senior leaders should heed it as a wake-up call to confront the open secret about their pricing practices. With all eyes focused on pricing, they have an unprecedented opportunity to initiate long-overdue changes that will bring their pricing in line with best practices and help them respond to uncertainty now and in the future.

How companies respond will determine much more than their ability to weather current input-cost inflation. It will also determine how resilient, responsive, and successful they will be amid any rapid or unexpected changes in future economic conditions, such as the inevitable period when inflation subsides and their customers’ procurement teams start hunting aggressively again for price concessions.

Overcoming Inflation’s Challenges

We have identified three areas where B2B companies need to improve their performance in the short and long term. They need to act faster, enforce discipline, and make nuanced price changes.

These moves are not only essential in a period of inflation. They are best practices that should form the foundation of any pricing organization. Without them, inflation’s corrosive effect on profits becomes inevitable.

Enabling and supporting these changes will require investments in how companies set, manage, and communicate prices as well as how they negotiate and design contracts. The technological and organizational changes that would give their pricing practices the necessary speed, discipline, and nuance are not quick fixes. B2B businesses must make the following fundamental changes to deeply ingrained habits.

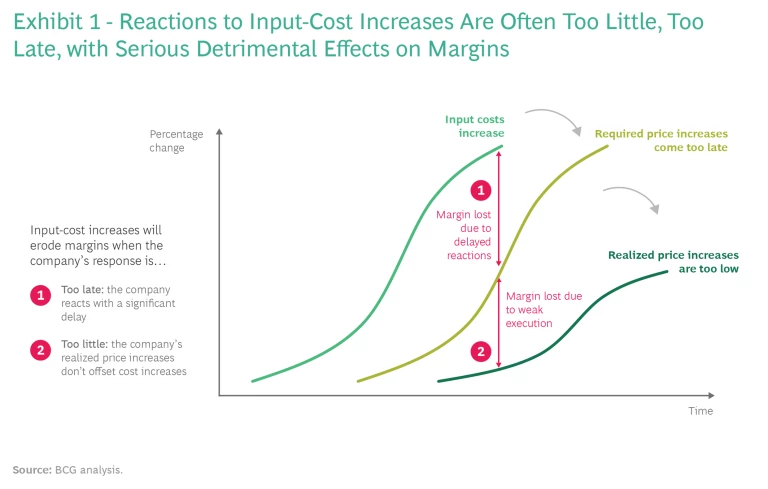

Act faster. Companies need to adjust their prices quickly when costs rise to avoid margin decreases. Let’s assume that a company wanted to offset cost increases with price increases that would keep margins constant. The longer the time lag between the cost increase and the decision to raise prices, the longer the company risks a decline in profit. (See Exhibit 1.)

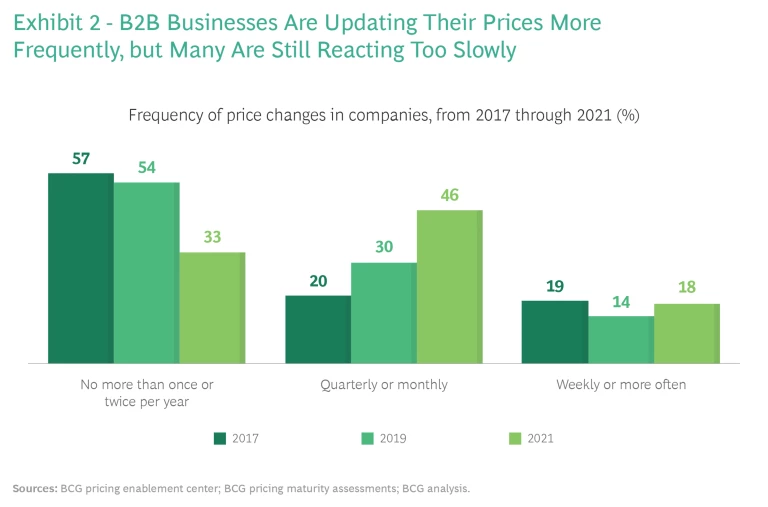

Time lags for price changes are still standard practice at the majority of B2B companies, despite improvements over the last few years. Our pricing maturity assessment survey shows that while companies now change their prices at more frequent intervals than they did in 2017, some 33% still make adjustments on an annual or a semiannual basis. (See Exhibit 2.) Such rhythms are benign when economic conditions are stable, but they wreak havoc on margins when conditions become volatile.

We recommend that companies break away from these slower planning cycles and change their prices as a function of the risks and opportunities they face, not based on what the calendar says. B2B businesses can greatly improve reaction times by setting up war rooms and by implementing better governance and more robust, transparent tracking processes.

As they reassess the frequency of price changes, they can also shift to more dynamic pricing response functions and introduce or reinforce pass-through mechanisms for costs. In countries where economic conditions are generally more volatile, such as Brazil, companies have become accustomed to changing prices within a day of observing changes in input costs, foreign exchange rates, or competitors’ prices.

Enforce discipline. When economic conditions are stable, companies often tolerate occasional lax enforcement of discount policies, terms, and conditions. They make so-called strategic exceptions and are more liable to make price concessions to win deals. Yet in a period of unpredictable and unprecedented change—such as the pandemic and current wave of inflation—it is difficult for companies to suddenly become strict enforcers of price discipline. It is also harder for them to recognize that the ability to supply the right quantity and quality of goods at the right time is far more valuable under such conditions. These difficulties manifest themselves in companies’ inability to implement the necessary price increases. Only 25% of companies succeed in passing on more than 80% of their input-cost increases to customers in a timely manner.

Temporary price escalators can provide a flexible workaround in cases when customers may balk at price increases because they perceive input-cost increases to be transitory. By creating an additional invoice line for a temporary cost surcharge tied to an underlying cost index, companies communicate that a price increase has a concrete cause, implying that the price can go back down if that particular form of cost pressure recedes.

Make nuanced price changes. In an effort to respond quickly to inflation, many companies resort to simplistic uniform price increases instead of exploring more nuanced ways to offset the rising costs. Whenever they change prices—but especially during a period of inflation—companies should implement a range of differentiated increases tailored to each customer’s situation, rather than implementing an average across-the-board increase. To accomplish this de-averaged approach, they should account for pricing power, product value, and potential competitive responses. Companies should also pull other revenue-generating levers besides blunt uniform price increases. They can adjust their discount levels, introduce surcharges, or change their product mix by drawing on lessons from the consumer packaged goods industry.

If supply is scarce, companies need to know how critical their products are for their customers and, ultimately, their customers’ customers. B2B businesses have to understand the way they contribute to the total value of their customers’ finished products and how easily these customers can implement price increases of their own, based on whether their customers’ prices are fluid or locked into long-term contracts. Companies can use that information to guide price changes, which can range from ad hoc moves—such as temporary discount decreases or surcharges—to permanent price increases or new price models.

Now Is the Time to Invest in Pricing

The current period of inflation is an investment opportunity, not a doomsday event that should trigger crisis scenarios. But responding to this period is not a simple matter of adding more technology to generate more data that more people can analyze and interpret. Targeted investments can create and preserve three key advantages—based on information, strategy, and sales—that can help B2B companies price with confidence and precision as economic conditions continue to change.

The current period of inflation is an investment opportunity, not a doomsday event that should trigger crisis scenarios.

Information. An information advantage provides B2B companies the transparency to assess how much exposure they have to inflation. What customers pose the greatest risk to profits? What is the expected impact of changes in raw material costs? What contracts contain cost-adjustment provisions, break provisions, or are subject to renegotiation? To answer these questions, companies must take the full value chain into account, from the sourcing and delivery of raw materials to the potential effects on competitors. As mentioned, companies should even account for the effects of inflation on their customers’ customers. (See Exhibit 3.)

B2B companies will need to build a standard way of calculating an overview of inflation exposure. This will serve as the starting point of a systematic review of the addressable business and contract structure. But three legacy practices—all predicated on an assumption of general stability—tend to hamper this process.

First, many B2B companies lack an overview of contract terms and thus of their inflation exposure. When contracts are stored in a decentralized way on paper, the company risks missing deadlines or opportunities that clauses could trigger. This is an example of a best practice from the 1980s losing a battle with challenges of the 21st century. Second, companies often work with standard costs rather than true costs because it makes planning and forecasting easier when there is little change or volatility. Finally, too many B2B companies still work with basic desktop tools such as Excel spreadsheets, which are often unable to provide sufficient transparency into cost drivers at the customer and product levels. Without the right level of granularity, companies are unable to identify where they should act or how to prepare the right arguments for salespeople.

The answers to this wake-up call are technology platforms that offer integrated views, more analytical power, and broad, real-time access to prices, costs, and customer data.

Strategy. The inflation wake-up call is an opportunity to strengthen internal pricing conversations. Building on their information advantage, leaders will have opportunities to improve their reaction times and price execution processes. Companies won’t be able to achieve faster reaction times unless they abandon traditional rigid annual planning cycles and periodic price adjustments. They also need to organize information flows better by bringing pricing, sales, and procurement teams together to assess situations properly and anticipate future cost changes. New pricing governance models rely on integrated teams to achieve the best results for companies and customers rather than focusing narrowly on the best price today.

B2B companies can also establish a strategic advantage by working on new pricing models. Generations of B2B pricing specialists have worked on going beyond cost-plus methods by pursuing value-based and, increasingly, outcome-based pricing models. Rather than lose sight of these ideas amid an urgent need for short-term solutions, companies ought to weave these bolder ideas into the broader conversation on increasing price levels. Such model changes can be a hard sell in normal times, but B2B companies should use the current disruption as an opportunity for price moves that create win-win opportunities with customers.

No business likes price increases, but they tend to be receptive to ones backed by a well-articulated and robust rationale.

Sales. The inflation wake-up call will also allow companies to change the nature of their conversations with customers. In an inflationary environment, customers are also talking constantly about prices. No business likes price increases, but they tend to be receptive to ones backed by a well-articulated and robust rationale. Price increases that come across instead as clumsy, irrational, or rash tend to make customers wary at a time when they need reliable partners to help them keep their own businesses going.

It is easy, and dangerous, for customers to view rapid price adjustments—especially uniform, indiscriminate price increases—as selfish actions that can harm the relationships. B2B companies need the logic behind price changes to be transparent and well-articulated; sales teams must be prepared to answer customer questions as they decide to accept the changes. They also need to ensure that the logic applies both ways because the prices of some inputs may go down again in the medium term. This is especially common in cyclical industries, such as pulp.

Companies that rely primarily or solely on cost-based arguments for price increases should be prepared for customers to use similar arguments against them when the tide turns. They should immediately build in ways to safeguard margins in case input costs decline. Rather than view the price changes as a one-sided defensive maneuver, B2B companies can use customers’ heightened awareness to steer the conversation toward longer-term solutions that rely on new pricing models, new deal structures, and other ways to facilitate win-win scenarios.

The current wave of inflation affords B2B companies a rare opportunity to transform the way they price their products and services. Inflation is a very hot topic right now, and input-cost pressures show no signs of abating as 2022 begins.

Even when inflation ends, we don’t expect a return to the era of stability that guided previous decision making on prices. Companies will always need the ability to respond quickly, precisely, and confidently as conditions in their industries continue to change. This demands an empowered organization with the right skill sets to secure and maintain information, strategic, and sales advantages.