Technology, media, and telecommunications (TMT) companies are the backbone of modern business and society. During the COVID-19 pandemic, they helped people work, learn, play, and stay connected remotely when it was hard to do any of those things in person. As constant innovators, TMT companies are constructing the future, achieving remarkable progress in such areas as artificial intelligence (AI), telehealth, and the emerging metaverse.

TMT companies’ outsized role in modern life have made them leaders in another way: from 2016 to 2021, they outperformed many other businesses in creating value for shareholders, according to BCG’s latest Value Creators rankings.

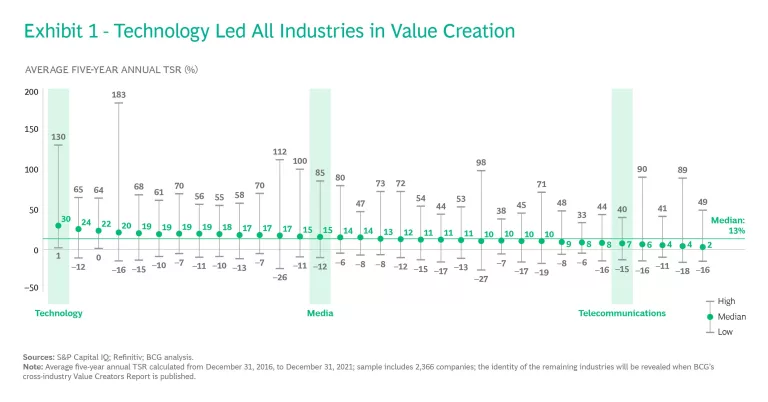

The lion’s share of that value creation came from tech players. In the five-year period analyzed for the 2022 Value Creators rankings, the tech companies in our overall TMT sample had a median total shareholder return (TSR) of 30%, more than double the median overall return of 13% for the 33 industries we study. (See Exhibit 1.)

But continuing on that trajectory may be a challenge for TMT companies. That hit home in early 2022, when equity markets turned volatile on investor anxieties about inflation, monetary policy, and moderating earnings growth.

TMT companies remain well positioned to retain or add value, however, if they take appropriate action. Depending on their specific industry segment, such action includes adopting more mature digital capabilities and employing next-generation personalization and AI to boost everything from

operations

to customer experience. It also includes establishing cross-industry partnerships and ecosystems, having a clear mergers and acquisitions game plan, and preparing for competition from innovative newcomers. Finally, TMT players should determine whether to pursue opportunities in the emerging metaverse market—and if so, how to compete in a way that works best for their business and investors.

Top TMT Companies for TSR

In calculating our Value Creators rankings, we look at five years of TSR data to crystallize long-term trends. But it’s impossible to overlook the impact that the pandemic has had on companies of all kinds over the past two years—and the generally positive effect it has had on TMT companies’ performance. Of the 232 publicly listed TMT companies in our sample, 70% posted a higher TSR during the period that included the peak of the pandemic, the 21-month period from March 2020 to November 2021, than during the prior 21 months.

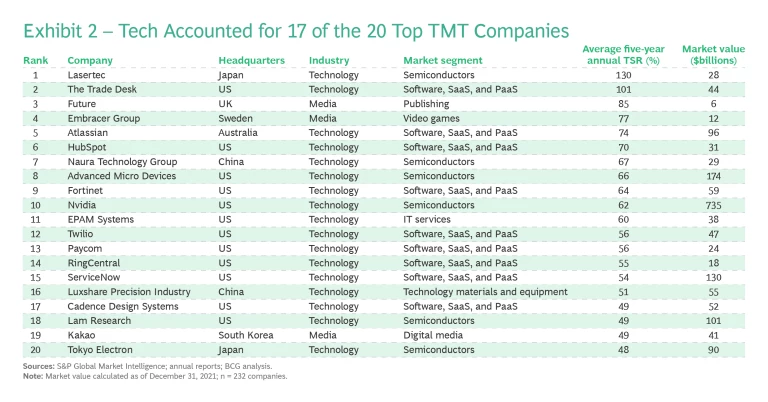

For the full five-year time frame, tech companies accounted for 17 of the 20 TMT companies with the highest TSR. (See Exhibit 2.) Dominating the cohort of leading tech companies were software and semiconductor businesses, including Lasertec, which topped the list. The Japanese company makes equipment for testing and inspecting the semiconductors used in cellphones and other devices. It’s the world’s leading supplier of photomask inspection machines, which detect errors in advanced computer chips. Demand from major chipmakers for its technology caused the company’s revenue and net income to spike over the past several years, resulting in a five-year average annual TSR of 130%.

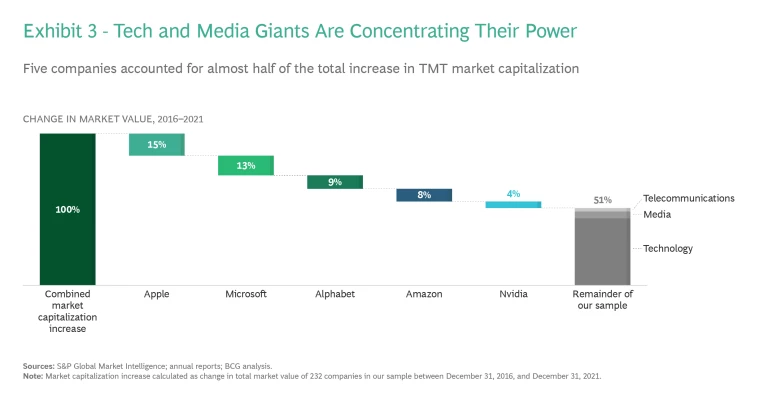

In terms of absolute value creation, the performance of a handful of digital giants had an outsized influence on the overall increase in the TMT sector’s market value. Five companies—Apple, Microsoft, Alphabet, Amazon, and Nvidia—accounted for almost half of the group’s entire increase in market capitalization. (See Exhibit 3.)

Not all notable TMT value creators are so big. More than half of the 20 TMT companies with the highest average annual TSR had a market capitalization of less than $50 billion. Among them: Future, a global digital platform for specialist media, with a TSR of 85% and market capitalization of $6 billion; Embracer Group, a Swedish video-game company, with a TSR of 77% and market cap of $12 billion; and RingCentral, a US maker of cloud-based collaboration and communications software, with a TSR of 55% and market cap of $18 billion.

Tech Dominates TMT Value Creation

The TMT sector’s strong returns were fueled by demand for tech products and services that spiked during the COVID-19 pandemic, including increased demand for cloud services, online conferencing platforms, collaboration tools, semiconductors, and cybersecurity solutions. In the five-year period that our analysis covers, the market value of some of the largest tech companies increased more than threefold.

The top-performing tech companies include five that appear on our list for the first time. In addition to Lasertec, they include The Trade Desk, an advertising-tech company; HubSpot, a cloud-based in-bound marketing and customer service platform; integrated circuit maker Naura Technology; and Twilio, a cloud communications platform.

Media Companies Performed Well

Demand for streaming services, social media, gaming, and other forms of online entertainment exploded during the pandemic, causing media company valuations to skyrocket. Valuations also increased for live entertainment companies, likely in anticipation of life returning to what it had been prior to the crisis.

Media’s performance dipped slightly from the numbers it achieved on our 2020 list , but the industry continues to create tremendous returns. Overall, the market value of companies we analyzed more than doubled from 2016 to 2021. The media companies in our sample realized an annualized average TSR of 15%, positioning them 14th among the 33 industries we track and ahead of the median TSR of 13% across all industries.

Five digital and video giants—Alphabet, Meta, Tencent, Netflix, and Walt Disney—accounted for the lion’s share (86%) of all media industry value creation during the five-year period.

Telecom Performance Was Split

Telecom ranks near the bottom of our cross-industry comparison, with a 7% average annual TSR. But the overall number doesn’t tell the whole story. In our telecom industry sample, infrastructure companies—the companies that build and maintain cell towers—had a median annualized TSR of 24%. That’s more than three times as high as telecom operators’ median annualized TSR of 7%. Infrastructure carve-outs, in which telecom operators or other companies spun off cell towers and other hard assets as separate entities, generated short-term value by unlocking the full value potential of the infrastructure assets, and long-term value by creating businesses with more efficient operations, more revenue sources, and stable cash flow.

As a counterpoint to infrastructure companies’ relatively strong showing within the industry, full-service telecom providers saw weaker returns. The pandemic led to an increase in internet traffic, but for telecom providers, higher traffic doesn’t automatically result in higher revenue. And according to some industry experts’ estimates, as people stopped traveling, telecom companies lost billions of dollars in revenue from lower roaming charges.

What the Future Holds for TMT Companies

How businesses operate and how people work, play, and socialize continue to evolve. TMT companies are well positioned to retain or add value if they take steps to capitalize on the following opportunities.

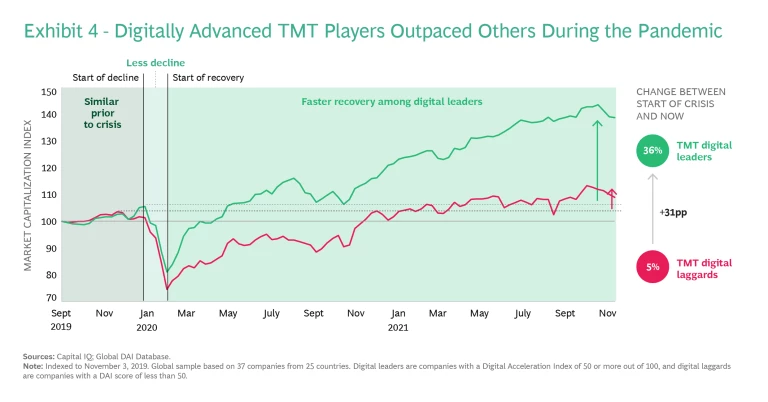

Adopt highly mature digital capabilities. Companies in all industries, including TMT, need to embrace digital. TMT leaders adopt a bionic form of organization that combines the strengths of people and technology to create highly mature digital capabilities. Although many TMT companies adopted these capabilities early on, others lag behind. But the model is worth pursuing because it can lead to improved performance. That’s according to BCG’s Digital Acceleration Index (DAI) analysis, which ranks digital maturity across 36 performance indicators, including revenue growth, time to market, cost efficiency, product quality, and customer satisfaction. The superior performance of TMT companies that are digital leaders was underscored during the pandemic, when those businesses vastly outperformed digital laggards. From February 2020 to November 2021, market capitalization for digital leaders grew 36%, compared to 5% for digital laggards. (See Exhibit 4.)

Employ next-generation personalization and AI. Tailoring products to what customers want can help TMT companies of all types minimize churn and improve price realization by developing more effective discounting structures and price management. Adopting advanced personalization and AI is one way to provide more customized offerings and improve customer service. For example, by increasing their use of AI, telecom operators can ensure that they deploy networks optimally, leading to better service and customer experience.

Use partnerships and ecosystems to move quickly and create synergies. Tech companies are at the forefront of innovation and digital operations, which is one reason they lead other industries in value creation. Many media and telecom players aspire to emulate them by transforming themselves into digital-first businesses capable of finding new ways to approach customers and deliver best-in-class data-driven customer experiences. For media and telecom companies, teaming up with a tech partner is a way to speed up that process. For example, telecom operators can partner with tech players to deliver on the potential benefits of 5G networks, network modernization, and edge computing. Operators are already starting to do that by partnering with hyperscalers to launch edge-based services .

Have a clear game plan for mergers and acquisitions. As TMT companies look for ways to increase returns, we expect to see more consolidation through mergers and acquisitions, particularly in media industry market segments such as gaming. Companies such as Microsoft, Sony, Embracer, and Take-Two Interactive have acquired game properties to bulk up their pipeline of future titles and, presumably, to strategically position themselves for a metaverse-focused future. TMT companies of all kinds need to formulate a clear deal strategy, including determining the targets that for them have the greatest potential to create value.

Prepare for competition from innovative newcomers. Young, high-growth companies could threaten the status quo of current TMT leaders for shareholder return—in particular, technology companies. The average annual valuation for BCG’s Growth Tech 100 increased by 93% from January 2020 through June 2021, more than three times overall market growth of 27%.

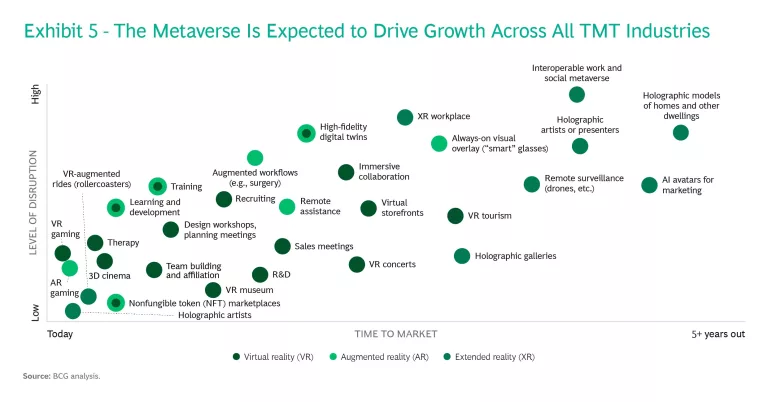

Develop a metaverse strategy. Over the next decade, the metaverse—an interconnected reality that seamlessly weaves virtual, augmented, and extended experiences into our physical world—is expected to pervade business, our private lives, and social interactions in many forms. (See Exhibit 5.) By some estimates, the size of the metaverse as a market could reach $1 trillion by 2030.

The metaverse market represents a merging of three areas of existing technology whose capabilities are rapidly evolving: platforms enabled by increased computing capacity and connectivity; AR, VR, and mixed reality (MR); and digital and web3 assets enabled by blockchain .

Although it’s too early to say exactly which technologies or platforms will dominate, it’s not too early for TMT companies to plan how to participate in the metaverse ecosystem. For tech companies, it’s an opportunity to help shape standards and platforms. Media companies—and video-game companies in particular—are in the best position to produce metaverse content, including VR- and AR-based immersive experiences. And telecoms are the obvious choice to build next-generation connectivity in the form of 5G and Wi-Fi 6.

Redefine excellence in customer experience. Delivering a great customer experience is another way that TMT companies can add value. According to BCG research, companies with the highest customer satisfaction scores generated twice as much shareholder value over the past ten years relative to the average score. Amazon and Apple, for example, use digital technologies and human-centric design thinking to provide an exceptional customer experience. It’s one reason they are in the cadre of companies that accounted for a large portion of the TMT sector’s entire increase in market capitalization.

To improve customer experience, companies must make bold moves rather than incremental updates to the status quo. One way is to take what we call

the “MIDAS” approach

to creating an operating model that puts customers at the center of the business:

- Measure customer behaviors and business impact concurrently to identify opportunities for immediate interventions.

- Innovate better customer experiences rather than simply reengineering existing processes.

- Deliver customer journeys that replace functionally focused projects with integrated frontline and backline teams dedicated to addressing end-to-end customer journeys.

- Activate a customer-first culture by making the customer experience everyone’s responsibility and by continuously emphasizing its importance.

- Synchronize and unify customer engagement across existing and emerging channels.

The TMT sector has created tremendous returns for shareholders. But companies can’t rest on their laurels and expect those returns to continue. Instead, they must keep investing in innovation and continue to reinvent themselves. Given the reach and power they’ve attained, TMT companies also need to manage their customers’ and society’s trust, by taking such actions as protecting user data and privacy and making it harder to spread disinformation. In addition, they should apply the same innovative thinking that led them to become top value creators to improve diversity and inclusion, operate more sustainably , and connect underserved communities to close the digital divide.