In 2014, BCG initiated a biennial Digital Government Citizen* Survey, tracking the state and evolution of digitally provided government services, as well as citizen expectations and adoption. Since 2020, BCG has recognized the intensified needs and accelerated transformation in this area driven by the COVID pandemic. Where last year’s regional drill-down examined building citizens’ trust in digital services, this year’s main theme is stronger adoption through personalization and proactivity, and the implications for latest digital government services.

About the GCC Digital Government Citizen Survey

- *"Citizen/s" refers to respondents who are nationals and residents living within each region

- “Net Experience” is positive experience minus negative experience

- 26 Digital Government Services are included in the core survey with the exception of an additional question on COVID-related digital services which will only be included in the 2022 survey

- Digital government services include priority high-touch and citizen-facing online services, including across social services, taxation, housing, health, education, transport and immigration.

GCC Is in a Strong Position to Further Increase Adoption of Digital Government Services

GCC citizens are avid users of digital government services. On average, 63% of people in the GCC access these services compared to 49% globally. From a regional perspective, GCC is the leader, followed by Asia Pacific, Europe, and finally North America (Exhibit 1). These numbers indicate that digital government services have become an integral part of GCC citizens’ daily life.

The COVID pandemic has driven people to seek digital services relating to health records, COVID services, and real time information. Most regions globally experienced a significant increase in citizen access to, and adoption of, digital government services. The GCC region ranks comparatively high as a digital society with penetration of digital government services among citizens (63%). Asia Pacific citizens continue to increase their uptake of digital services but at a lower rate than GCC, while Europe experienced a 4% increase in digital service adoption but still trails behind GCC and Asia Pacific.

The usage levels of digital government services in GCC countries echo global patterns, with COVID-related services ranking #1 both regionally and globally in 2022. COVID-related services have emerged as a benchmark for citizen expectations, with their fast go-to-market times, frequent new feature updates, and advanced/mobile functionality (e.g., QR code scanning, Bluetooth tracking).

Similar to other regions, the GCC offers increasingly sophisticated digital government services with more complex transactions – including registering or conducting a job search, accessing COVID services, and processing visa, residency, or work permits. These are increasingly at the top of digital services used by GCC citizens.

High GCC Citizen Expectations Met by Increasingly Strong Government Service Delivery

GCC governments offer superior digital services that broadly meet the high expectations set by their citizens. A net experience (positive experience minus negative experience) score of 79% suggests that the region is succeeding at delivering quality digital government services to its citizens. All three GCC countries surveyed place in the top ten of global net experience scores (Qatar ranks 1st, UAE 3rd and KSA 7th). The majority of GCC citizens perceive digital government services as better than those of the private sector in their countries. When asked to compare current government digital services to private organizations, 72% in GCC reported government services to be better, followed by 42% in Asia Pacific, 24% in North America, and 21% in Europe. The GCC has a considerable number of state-owned enterprises, notably leading to less difference between the public and private sectors, given harmonized delivery approach and aligned with quality goals.

This level of satisfaction is particularly significant in light of people’s high expectations. The vast majority of GCC citizens expect their government to provide services comparable to the best private companies in the world or global digital leaders. The finding that a significant portion of the population (41% in GCC) measures digital government service against leaders like Apple, Google, and Uber means that the GCC governments will need to improve and innovate at pace with global digital leaders to keep up with citizen expectations. We see expectations matched by citizens’ actual experience where the net experience is in the green territory (Exhibit 2).

Positive GCC Attitudes toward Personalized and Proactive Delivery of Digital Government Services

In the private sector, companies are providing – and consumers expect – increasingly personalized and proactive services. These include auto-filling forms with available user data, tailoring or recommending additional offerings, and even automating complex tasks like travel bookings or loan approvals.

When governments enter this traditionally private-sector territory, they must make a balanced trade-off between convenience on one hand and concerns about privacy on the other, given their broad access to citizen data. Our study shows that GCC citizens are slightly more open in their attitudes toward personalized services, with 78% of respondents comfortable with personalization, on par with Asia Pacific (78%) and higher than Europe (70%) and North America (72%). GCC citizens (60%) are more comfortable in sharing data beyond the bare minimum with their governments, and approximately 1 in 4 respondents say they would provide additional data beyond what the government already has, to enable further personalization.

Similarly, GCC citizens are receptive to proactive service delivery from the government. Proactive services include citizens being recommended, or auto enrolled, in services they are eligible for without them needing to initiate it. Other proactive services are ones that automate government documentation (e.g., helping parents with a newborn’s birth certificate, health care registration, etc.), or ones that include an engine that checks and notifies on available benefits, grants, and support citizens are eligible for (e.g., for new parents).

Notably, 88% of GCC citizens surveyed are comfortable with some level of proactive engagement, however, they differ in the degree of proactiveness they would accept (Exhibit 3). On one end of the spectrum, 16% of GCC citizens want the government to provide these services automatically. On the other end, 32% are only comfortable with proactiveness on services they've used in the past, with unsolicited outreach from the government perceived as an intrusion. At the core, 40% of GCC respondents prefer a balanced level of proactiveness where governments initiate interaction or anticipate their needs without automatic enrollment.

Although GCC governments have performed well across many digital government services indicators, they cannot be complacent in a fast-paced, high-expectation, post-pandemic world. They have an opportunity to be leaders in advancing personalized, proactive service delivery. The majority of GCC (78%) survey respondents said they are willing to share personal data in exchange for receiving better government services. Beyond meeting compliance requirements (i.e., providing bare minimum data), most citizens are willing to participate in a 'value exchange', where providing personal data helps make their lives better or easier.

But clearly one approach will not fit all regions, nor all services – each country must find the level of personalization and proactive digital service delivery that meets their citizens’ needs and expectations, without trespassing on boundaries and trust.

Next Generation Digital Government: Digital Identity and AI at the Center

A service attracting much high-level discussion is digital identity (digital ID). To what extent are citizens open to this digital service given the added convenience from identity data consolidation, and if so, who should provide it? Similar to global preferences, GCC citizens are generally open to digital IDs, and many respondents would prefer two or more digital identity solutions (diversifying cluster risk around one provider); however, they show the highest level of support for a single digital ID solution, prioritizing convenience, when simplicity and speed are needed.

GCC citizens report a much stronger preference for the government (national, followed by state) as their digital ID provider, compared to the global average. 67% of GCC respondents selected the national government as their digital ID provider of choice, compared to North America 23%, Europe 23%, and Asia Pacific 48%. This finding suggests that GCC governments have earned a high level of trust from their citizens, and that the single digital ID model balances convenience with privacy and security concerns.

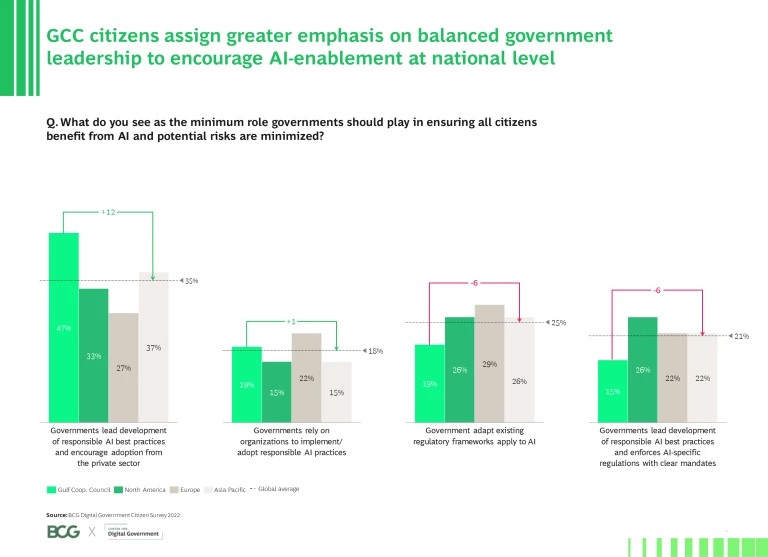

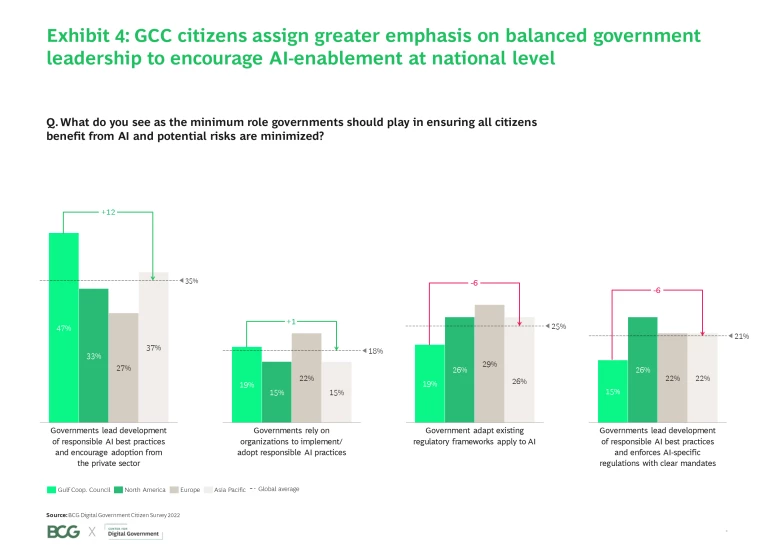

Artificial intelligence (AI) is not a service itself, but rather a key enabler of increasing personalization and proactivity. Similar to digital ID, it is increasingly prevalent in the future of digital government services and engenders certain privacy concerns. When asked about the type of AI management and oversight they would favor for digital government, 47% of GCC citizens clearly prefer a government-led approach to defining an AI best practice and encouraging the framework adoption (Exhibit 4), with a responsible AI framework* being at the center. Other regions also prefer a similar approach but do not converge as much on a single AI-led approach.

Accelerating Next-Generation Digital Government Services, Built on a Foundation of Trust

While the majority of GCC citizens express a willingness to share data and enter into situations with increasing personal data consolidation and connection, governments need to remember that trust is hard to build and easy to break. Establishing and preserving genuine, ongoing consent is vital to maintaining this delicate relationship of trust, particularly while pushing more sophisticated and modern digital government services.

Enabling and sustaining consent hinges on four factors, which must form the foundation of any government's digital service agenda:

- Trust and transparency - government must be transparent about how data will be collected, stored, accessed and used, and how breaches will be reported.

- Value exchange – citizens are willing to consent to their data being used in exchange for good and services they value.

- No secondary use of the data – there should be a single purpose for each consent. Citizens see secondary use or combining data as the creation of new data, requiring fresh consent.

- Right to opt-out – citizens value the right to withdraw consent or to opt-out of services. This process should be simple and comprehensive.

GCC governments have demonstrated a strong track record in providing digital services. Their offerings enjoy widespread adoption and meet or exceed the exacting expectations of their populations, and they are emerging as global leaders in the field of digital government services. However, they cannot afford to get complacent. With citizens comparing service levels against those provided by global digital leaders, governments must always be looking for ways to improve the range of services provided, convenience, and functionality. To do so safely, they must be rigorous in establishing genuine consent. They must be proactive in keeping abreast of ethical and technological best practices in managing and using ever larger and more detailed quantities of personal data, particularly around digital identity and AI-enabled services.

Although the GCC region has emerged as one of the leaders in digital government services, maintaining momentum and building on this position will require ongoing effort. GCC countries should continue to track people’s evolving needs, while innovating and investing in technology that yields efficiency gains, community benefits, and most importantly, value for citizens and residents.